- Home

- »

- Next Generation Technologies

- »

-

Generative AI Market Size And Share, Industry Report, 2033GVR Report cover

![Generative AI Market Size, Share & Trends Report]()

Generative AI Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Software, Service), By Technology (Generative Adversarial Networks, Transformers), By End Use, By Application, By Model, By Customers, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-011-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Generative AI Market Summary

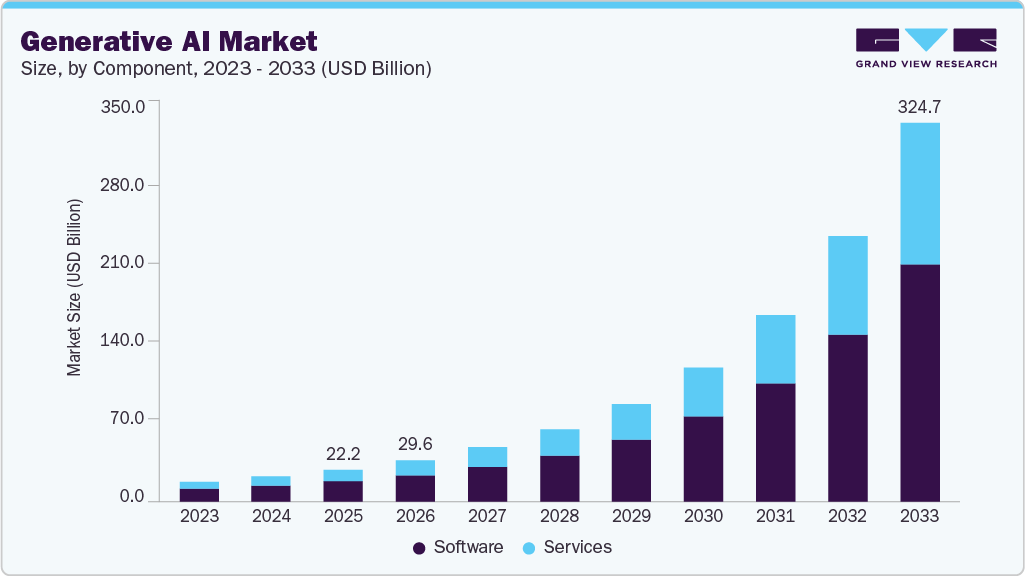

The global generative AI market size was estimated at USD 22.21 billion in 2025 and is projected to reach USD 324.68 billion by 2033, growing at a CAGR of 40.8% from 2026 to 2033. The demand for generative AI applications across industries is being driven by factors such as the expanding use of technologies such as super-resolution, text-to-image conversion, and text-to-video conversion, along with a growing need to modernize workflows.

Key Market Trends & Insights

- North America dominated the global generative AI market with the largest revenue share of 40.8% in 2025.

- The generative AI market in the U.S. led the North America market and held the largest revenue share in 2025.

- By component, software segment led the market and held the largest revenue share of 64.1% in 2025.

- By technology, transformers segment held the dominant position in the market and accounted for the leading revenue share of 40.9% in 2025.

- By end use, BFSI segment is expected to grow at the fastest CAGR of 43.2% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 22.21 Billion

- 2033 Projected Market Size: USD 324.68 Billion

- CAGR (2026-2033): 40.8%

- North America: Largest market in 2025

This trend shows the increasing importance of AI-driven solutions in enhancing operational efficiency and innovation across various sectors. Generative AI uses unverified learning algorithms for tasks such as spam detection, image compression, and data preprocessing, including noise reduction in visual data. Supervised learning algorithms are essential for medical imaging and image classification. These technologies are applied in industries such as BFSI, healthcare, automotive and transportation, IT and telecommunications, and media and entertainment. Generative AI enables organizations to generate new ideas, solve complex problems, and develop innovative products. It also helps save time and costs, increase efficiency, and improve content quality.

The growth of cloud storage solutions has accelerated the generative AI market by providing a strong foundation for technology development and deployment. Cloud storage delivers scalable computing power, allowing businesses to train resource-intensive generative AI model training without substantial capital investment. It enhances data accessibility and collaboration, enabling global teams to efficiently store and share diverse datasets. The pay-as-you-go model reduces financial barriers and supports secure management of sensitive AI projects. Cloud platforms also offer pre-trained models and APIs, streamlining development and optimizing resources.

Component Insights

Software segment accounted for the dominant share of 64.1% in 2025. The growth of the software segment in generative AI is driven by factors such as the rise in fraudulent activities, overestimation of capabilities, unexpected outcomes, and increasing concerns about data privacy. Generative AI software is expected to become increasingly significant across various industries, including fashion, entertainment, and transportation, as it gains power through advanced machine learning models. Brands such as H&M and Adidas, for instance, have leveraged generative AI to design clothing and create custom sneakers. Moreover, this technology has been applied to generate unique patterns for fabrics and prints, streamlining the design process and saving time for designers.

The service segment is projected to experience the fastest growth rate during the forecast period, driven by rising concerns about data protection, fraud detection, trading prediction, and risk modeling. Cloud-based generative AI services are anticipated to gain popularity due to their flexibility, scalability, and cost-effectiveness, fueling the segment's expansion. For instance, in April 2023, Amazon Web Services (AWS), a U.S.-based IT service management company, introduced Amazon Bedrock and a suite of generative AI services. These offerings are designed to provide AWS customers with tools for building chatbots, generating and summarizing text, and classifying images based on prompts, further advancing generative AI capabilities across industries.

Technology Insights

Transformers segment accounted for the dominant share in 2025, largely due to its capacity to handle vast amounts of data efficiently. These models excel in tasks involving natural language processing, image recognition, and even complex problem-solving. Their architecture, characterized by self-attention mechanisms, enables Transformers to learn intricate patterns in data, making them invaluable in a range of applications. Industries across sectors are increasingly adopting Transformers for personalized content generation, recommendation systems, and automation solutions. With continued advancements, Transformers are setting the standard for generative AI, pushing the limits of what is achievable in this field.

Diffusion networks are gaining momentum in the generative AI market, particularly recognized for their effectiveness in image and video generation. Unlike Transformers, diffusion models progressively refine data by removing noise, which allows for the creation of high-quality, realistic content. This technology is attracting attention in fields where creativity and detail are essential, such as entertainment, fashion, and advertising. As diffusion networks evolve, they are becoming more efficient, overcoming previous limitations in speed and resource usage. Their growing adoption reflects the market’s enthusiasm for diverse, powerful models that cater to specific generative needs.

End Use Insights

The media and entertainment industry accounted for the dominant share in 2025. The growth is driven as this sector extensively integrates AI for content creation, personalized recommendations, and audience engagement. Generative AI tools enable media companies to produce immersive visuals, generate unique audio tracks, and create interactive storytelling experiences, pushing the boundaries of creativity. This technology is also helping companies to tailor content for individual viewers, enhancing user experience and increasing engagement levels. The rise of virtual and augmented reality content further supports the demand for generative AI within this industry. As a result, media and entertainment continue to be a driving force in the adoption and innovation of generative AI.

The BFSI sector is seeing significant growth in generative AI adoption, focusing on applications that improve fraud detection, risk analysis, and customer service automation. Financial institutions are beginning to use AI-driven models to analyze complex datasets, identify suspicious patterns, and predict potential risks more accurately. Moreover, generative AI is streamlining customer support by enabling virtual assistants to handle routine inquiries and deliver personalized financial advice. With regulatory compliance becoming increasingly critical, AI models are also being utilized to ensure adherence to data privacy and security standards. The growing integration of generative AI within BFSI showcases the sector’s commitment to enhancing efficiency, security, and customer satisfaction.

Application Insights

Natural language processing (NLP) holds a dominant position in the generative AI market, driven by its widespread applications in chatbots, virtual assistants, and content creation. NLP models are highly effective in understanding and generating human-like text, enabling organizations to enhance communication, automate support tasks, and personalize user interactions. These models help businesses analyze customer feedback, interpret complex queries, and provide meaningful responses, contributing to improved user experiences. NLP also supports language translation and sentiment analysis, making it valuable across diverse industries. As a result, NLP continues to be the leading technology in generative AI, shaping how businesses engage with their audiences.

Computer vision is experiencing significant growth within the generative AI market, particularly due to its applications in industries such as healthcare, automotive, and retail. This technology enables machines to interpret and analyze visual data, which is essential for tasks such as medical imaging, autonomous driving, and inventory management. Recent advancements are making computer vision models more efficient, allowing for the generation of highly realistic images and videos. Technology also supports object detection and facial recognition, further enhancing its utility across sectors. As computer vision capabilities advance, it is gaining traction and expanding its role in the generative AI landscape.

Model Insights

Large language models (LLMs) continue to dominate the generative AI market in 2025, primarily due to their impressive capabilities in text-based tasks such as content generation, customer service automation, and data analysis. These models, built on extensive datasets and sophisticated architectures, can produce highly coherent and contextually accurate responses, making them invaluable for applications across sectors. Their widespread adoption in industries like education, healthcare, and finance highlights their versatility in handling complex linguistic tasks. LLMs are also pivotal in sentiment analysis and real-time language translation, enhancing user engagement and accessibility. This dominance solidifies large language models as a cornerstone of generative AI innovation and application.

Multi-modal generative models segment is experiencing the fastest growth during the forecast period, fueled by their ability to process and generate content across multiple data types, such as text, images, and audio. These models are gaining traction in fields that benefit from a seamless integration of diverse media, including e-commerce, entertainment, and education. By combining visual, textual, and auditory data, multi-modal models enable more interactive and immersive user experiences, such as creating video content based on textual descriptions or generating audio narrations for visual content. As these models become more refined, their growing adoption showcases the market's enthusiasm for versatile generative AI that supports complex, cross-media interactions.

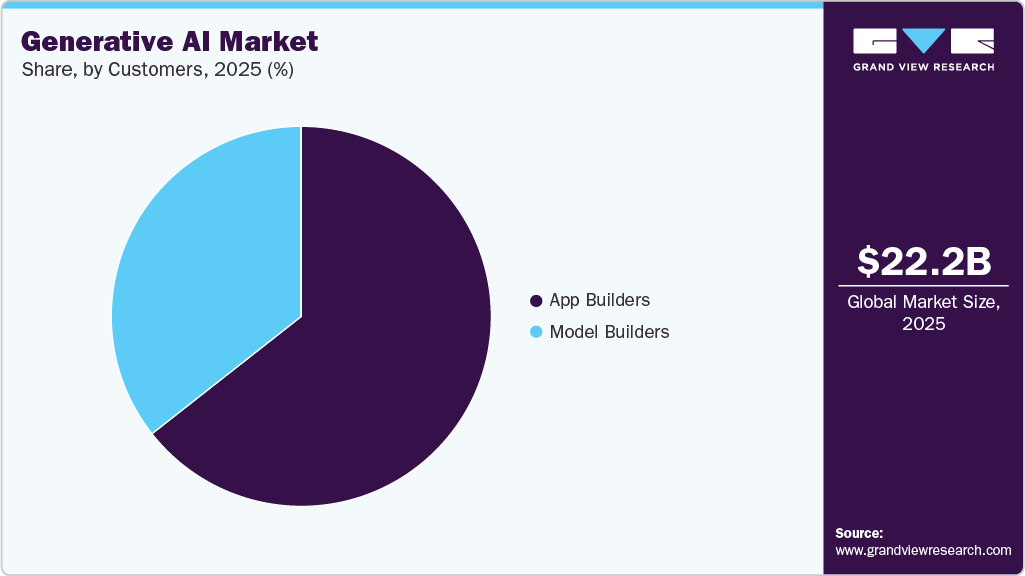

Customers Insights

App builders stand as the dominant customer segment within the generative AI market in 2025, driven by their need to integrate AI capabilities into applications across industries. These companies rely on generative AI to create innovative features such as personalized recommendations, automated customer support, and dynamic content generation, adding significant value to their applications. App builders are increasingly focused on enhancing user engagement and improving functionality, and generative AI provides the tools to achieve this efficiently. By incorporating AI-driven insights and interactions, app builders can meet growing customer expectations for responsive, intelligent applications. This demand reinforces the position of app builders as key customers driving generative AI advancements.

Model builders are increasingly using generative AI within this market, focusing on creating and refining advanced AI architectures for diverse applications. These builders play a crucial role in developing foundational models, optimizing them for efficiency, accuracy, and scalability. Model builders are essential in advancing generative AI’s capabilities, working on everything from language and vision models to complex multi-modal frameworks. Their work supports the broader ecosystem by enabling app builders to leverage robust, pre-trained models for specific use cases. As the demand for sophisticated AI grows, model builders are integral to the generative AI landscape, providing the backbone for new, impactful applications.

Regional Insights

North America Generative AI market leads the global industry accounting for leading share of 40.8% in 2025. The growth is supported by high investment levels and a strong ecosystem of technology companies and research institutions. The region is witnessing rapid adoption across sectors such as healthcare, finance, and entertainment, as organizations seek to enhance productivity and create innovative solutions. Regulatory developments in data privacy and AI ethics are shaping the market, encouraging responsible AI adoption. In Canada, there is a particular focus on AI research and government support for AI-driven innovation. North America’s emphasis on advanced technology positions it as a major hub for generative AI development.

U.S. Generative AI Market Trends

In the U.S., generative AI is widely used across industries, from media and entertainment to finance and healthcare. The country is home to leading AI companies and research facilities driving advancements in language, vision, and multi-modal AI technologies. There is also significant investment from both private and public sectors, fueling the growth and adoption of generative AI. Government interest in establishing ethical standards and ensuring AI safety is impacting the regulatory sector.

Europe Generative AI Market Trends

In Europe, the generative AI market is expanding, bolstered by supportive government policies and an emphasis on ethical AI. The European Union has set guidelines to ensure that AI is transparent, fair, and accountable, which influences AI deployment across industries. Key industries such as automotive, finance, and retail are actively exploring generative AI to improve customer experience and operational efficiency. Several European countries, including Germany and France, are investing in AI research to strengthen their positions in the global market.

Asia Pacific Generative AI Market Trends

In Asia-Pacific, the generative AI market is witnessing rapid growth, driven by technological advancements and increasing adoption across industries. Countries such as China, Japan, and South Korea are investing heavily in AI, aiming to lead in areas such as autonomous systems, robotics, and digital transformation. Generative AI is widely used in sectors such as e-commerce, manufacturing, and media, where automation and personalization are in high demand. Governments in the region are actively supporting AI research and development, fueling a competitive market environment.

Key Generative AI Company Insights

Some of the key companies in the Generative AI market include Adobe, Amazon Web Services, Inc., D-ID, Genie AI Ltd., Google LLC, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Amazon Web Services, Inc. (AWS) has developed Amazon Bedrock, offering pre-trained foundational models for building generative AI applications. AWS provides cloud-based solutions for businesses to create chatbots, summarize text, and generate images. It offers APIs and model training resources customized to various industry needs. AWS’s scalable infrastructure supports businesses in deploying and expanding generative AI models efficiently.

-

Google LLC focuses on generative AI with models such as Bard and Gemini, advancing large language and multi-modal systems. Google integrates generative AI into its products, including Google Workspace, to enhance productivity with AI-powered writing and visual tools. It also emphasizes responsible AI use with guidelines for ethical implementation. Google’s ongoing research continues to expand generative AI’s capabilities in enterprise and consumer settings.

Key Generative AI Companies:

The following are the leading companies in the generative AI market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe

- Amazon Web Services, Inc.

- D-ID

- Genie AI Ltd.

- Google LLC

- IBM

- Microsoft

- MOSTLY AI Inc.

- Open AI

- Rephrase.ai

- Synthesia

Recent Developments

-

In November 2024, Amazon Web Services (AWS) collaborated with partners, including Booz Allen Hamilton and Crayon, to launch the Generative AI Partner Innovation. This collaboration aims to expand the reach of the Generative AI Innovation Center and help customers build and deploy AI solutions by utilizing industry-specific expertise and proven methodologies to scale generative AI initiatives globally.

-

In September 2024, IBM and Oracle Corporation, a U.S.-based computer software company, collaborated to enhance Oracle clients' use of generative AI by combining IBM's expertise in technologies like OCI Generative AI, Watsonx, and third-party models. Through this partnership, IBM is helping clients maximize ROI and reduce compute costs.

-

In October 2024, Adobe expanded its Firefly generative AI to include video to provide creative professionals with new tools for generating and editing content in Photoshop, Illustrator, and Premiere Pro. These updates, available in a limited public beta, enable users to generate videos from text prompts and create faster, more refined images and designs.

Generative AI Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 29.62 billion

Revenue forecast in 2033

USD 324.68 billion

Growth rate

CAGR of 40.8% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD Million/Billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

Component, technology, end use, application, model, customers, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia, South Korea, Brazil, KSA, UAE; South Africa

Key companies profiled

Adobe; Amazon Web Services, Inc.; D-ID; Genie AI Ltd.; Google LLC; IBM; Microsoft; MOSTLY AI Inc.; Open AI; Rephrase.ai; Synthesia

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Generative AI Market Report Segmentation

This report offers revenue growth forecasts at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global Generative AI market report based on component, technology, end use, application, model, customers, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Service

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Generative Adversarial Networks (GANs)

-

Transformers

-

Variational Auto-encoders

-

Diffusion Networks

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Media & Entertainment

-

BFSI

-

IT & Telecommunication

-

Healthcare

-

Automotive & Transportation

-

Gaming

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Computer Vision

-

NLP

-

Robotics & Automation

-

Content Generation

-

Chatbots & Intelligent Virtual Assistants

-

Predictive Analytics

-

Others

-

-

Model Outlook (Revenue, USD Million, 2021 - 2033)

-

Large Language Models

-

Image & Video Generative Models

-

Multi-modal Generative Models

-

Others

-

-

Customers Outlook (Revenue, USD Million, 2021 - 2033)

-

Model Builders

-

App Builders

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global generative AI market size was estimated at USD 22.21 billion in 2025 and is expected to reach USD 29.63 billion in 2026.

b. The global generative AI market is expected to grow at a compound annual growth rate of 40.8% from 2026 to 2033 to reach USD 324.68 billion by 2033.

b. North America dominated the generative AI market with a share of 40.8% in 2025. This is attributable to the existence of leading companies researching & developing generative AI applications.

b. Some key players operating in the generative AI market include Adobe, Amazon Web Services, Inc., D-ID, Genie AI Ltd., Google LLC, IBM, Microsoft, MOSTLY AI Inc., Rephrase.ai, Synthesia

b. Key factors driving the generative AI market growth include factors such as the expanding use of technologies like super-resolution, text-to-image conversion, and text-to-video conversion, along with a growing need to modernize workflows.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.