- Home

- »

- Electronic Devices

- »

-

Gear Motor Market Size, Share And Trends Report, 2030GVR Report cover

![Gear Motor Market Size, Share & Trends Report]()

Gear Motor Market Size, Share & Trends Analysis Report By Type, By Rated Power, By Torque, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-395-9

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Gear Motor Market Size & Trends

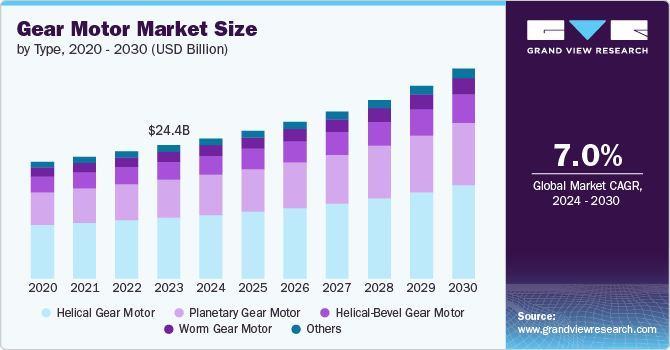

The global gear motor market size was estimated at USD 24.38 billion in 2023 and is expected to grow at a CAGR of 7.0% from 2024 to 2030. The growing trend of industrial automation primarily influences the market. As industries seek to enhance efficiency and productivity, the integration of automated systems becomes increasingly prevalent. Gear motors are essential components in these systems, providing precise control over mechanical operations. This precision is crucial for maintaining consistent production quality and optimizing operational workflows.

Energy efficiency also plays a significant role in driving the market growth. With rising energy costs and stringent environmental regulations, industries are placing greater emphasis on reducing energy consumption. Gear motors are designed to offer optimized performance with minimal energy loss, aligning with the broader industry push for more sustainable and cost-effective solutions.

Technological advancements play a crucial role in the development and adoption of gear motors. The incorporation of the Internet of Things (IoT) and smart technologies into gear motors is transforming their functionality. Modern gear motors are increasingly equipped with sensors and connectivity features that enable real-time monitoring and data collection. These smart capabilities provide valuable insights into performance metrics such as temperature, vibration, and load. By leveraging this data, companies can implement predictive maintenance strategies, thus minimizing downtime and enhancing the reliability and efficiency of their systems. Additionally, advancements in material science are driving significant improvements in gear motor design. The use of high-strength and lightweight materials, such as carbon composites and advanced polymers, is becoming more prevalent.

However, the target market faces several significant restraints that could slow down its widespread. One of the primary restraints is the high initial cost associated with advanced gear motors. The investment required for high-performance and technologically advanced gear motors can be significant, particularly for small to medium-sized enterprises. This high cost may limit adoption, especially in budget-sensitive industries or regions. Additionally, gear motors, particularly those with complex designs or advanced features, can be challenging to maintain and operate. The need for specialized maintenance and repair services can increase operational costs and require skilled personnel. This complexity can be a barrier for companies with limited resources or expertise in managing sophisticated gear motor systems.

Type Output Insights

Based on type, the gear motor market is segmented into helical gear motor, planetary gear motor, helical-bevel gear motor, worm gear motor, and others. The helical gear motor segment held the largest market share of 45.6% in 2023. Helical gear motors are known for their high operational efficiency and smooth performance. The helical gears have teeth cut at an angle, which allows for gradual engagement and continuous meshing. This design reduces vibration and noise, providing a quieter and more stable operation compared to other types of gears. Such characteristics make them preferable in applications where noise and operational smoothness are important considerations.

The planetary gear motor segment registered the fastest CAGR of 7.6% from 2024 to 2030. The design of planetary gear motors provides increased efficiency and effective load distribution. In planetary gear systems, multiple gears engage simultaneously, which helps distribute the load evenly across the gear train. This reduces wear and tear on individual gears, improves overall efficiency, and extends the lifespan of the motor. These characteristics make planetary gear motors a preferred choice for applications requiring reliable and efficient performance.

Rated Power Insights

Based on rated power, the market is bifurcated into up to 7.5 kW, 7.5 kW to 75 kW, and above 75 kW. The up to 7.5 kW segment dominated the market with a revenue share of 49.6% in 2023. Gear motors with power ratings up to 7.5 kW are suitable for a wide range of applications across various industries. These applications include manufacturing equipment, material handling systems, HVAC systems, and small to medium-sized industrial machinery. The versatility of these gear motors allows them to meet the power and performance requirements of numerous industrial and commercial applications, contributing to their dominant market share. Additionally, gear motors with power ratings up to 7.5 kW offer a cost-effective solution for many applications. They strike a balance between performance and affordability, making them an attractive option for businesses looking to optimize their investments in machinery and equipment.

The above 75 kW segment is anticipated to register the fastest CAGR of 7.7% from 2024 to 2030. The rise in industrial automation and large-scale operations is a significant growth driver for the above 75 kW segment. Industries such as manufacturing, mining, energy, and infrastructure are increasingly adopting automated and large-scale machinery that requires high-power gear motors. Additionally, applications requiring high torque, such as large-scale conveyors, crushers, and industrial presses, are driving the demand for gear motors rated above 75 kW. These applications are common in heavy industries, including mining, metals, and materials processing. The need for high-torque gear motors to handle these demanding tasks is contributing to the segment's expected fast CAGR.

Torque Insights

Based on torque, the gear motor market is segmented into up to 10,000 Nm and above 10,000 Nm. The up to 1,000 Nm segment held the largest market share of 64.3% in 2023. The standardization and availability of gear motors up to 1,000 Nm makes them easier to integrate and install. Their compatibility with a wide range of equipment and systems simplifies installation and maintenance processes. This ease of integration supports their popularity and high market share. Additionally, the high market share of gear motors up to 1,000 Nm is also a result of strong market penetration. These gear motors are widely available from various manufacturers and suppliers, contributing to their widespread use and large market share.

The above 10,000 Nm segment registered the fastest CAGR of 7.9% from 2024 to 2030. The renewable energy sector, particularly wind and solar power, has seen considerable growth. Wind turbines and large-scale solar tracking systems require gear motors with high torque capabilities to manage the mechanical loads involved. As investments in renewable energy infrastructure continue to increase globally, the demand for high-torque gear motors used in these applications is expected to rise, driving the segment’s growth.

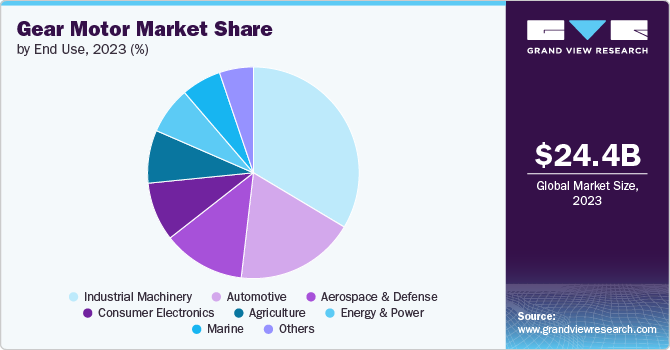

End Use Insights

Based on end use, the market is segmented into industrial machinery, automotive, aerospace & defense, consumer electronics, agriculture, energy & power, marine, and others. The industrial machinery segment dominated the market with a revenue share of 33.6% in 2023. Industrial machinery encompasses a wide array of equipment and processes, from conveyors and pumps to mixers and crushers. Gear motors are integral to these systems, providing the necessary power and torque to drive various mechanical functions. The extensive range of applications within industrial machinery drives significant demand for gear motors, making this segment a dominant player in the market.

The aerospace & defense segment registered the fastest CAGR of 7.6% from 2024 to 2030. The aerospace and defense industries require gear motors that offer exceptional precision and reliability. Applications in these sectors, such as aircraft control systems, missile guidance systems, and satellite mechanisms, demand gear motors that can operate with high accuracy and dependability. The stringent performance requirements drive the demand for high-quality gear motors, contributing to the growth of this segment.

Regional Insights

Asia Pacific accounted for the largest revenue share of 34.5% in 2023 and is expected to continue its dominance from 2024 to 2030. The region has undergone rapid industrialization, particularly in countries like China, India, and Southeast Asian nations. This industrial growth has led to increased demand for industrial machinery and equipment, including gear motors. The expansion of manufacturing facilities, production lines, and heavy machinery has significantly contributed to the high revenue share of this region in the gear motor market. Additionally, there is a growing trend of automation and advanced technology in the region. Industries are increasingly adopting automated systems and modern machinery to enhance productivity and efficiency. Gear motors play a crucial role in these automated systems, leading to higher demand and revenue in the region.

North America Gear Motor Market Trends

North America is a leader in technological innovation and advanced manufacturing techniques. The adoption of cutting-edge technologies, such as robotics, automation, and Industry 4.0, has increased the need for high-performance gear motors. These advancements require gear motors that offer precision, reliability, and efficiency, driving demand in the region. Additionally, North America has stringent regulatory standards and industry certifications for equipment and machinery, including gear motors. Compliance with these standards ensures high-quality and reliable performance, which drives the demand for gear motors that meet regulatory requirements.

U.S. Gear Motor Market Trends

The U.S. is experiencing substantial investment in infrastructure and construction projects, such as roads, bridges, public transit systems, and energy infrastructure. Gear motors are used in a variety of infrastructure applications, including elevators, escalators, HVAC systems, and pumps. The expansion and modernization of infrastructure contribute to the growing demand for gear motors.

Europe Gear Motor Market Trends

Europe has stringent regulations and policies aimed at promoting energy efficiency and sustainability. The European Union's commitment to reducing carbon emissions and improving energy efficiency drives the adoption of high-efficiency gear motors. The demand for gear motors that comply with these energy efficiency standards is growing, particularly in sectors like manufacturing, transportation, and building services. Additionally, the European automotive industry is one of the largest in the world, with a strong focus on innovation and technology. Gear motors are used in various automotive applications, including assembly lines, testing equipment, and electric vehicle (EV) components. The growth of the automotive sector, particularly with the rise of EVs, drives the demand for specialized gear motors.

Key Gear Motor Company Insights

Some of the key companies operating in the gear motor market include Siemens and Eaton.

-

Siemens is a multinational conglomerate comprising Siemens AG as the parent company and its subsidiaries. The company has several production facilities, sales offices, distribution centers, and R&D centers located across the globe. Siemens operates through various divisions, including gas & power, energy management, wind power & renewable, mobility, digital factory, process industries, building technology, power generation services, healthcare, and financial services. The company has a strong global presence with 289 manufacturing plants spread across regions including North America, Europe, Latin America, Asia Pacific, and the Middle East.

SEW-EURODRIVE and WEG Gear Systems GmbH are some of the emerging market participants.

-

WEG Gear Systems GmbH, formerly known as Watt Drive Antriebstechnik, is an Austrian manufacturer of drive solutions and geared motors . The company became part of the WEG Group in 2011 and has since been renamed WEG Gear Systems GmbH. It offers a wide range of products and solutions to drive technology and automation. They provide geared motors, frequency inverters, and gearbox solutions for various industrial applications. The company serves its customers globally with offices in Africa, the Americas, Asia, and Europe.

Key Gear Motor Companies:

The following are the leading companies in the gear motor market. These companies collectively hold the largest market share and dictate industry trends.

- Eaton

- Siemens

- SEW-EURODRIVE

- WEG Gear Systems GmbH

- Johnson Electric Holdings Limited

- Emerson Electric Co.

- Bauer Gear Motor

- Sumito Drive Technologies

- ABB

- Regal Rexnord

- Portescap

- ORIENTAL MOTOR USA CORP

Recent Developments

-

In March 2024, ORIENTAL MOTOR USA CORP announced the launch of its new AZX Series 600W servo motor. The AZX Series features enhanced performance with increased power output, improved precision, and efficiency. This new servo motor is designed for applications requiring high torque and accuracy, such as automation and robotics. The 600W model is expected to offer better control and reliability, helping to meet the demands of modern industrial automation systems.

-

In June 2023, Eaton announced the expansion of its manufacturing footprint in Puducherry, India, with a new facility to enhance its production capabilities for electrical products. This investment aims to support Eaton's growth in the Indian market and strengthen its supply chain. The expansion aligns with Eaton's strategy to increase its manufacturing presence in key regions and respond to growing demand in the Indian market.

Gear Motor Market Report Scope

Report Attribute

Details

Revenue forecast in 2024

USD 25.63 billion

Revenue forecast in 2030

USD 38.38 billion

Growth rate

CAGR of 7.0% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, rated power, torque, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Eaton; Siemens; SEW-EURODRIVE; WEG Gear Systems GmbH; Johnson Electric Holdings Limited; Emerson Electric Co.; Bauer Gear Motor; Sumito Drive Technologies; ABB; Regal Rexnord; Portescap; ORIENTAL MOTOR USA CORP

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gear Motor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global gear motor market report based on type, rated power, torque, end use, and region:

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Helical Gear Motor

-

Planetary Gear Motor

-

Helical-Bevel Gear Motor

-

Worm Gear Motor

-

Others

-

-

Rated Power Outlook (Revenue, USD Billion, 2017 - 2030)

-

Up to 7.5 kW

-

7.5 kW to 75 kW

-

Above 75 kW

-

-

Torque Outlook (Revenue, USD Billion, 2017 - 2030)

-

up to 10,000 Nm

-

Above 10,000 Nm

-

-

End Use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Industrial Machinery

-

Automotive

-

Aerospace & Defense

-

Consumer Electronics

-

Agriculture

-

Energy & Power

-

Marine

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global gear motor market size was estimated at USD 24.38 billion in 2023 and is expected to reach USD 25.63 billion in 2024.

b. The gear motor market is expected to grow at a compound annual growth rate of 7.0% from 2024 to 2030 to reach USD 38.38 billion by 2030.

b. The up to 10,000 Nm segment claimed the largest market share of 64.3% in 2023 in the gear motor market, driven by their versatility and effectiveness in a wide range of applications. These gear motors are known for their reliability and performance in industrial settings, including manufacturing and material handling, where high torque and efficiency are essential. Advances in technology, cost-effectiveness, and the growth of industrialization have further fueled their demand, making them the most popular choice across various sectors.

b. Prominent players in the gear motor market are Eaton, Siemens, SEW-EURODRIVE, WEG Gear Systems GmbH, Johnson Electric Holdings Limited, Emerson Electric Co., Bauer Gear Motor, Sumito Drive Technologies, ABB, Regal Rexnord, Portescap, ORIENTAL MOTOR USA CORP.

b. The gear motor market is driven by factors such as increasing industrial automation, growing demand for energy-efficient solutions, advancements in gear motor technology, and the expansion of industries like manufacturing, automotive, and material handling. Additionally, the rise in infrastructure development and the need for reliable, high-performance machinery contribute to the market's growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."