- Home

- »

- Next Generation Technologies

- »

-

Generative AI In Music Market Size, Industry Report, 2030GVR Report cover

![Generative AI in Music Market Size, Share & Trends Report]()

Generative AI in Music Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Technology (Transformers, Diffusion Models), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-418-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Generative AI in Music Market Summary

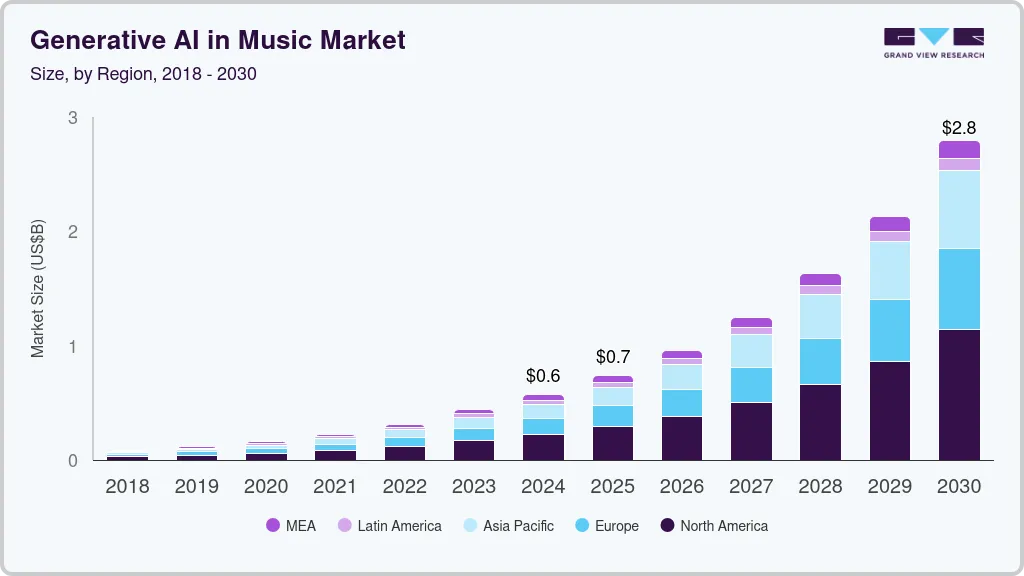

The global generative AI in music market size was estimated at USD 440.0 million in 2023 and is anticipated to reach USD 2,794.7 million by 2030, growing at a CAGR of 30.4% from 2024 to 2030. The market growth is driven by technological advancements that have made artificial intelligence (AI) more accessible and capable.

Key Market Trends & Insights

- North America generative AI in music market dominated and accounted for a 38.6% share in 2023.

- The generative AI in music market in the U.S. is expected to grow significantly over the forecast period.

- By component, software segment led the market accounting for 65.25% of the global revenue 2023.

- By technology, transformers segment accounted for the largest market revenue share in 2023.

- By application, automated music composition segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 440.0 Million

- 2030 Projected Market Size: USD 2,794.7 Million

- CAGR (2024-2030): 30.4%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

AI's ability to generate high-quality music compositions, harmonies, and even lyrics has attracted significant attention from artists, producers, and businesses looking to enhance creativity and efficiency. These tools democratize music creation, allowing even non-musicians to produce professional-sounding tracks. Furthermore, AI-driven platforms streamline processes like mastering and editing, reducing the time and cost associated with traditional music production. This efficiency appeals to established musicians and aspiring artists, broadening the market's reach. As AI continues to evolve, its ability to mimic human creativity more closely leads to wider adoption across various music industry sectors. This innovation is seen as a tool and a collaborative partner in the creative process.

The rise of on-demand music platforms and customized content is another significant factor fueling the growth of generative AI in music. On-demand music platforms increasingly utilize AI to curate personalized playlists and even generate new music customized to individual preferences. This level of personalization enhances user experience, driving greater engagement and loyalty.

Moreover, AI-generated music is used in background scores for films, video games, and advertisements, with high demand for custom, adaptable soundtracks. The scalability of AI allows these platforms to meet the growing demand for diverse and unique music content at a much faster pace than traditional methods. As a result, generative AI is becoming integral to how music is consumed and produced in the digital age. The ability to generate vast amounts of music quickly and efficiently makes AI an attractive solution for content creators and distributors alike.

The expanding applications of generative AI in the music industry fuel the growth of demand, particularly in education, marketing, and interactive entertainment. Generative AI tools are being developed to assist music education, enabling students to learn composition and music theory through interactive platforms. In marketing, AI-generated music is a powerful tool for crafting engaging and memorable advertisements. Moreover, the video game industry is leveraging generative AI to create dynamic soundtracks that adapt to player actions, enhancing the immersive experience. As more industries recognize the transformative potential of generative AI in music creation and usage, investment and innovation in this space are rapidly accelerating.

Component Insights

Software led the market, accounting for 65.25% of the global revenue 2023. The software component dominates the market because it forms the core of AI-driven music creation tools, platforms, and applications. These software solutions are essential for composing, editing, and mastering music, enabling professionals and amateurs to easily produce high-quality tracks. Advanced algorithms and machine learning models embedded in the software allow for sophisticated music generation that can mimic various styles and genres. The scalability and versatility of software make it the preferred choice for integration into various digital platforms, from DAWs to mobile apps. Moreover, continuous updates and improvements in AI technology are primarily delivered through software, keeping it at the forefront of innovation in the music industry.

The services segment is projected to grow significantly over the forecast period. The services component in the market is growing as companies and artists increasingly seek customized solutions and support for integrating AI into their workflows. This includes consulting, training, and custom development services to optimize AI tools for specific needs, such as creating unique soundscapes or automating production processes. Managed services that handle the maintenance, deployment, and scaling of AI-driven music platforms are also in demand, as they allow users to focus on creativity rather than technical complexities. Moreover, the rise of AI-powered subscription services that offer on-demand music generation or personalized playlists is contributing to the growth of this segment. As the market matures, the need for expert guidance and specialized services is expected to continue expanding.

Technology Insights

Transformers accounted for the largest market revenue share in 2023. Transformers dominate the market due to their ability to model complex sequences and capture long-range dependencies in music composition. Originally designed for natural language processing, their architecture is highly effective in generating coherent and contextually rich music by understanding patterns over extended time frames. Transformers have been adopted in various music generation tools because they excel at creating intricate, multi-layered compositions that mimic human creativity. Their scalability and efficiency in processing large datasets make them ideal for training on vast music libraries, resulting in more sophisticated and diverse outputs. As a result, Transformers have become a cornerstone in advancing the capabilities of AI-driven music creation.

Variational Autoencoders (VAEs) is predicted to foresee significant growth in the forecast period due to their ability to learn and generate complex music structures from latent representations. VAEs are particularly effective in generating variations of music that retain stylistic elements while introducing creativity, making them valuable for artists and producers seeking unique sounds. They enable more controlled and nuanced music generation by allowing users to manipulate the latent space to explore different musical ideas and themes. As the demand for personalized and adaptive music grows, VAEs are increasingly being integrated into music production tools for their ability to generate diverse musical content. Their role in facilitating experimentation and innovation in music composition drives their adoption across the industry.

Application Insights

Automated music composition accounted for the largest market revenue share in 2023. This technology allows the generation of complete compositions in various styles and genres, making it a powerful tool for content creators, from independent artists to large production studios. Automated systems are increasingly used in applications like background music for videos, advertisements, and games, where quick and scalable music production is essential. The ability to produce high-quality, royalty-free music instantly has made automated composition a key driver in adopting AI in the music industry. Moreover, as AI models continue to improve, the quality and diversity of automatically composed music are comparable to those of human composers.

Music personalization and recommendation is predicted to foresee significant growth in the forecast period. The music personalization and recommendation component is growing rapidly as streaming platforms and music services utilize AI to deliver highly tailored listening experiences. By analyzing user preferences, listening habits, and contextual data, AI-driven recommendation systems can curate personalized playlists and suggest new music that aligns with individual tastes. This level of customization enhances user engagement and satisfaction, driving greater loyalty and longer platform usage. As consumers increasingly demand unique and relevant content, the importance of AI in personalizing music experiences is becoming more pronounced. The expansion of this component is also fueled by the ability of AI to continuously learn and adapt to changing user preferences, ensuring that recommendations remain fresh and appealing.

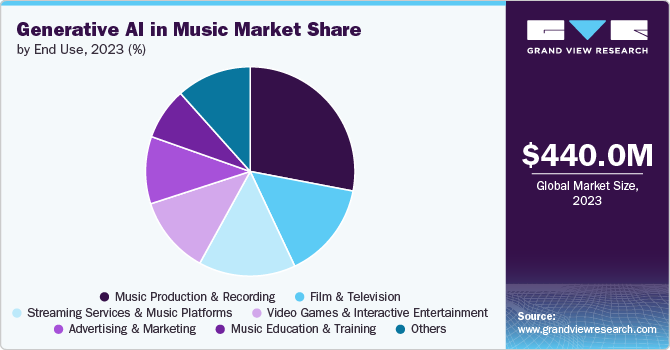

End Use Insights

Music production and recording accounted for the largest market revenue share in 2023 due to the widespread adoption of generative AI tools in professional music studios and home recording environments. These AI-driven technologies have significantly streamlined the composition, mixing, and mastering processes, making high-quality music production more accessible. Moreover, AI has enabled producers to experiment with new sounds and styles, driving innovation and creativity in the industry. The integration of AI in music production has also reduced costs and time, further boosting its appeal. As a result, the demand for generative AI in this segment has surged, leading to its dominant market position.

Streaming services and music platforms is projected to grow significantly over the forecast period. Streaming services and music platforms are rapidly growing due to their use of AI to personalize user experiences and generate new content. AI algorithms analyze user data to create customized playlists, recommend new tracks, and even generate AI-driven music that caters to specific tastes. This personalized approach enhances user engagement and keeps listeners returning to the platform. As streaming continues to be the primary way people consume music, these platforms invest heavily in AI to differentiate their services and provide unique listening experiences. Furthermore, the scalability of AI allows these platforms to handle vast amounts of data and deliver increasingly refined recommendations, fueling their growth in the market.

Regional Insights

North America generative AI in music market dominated and accounted for a 38.6% share in 2023 due to its strong technology infrastructure and major AI research and development hubs. The region is home to leading tech companies and startups pioneering AI innovations in music production and streaming services. Moreover, a large and diverse music industry in North America drives demand for advanced AI tools that can enhance creativity and efficiency. The region's high adoption rate of new technologies and AI-driven platforms further contributes to its leading market share.

U.S. Generative AI in Music Market Trends

The generative AI in music market in the U.S. is expected to grow significantly over the forecast period.The U.S. has a rich ecosystem of music producers, record labels, and streaming platforms, all of which are early adopters of AI to gain competitive advantages. Government support for AI research, coupled with significant investment from the private and public sectors, accelerates the development and commercialization of AI in music. Moreover, the U.S. consumer base is tech-savvy, leading to higher engagement with AI-powered music services.

Europe Generative AI in Music Market Trends

The generative AI in music market in Europe is characterized by its strong cultural emphasis on music and art, which fuels innovation and adoption of AI in creative industries. European countries have a long history of musical heritage, and this is complemented by a growing tech scene that is increasingly integrating AI into music production and distribution. The region also benefits from supportive regulations and initiatives aimed at fostering AI development across various sectors, including creative industries.

Asia Pacific Generative AI in Music Trends

The generative AI in music in Asia Pacific is anticipated to register the fastest CAGR over the forecast period. The Asia-Pacific region is experiencing rapid market growth due to its large, tech-savvy population and the increasing popularity of music streaming services. Countries such as China, Japan, and South Korea are investing heavily in AI technologies and are home to some of the world's most advanced tech companies. The region's booming entertainment industry, particularly in K-pop and anime, drives demand for innovative AI solutions in music composition and production.

Key Generative AI in Music Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations, as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, in September 2024, Stability AI, a UK-based open, generative AI company, launched Stable Audio, an AI-driven music and sound generation product that allows users to create audio tracks via descriptive text prompts. The tool offers a free version for 45-second tracks and a 'Pro' subscription for 90-second tracks, using models trained with music and metadata from AudioSparx.

Key Generative AI In Music Companies:

The following are the leading companies in the generative AI in music market. These companies collectively hold the largest market share and dictate industry trends.

- Aiva Technologies SARL

- Boomy Corporation

- Ecrett Music

- Google LLC

- International Business Machines Corporation

- LANDR

- Meta

- Microsoft

- OpenAI

- Stability AI

Recent Developments

-

In June 2024, Meta Platforms' AI research division launched JASCO, a new tool that transforms chords or beats into full musical tracks. This tool offers creators greater control over AI-generated music. Following the success of MusicGen, Meta continues to advance AI music technology by making JASCO's research and models publicly available, fostering collaboration within the global AI community.

-

In May 2024, Google LLC introduced Veo, a new AI video generation model capable of creating 1080p videos from text, images, and other videos, utilizing DeepMind's Gemini model for enhanced consistency and quality. Alongside Veo, Google unveiled Imagen 3, an upgraded image generation model that delivers more photorealistic images with improved detail and prompt understanding.

-

In February 2024, Google LLC released MusicFX, an upgraded version of its music-generating tool MusicLM. MusicFX enables users to create and customize tracks up to 70 seconds long using text prompts, offering alternative descriptor suggestions and a word cloud for more refined music generation.

-

In December 2023, Microsoft collaborated with Suno, Inc., to integrate a generative AI in music engine into its Copilot assistant. This enables users to create full songs, including lyrics and instrumentals, simply by describing what they want. This partnership utilizes Suno's advanced music generation technology to make music creation accessible to everyone through Microsoft's platform.

Generative AI in Music Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 569.7 million

Revenue forecast in 2030

USD 2,794.7 million

Growth rate

CAGR of 30.4% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Aiva Technologies SARL; Boomy Corporation; Ecrett Music; Google LLC; International Business Machines Corporation; LANDR; Meta; Microsoft; OpenAI; Stability AI

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Generative AI in Music Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global generative AI in music market report based on component, technology, application, end use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Transformers

-

Variational Autoencoders (VAEs)

-

Generative Adversarial Networks (GANs)

-

Diffusion Models

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automated Music Composition

-

Music Arrangement and Orchestration

-

Music Style Transfer and Remixing

-

Sound Synthesis and Design

-

Music Personalization and Recommendation

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Music Production and Recording

-

Film and Television

-

Video Games and Interactive Entertainment

-

Advertising and Marketing

-

Music Education and Training

-

Streaming Services and Music Platforms

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global generative AI in music market size was estimated at USD 440.0 million in 2023 and is expected to reach USD 569.7 million in 2024.

b. The global generative AI in music market is expected to grow at a compound annual growth rate of 30.4% from 2024 to 2030 to reach USD 2,794.7 million by 2030.

b. North America dominated the generative AI in music market with a share of 38.6% in 2023. This is attributable to due to its advanced technology infrastructure and significant investment in AI research and development. The presence of major tech companies and innovative startups further fueled the region's leadership in this sector.

b. Some key players operating in the generative AI in music market include Aiva Technologies SARL, Boomy Corporation, Ecrett Music, Google LLC, International Business Machines Corporation, LANDR, Meta, Microsoft, OpenAI, and Stability AI.

b. Key factors that are driving the market growth include Key factors driving market growth include advancements in AI technology, increasing demand for personalized music experiences, and the integration of AI in music production and distribution.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.