- Home

- »

- Distribution & Utilities

- »

-

Generator Sets Market Size And Share, Industry Report 2030GVR Report cover

![Generator Sets Market Size, Share & Trends Report]()

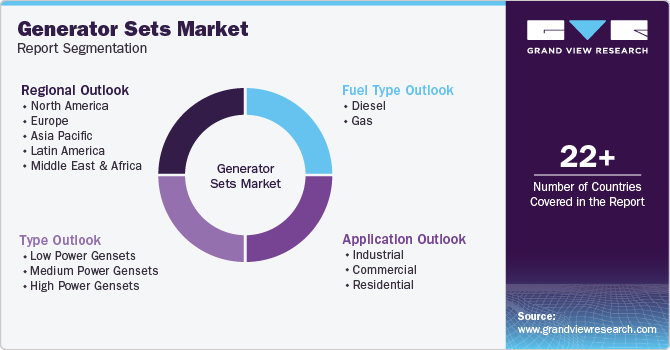

Generator Sets Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Low Power, Medium Power, High Power), By Fuel Type (Diesel, Gas), By Application (Commercial, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-613-4

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Generator Sets Market Summary

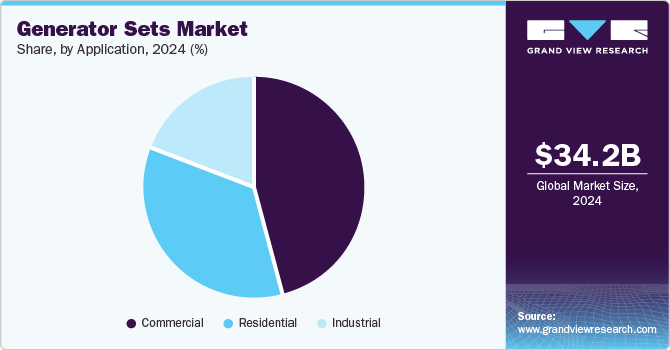

The global generator sets market size was estimated at USD 34,166.6 million in 2024 and is projected to reach USD 57,926.1 million by 2030, growing at a CAGR of 9.3% from 2025 to 2030. This growth is attributed to the increasing frequency of power outages, rapid industrialization, and urbanization.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, Saudi Arabia is expected to register the highest CAGR from 2026 to 2030.

- In terms of type, low power gensets accounted for the largest revenue share in 2024.

- Medium Power Gensets is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 34,166.6 Million

- 2030 Projected Market Size: USD 57,926.1 Million

- CAGR (2025-2030): 9.3%

- Asia Pacific: Largest market in 2025

As industries expand and infrastructure projects grow, the demand for reliable power sources becomes critical. In addition, sectors such as healthcare and telecommunications require an uninterrupted power supply, further propelling market growth. Moreover, the rising need for emergency backup solutions and generator technology advancements also contributes to expanding the generator sets market globally.

A generator set, commonly called a genset, is an integrated system consisting of an internal combustion engine and an electrical generator that converts mechanical energy into electrical energy. The market for generator sets is experiencing significant growth due to the increasing popularity of hybrid, inverter, and bi-fuel generators. Hybrid generators combine traditional fuel sources with renewable energy, appealing to environmentally conscious consumers through efficient operation and reduced costs. Inverter generators provide stable power suitable for sensitive electronics, making them ideal for residential use.

The demand for reliable backup power sources is another critical factor driving market expansion. In an era where electricity is vital across all sectors, any disruption can lead to severe consequences, prompting businesses and households to seek dependable power solutions. Furthermore, ongoing advancements in generator technology enhance efficiency and environmental performance. Innovations such as improved engine designs and smart controllers allow for better fuel management and integration with renewable energy sources, reducing reliance on fossil fuels. Manufacturers continuously refine these technologies to meet diverse customer needs, ensuring that modern generator sets are user-friendly and reliable.

Type Insights

The low power generator sets held the dominant position in the market and accounted for the largest revenue share of 43.8% in 2024 attributed to the increasing demand for reliable and uninterrupted power supply across various sectors, including communications, healthcare, and residential applications. In addition, the rise in industrialization and infrastructure development in emerging economies further fuels this demand. Furthermore, the frequency of power outages and natural disasters has heightened the need for backup solutions. The availability of cleaner energy sources and technological advancements also contribute to the growing adoption of low-power gensets, enhancing their appeal to consumers.

The medium power generator sets are expected to grow at a CAGR of 10.2% over the forecast period, driven by the expanding construction and manufacturing industries that require consistent operation power. In addition, the growing reliance on backup power systems in commercial establishments, such as data centers and hospitals, further stimulates demand. Furthermore, technological advancements that improve efficiency and reduce emissions are also significant factors driving this segment. Moreover, ongoing urbanization and infrastructure projects in developing regions create a robust market for medium power gensets, ensuring their continued relevance in meeting diverse energy needs.

Fuel Type Insights

The diesel fuel type segment led the market and accounted for the largest revenue share of 67.4% in 2024 attributed to their reliability and efficiency in providing uninterrupted power supply across various sectors. Diesel gensets are favored for their ability to deliver high capacity and longevity, making them suitable for critical applications in industries such as construction, healthcare, and telecommunications. In addition, the rising frequency of power outages and the increasing demand for backup power solutions further propel the market. Furthermore, technological advancements to improve fuel efficiency and reduce emissions also contribute to the growing adoption of diesel generators.

The gas fuel type segment is expected to grow at a CAGR of 10.2% from 2025 to 2030, owing to the increasing emphasis on cleaner energy sources and lower emissions. Natural gas gensets are recognized for their environmental benefits, offering a more sustainable alternative to traditional diesel generators. Furthermore, the growing infrastructure development and industrialization in emerging economies are driving demand for gas-powered solutions, particularly in urban areas where air quality concerns are paramount. Moreover, government initiatives promoting the use of natural gas as a primary fuel source support the growth of this segment.

Application Insights

Commercial applications dominated the market and accounted for the largest revenue share of 45.9% in 2024, driven by the increasing need for reliable power supply in various sectors, including healthcare, telecommunications, and hospitality. As businesses become more dependent on technology, any power interruption can lead to significant financial losses and operational disruptions. In addition, generator sets provide a crucial backup power solution, ensuring continuity of operations during outages. Furthermore, the rising number of data centers and government initiatives promoting energy resilience also stimulate demand for commercial generator sets.

The industrial segment is expected to grow at a CAGR of 9.4% over the forecast period, owing to rapid industrialization and infrastructure development across emerging economies. Industries such as manufacturing, oil and gas, and construction require consistent power to maintain productivity and prevent costly downtime. In addition, the increasing frequency of natural disasters and grid instability has heightened the demand for backup power solutions. Furthermore, technological advancements in generator efficiency and emissions reduction make industrial generator sets more appealing, ensuring they meet the evolving energy needs of various sectors while supporting sustainable practices.

Regional Insights

North America generator sets market is expected to witness substantial growth over the forecast period, owing to an increase in severe weather events and aging infrastructure leading to more frequent power outages. This has heightened awareness of energy security among residential and commercial users, driving demand for backup power solutions. In addition, advancements in generator technology that improve efficiency and reduce emissions contribute to market growth. Furthermore, the robust industrial sector, which includes manufacturing and construction, further enhances the demand for reliable generator sets to maintain operational continuity.

The generator sets market in the U.S. held the dominant position in the North American market and accounted for the largest revenue share in 2024 attributed to a rising reliance on backup power solutions across various industries, including healthcare, telecommunications, and data centers. In addition, increased natural disasters and extreme weather conditions have intensified concerns over power reliability, prompting businesses to invest in generator systems. Furthermore, government incentives to promote clean energy technologies support adopting advanced generator solutions.

Asia Pacific Generator Sets Market Trends

Asia Pacific generator sets market dominated the global market and accounted for the largest revenue share of 37.3% in 2024 attributed to rapid industrialization and urbanization across emerging economies. Increasing energy demands due to population growth and economic expansion have heightened the need for reliable power sources. In addition, frequent power outages and grid instability in several countries further propel the demand for generator sets. Furthermore, government initiatives promoting infrastructure development and investments in renewable energy technologies enhance the appeal of advanced generator solutions, ensuring their relevance in meeting diverse energy needs.

The generator sets market in China dominated the Asia Pacific market and accounted for the largest revenue share in 2024, driven by the country's rapid industrialization and urban development. In addition, the increasing demand for reliable power sources across various sectors, including manufacturing and telecommunications, is a key driver. Furthermore, China's focus on reducing carbon emissions has also led to investments in cleaner technologies, such as gas and hybrid generators. Moreover, the government's commitment to enhancing energy security and infrastructure development further stimulates the market, positioning China as a leader in adopting innovative power generation solutions.

Europe Generator Sets Market Trends

Europe generator sets market is expected to grow at a CAGR of 9.4% over the forecast period, owing to rising energy costs and stringent environmental regulations that drive the demand for reliable power sources. In addition, the region's commitment to sustainability has led to increased investments in advanced generator technologies that minimize emissions. Furthermore, the growing need for backup power in critical sectors such as healthcare and data centers contributes to market growth.

The generator sets market in Germany led the European market and accounted for the largest revenue share in 2024, driven by its strong industrial base and a focus on integrating renewable energy sources. The increasing frequency of power outages and grid instability has heightened the demand for reliable backup power solutions across various sectors, including manufacturing and logistics. Furthermore, Germany’s commitment to reducing carbon emissions encourages the adoption of cleaner technologies, such as hybrid and gas-powered generators. Moreover, ongoing infrastructure investment also stimulates the country's need for dependable power sources.

Key Generator Sets Company Insights

Some key global generator sets industry companies include Atlas Copco AB, Caterpillar Inc., Cummins Inc., and others. These companies adopt several strategies to gain a competitive edge. These include new product launches and improved product efficiency, reliability, and environmental performance. In addition, companies also focus on expanding their manufacturing capacities to meet rising demand and entering new markets through strategic partnerships and collaborations. Mergers and acquisitions are utilized to consolidate market positions and diversify product offerings, while marketing efforts are tailored to highlight technological advancements and sustainability benefits of their generator sets.

-

Cummins Inc. produces diesel, natural gas, and alternative fuel-powered generator sets, catering to diverse applications across industries such as healthcare, telecommunications, and data centers. The company operates in the power generation segment, offering solutions that include backup, prime, and continuous power systems, ensuring reliability and efficiency for both commercial and industrial users.

-

Generac Holdings Inc. specializes in portable and stationary generators powered by gasoline and natural gas, providing essential power during outages. Operating within the power generation segment, the company emphasizes innovation and sustainability in its products to meet the growing demand for reliable energy sources. Their offerings are designed to support critical infrastructure and enhance energy security for various sectors.

Key Generator Sets Companies:

The following are the leading companies in the generator sets market. These companies collectively hold the largest market share and dictate industry trends.

- Atlas Copco AB

- Caterpillar Inc.

- Cummins Inc.

- Generac Holdings Inc.

- General Electric

- Briggs and Stratton Corporation

- AKSA Power Generation

- Cooper Corporation

- Kohler Co.

- MTU Onsite Energy

- Mitsubishi Heavy Industries Ltd

- Doosan Corporation

- Wartsila Corporation

- Honda Siel Power Products Ltd.

Recent Developments

-

In April 2024, Rolls-Royce announced a collaboration with Landmark and ASCO to develop innovative CO2 recovery power generation solutions. This partnership aims to enhance the efficiency of generator sets by integrating carbon capture technology, thereby reducing greenhouse gas emissions. The initiative focuses on creating sustainable power generation systems that align with global climate goals. Rolls-Royce emphasizes its commitment to advancing cleaner energy solutions through this collaboration, which seeks to provide environmentally friendly alternatives in the power generation sector.

-

In April 2024, Cummins Power Generation announced the launch of two new generator sets, the C2750D6E and C3000D6EB. These models, powered by the QSK78 engine, deliver outputs of 2750kW and 3000kW and are designed for crucial applications such as data centers and healthcare facilities. The new generator sets feature fast start performance and robust load-handling capabilities while optimizing space with a smaller footprint.

Generator Sets Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 37.1 billion

Revenue forecast in 2030

USD 57.9 billion

Growth Rate

CAGR of 9.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, fuel type, application, region

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, Germany, Russia, UK, France, China, India, Japan, South Korea, Brazil, Argentina, UAE, Saudi Arabia

Key companies profiled

Atlas Copco AB; Caterpillar Inc.; Cummins Inc.; Generac Holdings Inc.; General Electric; Briggs and Stratton Corporation; AKSA Power Generation; Cooper Corporation; Kohler Co.; MTU Onsite Energy; Mitsubishi Heavy Industries Ltd.; Doosan Corporation; Wartsila Corporation; Honda Siel Power Products Ltd.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Generator Sets Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global generator sets market report based on type, fuel type, application, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Low Power Gensets

-

Medium Power Gensets

-

High Power Gensets

-

-

Fuel Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Diesel

-

Gas

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Commercial

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

UAE

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.