GCC Protective Relay Market Size, Share & Trends Analysis Report, By Voltage (Low, Medium, High), By Application (Feeder protection, Generator protection), By End-use (Infrastructure, Industrial, Government, Power), By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-263-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

Market Size & Trends

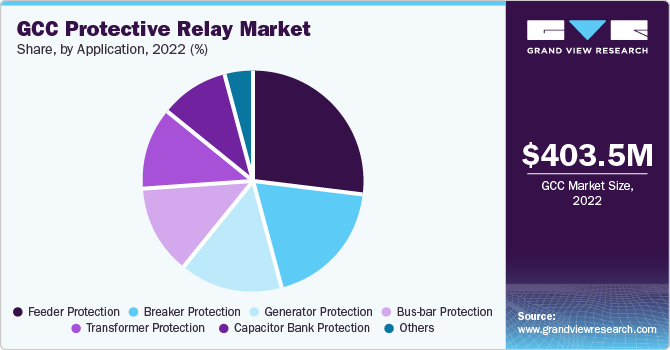

The GCC protective relay market size was valued at USD 403.5 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.0% over the forecast period from 2023 to 2030.The growth is primarily attributed to the growing investments in the transmission & distribution infrastructure in the GCC region.

The impact of the COVID-19 pandemic on the GCC (Gulf Cooperation Council) protective relay market was significant. COVID-19 led to disruptions in supply chains, labor shortages, and lockdown measures that affected business operations and economic activities across the region. Industries such as construction, manufacturing, and oil & gas, major users of protective relays, experienced slowdowns and project cancellations. As a result, there was a decrease in demand for protective relay devices during this period.

On the other hand, the pandemic also highlighted the importance of digital transformation and the need for reliable power infrastructure, potentially leading to increased demand for protective relays as businesses and governments focus on strengthening critical infrastructure.

Voltage Insights

The medium voltage held the largest market share of 44.2% in 2022. The high share is attributed to an upsurge in using medium-voltage protective relays in medium-voltage substations and power systems. The growing population in Saudi Arabia, UAE, Kuwait, and Qatar has led to a significant population migration rate, increasing the demand for residential infrastructure and electricity consumption. Thus, the rising demand for electricity in these countries is expected to spur industry growth over the forecast period.

The low voltage segment is projected to register a significant CAGR of 5.0% over the forecast period. The GCC countries increasingly invest in renewable energy sources like solar and wind power. These energy sources typically operate at low voltage levels, requiring specialized relays to ensure proper electrical system coordination, protection, and control. The expansion of the renewable energy sector contributes to the growing demand for low-voltage relays.

Application Insights

The feeder protection segment dominated the market with the highest revenue share of 27.5% in 2022. The extensive use of protective relays to safeguard electrical power transmission lines is anticipated to drive industry growth over the next eight years.

The probability of fault occurrence in the electrical power transmission lines is much higher than the other power system components as these lines are usually long enough and run through an open atmosphere. Thus, the lines and cables forming the feeder system require maximum protection, or else they can cause harm to the surroundings. The growing demand for feeder protection across the power, infrastructure, and industrial sectors is anticipated to positively impact industry growth over the projected period.

On the other hand, the breaker protection segment is expected to grow at a significant CAGR of 5.5% over the forecast period. Electrical safety is a key priority in the GCC region, and stringent regulations and standards are in place to protect personnel, equipment, and property from electrical hazards. Breaker protection systems provide essential safety features like fault detection, arc flash detection, and rapid shutdown capabilities. Implementing robust breaker protection solutions helps organizations adhere to safety regulations, mitigate risks, and prevent accidents. The growing focus on electrical safety drives the adoption of breaker protection systems in the GCC relay market.

End-use Insights

The power segment dominated the market with the highest revenue share of 32.0% in 2022. The rapid industrialization and the rise in power generation applications in the GCC region are expected to fuel the GCC protective relay market's growth. The growing population and increasing per capita electricity consumption in GCC are vital factors backing the demand over the coming years.

The infrastructure segment is expected to witness significant CAGR of 5.4% over the forecast period. The increasing commercial and residential projects, coupled with a rise in the set-up of several industrial plants in GCC, will likely drive the demand for the voltage over the coming years.

Regional Insights

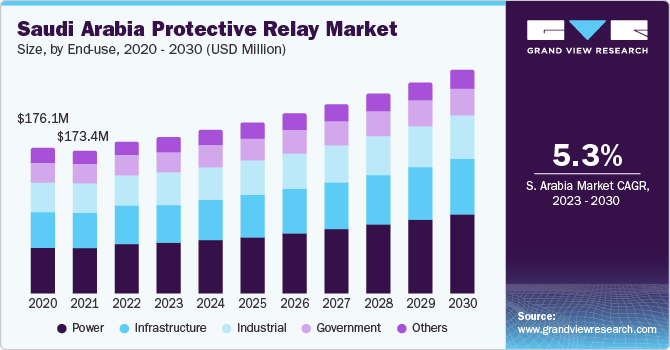

Saudi Arabia dominated the market with the largest revenue share of 45.5% in 2022. The modernization of grid infrastructure coupled with huge investments in the renewable sector are a few factors significantly contributing to the industry's growth in this country. Infrastructure development in the residential, commercial, and industrial sectors is expected further to drive the Saudi Arabian industry over the forecast period.

Although Saudi Arabia remains the largest segment, UAE is projected to witness healthy growth over the forecast period. The increase in transmission and distribution equipment exports, paired with the substation automation in this country, is expected to fuel industry growth.

UAE is expected to grow at the fastest CAGR of 5.6% over the forecast period. The UAE has stringent safety and quality standards for electrical systems and equipment. Relay systems are crucial in ensuring power networks' safe and reliable operation. Compliance with these standards necessitates the adoption of high-quality relay solutions. The growing emphasis on safety and quality drives the demand for reliable and certified relay systems in the UAE market.

Key Companies & Market Share Insights

Product launches, investment in R&D, along with the expansion of voltage portfolios are strategies undertaken by key players to strengthen their market position.

Key GCC Protective Relay Companies:

- ABB

- Eaton

- General Electric

- Semiens

- TIEPCO

- Toshiba Corporation

- THYEAST

- Mitsubishi Electric Corporation

- FANOX

- Schneider Electric

- NR Electric Co., Ltd.

- Doble Engineering Company

GCC Protective Relay Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 419.9 million |

|

Revenue forecast 2030 |

USD 592.3 million |

|

Growth rate |

CAGR of 5.0% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2017 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Report updated |

November 2023 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Voltage, application, end-use, region |

|

Country scope |

Saudi Arabia; UAE; Bahrain; Kuwait; Qatar; Oman |

|

Key companies profiled |

ABB; Eaton; General Electric; Semiens; TIEPCO; Toshiba Corporation; THYEAST; Mitsubishi Electric Corporation; FANOX; Schneider Electric; NR Electric Co., Ltd.; Doble Engineering Company |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

GCC Protective Relay Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the GCC protective relay market on the basis of voltage, application, end use, and region:

-

Voltage Outlook (Revenue in USD Million, 2017 - 2030)

-

Low voltage

-

Medium voltage

-

High voltage

-

-

Application Outlook (Revenue in USD Million, 2017 - 2030)

-

Feeder protection

-

Generator protection

-

Bus-bar protection

-

Capacitor bank protection

-

Breaker protection

-

Transformer protection

-

Other protection

-

-

End Use Outlook (Revenue in USD Million, 2017 - 2030)

-

Infrastructure

-

Industrial

-

Government

-

Power

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2017 - 2030)

-

GCC

-

UAE

-

Bahrain

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The GCC protective relay market size was estimated at USD 403.5 million in 2022 and is expected to reach USD 419.9 million in 2023.

b. The GCC protective relay market is expected to grow at a compound annual growth rate of 5.0% from 2023 to 2030 to reach USD 592.3 million by 2030.

b. Medium voltage segment dominated the GCC protective relay market with a share of 44.2% in 2022. This is attributable to an upsurge in the usage of medium voltage protective relays in medium voltage substations and power systems.

b. Some key players operating in the GCC protective relay market include ABB Ltd., Doble Engineering Company, Eaton Corporation Plc, Fanox Electronics, General Electric, Mitsubishi Electric Corp., and Schneider Electric among others.

b. Key factors that are driving the market growth include the rising investments in the transmission & distribution networks, rapid industrialization and rise in power generation capacity worldwide.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."