- Home

- »

- Medical Devices

- »

-

Gastrointestinal Stents Market Size And Share Report, 2030GVR Report cover

![Gastrointestinal Stents Market Size, Share & Trends Report]()

Gastrointestinal Stents Market Size, Share & Trends Analysis By Type (Biliary Stents, Duodenal Stents), By Application (Biliary Disease, Stomach Cancer), By Material, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-883-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Gastrointestinal Stent Market Size & Trends

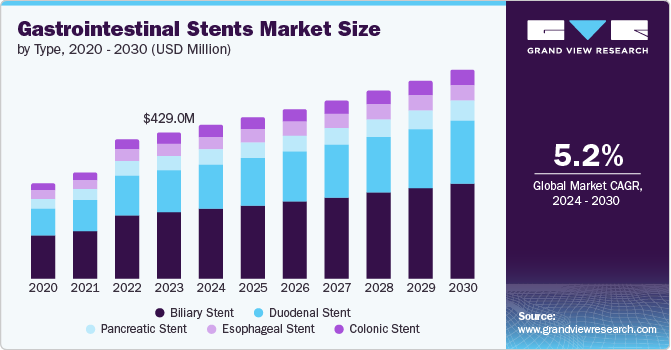

The global gastrointestinal stents market was valued at USD 429.0 million in 2023 and is expected to grow at a CAGR of 5.2% from 2024 to 2030. This can be attributed to the growing prevalence of colorectal cancer and other digestive malignancies. Such conditions often require stent placement to weaken and manage obstructions caused by malignant tissues in the bile ducts, esophagus, intestine, or colon to improve quality of life.

Furthermore, ongoing research and development efforts have led to innovations in gastrointestinal stent design and materials. Modern stents are more effective, durable, and minimally invasive. This makes them a preferred choice for patients and healthcare providers due to reduced post-operative complications, shorter hospital stays, and faster recovery.

Moreover, the increasing lifestyle shifts including dietary habits and sedentary lifestyles have significantly contributed to gastrointestinal disorders. As consumers grow more concerned about these disorders, they increasingly spend on gastrointestinal treatments for early diagnosis and intervention. This has led to greater stent utilization.

Type Insights

Biliary stents accounted for the dominant market share with 45.4% in 2023 owing to the rising prevalence of bile duct cancer (cholangiocarcinoma) and chronic liver diseases. Manufacturers in healthcare settings introduced innovative self-expandable metallic stents to enhance patency rates and reduce biofilm formation, which makes them effective for bile duct obstruction management. Moreover, the number of patients suffering from gallstones has considerably increased. To combat this, manufacturers have introduced polymer biliary stents that offer minimally invasive approaches.

Duodenal stents are projected to emerge as the fastest-growing segment during the forecast period. This can be attributed to the rising gastrointestinal disorders such as tumors, strictures, and other pathologies. Duodenal stents play a critical role in managing obstructions caused by these conditions as surgical procedures involving the duodenum, including tumor resections or bypass surgeries, necessitate stent placement. Furthermore, ongoing research and development efforts have led to innovations in duodenal stent design to enhance stent flexibility, patency, and compatibility with the gastrointestinal tract.

Application Insights

Biliary diseases held the largest market share in 2023 owing to the rising prevalence of bile duct cancer and chronic liver disease in the growing geriatric population. As elderly individuals increasingly favor minimally invasive interventions, they prefer biliary stents to combat and manage obstructions caused by malignant tissues in the bile ducts. In addition, innovations in biliary stent design, including self-expandable metallic and plastic stents, have remarkably enhanced patency rates and reduced complications. This has further resulted in the market expansion.

Stomach cancer, also known as gastric cancer, is anticipated to witness the fastest CAGR over the forecast period. The rising prevalence of such malignancy remains a significant health concern and necessitates effective treatment options. Surgeons have increasingly depended on gastrointestinal stents to manage obstructions caused by stomach tumors. These stents help maintain luminal patency, alleviate symptoms, and improve patients’ quality of life. In addition, these stents are valued for palliative treatment in stomach cancer cases, with minimally invasive approaches.

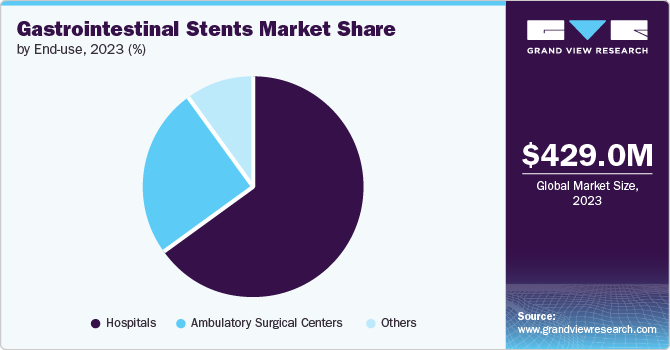

End-use Insights

Hospitals secured the dominant market share in 2023 as they are equipped with state-of-the-art diagnostic tools, enabling precise diagnosis and treatment planning. Their interventional facilities enable stent placement procedures and ensure effective management of gastrointestinal disorders.

Ambulatory surgical centers (ASC) are expected to emerge as the fastest-growing segment at a CAGR of 6.1% during the forecast period. The market has witnessed significant shifts in patient preferences including a robust increase in surgical procedures performed in ambulatory surgery facilities. Patients have increasingly preferred ASCs due to shorter stays, innovative technologies, cost-effective surgical procedures, and lower infection risks. In addition, ASCs offer flexible scheduling options, calmer environments, and more comfortable experiences compared to inpatient hospital settings. These facilities focus on standard, lower-risk procedures, providing surgical treatments at rates 35% to 50% lower than hospitals.

Material Insights

Metal stents have dominated the market with a share of 44.9% in 2023, owing to several benefits such as ease of insertion, reduced risk of dislodgment or migration, and extended patency. More particularly, self-expanding metal stents (SEMS) offer superior flexibility and biocompatibility in clinical applications. These stents are widely used in managing obstructions caused by gastrointestinal cancers, strictures, and other pathologies.

Plastic stents are expected to emerge substantially during the forecast period. These stents are often more easily deployable and adaptable to various anatomical locations within the gastrointestinal tract which makes them a viable alternative to traditional metal stents. Plastic stents offer advantages such as low risk of infections, long patency, and minimal blood loss. In addition, the market was further propelled by the continuous advances in polymer science which has led to the development of stents with improved flexibility and biocompatibility.

Regional Insights

The North America gastrointestinal stents market registered the dominant market share of 31.8% in 2023. The region has increasingly allocated substantial resources to healthcare which has supported the adoption of advanced medical technologies, including gastrointestinal stents. Additionally, the region boasts advanced healthcare infrastructure including well-established hospitals, ambulatory surgical centers, and diagnostic facilities which enable efficient stent placement and management of gastrointestinal disorders.

U.S. Gastrointestinal Stents Market Trends

The gastrointestinal stent market in the U.S. was propelled by the increasing incidence of colorectal cancer which necessitates effective treatment options. These stents play a pivotal role in managing obstructions caused by malignant tissues in the bile ducts, esophagus, intestine, or colon. The market has witnessed patients and healthcare professionals owing to reduced risks, shorter hospital stays, and faster recovery as offered and vailed by gastrointestinal stents.

Europe Gastrointestinal Stents Market Trends

The Europe gastrointestinal stent market held a significant market share in 2023. The region’s aging demographic has contributed to an increased incidence of gastrointestinal conditions including diverticulosis, bowel disorders, and gastrointestinal cancers. Moreover, ongoing research and development efforts have focused on enhancing stent design, materials, and deployment techniques for better patency rates, reduced complications, and improved patient outcomes.

Asia Pacific Gastrointestinal Stents Market Trends

The growth of the gastrointestinal stent market in the Asia Pacific was augmented by the growing elderly population, leading to an increased demand for gastrointestinal disorders. Additionally, governments and private sectors in Asia Pacific countries have significantly invested in healthcare infrastructure owing to the rising per capita income.

Key Gastrointestinal Stents Company Insights

Prominent market players such as Boston Scientific Corporation, Olympus Corporation, and CONMED Corporation have adopted cutting-edge technologies to address the substantial demands of consumers. Their strategies include forming strategic partnerships, launching new products, and commercializing innovations to expand market reach.

-

Boston Scientific Corporation (BSC) is a biomedical/biotechnology engineering firm, which is a multinational manufacturer of medical devices used in various interventional medical specialties. The company’s specialties include interventional radiology, interventional cardiology, peripheral intervention, neuromodulation, and more.

-

Olympus Corporation is a global medical technology company that partners with healthcare professionals, providing solutions for early detection, diagnosis, and minimally invasive treatment to improve patient outcomes. The company’s portfolio includes endoscopes, laparoscopes, video imaging systems, system integration solutions, and medical services.

Key Gastrointestinal Stents Companies:

The following are the leading companies in the gastrointestinal (GI) stents market. These companies collectively hold the largest market share and dictate industry trends.

- Boston Scientific Corporation

- Olympus Corporation

- CONMED Corporation

- Cook Medical

- Medtronic

- ELLA

- Cantel Medical Corporation

- Merit Endotek

- Hobbs Medical, Inc.

- Gore Medical

Recent Development

-

In June 2024, Boston Scientific Corporation revealed its definitive agreement to acquire Silk Road Medical, Inc., a medical device company known for its products designed to prevent strokes in patients with carotid artery disease. Their minimally invasive procedure, called transcarotid artery revascularization (TCAR), aims to enhance patient outcomes and reduce the risk of stroke.

Gastrointestinal Stents Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 450.0 million

Revenue forecast in 2030

USD 611.4 million

Growth rate

CAGR of 5.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, material, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, Thailand, South Korea, Brazil, Argentina, South Africa, Kuwait, Saudi Arabia, UAE

Key companies profiled

Boston Scientific Corporation; Olympus Corporation; CONMED Corporation; Cook Medical; Medtronic; ELLA; Cantel Medical Corporation; Merit Endotek; Hobbs Medical, Inc.; Gore Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gastrointestinal Stents Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gastrointestinal stents market report based on type, application, material, end-use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Biliary Stent

-

Esophageal Stent

-

Colonic Stent

-

Pancreatic Stent

-

Duodenal Stent

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Gastrointestinal Cancer

-

Biliary Disease

-

Colorectal Cancer

-

Stomach Cancer

-

Others

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Metal

-

Plastic

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."