- Home

- »

- Biotechnology

- »

-

Gene Panel Market Size, Share And Growth Report, 2030GVR Report cover

![Gene Panel Market Size, Share & Trends Report]()

Gene Panel Market (2024 - 2030) Size, Share & Trends Analysis Report By Product & Services (Test Kits, Testing Services), By Technique (Amplicon Based), By Design, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-977-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Gene Panel Market Size & Trends

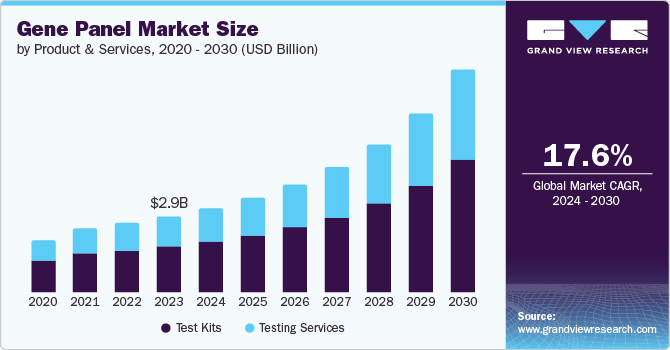

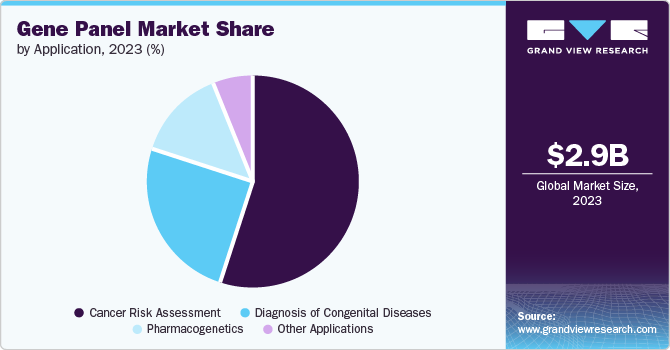

The global gene panel market size was valued at USD 2.97 billion in 2023 and is projected to grow at a CAGR of 17.6% from 2024 to 2030. The market is experiencing expansion owing to the rising prevalence of hereditary disorders and cancer and the increasing need for genetic screening to proactively reduce mortality rates from genetic disorders. In addition, identifying the genetic predisposition for various types of cancer or other genetic disorders has become the primary approach for clinicians to advance disease prognosis and treatment.

According to the National Cancer Institute, there were approximately 20 million new cases of cancer in 2022 globally, and the number of new cases is expected to rise to 29.9 million by 2040. The increasing prevalence of cancer, coupled with the rising adoption of gene panels in cancer-focused treatments, is expected to foster market growth.

According to the Genetic and Rare Disease (GARD) Information Centre, there are at least 7,000 diagnosed genetic conditions and the list is growing continuously. At least 200,000 people in the U.S. are survivors of some kind of known genetic disorder. On the other hand, in the U.K., at least 30,000 infants are diagnosed each year with a genetic disorder, with an accumulation of over 2.4 million survivors of different kinds of genetic conditions. Many gene panels are designed to detect genetic disorders at birth so that effective prognosis and therapeutic steps can be taken as early as possible.

The market shows substantial promise in meeting the unmet diagnostic and therapeutic requirements for chronic illnesses. As the number of deaths related to cardiovascular diseases, diabetes, and arthritis rises among adults, there is a critical need for advanced diagnostic services. These services integrate clinically significant target sequences into NGS tests, providing a hopeful resolution.

Product & Services Insights

Test kits dominated the market and accounted for a revenue share of 60.0% in 2023. The population across the globe is inclining towards self-utilitarianism. The development of advanced test solutions to facilitate the diagnosis of various chronic diseases is a major driver for market growth. For instance, in October 2023, the National Medical Products Administration (NMPA) of China approved Geneseeq’s NSCLC tumor mutational burden test Kit with a large gene panel covering 425 cancer-associated genes.

Testing services segment is expected to grow at the fastest CAGR over forecast period from 2024 to 2030. Genetic testing services offer a diverse array of tests that play a crucial role in informing significant health decisions. These services serve multiple purposes, including disease diagnosis, gene mutation identification, disease risk prediction, and treatment strategy guidance. By seamlessly integrating genetic testing into routine healthcare, these services provide convenient ordering, flexible cost options, and professional genetic counseling to aid in the interpretation of test results.

Application Insights

Cancer risk assessment accounted for the largest share of 54.9% in the year 2023. Gene panels offer a comprehensive alternative to multiple screening tests in identifying genetic risk factors for different cancers. For instance, in October 2023, Invitae, a medical genetics company, received market authorization for its Common Hereditary Cancers Panel from the U.S. Food and Drug Administration. The panel can be utilized in identifying the germline variants related to hereditary cancer. The development of such products is further expected to drive growth in the market.

The diagnosis of congenital diseases segment is expected to grow significantly over the forecast period. Congenital diseases, commonly developed during fetal development, can be diagnosed before birth, during delivery, or even in early childhood. Several tests are being developed which can assist in identifying these diseases and providing treatment solutions. For instance, in February 2024, the Cord Blood Registry by CooperSurgical and Fulgent Genetics introduced various genetic testing options, including the CBR Snapshot genetic test, the CBR Portrait genetic test, and the CBR Landscape genetic test, which can help in screening children for various diseases, including cardiovascular, cancer, neonatal diabetes, and others.

Techniques Insights

Amplicon-based approach dominated the market and accounted for a share of 79.2% in 2023. This approach is widely used as a target-based next-generation sequencing technique that examines genetic variations in a particular genomic area. This method has various applications, such as genotyping via sequencing, CRISP validation, identification of inherited SNPs, and detection of indels. Numerous products based on amplicon sequencing are being launched, which is expected to drive growth in the market. For instance, in October 2022, PacBio introduced Onso, a short-read sequencing platform. The platform supports whole-genome sequencing and other targeted methods, including amplicon and hybridization capture panels.

The hybridization-based approach is expected to grow at a significant CAGR over the forecast period. The hybridization-based approach is considered reproducible and reliable and is thus frequently utilized for multigene panels. For instance, Integrated DNA Technologies, Inc. offers xGen Custom Hybridization Capture Panels, which include high-fidelity, individually synthesized, 5′-biotinylated oligos that can be used for targeted NGS research. The approach proves to be highly advantageous when sequencing a large number of genes, which is expected to help in driving segmental growth.

Design Insights

The predesigned gene panel approach dominated the market and accounted for a revenue share of 66.1% in 2023. The increasing investment in genomics and efforts to build technologies that can help in gaining new insights into the biological systems that regulate human health and disease are major factors driving the growth of this segment. For instance, in October 2023, Vizgen launched predesigned MERFISH Gene Panels at the American Association for Cancer Research (AACR) Annual Meeting2023 in oncology and neuroscience, which are expected to help in studying the human tumor biology and investigating the mouse brain, respectively.

The customized gene panel is expected to register a significant CAGR over the forecast period. Customized gene panels aid in identifying individual nucleotide and copy number variations. Gene panels can be used for profiling various cell types and cell signaling pathways for multiple tissue types and diseases. This enables extremely effective and sensitive sequencing of specific gene panels or customized targets. In March 2024, 10x Genomics launched a 5,000-Plex Gene Panel for Xenium. The panel is highly customizable which facilitates targeting of specific biology as per research requirements. The development of such panels is expected to foster segmental growth in the market.

End-use Insights

The academic & research institutes segment held the largest revenue share accounting for over 42.4% in 2023 and is expected to witness significant growth during the forecast period. The rise in cancer and genetic disorder incidences worldwide is poised to drive research and development activities, paving the way for favorable growth prospects within the industry. The increasing emphasis on preventing genetic disorders from being inherited by future generations is driving the demand for gene panels for pre-gestational, prenatal, and neonatal screenings, and cancer screenings. In the U.S., the price of genetic testing varies significantly, ranging from less than USD 100 to over USD 2,000. The final cost is determined by the type and intricacy of the test. In cases where multiple tests are required or when several family members need to be tested for a conclusive outcome, the cost tends to rise.

The pharmaceutical & biotechnology companies segment witnessed a rapid growth rate of 22.8%. The segment is experiencing growth due to factors such as the increasing demand for gene panels in research, higher government funding, and focus of major companies on research and development of advanced drug development. For instance, in November 2023, Natera, Inc., and MSD entered into an agreement that allowed MSD to use the real-world database of Natera. The database contains clinical and genomic data of approximately 100,000 patients with cancer, which MSD is expected to use to advance oncology research.

Regional Insights

North America dominated the global gene panel market with a share of 36.7% in 2023. Cancer research and inherited rare diseases have witnessed a significant surge, accompanied by a notable increase in the number of NGS-based and clinical applications. Moreover, the presence of leading NGS providers in this region, coupled with the growing government support for genomics research, has further propelled advancements in this field. For instance, in September 2022, the CDC announced funding of around USD 90 million to support the Pathogen Genomics Centers of Excellence (PGCoE) network, which is expected to help in the implementation of advanced genomics technologies and applications for public health in the U.S. and prepare for infectious disease threats.

U.S. Gene Panel Market Trends

The U.S. accounted for a market share of 26.3% in the global gene panel market in 2023 due to the increasing prevalence of chronic diseases such as cancer and the development of advanced solutions. For instance, according to the American Cancer Society, approximately 2 million people are expected to be diagnosed with cancer in 2024. The rising cases are also driving private and public players to invest in research and development of advanced solutions, which is further expected to drive market growth.

Europe Gene Panel Market Trends

The gene panel market in Europe is expected to grow over the forecast period. Supportive government policies, regulations, development, and approval of new products in the region are likely to foster growth in the market. For instance, Germany has genomeDE, which is the National Strategy for Genomic Medicine, that can help in improving the prevention, diagnosis, and treatment of certain diseases.

The UK government has demonstrated a resolute dedication to the progression of genomic healthcare and research. Notably, the NHS in England has become the pioneer in providing whole genome sequencing as a standard component of routine care, which is anticipated to add to the market growth in the country.

Asia Pacific Gene Panel Market Trends

Asia Pacific gene panel market is expected to grow at the fastest CAGR over the forecast period. The increasing research on chronic diseases, including cancer, as well as the growing number of NGS-based and clinical applications, are major driving factors for market growth. Moreover, the presence of key players in this region, coupled with the rising government support for genomics research, further contributes to the region's potential for growth. In June 2022, Avesthagen Limited entered into a collaboration with Wipro L, which aims to develop and commercialize genetic testing solutions for analysis of several diseases conditions, such as cancers, neurodegenerative diseases, autoimmune disorders, and other diseases.

India's global gene panel market is expected to grow significantly over the forecast period owing to the increasing demand for advanced treatment options and development activities by major players in the market. For instance, in August 2021, 4baseCare, which operates in the precision oncology market, introduced a cancer gene specific to the Indian population. Such advancements in the country are likely to foster growth in the market.

Key Gene Panel Company Insights

The key companies in the gene panel market include Agilent Technologies, Illumina Inc., Qiagen Inc., Eurofins Genomics, Thermo Fisher Scientific, Foundation Medicine Inc., Guardant Health, Inc., Myriad Genetic Laboratories Inc., Cepheid, Bio-Rad Laboratories, Inc., and Personalis. The players in the market are engaged in strategic alliances, partnerships, product launches, and acquisitions to increase their share in the market.

-

Agilent Technologies is a global life science company that also offers solutions for genetic analysis and research. The company provides a range of products and services related to gene panels, including expert-designed NGS assays and panels, which can further help in advancing genomic research.

-

Illumina Inc. is a global company operating in the genomics market. The is engaged in the development of advanced technologies based on DNA sequencing and array-based life sciences to facilitate research discovery and personalized health.

Key Gene Panel Companies:

The following are the leading companies in the gene panel market. These companies collectively hold the largest market share and dictate industry trends.

- Agilent Technologies

- Illumina Inc.

- Qiagen Inc.

- Eurofins Genomics

- Thermo Fisher Scientific

- Foundation Medicine Inc.

- Guardant Health, Inc.

- Myriad Genetic Laboratories Inc.

- Cepheid

- Bio-Rad Laboratories, Inc.

- Personalis

Recent Developments

-

In April 2023, Agilent Technologies, Inc. launched the NGS assay, which can be used for somatic variant profiling in a broad range of solid tumors and is expected to help advance precision oncology through comprehensive genomic profiling (CGP).

-

In May 2023, Unipath Specialty Laboratory in India, leveraging SOPHiA GENETICS technology, introduced the HRD Gene Panel, which is expected to help in the development of the cancer genomics field.

-

In January 2023, Twist Bioscience and Centogene launched new NGS panels, expected to facilitate sensitive detection of target genetic sequences and aid in research associated with hereditary cancer.

Gene Panel Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.29 billion

Revenue forecast in 2030

USD 8.73 billion

Growth Rate

CAGR of 17.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & services, techniques, design, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa

Key companies profiled

Agilent Technologies; Illumina Inc.; Qiagen Inc.; Eurofins Genomics; Thermo Fisher Scientific; Foundation Medicine Inc.; Guardant Health, Inc.; Myriad Genetic Laboratories Inc.; Cepheid; Bio-Rad Laboratories, Inc.; Personalis

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gene Panel Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gene panel market report based on product & services, techniques, design, application, end-use, and region:

-

Product & Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Test Kits

-

Testing Services

-

-

Techniques Outlook (Revenue, USD Million, 2018 - 2030)

-

Amplicon Based Approach

-

Hybridization Based Approach

-

-

Design Outlook (Revenue, USD Million, 2018 - 2030

-

Predesigned Gene Panel

-

Customized Gene Panel

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic & Research Institutes

-

Hospital & Diagnostic Laboratories

-

Pharmaceutical & Biotechnology Companies

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer Risk Assessment

-

Diagnosis of Congenital Diseases

-

Pharmacogenetics

-

Other Applications

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.