- Home

- »

- Pharmaceuticals

- »

-

General Anesthesia Drugs Market Size & Share Report, 2030GVR Report cover

![General Anesthesia Drugs Market Size, Share & Trends Report]()

General Anesthesia Drugs Market Size, Share & Trends Analysis Report By Drug (Propofol, Sevoflurane), By Route Of Administration (Intravenous, Inhaled), By End-use, By Application, By Region and Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-455-1

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

General Anesthesia Drugs Market Trends

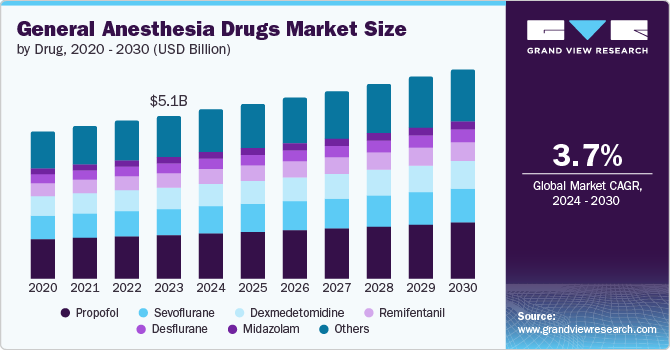

The global general anesthesia drugs market size was estimated at USD 5.1 billion in 2023 and is projected to grow at a CAGR of 3.7% from 2024 to 2030. This growth is primarily fueled by the increasing volume of surgical procedures, advancements in anesthesia technology, and the rising prevalence of chronic diseases. As per the World Health Organization (WHO), the global surgical volume is rising due to increased incidence of chronic diseases and aging populations. The National Library of Medicine also estimates that over 313 million surgical procedures are conducted annually worldwide, underscoring the expanding demand for effective anesthesia solutions.

A primary driver for market growth is the increasing prevalence of chronic diseases & surgical procedures. Chronic conditions such as CVD, cancer, and obesity are on the rise globally, leading to a higher volume of surgeries and medical interventions. For instance, cardiovascular diseases (CVDs) kill approximately 10,000 people in the WHO European Region every day. In addition, the American Cancer Society reports that nearly 2,001,140 new cancer cases are projected in 2024 in the U.S., highlighting a robust demand for surgical interventions and, consequently, anesthesia drugs.

Furthermore, the aging population is a significant demographic factor driving the market's growth. With the aging population across the globe, there is an increasing need for medical procedures, many of which require anesthesia. According to WHO, the number of people aged 60 and older is expected to reach 2.1 billion by 2050, representing a substantial portion of the population that will require surgical interventions and anesthesia. The changing demographics highlight an increasing need for anesthesia medications and services designed with the elderly in mind.

Technological advancements in anesthesia delivery systems are also contributing to market growth. Innovations in anesthesia drugs and equipment have led to enhanced safety profiles, improved efficacy, and reduced side effects. For instance, the development of new anesthetic agents and delivery systems, such as target-controlled infusion systems and advanced monitoring devices, have revolutionized how anesthesia is administered and managed. For instance, in February 2024, Hikma Pharmaceuticals PLC launched Fentanyl Citrate Injection, USP, in the U.S. This medication is designed for short-duration analgesia during anesthesia, premedication, induction, maintenance, and immediate postoperative recovery. These advancements are supported by R&D efforts from major pharmaceutical companies and academic institutions, leading to the introduction of new products that meet the evolving needs of healthcare providers and patients.

The rise in outpatient and minimally invasive surgical procedures influences market dynamics. Advances in surgical techniques, such as laparoscopic and endoscopic procedures, often require different anesthesia approaches than traditional surgeries. The demand for short-acting and rapid-recovery anesthesia agents has increased, leading to innovations and growth in this market segment. Outpatient surgeries, which are less invasive and often performed under general anesthesia, are becoming more common, driving the need for effective and efficient anesthetic solutions.

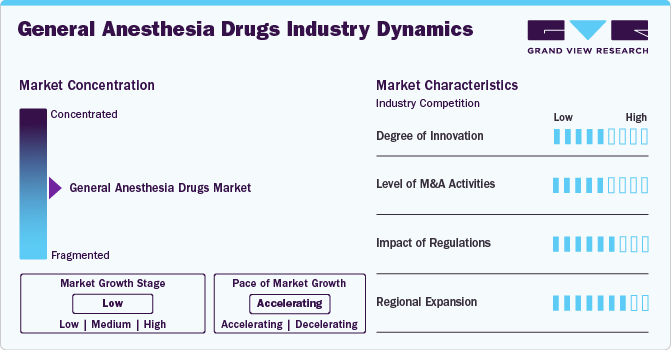

Market Concentration & Characteristics

The general anesthesia drugs industry is characterized by significant innovation driven by advancements in drug development and anesthesia delivery technologies. Companies focus on creating novel anesthetic agents with improved safety profiles, faster onset, and shorter recovery times. For instance, the development of target-controlled infusion systems has revolutionized anesthesia delivery, allowing for precise control over drug administration and enhancing patient outcomes. Innovations such as desflurane and sevoflurane, which offer rapid induction and emergence from anesthesia, have become staples in modern anesthetic practice.

M&A plays a pivotal role in the general anesthesia drugs industry, facilitating market consolidation and the acquisition of new technologies. Major pharmaceutical companies frequently engage in M&A to expand their existing product portfolios and gain access to innovative technologies. M&A activities enable companies to leverage synergies, integrate advanced technologies, and streamline production processes, boosting their competitive edge and market presence. For instance, in April 2024, Baxter expanded its pharmaceutical portfolio in the U.S. with the launch of Ropivacaine Hydrochloride Injection, USP.

Regulations significantly impact the market by ensuring product safety and efficacy. Regulatory organizations such as the U.S. FDA and the European Medicines Agency (EMA) enforce rigorous drug approval and monitoring standards. Recent regulatory updates, such as enhanced labeling requirements and post-market surveillance, aim to improve patient safety and drug effectiveness. These regulations help maintain high standards in the industry and foster trust among healthcare professionals, contributing to a stable and reliable market environment.

Regional expansion is a critical factor in the market's growth, with emerging economies experiencing increased demand due to improved healthcare infrastructure. In regions such as Asia-Pacific and Latin America, growing healthcare investments and rising surgical procedures drive market growth. Favorable government initiatives in India and China, focusing on enhancing healthcare access and infrastructure, contribute to this regional growth. The rise in disposable incomes and improved access to healthcare services also support the expansion of markets in these regions.

Drug Insights

In 2023, the propofol segment dominated the market with a substantial revenue share of 25.4%, and it is also expected to grow at the fastest CAGR of 4.2% over the forecast period. Propofol is renowned for its rapid onset and quick recovery times, which enhance patient comfort and procedural efficiency. It is widely used for induction and maintenance of anesthesia, making it a versatile choice in various surgical and diagnostic procedures. The agent's favorable pharmacokinetic profile, including its short half-life and rapid metabolism, contributes to its popularity among anesthesiologists.

Propofol's broad acceptance in outpatient and same-day discharge procedures underscores its appeal in the growing trend of minimally invasive and outpatient surgeries. Furthermore, advances in formulation and delivery systems, such as improved intravenous administration techniques and the introduction of propofol-based emulsion formulations, have enhanced their clinical utility and safety profile.

Route Of Administration Insights

The intravenous (IV) segment held the largest revenue share of 64.0% in 2023 and is also expected to grow at the fastest CAGR of 3.9% during the forecast period. Several key factors, including IV anesthesia delivery advancements, efficacy, and convenience, are primarily driving this growth trajectory. IV anesthesia is preferred for its rapid onset of action and precise control over drug administration, which are crucial for managing complex surgical procedures and ensuring patient safety. The ability to adjust dosage in real-time allows anesthesiologists to tailor anesthesia depth according to the patient’s needs and the requirements of the surgery.

Innovations in infusion systems, such as target-controlled infusion (TCI) devices, have improved the accuracy of drug delivery and patient monitoring. These systems enable precise control over anesthesia levels, enhancing overall procedural outcomes and patient comfort. For instance, the integration of smart infusion pumps with advanced monitoring systems has streamlined the administration process, reducing the risk of dosing errors and improving patient safety.

End-use Insights

In 2023, the hospitals segment dominated the market, capturing a substantial revenue share of 68.6%. Hospitals are central to providing complex and high-volume surgical procedures, critical drivers for the demand for general anesthesia. As per the American Hospital Association (AHA), hospitals perform most of the country's surgical procedures, including elective and emergency surgeries. This high volume creates a consistent demand for general anesthesia drugs, as hospitals require a wide range of anesthetic agents to effectively manage different types of surgeries. The Urgent Care Association reported in May 2024 that approximately 14,714 urgent care centers nationwide provide diagnostic services and care to over 100 million patients annually.

The Ambulatory Surgery Centers (ASC)s are anticipated to grow at the fastest CAGR of over 4.1% during the forecast period. The growing preference for outpatient surgeries, where patients can undergo procedures and return home on the same day, is a significant driver of ASC growth. As per the Ambulatory Surgery Center Association (ASCA), ASCs offer a practical and affordable substitute for hospital surgeries, attracting patients and insurance providers. Moreover, the Centers for Medicare & Medicaid Services (CMS) have widened the scope of procedures that can be done in ASCs, thus enhancing their attractiveness and application. A study published in Health Affairs highlights that outpatient care settings, including ASCs, offer significant cost savings compared to inpatient hospital care, further fueling their growth.

Application Insights

In 2023, the knee and hip replacement segment dominated the market, capturing a substantial revenue share. This dominance is driven by the increasing prevalence of osteoarthritis, advancements in surgical techniques, and demographic trends. Osteoarthritis, particularly in the knee and hip joints, is a leading driver of the high demand for knee and hip replacement surgeries. According to the Centers for Disease Control and Prevention (CDC), approximately 32.5 million adults in the U.S. suffer from osteoarthritis, with knee and hip joints being commonly affected. This high prevalence results in a significant volume of replacement procedures, driving the demand for adequate general anesthesia.

The cancer segment is anticipated to grow at the fastest CAGR over the forecast period. It is driven by rising cancer incidence, advancements in treatment protocols, and increasing focus on improving patient outcomes. According to the WHO, cancer affects 1 in 5 people, particularly 1 in 12 women, and 1 in 9 men. In 2022, there were reports of 20 million new instances of cancer and 9.7 million fatalities due to the disease, while 53.5 million individuals were living for five years post-diagnosis. These numbers are expected to grow as the worldwide population ages and exposure to known risk factors increases. Cancer requiring surgical intervention, such as those of the breast, lungs, and gastrointestinal tract, necessitate adequate general anesthesia.

Regional Insights

The North America general anesthesia drugs market dominated with a revenue share of 35.98% in 2023, fueled by several critical factors, including the high prevalence of chronic diseases, technological advancements, and substantial healthcare infrastructure. The rising prevalence of chronic conditions such as CVD and cancer, which often require surgical interventions, fuels the demand for general anesthesia. According to the International Society of Aesthetic Plastic Surgery report, 26.2 million surgical procedures were conducted in the U.S. in 2022. In addition, data from the National Library of Medicine indicated that, in 2021, nearly nine significant surgeries were performed per 100 older adults, with over one in seven Medicare beneficiaries undergoing major surgery within five years, highlighting a substantial and growing demand for effective general anesthesia drugs.

U.S. General Anesthesia Drugs Market Trends

The general anesthesia drugs market in the U.S. is notable for its size and dynamic growth. It is driven by the high volume of surgeries, continuous innovation in anesthesia drugs, and a strong emphasis on patient safety and recovery. The U.S. has one of the highest surgical procedure rates globally, reflecting the high demand for anesthesia. The FDA plays an essential role in regulating and approving new anesthetic agents, ensuring safety and efficacy, which supports market expansion. According to the CDC, over 32.5 million adults in the U.S. are affected by osteoarthritis, creating a substantial demand for joint replacement surgeries.

The aging population plays a crucial role in this trend. According to a report published by the U.S. Census Bureau, the proportion of adults aged 65 and older is increasing, and this demographic is more susceptible to joint-related ailments. With the growing elderly population, the frequency of elective joint replacement surgeries, including total knee arthroplasties (TKAs) and total hip arthroplasties (THAs), is rising. These procedures often require general anesthesia for effective pain management and to facilitate a smooth surgical process.

Europe General Anesthesia Drugs Market Trends

The general anesthesia drugs market in Europe is witnessing substantial growth driven by increasing surgical volumes, an aging population, and advancements in anesthesia technology. The aging population across Europe, as highlighted by the European Commission, results in a higher prevalence of age-related diseases that require surgical interventions, driving demand for anesthesia. According to the European Commission, Europe reports an average of around 40 million surgical procedures annually, and the European Medicines Agency (EMA) ensures stringent regulatory oversight, which promotes high standards for anesthesia drugs.

The UK general anesthesia drugs market is bolstered by the increasing number of surgical procedures, advancements in surgical techniques, and government healthcare initiatives. The National Health Service (NHS) performs a high volume of elective and emergency surgeries, creating a substantial demand for anesthesia. According to Cancer Research UK, every year, over 393,000 people are diagnosed with cancer. On average, someone in the UK is diagnosed with cancer every 90 seconds. Recent advancements in anesthesia technologies, including developing new anesthetic agents and improved delivery systems, support market growth.

The general anesthesia drugs market in Germany is thriving due to a combination of high healthcare standards, advanced medical technologies, and an increasing number of surgical procedures. Germany's robust healthcare system, supported by high standards set by regulatory bodies like the Federal Institute for Drugs and Medical Devices (BfArM), ensures the availability of safe and effective anesthesia drugs. The country's commitment to technological innovation in anesthesia and surgical techniques contributes to market growth. Furthermore, as noted by the Federal Statistical Office, Germany's aging population drives the demand for surgeries and, consequently, anesthesia drugs.

Asia Pacific General Anesthesia Drugs Market Trends

The general anesthesia drugs market in the Asia Pacific region is expanding rapidly due to increasing healthcare expenditures, a rising population with growing surgical needs, and advancements in medical technology. APAC's large and diverse population, rising incidence of chronic conditions, and need for surgical interventions further fuel the demand for general anesthesia. Governments in China and India are investing heavily in healthcare infrastructure and medical technology, further driving market growth.

The general anesthesia drugs market in India is experiencing rapid growth, fueled by a rising burden of chronic diseases, increasing surgical volumes, and significant healthcare reforms. India’s large population, with a growing prevalence of conditions like cardiovascular diseases and diabetes, results in a high demand for surgical interventions and anesthesia. According to the National Center for Disease Informatics and Research, the projected number of new cancer cases in India was 1,461,427, with a crude incidence rate of 100.4 per 100,000 individuals in 2022. Recent government initiatives, such as the Ayushman Bharat scheme, aim to improve healthcare access and affordability, thereby increasing the number of surgeries performed.

The general anesthesia drugs market in China is experiencing robust growth, driven by several critical factors, including the increasing prevalence of chronic diseases, significant investments in healthcare infrastructure, and recent advancements in medical technology. According to the China Cardiovascular Disease Report 2022, cardiovascular diseases are the leading cause of death in China, contributing to a high volume of surgical procedures. Additionally, the growing incidence of cancer, as reported by the China National Cancer Center, further fuels the demand for effective anesthesia solutions. The Healthy China 2030 initiative emphasizes improving health services and expanding coverage, which includes increasing the availability of surgical procedures and related anesthesia services. This initiative supports developing and growing healthcare infrastructure, enhancing the overall market for general anesthesia drugs.

Latin America General Anesthesia Drugs Market Trends

The general anesthesia drugs market in Latin America is expanding due to increasing healthcare access, rising surgical procedures, and improvements in medical technology. The region’s growing population and increasing incidence of chronic diseases lead to a higher volume of surgeries, which drives demand for anesthesia drugs. Governments in Brazil and Mexico are investing in healthcare infrastructure and medical technology, supporting market growth.

The general anesthesia drugs market in Brazil is driven by increasing healthcare access, a high volume of surgeries, and advancements in medical technologies. Brazil’s expanding healthcare system, supported by government initiatives like the Unified Health System (SUS), increases access to surgical procedures, thereby driving demand for anesthesia. The country’s high incidence of chronic diseases, such as cardiovascular conditions and diabetes, necessitates frequent surgical interventions.

Middle East & Africa General Anesthesia Drugs Market Trends

The general anesthesia drugs market in the Middle East and Africa is expanding significantly due to rising healthcare investments, increasing surgical procedures, and advancements in medical technology. Favorable initiatives by the government in this region to improve healthcare infrastructure and medical technologies improve access to surgical services. The growing prevalence of chronic conditions and an increasing number of surgical interventions further drive the demand for general anesthesia drugs.

The general anesthesia drugs market in Saudi Arabia is experiencing rapid growth due to significant investments in the healthcare sector, a rising number of surgical procedures, and advancements in medical technologies. The Saudi government’s Vision 2030 initiative emphasizes enhancing healthcare infrastructure and services, supporting the growth of the general anesthesia drugs market. The rising prevalence of chronic diseases and the demand for advanced surgical procedures drive the need for adequate general anesthesia drugs.

Key General Anesthesia Drugs Company Insights

The general anesthesia drugs industry is dominated by several major pharmaceutical companies, which collectively account for a significant market share. These leading players have established themselves through extensive R&D efforts, resulting in the introduction of innovative treatment options. They have also expanded their drug portfolios through strategic collaborations, mergers, and acquisitions.

Key General Anesthesia Drugs Companies:

The following are the leading companies in the general anesthesia drugs market. These companies collectively hold the largest market share and dictate industry trends.

- Baxter International Inc.

- AstraZeneca

- AbbVie Inc.

- B. Braun Melsungen AG

- Fresenius SE & Co. KgaA

- Pfizer

- Hospira Inc.

- Aspen Pharmacare Holdings Limited

- Hikama Pharmaceuticals plc

- Abbott Laboratories

Recent Developments

-

In August 2024, Amneal Pharmaceuticals, Inc. announced FDA approval for its Propofol Injectable Emulsion USP in three single-dose vial concentrations; it is widely used in hospitals to induce and maintain anesthesia and sedation.

-

For instance, in April 2024, Baxter expanded its pharmaceutical portfolio in the U.S. with the launch of Ropivacaine Hydrochloride Injection, USP. This new product comes in a convenient, ready-to-use, single-dose infusion bag.

-

In March 2023, Lupin Ltd's partner, Caplin Steriles, received FDA approval to market Rocuronium Bromide Injection and Thiamine Hydrochloride Injection USP. Rocuronium Bromide Injection is used to aid rapid sequence intubation and muscle relaxation during surgery. Following this, in November 2023, Lupin Ltd's stock rose by 3% succeeding the U.S. launch of Rocuronium Bromide Injection, highlighting the market impact of regulatory approvals.

General Anesthesia Drugs Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.3 billion

Revenue forecast in 2030

USD 6.6 billion

Growth Rate

CAGR of 3.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug, route of administration, end-use, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Sweden, Denmark, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, Saudi Arabia, South Africa, UAE, Kuwait

Key companies profiled

Baxter International Inc.; AstraZeneca; AbbVie Inc.; B. Braun Melsungen AG; Fresenius SE & Co. KgaA; Pfizer; Hospira Inc.; Aspen Pharmacare Holdings Limited; Hikama Pharmaceuticals plc; Abbott Laboratories

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global General Anesthesia Drugs Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global general anesthesia drugs market report based on drug, route of administration, application, end-use, and region.

-

Drug Outlook (Revenue, USD Million, 2018 - 2030)

-

Sevoflurane

-

Propofol

-

Dexmedetomidine

-

Remifentanil

-

Desflurane

-

Midazolam

-

Others - (Sufentanil, Fentanyl, Ketamine, Isoflurane, Thiopental, etc.)

-

-

Route Of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Intravenous

-

Inhaled

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Heart Surgeries

-

Cancer

-

General Surgery

-

Knee And Hip Replacements

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global general anesthesia drugs market was valued at USD 5.1 billion in 2023 and is projected to reach USD 5.3 billion in 2024.

b. The global general anesthesia drugs market is projected to grow at a compound annual growth rate (CAGR) of 3.7% from 2024 to 2030 to reach USD 6.6 billion by 2030.

b. The intravenous (IV) segment held the largest revenue share of 64.0% in 2023 and is also expected to grow at the fastest CAGR of 3.9% during the forecast period.

b. Some of the key players operating in this market include Baxter International Inc.; AstraZeneca; AbbVie Inc.; B. Braun Melsungen AG; Fresenius SE & Co. KgaA; Pfizer; Hospira Inc.; Aspen Pharmacare Holdings Limited; Hikama Pharmaceuticals plc; Abbott Laboratories.

b. The growth is primarily fueled by the increasing volume of surgical procedures, advancements in anesthesia technology, and the rising prevalence of chronic diseases.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."