- Home

- »

- Petrochemicals

- »

-

Gelcoat Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Gelcoat Market Size, Share & Trends Report]()

Gelcoat Market (2024 - 2030) Size, Share & Trends Analysis Report By Raw Material (Polyester Resin, Vinyl Ester Resin, Epoxy Resin, By End Use (Marine, Transportation, Construction, Wind & Energy), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-412-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Gelcoat Market Size & Trends

“2030 Gelcoat Market value to reach USD 3,328.1 million”

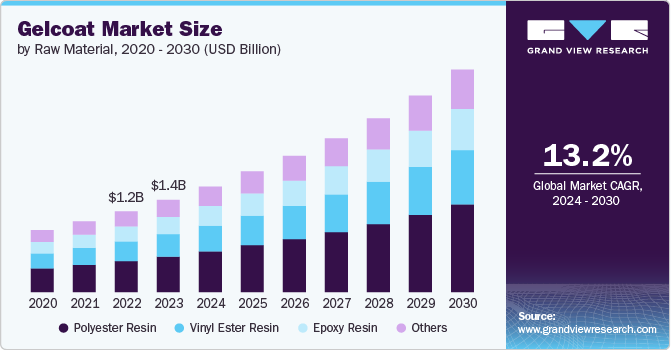

The global gelcoat market size was estimated at USD 1,380.1 million in 2023 and is projected to grow at a CAGR of 13.2% in terms of revenue from 2024 to 2030. Gelcoats are essential for protecting and enhancing the appearance of composite materials. The increasing use of composites in various industries, such as automotive, marine, construction, and wind energy, is driving gelcoat demand.

Gelcoats contribute to the lightweight and durable properties of composite structures. As industries seek to reduce weight and improve performance, the demand for gelcoats is on the rise. The boating and marine industry is a major consumer of gelcoats. Increasing leisure activities and growing tourism are boosting the demand for boats and marine equipment, thereby driving gelcoat consumption.

They are used in construction for various applications, including roofing, cladding, and architectural elements. The growing construction industry is contributing to the gelcoat market's expansion. The automotive industry is increasingly using composite materials for body panels and other components. They are essential for providing a protective and aesthetically pleasing finish to these components.

Drivers, Opportunities & Restraints

The wind energy sector utilizes composite materials extensively for turbine blades. Gelcoats play a crucial role in protecting these blades from environmental factors. They offer a wide range of colors and finishes, allowing for customization and enhancing the visual appeal of products. Ongoing research and development are leading to the development of new product formulations with improved properties, such as better resistance to UV rays, chemicals, and abrasion.

Ongoing research and development are leading to the development of new gelcoat formulations with improved properties, such as better resistance to UV rays, chemicals, and abrasion. Developing innovative gelcoat formulations with improved properties like UV resistance, fire retardancy, and self-healing capabilities can create new market niches.

Raw Material Insights & Trends

“Polyester resin to emerge as the fastest growing product with a CAGR of 13.5% from 2024-2030”

Polyester resin segment dominated the market and accounted for a revenue share of 38.67% in 2023. It forms the base material that gives gelcoat its essential properties. When combined with pigments, fillers, and other additives, polyester resin transforms into a durable, protective, and aesthetically pleasing coating. It acts as the binding agent that holds the pigments and fillers together.

The resin contributes to the product's resistance to weathering, UV radiation, and chemicals. While pigments provide color, the resin contributes to the overall finish and gloss of the gelcoat. Gelcoat, based on polyester resin, effectively protects the underlying composite material from environmental factors.

While polyester resin is the traditional choice, epoxy resin is an increasingly popular alternative. Epoxy resins generally exhibit better adhesion to various substrates, including fiberglass and other materials. Epoxy-based product often offer enhanced resistance to chemicals, solvents, and environmental factors. They tend to have superior mechanical properties, such as strength and flexibility.

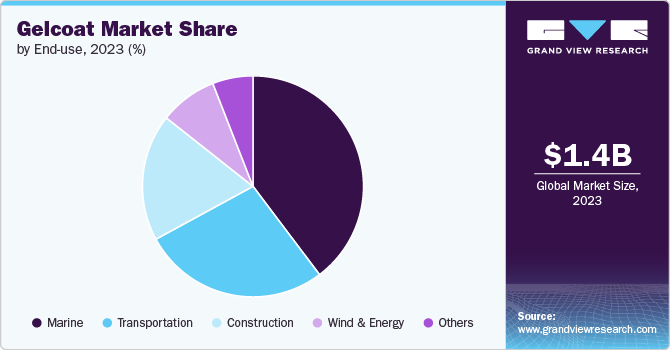

End Use Insights & Trends

“Marine to emerge as the fastest growing end use segment with a CAGR of 13.6% from 2024-2030”

Marine dominated the market with a market and accounted for a revenue share of 39.72% in 2023. It serves as the outermost layer of fiberglass boats, providing both aesthetic appeal and crucial protection. It provides the boat with its color, shine, and overall appearance, enhancing its visual appeal. They creates a smooth, glossy surface, reducing drag and improving the boat's hydrodynamic performance. It is designed to withstand harsh marine environments, including exposure to sunlight, waves, and marine organisms.

While primarily associated with the marine industry, they are finding increasing applications in the construction sector. Its unique properties make it a suitable choice for various construction projects. Some specialized product formulations are employed in roofing applications due to their excellent weather resistance and ability to protect underlying materials. In some industrial settings, gelcoat-based coatings are used on floors to provide a durable, chemical-resistant, and easy-to-clean surface.

Regional Insights & Trends

“The U.S. to emerge as the fastest growing region in North America with a CAGR of 13.9% from 2024-2030”

North America dominated the market and accounted for a 31.52% share in 2023. The increasing popularity of recreational boating, coupled with commercial marine activities, drives the demand for gelcoat for hull and deck finishing. The aging infrastructure in North America requires significant repair and restoration work. They are often used to restore the appearance and protect damaged surfaces.

U.S. Gelcoat Market Trends

The U.S. has a vast coastline and a strong boating culture. With increasing disposable income and a growing interest in water-based leisure activities, the demand for boats is on the rise. They are essential for providing the protective and aesthetic finish for boat hulls, decks, and other components.

Europe Gelcoat Market Trends

Europe is investing heavily in infrastructure development and renovation projects. They are used in various construction applications, including architectural panels, roofing, and precast concrete components. The European Union has set ambitious targets for renewable energy, including wind power. The production of wind turbine blades requires composite materials, often coated with gelcoat for protection and aesthetics.

Gelcoat Company Share & Insights Key Gelcoat Company Insights

-

AkzoNobel N.V. is a prominent Dutch multinational corporation specializing in the creation of paints and performance coatings for both industrial and consumer markets. With a global reach spanning over 150 countries, AkzoNobel is a recognized leader in its industry.

-

Ashland Inc. is a prominent American global specialty chemicals company headquartered in Wilmington, Delaware. The company was initially founded in Ashland, Kentucky, in 1924. It is primarily engaged in the manufacture and distribution of specialty chemicals

Owens Corning, Polynt Reichold, and Interplastic Corporation are some of the emerging market participants.

-

Owens Corning is a global leader in building and industrial materials, with a strong focus on insulation, roofing, and fiberglass. The company has a rich history dating back to 1938 and has established itself as a trusted name in the industry.

-

Interplastic Corporation is a prominent specialty chemical company specializing in the production and distribution of unsaturated polyester and vinyl ester resins, gel coats, colorants, and putties. It serves a wide range of industries, including marine, RV, construction, and cast polymer.

Key Gelcoat Companies:

The following are the leading companies in the gelcoat market. These companies collectively hold the largest market share and dictate industry trends.

- LyondellBasell Industries Holdings B.V

- Interplastic Corporation

- Lanxess

- Eastman Chemical Company

- Polynt Reichold

- Owens Corning

- 3M

- Ashland Inc.

- Ineos

- Akzo Nobel N.V.

Recent Developments

- In February 2024, INEOS Automotive and BASF have formed a strategic partnership to revolutionize automotive repair and refinishing. The collaboration aims to develop sustainable, advanced solutions for vehicle body repair and paint refinishing that surpass industry standards. By combining their expertise, the companies will offer cutting-edge digital color matching technology, comprehensive training, and environmentally friendly products.

Gelcoat Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,578.75 million

Revenue forecast in 2030

USD 3,328.16 million

Growth rate

CAGR of 13.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kiloton, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Akzo Nobel N.V.; Ineos; Ashland Inc.; 3M; Alpha Owens Corning; Polynt Reichold; Eastman Chemical Company; Lanxess; Interplastic Corporation; LyondellBasell Industries Holdings B.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gelcoat Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gelcoat market report raw material, end use, and region:

-

Raw Material Outlook (Volume, Kiloton; Revenue, USD Million, 2018 - 2030)

-

Polyester Resin

-

Vinyl Ester Resin

-

Epoxy Resin

-

Other Raw Materials

-

-

End Use Outlook (Volume, Kiloton; Revenue, USD Million, 2018 - 2030)

-

Marine

-

Transportation

-

Construction

-

Wind & Energy

-

Other End Uses (if any)

-

- Regional Outlook (Volume, Kiloton; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global gelcoat market size was estimated at USD 1,380.14 million in 2023 and is expected to reach USD 1,578.75 million in 2024.

b. The global gelcoat market is expected to grow at a compound annual growth rate of 13.2% from 2024 to 2030 to reach 3,328.16 million by 2030.

b. North America dominated the gelcoat market with a share of 31.52% in 2023. This growth is attributable to the increasing popularity of recreational boating, coupled with commercial marine activities, driving the demand for gelcoats for hull and deck finishing.

b. Some key players operating in the gelcoat market include Akzo Nobel N.V.; Ineos; Ashland Inc.; 3M; Alpha Owens Corning; Polynt Reichold; Eastman Chemical Company; Lanxess; Interplastic Corporation; and LyondellBasell Industries Holdings B.V.

b. Key factors that are driving the market growth are essential for protecting and enhancing the appearance of composite materials. The increasing use of composites in various industries, such as automotive, marine, construction, and wind energy, is driving gelcoat demand.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.