GCC Animal Health Market Size, Share & Trends Analysis Report By Product Type, By Animal Type (Production Animals, Companion Animals), By Distribution Channel, By End-use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-262-5

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

GCC Animal Health Market Size & Trends

The GCC animal health market size was valued at USD 1.26 billion in 2023 and is expected to grow at a CAGR of 9.45% from 2024 to 2030. The market is primarily driven by factors like the high prevalence of zoonotic diseases in the GCC region, the need for a structured approach to animal disease control, supportive animal health-related government initiatives, and rising meat & poultry production. The GCC region presents lucrative growth opportunities owing to advanced healthcare facilities and a rising expat population with pets.

This region is highly susceptible to outbreaks of a variety of zoonotic diseases. As per Gulf Business states, the total number of zoonotic diseases that occurred globally in 2019, 17% were detected in the GCC region. These diseases accounted for about a 20% reduction in animal production volume. This highlights the growing need for multi-sectoral and interdisciplinary initiatives by authorities, industry players, etc. in predicting, diagnosing, controlling, and treating these zoonotic diseases.

The World Organization for Animal Health (WOAH) report in 2023 highlighted six zoonotic diseases that are dominant and in the GCC region. Brucellosis (6%), Rabies (6%), Middle East Respiratory Syndrome Corona Virus - MersCoV (5%), Bovine TB (4%), Rift Valley fever (3%), CC Hemorrhagic fever (3%) are the diseases that need to be addressed with priority due to their high prevalence in the region. MersCoV is present in dromedary camels and can infect humans. Despite its low impact on the health of camels, this syndrome can have a very high health impact on humans. This disease can be primarily found in countries of GCC like Qatar, UAE, and Saudi Arabia.

Rift Valley Fever (RVF) is caused in production animals like cattle, buffalo, camels, and goats and is transmitted through arthropods like mosquitoes and ticks. RVF is known to cause major disruptions in meat production. Another major disease among the animals in the GCC region is the Lumby skin disease (LSD), another arthropod-borne disease that affects domestic production animals like bulls and cows. LSD is reported to have over 167 outbreaks between 2021 and 2023 in the MEA region. Proper vaccination of cattle can help curb the disease's spread.

This highlights the alarming need for proper animal screening & treatment products throughout the region, increasing demand for appropriate vaccines, medications, diagnostic products, etc. Thereby, driving the market growth.

The rising meat & poultry production in the region leads to the need for appropriate animal health products to ensure that these animals are healthy. According to a 2021 US Foreign Agricultural Service report, Saudi Arabia produced around 910,000 MT of chicken meat. The country currently produces 60% of its chicken meat requirements and aims to increase this number to 85% by 2025. To ensure this, the authorities are taking necessary steps to ensure state-of-the-art facilities with proper diagnostic & treatment options are available in the country. Such initiatives contribute to ensuring that the demand for animal health products keeps increasing, hence driving the market to lucrative growth.

Market Concentration & Characteristics

Animal health product companies, both global and regional are expanding into the GCC countries to capitalize on emerging markets, broaden their customer base as well as ensure penetration of veterinary services. By establishing partnerships and distribution with industry players and authorities alike, these organizations can enhance product availability and industry penetration, thereby driving overall market expansion.

For instance, in April 2022, ADQ (Abu Dhabi) and E20 signed an agreement to open an animal vaccine facility and two veterinary hospitals in UAE to enhance veterinary care delivery.

In this industry, end-users have multiple options to choose any type of product they want. Global players are ensuring that their products reach the GCC market by collaborating with domestic distributors to ensure the convenient availability of products. On the other hand, domestic manufacturers are trying to compete with these global companies by providing similar products to the customers but at a cheaper price. This ensures buyers can comfortably choose products that better suit their needs. This drives the competition between different companies in the industry.

The GCC animal health industry is having moderate competition due to companies engaging in mergers and acquisitions. Global leaders are strategically expanding their product offerings, enhancing their capabilities, and penetrating newer regions by acquiring other businesses. Such actions enhance competitiveness among leading players, stimulate innovation, and expedite industry consolidation.

In June 2022, Zoetis acquired a genetic test kits & analytics company by the name of Basepaws. This acquisition enhances the former’s animal health diagnostic test portfolio on a global level.

Businesses are heavily investing in research and development of advanced technological solutions to address the unique needs of the GCC animal health industry. A notable area of focus is the implementation of AI for the diagnosis and treatment of animal health conditions.

In April 2022, Zoetis upgraded VetScan Imagyst by inculcating AI blood smear testing. The company introduced AI into their product for analyzing veterinary blood samples with improved efficiency.

Compliance with regulatory frameworks ensures the safety, efficacy, and quality of treatment for animal conditions, which significantly impacts the GCC animal health industry. Industry access and product approval hinge on observance of laws governing animal pharmaceuticals, diagnostic products, and biologics. The products to be introduced in the GCC, need to comply with the regulatory requirements provided by the domestic regulatory bodies such as the Veterinary Products Act and Regulation in GCC, Kingdom of Saudi Arabia Saudi Food & Drug Authority.

Product Type Insights

The pharmaceuticals segment held the highest market share of over 39.95% in 2023. The increasing prevalence of food-borne diseases, brucellosis, and zoonotic diseases, which pose a potential hazard to animal health, necessitates the use of pharmaceuticals and targeted medicines. Furthermore, the significant rise in animal bites, which increases the risk of disease and microbe transmission, propels the demand for pharmaceuticals. This market is further segmented into parasiticides, anti-infectives, anti-inflammatory drugs, analgesics, and others.

The veterinary software segment is expected to grow at the fastest CAGR during the forecast period. This is due to several factors like the increasing adoption of specialized software like livestock monitoring software, and the increasing animal population globally leading to an increase in the adoption of telehealth software. These softwares are adopted to foster efficiency, streamline workflow, and improve diagnostic & treatment efficiency.

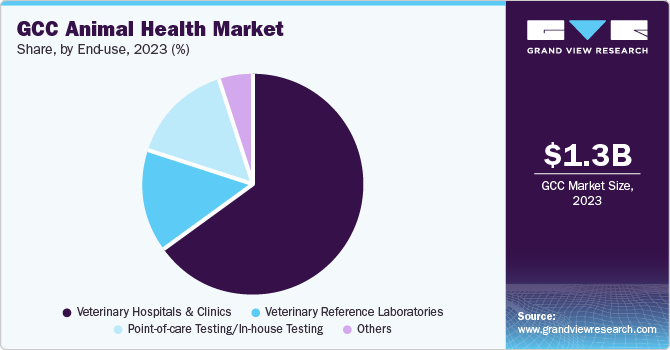

End-use Insights

The veterinary hospitals & clinics segment held the highest revenue share in 2023. The presence of in-house laboratories in veterinary hospitals and clinics enables swift diagnosis and timely intervention. Additionally, the number of visits and time consumed in transporting animals from one place to another for a variety of tests is also conserved due to the availability of multiple testing facilities under one setting. Thus, this segment is anticipated to exhibit considerable growth over the forecast period. Moreover, some vaccines are available in accredited veterinary hospitals & clinics only. This ensures that all set protocols are followed while administering the vaccines. This exclusivity often means that animal owners will have to bring their animals to the nearest hospital/clinic, hence driving the market growth.

The point-of-care testing/in-house testing grew at the fastest CAGR in 2023 due to rise in the number of initiatives undertaken for animal healthcare and availability of cost-efficient measures for disease diagnosis & monitoring. These tests can be easily conducted by the animal owners at their home or at the animal farm/facility and therefore they prove to be helpful in increasing the volume of animals being tested. This ultimately leads to higher detection of animal diseases being diagnosed & treated. Commonly used veterinary point-of-care tests include cCRP, fibrinogen, fructosamine, hemoglobin, lactate, lipase (pancreatic), NH3, phenobarbital, Serum Amyloid A (SAA), and T4 tests. Industry participants are actively seeking innovative ways to make animal diagnostic testing simpler yet efficient by launching such testing options. Hence, providing a very lucrative growth rate in the forecast period.

Animal Type Insights

The production animals segment held the highest market share of over 65.93% in 2023. This can be attributed to the high consumption of milk, meat, and other animal products sourced from these animals. The enhanced focus on food safety and sustainability by government healthcare organizations can be seen in the region. Authorities are striving to achieve food security, propel large-scale food production, and result in greater rearing of production animals. These initiatives are focused on long-term sustainability, which can be achieved by improving productivity and giving more attention to the production of animal healthcare.

The companion animals segment is estimated to grow with the fastest CAGR from 2024 to 2030, owing to an increase in companion animal adoption leading to awareness as well as demand for efficient animal care. The increase in companion animal ownership is due to the associated health benefits. Companion animals are known to assist in lowering blood pressure, providing psychological stability, and reducing the frequency of cardiac arrhythmias & anxiety attacks, which enhance the overall well-being of humans. Additionally, animal-assisted therapy is increasingly gaining traction as an assistive form of treatment. Industry participants are aiming continuously to develop differentiated and highly efficacious animal products, thereby driving the segment’s growth.

Distribution Channel Insights

The hospital/clinic pharmacy segment held the highest market share in 2023. This share can be attributed to high accessibility, affordability, and the increasing prevalence of epidemics & chronic diseases. Additionally, these healthcare settings provide advanced treatment products, which is expected to contribute to the overall growth of this segment. The rise in the adoption of companion pets in the region is driving the segment growth. Besides, high procedural volume as a consequence of frequent readmission of animals for treatment is one of the factors responsible for growth. This has led to an increase in the need for veterinary products, thereby enhancing their adoption in hospital/clinic pharmacies.

Country Insights

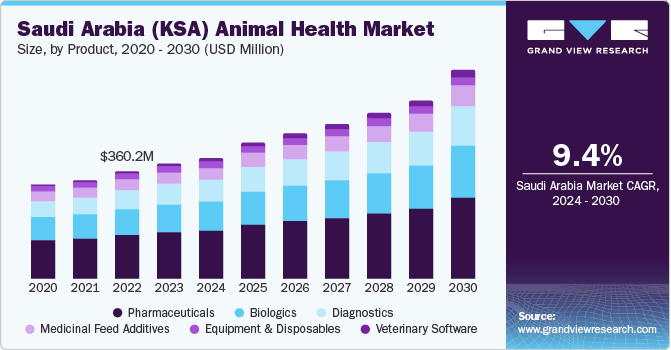

Saudi Arabia (KSA) Animal Health Market Trends

The animal health market in Saudi Arabia held the highest share of 30.53% owing to the favorable government initiatives that attract investment as well as encourage domestic players to focus on developing animal health products. For instance, Saudi Vision 2030, is one such initiative that spans multiple sectors like animal health, human health, biotechnology, etc. to make the country a top investment location in the world.

UAE Animal Health Market Trends

UAE’s animal health market held the second-largest share in 2023. Government-encouraged initiatives and development of animal welfare legislation as a part of OIE initiative lead to high adoption animal health products and hence reduce the overall animal disease burden. The rising demand for service dogs for the elderly population is boosting the market growth. Additionally, strong economic growth in the country leading to higher protein consumption, coupled with the rising preference for meat are some of the other factors demand for animal health products.

Key GCC Animal Health Company Insights

The GCC animal health market is seeing active participation from businesses as they seek to expand their product offerings and market share. Companies are pursuing initiatives such as strategic partnerships to penetrate the regional market, product portfolio diversification through mergers & acquisitions, and launching innovative products tailored to the industry's needs. These efforts aim to drive the market growth and cater to the evolving needs of both veterinarians and animal owners.

Key GCC Animal Health Companies:

- Zoetis

- Boehringer Ingelheim Gmbh

- Vetoquinol S.A.

- Dechra Pharmaceuticals Plc

- Idexx Laboratories, Inc.

- Merck & Co., Inc.

- MEVAC

- JOVAC

- Mars Inc.

- Virbac

Recent Developments

-

In February 2024, EQT investment firm acquired Dechra Pharmaceuticals.

-

In February 2024, Merck Animal Health signed a definitive agreement to acquire Elanco Animal Health's Aqua business.

-

In May 2023, Zoetis received FDA approval for Librela, which has application in Osteoarthritis (OA) pain

-

In August 2023, TVG & Australia-based Troy Animal Healthcare extended their product distribution partnership to provide affordable pharmaceuticals for animal care in the GCC region.

-

In October 2023, Animal Health Directorate of Bahrain launched vaccination programs against foot-and-mouth disease & smallpox in animals.

GCC Animal Health Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.37 billion |

|

Revenue forecast in 2030 |

USD 2.36 billion |

|

Growth Rate |

CAGR of 9.45% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product type, animal type, distribution channel, end-use, country |

|

Regional scope |

GCC |

|

Country scope |

Saudi Arabia; UAE; Qatar; Oman; Kuwait; Bahrain |

|

Key companies profiled |

Zoetis; Boehringer Ingelheim Gmbh; Vetoquinol S.A.,; Dechra Pharmaceuticals Plc; Idexx Laboratories, Inc.; Merck & Co., Inc.; MEVAC; JOVAC; Mars Inc.; Virbac |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

GCC Animal Health Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of latest industry trends in each of sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the GCC animal health market report based on product type, animal type, distribution channel, end-use, and country:

-

Product type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Biologics

-

Attenuated Live Vaccines

-

Inactivated Vaccines

-

Other Vaccines & Biologics

-

-

Pharmaceuticals

-

Parasiticides

-

Anti-infectives

-

Anti-inflammatory

-

Analgesics

-

Others

-

-

Diagnostics

-

Consumables, Reagents & Kits

-

Instruments & Devices

-

-

Equipment & Disposables

-

Critical Care Consumables

-

Anesthesia Equipment

-

Fluid Management Equipment

-

Temperature Management Equipment

-

Rescue & Resuscitation Equipment

-

Research Equipment

-

Patient Monitoring Equipment

-

-

Medicinal Feed Additives

-

Veterinary Software

-

Practice Management Software

-

Imaging Software

-

Telehealth Software

-

Others

-

-

-

Animal type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Production Animals

-

Poultry

-

Swine

-

Cattle

-

Sheep & Goats

-

Others (Camel, Fish, etc.)

-

-

Companion Animals

-

Dogs

-

Cats

-

Horses

-

Others

-

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retail

-

E-Commerce

-

Hospital/ Clinic Pharmacy

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Veterinary Reference Laboratories

-

Point-of-care Testing/In-house Testing

-

Veterinary Hospitals & Clinics

-

Others

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

GCC

-

Saudi Arabia

-

UAE

-

Qatar

-

Oman

-

Kuwait

-

Bahrain

-

-

Frequently Asked Questions About This Report

b. The GCC animal health market size was estimated at USD 1.26 billion in 2023 and is expected to reach USD 1.37 billion in 2024.

b. The GCC animal health market is expected to grow at a compound annual growth rate of 9.45% from 2024 to 2030 to reach USD 2.36 billion by 2030.

b. Saudi Arabia dominated the GCC animal health market with a share of 30.53% in 2023. This is attributable to to government actively involved in boosting the market with the help of government initiatives to attract investment as well as encourage domestic players to focus on developing animal health products.

b. Some key players operating in the GCC animal health market include Zoetis, Boehringer Ingelheim Gmbh, Vetoquinol S.A., Dechra Pharmaceuticals Plc, Idexx Laboratories, Inc., Merck & Co., Inc., MEVAC, JOVAC, Mars Inc., Virbac.

b. Key factors that are driving the market growth include high prevalence of zoonotic diseases in GCC region, need for structured approach to animal disease control, government initiatives for animal health, and rising meat & poultry production.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."