Gene Silencing Market Size, Share & Trends Analysis Report By Application (Drug Discovery & Development, Therapeutics Manufacturing), By Product & Service, By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-544-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Gene Silencing Market Size & Trends

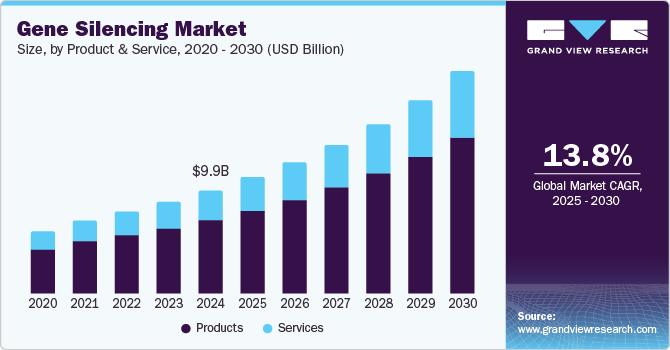

The global gene silencing market size was estimated at USD 9.92 billion in 2024 and is projected to grow at a CAGR of 13.8% from 2025 to 2030. The gene silencing industry is driven by the rising prevalence of genetic disorders and chronic diseases, prompting demand for targeted therapies such as RNA interference (RNAi) and antisense oligonucleotides (ASOs). Advancements in delivery systems, like lipid nanoparticles, have improved the stability and precision of these treatments, expanding their potential to address conditions like neurological and cardiovascular diseases.

One primary driver is the increasing prevalence of genetic disorders and chronic diseases, which has heightened the demand for innovative therapeutic approaches. Gene silencing technologies, such as RNA interference (RNAi) and antisense oligonucleotides (ASOs), offer targeted treatments by specifically inhibiting the expression of disease-causing genes. This precision has made them attractive candidates for addressing conditions that were previously difficult to treat.

Technological advancements have also played a pivotal role in driving the market forward. Innovations in delivery mechanisms, such as lipid nanoparticles and conjugate-based systems, have enhanced the stability and specificity of gene silencing agents, improving their efficacy and safety profiles. These developments have expanded the potential applications of gene silencing beyond hepatic diseases to include neurological and cardiovascular disorders. Collaborations between biotech companies, pharmaceutical firms, and academic institutions have further accelerated the development and commercialization of RNAi therapeutics, addressing regulatory and technical challenges.

Recent corporate activities underscore the dynamic market nature. For example, Arrowhead Pharmaceuticals entered into a substantial licensing agreement with Sarepta Therapeutics, valued at up to $11.38 billion over the next five years. This deal includes an upfront payment of $825 million and reflects a significant commitment to advancing gene silencing therapies for neuromuscular diseases. In addition, Avidity Biosciences has made notable strides in developing RNA-targeting therapies for muscular dystrophies. Their innovative approach aims to silence problematic genes associated with these conditions, offering hope for effective treatments. These developments highlight the growing investment and confidence in gene silencing technologies as transformative therapeutic modalities.

The market is experiencing significant growth, driven by advancements in gene silencing technology and the increasing demand for targeted therapies. Market research indicates a growing interest in gene silencing techniques, such as RNA interference (RNAi) and CRISPR-based technologies, which pave the way for innovative treatments in various therapeutic areas, including genetic disorders and cancer. As the gene silencing industry size continues to expand, key technology trends, such as improved delivery systems and enhanced precision targeting, are facilitating more effective and personalized treatments. These innovations are attracting investment and driving the market forward, with a focus on overcoming delivery challenges and maximizing therapeutic potential.

Rising Incidence of Genetic Disorders

The prevalence of genetic and congenital diseases significantly impacts prenatal and neonatal mortality rates across various regions. Genetic factors are key contributors to many multifactorial conditions, adding to their complexity and severity. These disorders often involve multiple bodily systems, making effective treatment challenging due to their genetic origins.

Data from the Department of Health and the Government of Western Australia highlight the extensive reach of genetic disorders, affecting a notable portion of the population. The high incidence of genetic conditions and birth abnormalities among newborns underscores the urgent need for targeted interventions. While gene silencing techniques offer promising treatment options for certain genetic disorders, many current therapies fail to address the root genetic causes.

Genetic mutations, environmental factors like chemical exposure, and radiation further contribute to developing these conditions, emphasizing the demand for improved therapeutic strategies. The rising prevalence of genetic disorders across different demographics and regions drives market growth as innovative treatments become essential to managing these complex conditions.

Gene Therapy Clinical Trial Pipeline

|

Gene Therapies |

Company |

Phase |

Indication |

|

RP-L102 |

Rocket Pharmaceuticals |

Preregistration |

Fanconi's anaemia |

|

DTX401 |

Ultragenyx Pharmaceutical Inc |

III |

Glycogen storage disease type I |

|

ADVM-022 |

Adverum Biotechnologies |

II |

Diabetic retinopathy; Wet age-related macular degeneration |

|

KYV-101 |

Kyverna Therapeutics |

II |

Multiple sclerosis; Myasthenia gravis; Stiff-person syndrome |

|

RP A501 |

Rocket Pharmaceuticals |

II |

Glycogen storage disease type II |

|

ALLO 605 |

Allogene Therapeutics/Cellectis |

I/II |

Multiple myeloma |

|

CD19-NEX-T |

Juno Therapeutics |

I |

Multiple sclerosis; Non-Hodgkin's lymphoma; Systemic lupus erythematosus |

|

NW 301V |

Neowise Biotechnology |

I |

Solid tumors |

|

WZTL 002 |

Wellington Zhaotai Therapies |

I |

Non-Hodgkin's lymphoma |

High Cost of Gene Silencing Treatments

The high cost of gene silencing treatments is primarily driven by the complexity of the technologies involved, including the development of specialized delivery systems, rigorous clinical trial processes, and the need for precise genetic targeting. Advanced techniques like RNA interference (RNAi) and CRISPR-based therapies require significant research and development investment and sophisticated manufacturing capabilities to ensure safety and efficacy. Moreover, the regulatory hurdles for approval and the need for personalized treatment regimens further contribute to the high expenses. These factors make gene silencing therapies expensive, limiting their accessibility despite their potential to treat rare and complex genetic disorders.

|

Technique |

Mechanism |

Applications |

Advantages |

Limitations |

Cost |

|

RNA Interference (RNAi) |

Utilizes small interfering RNAs (siRNAs) to degrade target mRNA, preventing translation. |

Functional genomics, therapeutic gene silencing. |

High specificity, reversible effects. |

Delivery challenges, potential off-target effects. |

Moderate |

|

CRISPR-Cas9 |

Employs a guide RNA to direct the Cas9 nuclease to specific DNA sequences, enabling targeted gene editing. |

Gene knockout, functional genomics, potential therapeutic applications. |

Permanent gene disruption, versatile applications. |

Ethical concerns, risk of off-target effects. |

High (due to research and development expenses) |

|

RISPR Interference (CRISPRi) |

A catalytically dead Cas9 (dCas9) is guided to gene promoters to inhibit transcription without inducing DNA breaks. |

Reversible gene silencing, regulation of gene expression. |

Does not rely on double-stranded DNA breaks or tunable expression. |

Requires careful design to avoid off-target effects. |

High (due to development and optimization efforts) |

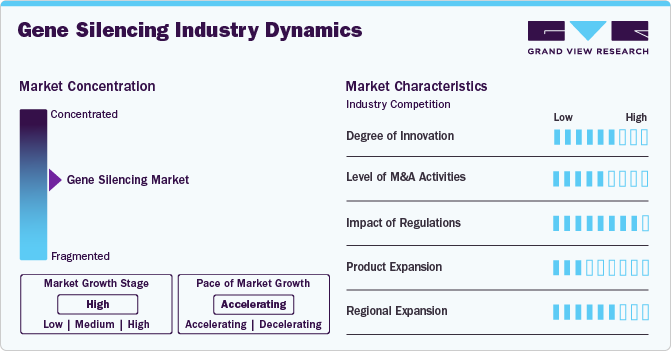

Market Concentration & Characteristics

Innovation in the gene silencing industry is robust, with continuous advancements in RNA interference (RNAi) technologies, antisense oligonucleotides (ASOs), and improved delivery systems like lipid nanoparticles. Companies are actively developing novel therapeutic approaches to target previously untreatable genetic conditions, enhancing treatment precision and efficacy.

The industry has seen substantial merger and acquisition (M&A) activity as larger pharmaceutical firms acquire biotech innovators to strengthen their gene silencing portfolios. Notable deals include Novartis' acquisition of The Medicines Company for its RNAi technology, showcasing the strategic importance of these therapies in expanding treatment pipelines.

Regulatory frameworks play a crucial role in shaping the gene silencing industry, with stringent guidelines set by authorities like the FDA and EMA. These regulations ensure safety, efficacy, and ethical considerations in gene-editing applications, influencing the pace of product approvals and commercialization.

The gene silencing industry is witnessing rapid product expansion, with therapies targeting conditions such as hereditary transthyretin amyloidosis (hATTR), hypercholesterolemia, and certain cancers. Companies are actively exploring new indications to broaden the clinical application of gene silencing therapies.

North America leads the gene silencing industry due to strong research infrastructure and high investment in biotech innovations. However, Asia-Pacific is emerging as a key growth region, driven by increasing healthcare investments, rising genetic disorder prevalence, and expanding clinical research initiatives.

Product & Service Insights

In 2024, the products segment accounted for the largest revenue share. The market is driven by continuous advancements in RNA interference (RNAi), antisense oligonucleotides (ASOs), and CRISPR-Cas technologies. Innovations in delivery systems such as lipid nanoparticles, GalNAc conjugates, and viral vectors have enhanced these therapies' stability, specificity, and efficacy. Furthermore, the increasing demand for targeted treatment options addressing rare genetic disorders, cancer, and neurodegenerative diseases has spurred product development. Companies are actively investing in expanding their product pipelines, with several gene silencing drugs gaining regulatory approvals or advancing through clinical trials, further driving gene silencing industry growth.

Services is expected to register the fastest CAGR during the forecast period. As pharmaceutical and biotech companies focus on developing RNAi, antisense oligonucleotides (ASOs), and CRISPR-based therapies, they increasingly rely on external service providers for assay development, gene sequence validation, vector design, and delivery optimization.

Application Insights

Drug discovery & development dominated the market and captured the largest revenue share in 2024. Researchers are leveraging RNA interference (RNAi), antisense oligonucleotides (ASOs), and CRISPR-Cas technologies to identify and silence disease-causing genes, accelerating the development of novel therapeutics. In addition, collaborations between biotech firms, academic institutions, and pharmaceutical companies foster innovation in gene silencing-based drug discovery, enabling faster progression from preclinical research to clinical trials and driving gene silencing industry growth.

The therapeutics manufacturing segment is expected to register a significant CAGR during the forecast period. Increasing demand for RNAi, antisense oligonucleotide (ASO), and CRISPR-based therapies has prompted manufacturers to invest in automated systems, single-use bioreactors, and improved purification techniques to enhance production efficiency and product stability. Moreover, partnerships between biotech firms and contract manufacturing organizations (CMOs) are accelerating the large-scale production of gene silencing therapies. Regulatory advancements ensuring quality control and streamlined approval processes further support the expansion of gene silencing therapeutics manufacturing.

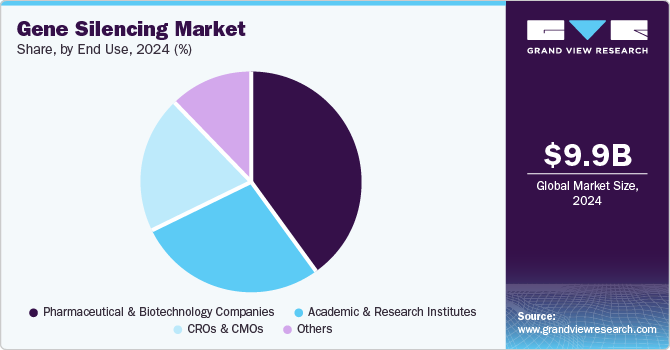

End Use Insights

The pharmaceutical & biotechnology companies segment dominated the market and accounted for the largest revenue share of 41.75% in 2024. Companies are actively expanding their R&D pipelines, leveraging gene silencing to address unmet medical needs. Strategic collaborations, licensing agreements, and acquisitions further accelerate innovation and product development. Furthermore, regulatory incentives such as orphan drug designations and fast-track approvals encourage biotech and pharma firms to pursue gene silencing therapies, driving industry growth.

CROs & CMOs segment.is expected to register the highest CAGR during the forecast period. The market is driven by the rising demand for specialized expertise and scalable production solutions in gene silencing therapeutics. Pharmaceutical and biotech companies increasingly outsource preclinical research, clinical trials, and manufacturing processes to CROs and CMOs to reduce costs, enhance efficiency, and accelerate time-to-market. CROs provide advanced services such as target validation, assay development, and bioinformatics support, while CMOs invest in cutting-edge bioprocessing technologies to meet the growing demand for RNAi, antisense oligonucleotides (ASOs), and CRISPR-based therapies. This outsourcing trend is boosting growth in the CRO and CMO segments within the market.

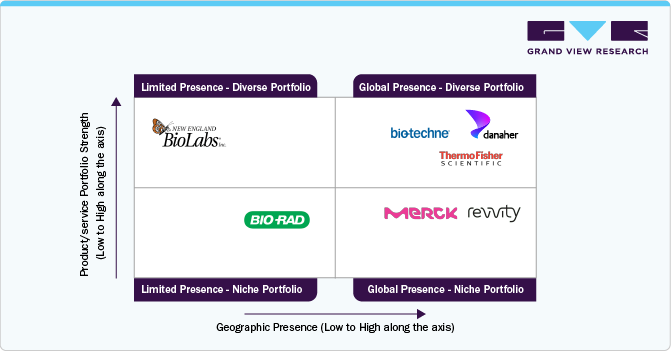

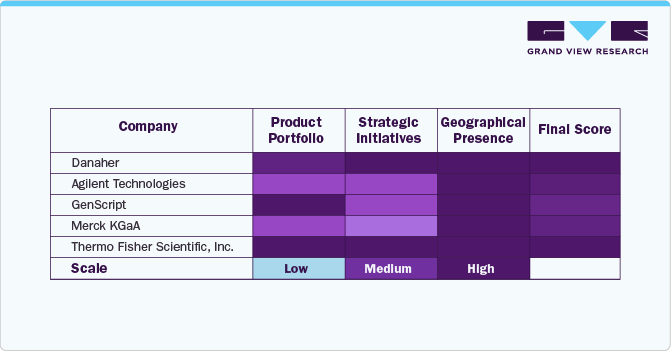

Competitive Analysis

Source: Investor Presentations, Company Websites, Primary Research, Grand View Research

Source: Investor Presentations, Company Websites, Primary Research, Grand View Research

The table evaluates key players in the market based on parameters such as product portfolio, strategic initiatives, and geographic presence. Danaher, Agilent Technologies, GenScript, Merck KGaA, and Thermo Fisher Scientific, Inc. exhibit high scores across all parameters, indicating a strong product portfolio, strategic initiatives, and global presence. These companies are well-positioned in the market due to their broad offerings and international reach. Revvity, Inc. and others show medium rankings in strategic initiatives while maintaining high scores in other areas. This suggests that while they have strong market penetration, they may need to enhance their strategic initiatives to remain competitive. Bio-Techne and Bio-Rad Laboratories have room for growth in expanding collaborations, partnerships, and innovation strategies.

Regional Insights

North America captured the largest market share of 48.23% in 2024. The North American market size is driven by strong investment in biotechnology, a well-established healthcare infrastructure, and ongoing research in RNA interference (RNAi) and antisense oligonucleotide (ASO) technologies. Leading pharmaceutical firms actively collaborate with research institutions to develop innovative therapies, boosting market growth. Furthermore, a population with high susceptibility to rare diseases, increased market penetration rates, and technologically advanced healthcare infrastructure support regional growth.

U.S. Gene Silencing Market Trends

The gene silencing market in the U.S. benefits from extensive government funding for genetic research, coupled with the presence of major biotech players like Alnylam Pharmaceuticals and Ionis Pharmaceuticals. Increasing clinical trials for gene-silencing therapies and FDA approvals for RNA-based drugs further accelerate growth.

Europe Gene Silencing Market Trends

The gene silencing market in Europe is growing due to the rising incidences of genetic disorders. Supportive regulatory frameworks from the European Medicines Agency (EMA) drive demand for gene silencing therapies. Strategic collaborations between biotech firms and academic institutions foster innovation across the region.

The UK gene silencing market is propelled by strong government support for genomic research, advanced healthcare facilities, and initiatives like Genomics England. This fosters the development of gene-silencing therapies targeting rare and complex genetic disorders.

The gene silencing market in Germany is witnessing significant growth due to its robust biotechnology sector. This sector, combined with increased funding for genetic research and partnerships between pharma giants and universities, has accelerated the development of gene silencing technologies. Regulatory support for advanced therapies further strengthens the market.

Asia Pacific Gene Silencing Market Trends

The gene silencing market in Asia Pacific is expanding rapidly due to increasing investments in healthcare innovation, rising awareness of genetic conditions, and growing partnerships between regional biotech firms and global pharmaceutical leaders.

China gene silencing market is driven by government initiatives promoting genetic research, rising healthcare investments, and an expanding biotechnology industry. The country’s emphasis on developing precision medicine further fuels demand.

The gene silencing market in Japan is supported by a strong focus on genetic medicine research, government-backed genomic initiatives, and collaborations between Japanese pharma companies and global biotech firms.

MEA Gene Silencing Market Trends

The gene silencing market in the Middle East is gaining momentum due to increasing investments in healthcare infrastructure and growing awareness of advanced cancer diagnostics. The region’s rising cancer burden and efforts to improve early detection and personalized medicine are moderately driving demand for innovative technologies like CTC analysis. Partnerships between healthcare institutions and global biotech firms are further accelerating the adoption of liquid biopsy solutions.

The gene silencing market in Saudi Arabia isexpected to grow significantly over the forecast period. In Saudi Arabia, the CTC market is supported by the government's healthcare reforms under Vision 2030, which emphasize advanced diagnostic technologies and improved cancer care. Rising investments in precision medicine and initiatives to enhance oncology research capabilities are fostering demand for CTC-based testing for early detection and monitoring of metastatic cancers.

Kuwait gene slicing market is growing due to the rise in the prevalence of cancer, and increasing investments in diagnostic innovations drive the adoption of CTC technologies. The country's healthcare sector is expanding its focus on precision oncology, with medical institutions exploring non-invasive methods like CTC analysis to improve cancer diagnosis, prognosis assessment, and treatment monitoring.

Key Gene Silencing Company Insights

Key players mostly adopted partnerships, acquisitions, and expansion strategies. Companies such as Bio-Techne have acquired smaller companies with advanced technologies to expand their market reach globally.

Key Gene Silencing Companies:

The following are the leading companies in the gene silencing market. These companies collectively hold the largest market share and dictate industry trends.

- Revvity, Inc.

- Danaher

- Agilent Technologies

- GenScript

- Merck KGaA

- Thermo Fisher Scientific, Inc.

- Illumina

- Bio-Rad Laboratories

- Bio-Techne

- New England Biolabs, Inc.

Recent Developments

-

In January 2024, the completion of the gene therapy collaboration between Biogen and Ginkgo Bioworks is anticipated to drive the demand for gene therapies in the future.

-

In December 2023, The Swiss Agency for Therapeutic Products approved Libmeldy to treat early-onset metachromatic leukodystrophy. This regulatory approval highlights gene therapy's increasing recognition and acceptance as a viable treatment for genetic disorders.

-

In May 2023, Novartis acquired a gene therapy candidate from Avrobio, a company experiencing financial difficulties. Novartis provided an exceptional advance payment of $87.5 million for the clinical-phase asset without any conditions for future payments. The agreement included AVR-RD-04, a hematopoietic stem cell gene therapy program currently being investigated for treating the rare genetic disorder cystinosis.

Gene Silencing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 11.17 billion |

|

Revenue forecast in 2030 |

USD 21.29 billion |

|

Growth rate |

CAGR of 13.8% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product & service, application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; Kuwait; UAE; South Africa |

|

Key companies profiled |

Revvity, Inc.; Danaher; Agilent Technologies; GenScript; Merck KGaA; Thermo Fisher Scientific, Inc.; Illumina; Bio-Rad Laboratories; Bio-Techne; New England Biolabs, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Gene Slicing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gene silencing market report based on product & service, application, end use, and region:

-

Product & Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Products

-

RNAi

-

miRNA

-

siRNA

-

Others

-

-

CRISPR-Cas9

-

CRISPR Kits & Reagents

-

CRISPR Libraries

-

Others

-

-

Antisense Oligonucleotides

-

Others

-

-

Services

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Drug Discovery & Development

-

Neurology

-

Oncology

-

Infectious Diseases

-

Metabolic Diseases

-

Others

-

-

Therapeutics Manufacturing

-

Agricultural Applications

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

Academic & Research Institutes

-

CROs & CMOs

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global gene silencing market size was estimated at USD 9.92 billion in 2024 and is expected to reach USD 11.17 billion in 2025.

b. The global gene silencing market is expected to grow at a compound annual growth rate of 13.76% from 2025 to 2030 to reach USD 21.29 billion by 2030.

b. North America dominated the gene silencing market with a share of 48.23% in 2024. This is attributable to rising demand for advanced drug development technologies and increasing opportunities in the RNAi therapy space.

b. Some key players operating in the gene silencing market include Revvity, Inc., Danaher, Agilent Technologies, GenScript, Merck KGaA, Thermo Fisher Scientific, Inc., Illumina, Bio-Rad Laboratories, Bio-Techne, New England Biolabs, Inc.

b. Key factors that are driving the market growth include advancements in gene-editing technologies, increased research in targeted therapies, and growing demand for personalized medicine.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."