Generative AI Smartphone Market Size, Share & Trends Analysis Report By Price Range (Premium, Mid-Range, Budget/Low), By Distribution Channel, By Application, By User, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-437-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2024 - 2030

- Forecast Period: 2024 - 2030

- Industry: Technology

Generative AI Smartphone Market Trends

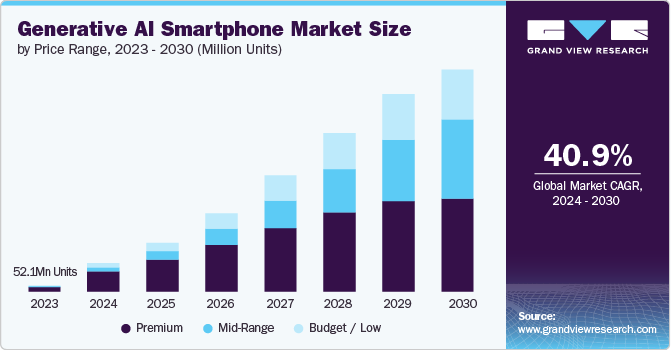

The global generative AI smartphone market shipments was estimated at 52.1 million units in 2023 and is projected to grow at a CAGR of 40.9% from 2024 to 2030. The market is driven by the growing consumer demand for enhanced mobile experiences, such as AI-powered photography, voice assistants, and personalized content generation. The increasing integration of AI into mobile applications, coupled with advancements in mobile processors, is fueling the adoption of Generative AI in smartphones. The rise of 5G technology and the need for real-time data processing on mobile devices further accelerate the demand for smartphones equipped with AI capabilities.

As consumers increasingly seek smarter, more intuitive devices, smartphone manufacturers are focusing on incorporating AI features that enhance user experience, such as improved battery management, adaptive user interfaces, and real-time language translation. The collaboration between smartphone manufacturers, AI software developers, and telecom companies is also on the rise, aimed at optimizing AI performance on mobile networks, especially with the expansion of 5G.

A significant trend in the global market is the push towards on-device AI processing, which reduces reliance on cloud-based solutions and enhances privacy and security. Smartphone manufacturers are increasingly developing AI-dedicated hardware, such as Neural Processing Units (NPUs), to support complex generative AI tasks directly on the device. This trend is further supported by the development of AI-powered camera systems that offer features like scene recognition, real-time video enhancement, and computational photography. Another key trend is the integration of Generative AI for content creation, where smartphones are being equipped with AI-driven tools for generating text, images, and videos. This not only enhances user creativity but also opens up new possibilities for mobile content generation in areas like social media, gaming, and virtual reality.

Price Range Insights

Based on price range, the premium segment led the market with a volume share of 77.8% in 2023. This dominance is driven by high consumer demand for cutting-edge technology and advanced AI features, which are often first introduced in premium devices. These smartphones cater to tech-savvy consumers who prioritize performance, innovation, and exclusive AI-driven functionalities like superior AI-enhanced photography, augmented reality, and personalized user experiences. The premium segment continues to attract significant investment from manufacturers aiming to differentiate their products through the integration of advanced AI capabilities, leading to higher profit margins and brand loyalty.

The mid-range segment is projected to witness the fastest CAGR from 2024 and 2030. This growth is fueled by increasing consumer expectations for AI features at more affordable price points, as well as advancements in mobile processors that make it feasible to incorporate AI functionalities into mid-range devices. As smartphone manufacturers focus on democratizing AI technology, mid-range devices are becoming more attractive to a broader audience, including emerging markets. The trend towards on-device AI processing and the growing demand for cost-effective yet feature-rich smartphones are key factors driving the rapid expansion of the mid-range segment during this period.

Distribution Channel Insights

Based on distribution channel, the online segment is leading the market with the largest volume share of 68.4% in 2023. The growth is attributed to the increased emphasis on e-commerce platforms among buyers. As consumers increasingly turn to online shopping for convenience and a wider selection, smartphone manufacturers are optimizing their online presence through dedicated e-commerce websites and partnerships with major online retailers. This shift allows consumers to easily compare models, read reviews, and access exclusive online deals, thereby driving sales. Furthermore, retailers are leveraging AR tools to allow consumers to visualize how a smartphone would look and feel in their hands, enhancing the decision-making process. This immersive experience can significantly influence purchasing behavior, particularly for high-end models.

The offline segment is anticipated to grow at a significant CAGR over the forecast period. As generative AI smartphones gain popularity, manufacturers are focusing on enhancing the in-store experience by training sales staff on the unique AI features of these devices, enabling them to effectively communicate the benefits to potential buyers. This hands-on approach allows consumers to experience the advanced capabilities of Generative AI smartphones firsthand, fostering greater engagement and informed purchasing decisions. Moreover, the expansion of exclusive retail partnerships is propelling the market expansion. Manufacturers are partnering with various retail chains to launch exclusive models or promotional bundles, leveraging the physical presence of these stores to attract customers. This strategy not only enhances brand visibility but also creates a sense of urgency among consumers, encouraging them to visit stores to explore the latest offerings.

User Insights

Based on user, the commercial segment led the market with the largest volume share of 38.7% in 2023. Commercial users are increasingly embracing AI-powered applications designed for smartphones, such as virtual assistants, project management tools, and customer relationship management (CRM) software. These applications leverage Generative AI features to provide intelligent insights, automate workflows, and enhance decision-making. Moreover, as generative AI smartphones become more prevalent in the workplace, manufacturers are focusing on improving integration with enterprise software and cloud platforms. This trend ensures that commercial users can seamlessly access and share data across various systems, fostering collaboration and productivity.

The personal segment is estimated to grow at a substantial CAGR over the forecast period. The growth is attributed to rollout of 5G networks globally, fueling the demand for generative AI smartphones that can leverage the combined power of 5G and AI. Users are drawn to the improved performance, faster data speeds, and enhanced AI features that 5G-enabled generative AI smartphones offer. Moreover, the prominent player in this market is innovating new features to attract this segment customers. For instance, Google Pixel 8 Pro, offers features like summarizing recorded conversations, suggesting replies to messages, and creating AI-generated wallpapers. The camera also benefits from AI with Magic Editor (moving or removing objects); Best Take (selecting the best shot), and Video Boost (enhancing video color and lighting).

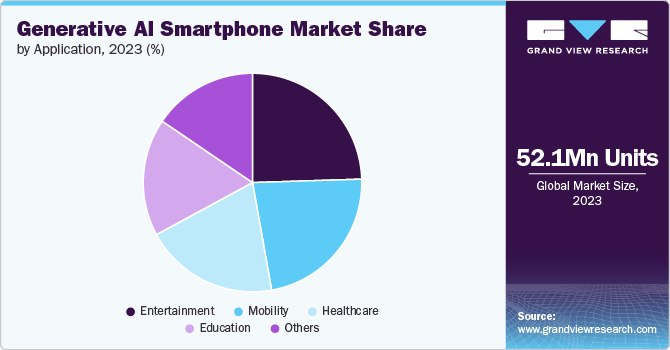

Application Insights

Based on application, the entertainment segment led the market with the largest volume share of 24.5% in 2023. Smartphones are now equipped with tools that allow users to perform complex edits, such as background regeneration, object removal, and real-time enhancements, making it easier for users to create professional-quality content directly from their devices. For instance, features like "Magic Editor" in Google Pixel 8 and similar tools in Samsung Galaxy devices enable users to manipulate images and videos with minimal effort, catering to the growing demand for high-quality visual content on social media platforms. In addition, the smartphone is the device of choice for content creation, taking photos and creating videos for social media. It has also become the primary tool for streaming content and gaming. AI will optimize visual effects, providing a more immersive experience, and act as a “gaming assistant”, enhancing the overall experience and increasing engagement.

The mobility segment is estimated to grow at a significant CAGR over the forecast period. Users increasingly rely on smartphones for directions and finding information about locations. AI improves commuting and travel by efficiently analyzing traffic patterns, user travel journeys, and frequent destinations. It will offer improved planning by integrating travel needs with calendar appointments, making commutes more efficient. Moreover, the segment is experiencing significant growth due to the enhanced navigation and commuting experiences. Moreover, the integration of AI-driven personal assistants that automate various mobility-related tasks. These assistants manage schedules, set reminders for travel times, and even provide intelligent recommendations for nearby services, such as restaurants or gas stations.

Regional Insights

North America dominated the generative AI smartphone market with the revenue share of 31.8% in 2023. Major players in Generative AI smartphones from this region is engaged in continues innovation and offering cutting edge application to the users. For instance, in June 2024, Motorola and Google Online have announced a new multi-year partnership to bring generative AI capabilities to Motorola phones, beginning with the latest razr series, including the flagship Motorola razr+/Motorola razr 50 Ultra. Moto AI application, developed using Google Online's Vertex AI, Gemini, and Imagen models, is now deeply integrated into the smartphone's native applications. This integration enhances the user experience by enabling the phone to complete tasks, offer relevant suggestions and reminders, summarize information, and more.

U.S. Generative AI Smartphone Market Trends

The generative AI smartphone market in U.S. is accounted for the largest market share in 2023, this growth is driven by consumer demand for advanced, AI-powered features in their devices. As smartphones increasingly integrate AI capabilities such as personalized user experiences, enhanced photography, and voice assistants, more users are upgrading to models that offer these functionalities. The U.S. market, being highly competitive and tech-savvy, has seen a strong uptake in mid-range and flagship generative AI smartphones, particularly as 5G networks expand and consumers seek faster, more responsive devices.

Europe Generative AI Smartphone Market Trends

The generative AI smartphone market in Europe is particularly strong this growth is driven by the Europe's strong focus on data privacy and security is influencing the market, with a growing preference for AI smartphones that process data locally on the device. As major manufacturers like Samsung, Apple, and emerging Chinese brands continue to introduce AI-integrated models tailored to European preferences, shipments are expected to see sustained growth, further solidifying the market growth.

Asia Pacific Generative AI Smartphone Market Trends

The generative AI smartphone market in Asia-Pacific is experiencing rapid growth. Countries like China, India, and Southeast Asian nations are leading this surge, as consumers in these markets are eager to upgrade to smartphones that offer the latest AI-driven features, such as advanced camera systems, personalized content recommendations, and smart assistants. The competitive landscape, with strong local brands like Xiaomi, Oppo, and Vivo, alongside global giants like Samsung and Apple, is driving innovation and making AI-enabled smartphones more accessible and affordable.

Key Generative AI Smartphone Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, partnerships, and collaborations contracts, agreements, as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, In February 2024, Global application brand HONOR unveiled its new all-scenario strategy, showcasing AI-powered cross-OS experiences and an intent-based user interface, along with a range of smart devices developed in collaboration with global partners. During its keynote, HONOR announced the global launch of the premium flagship HONOR Magic6 Pro, as well as the latest AIPC, the HONOR MagicBook Pro 16. Both devices feature HONOR's platform-level AI, designed to deliver human-centric innovations.

Key Generative AI Smartphone Companies:

The following are the leading companies in the generative AI smartphone market. These companies collectively hold the largest market share and dictate industry trends.

- Samsung

- Xiaomi

- Apple

- OPPO

- Honor Device Co., Ltd.

- Motorola Mobility LLC.

Recent Developments

-

In January 2024, Samsung Electronics introduced the Galaxy S24+, Galaxy S24 Ultra and Galaxy S24, unlocking new mobile experiences through Galaxy AI. The Galaxy S series is paving the way for a new era, revolutionizing how mobile devices empower users. AI enhances nearly every aspect of the Galaxy S24 series, from facilitating seamless communication with intelligent text and call translations, to maximizing creative possibilities with Galaxy’s ProVisual Engine, and redefining search standards, transforming how Galaxy users explore the world around them

-

In June 2024, Apple unveiled Apple Intelligence, a personal intelligence system for iPhone, Mac and iPad that unites the power of generative models with personal context to offer highly effective and relevant insights. Deeply embedded in iPadOS 18, iOS 18, and macOS Sequoia, Apple Intelligence harnesses the influence of Apple silicon to understand and generate language and images, perform tasks across apps, and draw on personal context to simplify and accelerate everyday tasks.

Generative AI Smartphone Market Report Scope

|

Report Attribute |

Details |

|

Market volume in 2024 |

240.0 million units |

|

Volume forecast in 2030 |

1,874.0 million units |

|

Growth rate |

CAGR of 40.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in million units and CAGR from 2024 to 2030 |

|

Report coverage |

Volume forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Price range, distribution channel, application, user, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; and MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

Samsung; Xiaomi; Google; Apple; OPPO; Honor Device Co., Ltd.; Motorola Mobility LLC |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Generative AI Smartphone Market Report Segmentation

This report forecasts volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2030. For this study, Grand View Research has segmented the global generative AI smartphone market report based on price range, distribution channel, application, user and region:

-

By Price Range Outlook (Volume, Million Units, 2023 - 2030)

-

Premium

-

Mid-Range

-

Budget / Low

-

-

By Distribution Channel Outlook (Volume, Million Units, 2023 - 2030)

-

Offline

-

Online

-

-

By Application Outlook (Volume, Million Units, 2023 - 2030)

-

Healthcare

-

Education

-

Entertainment

-

Mobility

-

Others

-

-

By User Outlook (Volume, Million Units, 2023 - 2030)

-

Personal

-

Commercial

-

-

Regional Outlook (Volume, Million Units, 2023 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global generative AI smartphone market size was estimated at USD 52.1 million in 2023 and is expected to reach 240.0 million units in 2024.

b. The global generative AI smartphone market is expected to grow at a compound annual growth rate of 40.9% from 2024 to 2030 to reach 1,874.0 million units by 2030.

b. North America dominated the generative AI smartphone market with a share of 31.8% in 2023. This growth is driven by consumer demand for advanced, AI-powered features in their devices. As smartphones increasingly integrate AI capabilities such as personalized user experiences, enhanced photography, and voice assistants, more users are upgrading to models that offer these functionalities.

b. Some key players operating in the generative AI smartphone market include: Samsung, Xiaomi, Google, Apple, OPPO, Honor Device Co., Ltd., Motorola Mobility LLC.

b. Key factors that are driving the market growth include a significant trend in the Generative AI smartphone is the push towards on-device AI processing, which reduces reliance on cloud-based solutions and enhances privacy and security. Smartphone manufacturers are increasingly developing AI-dedicated hardware, such as Neural Processing Units (NPUs), to support complex generative AI tasks directly on the device.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."