GCC Metal Forging Market Size & Trends

The GCC metal forging market size was valued at USD 1.19 billion in 2024 and is projected to grow at a CAGR of 5.0% from 2025 to 2030. This growth is driven by increasing demand for high-strength, durable components in the automotive and aerospace industries, as these sectors require materials that can withstand extreme conditions. Additionally, the expansion of construction and infrastructure projects in the region is boosting the need for forged metal parts. The growing focus on renewable energy and the modernization of power generation facilities also play a crucial role, as these projects often require robust metal components.

The GCC countries collectively held a substantial share of the world's proven crude oil reserves. The oil and gas sector is a critical driver of economic activity in these nations, often representing a substantial portion of their GDP. This sector demands various forged components, such as ball valves, pumps, turbines, and wellhead equipment, essential for multiple operations, including exploration and production. As oil prices stabilize and investments in infrastructure projects increase, the demand for these high-quality forged products is expected to rise steadily.

Raw Material Insights

The carbon steel segment accounted for 45.4% of revenue in 2024 due to its cost-effectiveness and widespread availability. Carbon steel is favored in the metal forging industry for its high strength, durability, and versatility, making it suitable for various applications, including automotive, construction, and oil and gas industries. The material's ability to withstand high-stress conditions and its ease of fabrication contribute to its significant market share.

The magnesium segment is expected to grow at a CAGR of 5.1% from 2025 to 2030. Magnesium is increasingly used in the metal forging industry due to its lightweight properties and high strength-to-weight ratio. The demand for magnesium is driven by its applications in aluminum alloys and die casting, which are essential in industries such as automotive and aerospace for producing lightweight components that enhance fuel efficiency and performance. The growing emphasis on sustainability and energy efficiency in these industries further propels the demand for magnesium-forged parts.

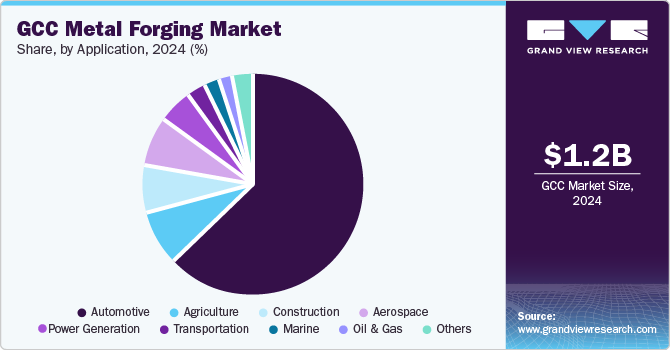

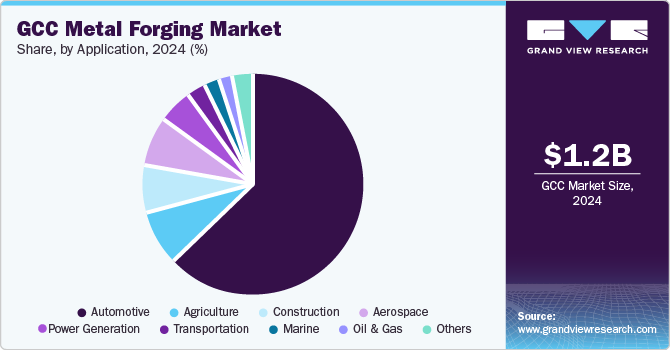

Application Insights

The automotive segment dominated the GCC metal forging market in 2024, primarily due to the high demand for durable and high-strength components in vehicle manufacturing. Forged parts, such as crankshafts, connecting rods, and gears, are essential for ensuring automobile reliability and performance. The continuous growth in automobile production and the emphasis on safety and fuel efficiency drive the demand for metal forging in this segment.

The power generation segment is projected to grow fastest over the forecast period. This growth is fueled by the expansion of power plants and the increasing focus on renewable energy sources. Forged components, such as turbine blades and shafts, are critical for efficiently operating power generation equipment. The shift towards sustainable energy solutions and the modernization of existing power infrastructure are key factors driving the demand for forged metal parts in this segment.

Country Insights

Saudi Arabia Metal Forging Market Trends

Saudi Arabia dominated the GCC metal forging market in 2024 with a revenue share of 51.5% due to its extensive industrial base and government-backed initiatives such as Vision 2030, which aims to enhance the country’s manufacturing capabilities. The kingdom's large-scale projects, particularly in the energy, construction, and automotive sectors, drive a substantial demand for forged metal components. The presence of established players and the availability of raw materials further solidify Saudi Arabia's leading position, making it a pivotal market for regional and global suppliers. Initiatives such as developing new cities such as Neom Bay create numerous opportunities for metal forging applications.

UAE Metal Forging Market Trends

The UAE metal forging market is projected to grow fastest in the region from 2025 to 2030. This surge can be attributed to several key developments, including the country's robust infrastructure projects, increased investments in manufacturing, and the government's strategic initiatives to diversify the economy away from oil dependence. The UAE's focus on technological advancements and high-value manufacturing processes positions it as a competitive player in the global forging market, appealing to domestic and foreign investments.

Bahrains Metal Forging Market Trends

Bahrain’s industrial sector has been growing steadily, with Bahrain Steel achieving record production levels. The kingdom's Economic Vision 2030 and Industrial Sector Strategy aim to increase the industrial sector's contribution to GDP and non-oil exports, further supporting the metal forging market.

Oman Metal Forging Market Trends

Oman's metal forging market is anticipated to grow steadily throughout the forecast period. The country's strategic location and ongoing infrastructure development projects are expected to drive the demand for forged metal components. Oman's commitment to enhancing its industrial capabilities and attracting foreign investments will be crucial to the market's steady growth.

Key GCC Metal Forging Company Insights

Some of the key companies in the metal forging market include AL NASR FORGING, Dongguan Songshun Mould Steel Co., LTD, Doosan Corporation, FTV Proclad LLC, FUCHS Group, and Galperti Group.

-

Doosan Corporation is a global leader in producing large castings and forgings. Their product offerings include super-large castings and forgings for power plants, marine vessels, steelworks, and various industrial facilities.

-

Dongguan Songshun Mould Steel Co., LTD is a Chinese steel manufacturer and supplier. The company offers a diverse range of steel products, including carbon steel, alloy steel, tool steel, and stainless steel. Its products are widely used in industries such as construction, manufacturing, automotive, and energy.

Key GCC Metal Forging Companies:

- AL NASR FORGING

- Dongguan Songshun Mould Steel Co., LTD

- Doosan Corporation

- FTV Proclad LLC

- FUCHS Group

- Galperti Group

- Precision Forgings Factory

- Precision Metal Industries FZC

- Steel Forgings Gulf

GCC Metal Forging Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 1.24 billion

|

|

Revenue forecast in 2030

|

USD 1.59 billion

|

|

Growth rate

|

CAGR of 5.0% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Volume in kilotons, Revenue in USD million/billion, and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Raw material, application, country

|

|

Country scope

|

Kuwait; Saudi Arabia; Oman; Bahrain; UAE; Qatar

|

|

Key companies profiled

|

AL NASR FORGING; Dongguan Songshun Mould Steel Co., LTD; Doosan Corporation; FTV Proclad LLC; FUCHS Group; Galperti Group; Precision Forgings Factory; Precision Metal Industries FZC; Steel Forgings Gulf

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global GCC Metal Forging Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the GCC metal forging market report based on raw material, application, and country:

-

Raw Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Carbon Steel

-

Alloy Steel

-

Aluminum

-

Magnesium

-

Stainless Steel

-

Titanium

-

Others

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Transportation

-

Aerospace

-

Oil & Gas

-

Construction

-

Agriculture

-

Power Generation

-

Marine

-

Others

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Kuwait

-

Saudi Arabia

-

Oman

-

Bahrain

-

UAE

-

Qatar