Gastrointestinal Diagnostics Market Size, Share & Trends Analysis Report By Test Type (Endoscopy, Blood Test), By Technology, By Application, By Test Location, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-988-6

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Gastrointestinal Diagnostics Market Trends

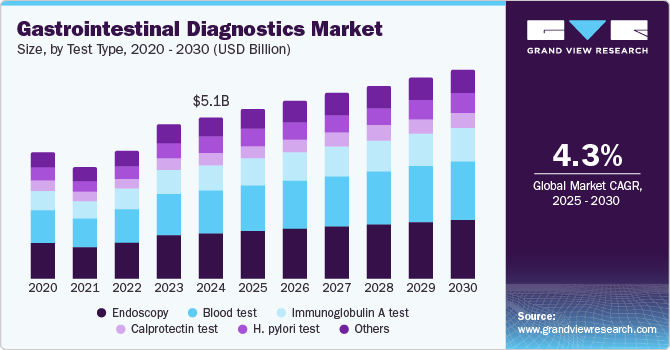

The global gastrointestinal diagnostics market size was estimated at USD 5.08 billion in 2024 and is anticipated to grow at a CAGR of 4.3% from 2025 to 2030. The market is being driven by factors such as the growing demand for point-of-care (POC) testing for gastrointestinal disorders and the increasing incidence of gastric infections and cancers. In addition, the rising need for advanced molecular diagnostic tests and frequent product launches are expected to propel market expansion in the coming years. For instance, in October 2024, F. Hoffmann-La Roche Ltd announced U.S. FDA approval of VENTANA CLDN18 (43-14A) RxDx Assay for gastroesophageal junction adenocarcinoma. With this launch, the company is expected to gain market share in personalized medicine.

The rising prevalence of gastric disorders is encouraging manufacturers and researchers to focus on developing innovative, rapid, and accurate methods for detecting these conditions. For instance, in June 2024, QIAGEN launched QIAstat-Dx Gastrointestinal Panel 2 in the U.S. This regulatory approval underscores the test's potential to streamline GI infection diagnosis, offering quicker and more reliable results, which is expected to contribute significantly to better patient outcomes and drive the growth in the coming years.

Genetic factors play a role in some GI disorders, including colorectal cancer and IBS. Research suggests that certain types of GI cancers and diseases are often linked to inherited gene mutations and gene-gene interactions. As a result, both government bodies and private organizations are promoting initiatives for gastrointestinal genetic testing. For instance, GI OnDemand partnered with Ambry Genetics in March 2021 to enhance genetic testing and counseling services within gastroenterology practices across the U.S.

Moreover, regulatory approvals and the launch of innovative diagnostic tests for GI disorders are expected to drive market growth. In May 2022, Biomerica, Inc. obtained CE mark approval for its hp+detect diagnostic test, which detects Helicobacter pylori, a common risk factor for gastric cancer, across the European Union and other global markets. In addition, in June 2022, Sentinel Diagnostics introduced the SENTiFIT 800 analyzer, an automated system for Fecal Immunochemical Tests. Furthermore, in March 2022, Hardy Diagnostics signed a distribution agreement with Applied BioCode to offer the MDx-3000 System for diagnosing gastrointestinal infections to U.S. laboratory customers.

Test Type Insights

The endoscopy segment captured the largest revenue share at 28.7% in 2024. The growing demand for non-invasive procedures, along with the preference of medical professionals for endoscopy and advancements in technology, are key factors driving the growth of the endoscopy segment. In addition, the introduction of innovative products with high precision is expected to boost market expansion. For instance, in February 2024, Fujifilm India announced the launch of the Aloka ARIETTA 850 diagnostic ultrasound system in India. The launch is expected to improve the overall landscape for GI diagnostics within the country.

Meanwhile, the blood test segment is projected to experience the fastest growth of 5.2% during the forecast period. The increasing approval of molecular and blood-based tests for diagnosing gastrointestinal diseases is a major factor propelling the segment's growth.

Technology Insights

The PCR segment accounted for the share of 25.6% in 2024. PCR is in demand for gastrointestinal diagnostics due to its ability to detect pathogens with high sensitivity and specificity. PCR can identify a wide range of gastric infections, including bacterial, viral, and parasitic causes, even in cases where traditional diagnostic methods fall short. Its rapid and accurate results enable quicker diagnosis and targeted treatment, reducing complications and improving patient outcomes. Moreover, PCR's capacity to analyze genetic material directly makes it a valuable tool for detecting GI-related diseases at early stages.

The ELISA segment is expected to show the fastest CAGR of 5.0% during the forecast period, driven by the increasing use of immunoassay tests, such as the Calprotectin ELISA test. The technique's advantages, including rapid detection and straightforward procedures, are significantly boosting its adoption in the diagnostics market. These factors contribute to the rising demand for ELISA tests in various applications, enhancing their role in disease diagnosis and management.

Test Location Insights

In 2024, the central laboratories segment accounted for a share of 65.5% of the overall revenue. The growth of the segment is driven by a large number of laboratories conducting GI tests, the provision of rapid test results, and improvements in healthcare infrastructure. Laboratory-based tests are known for their accuracy compared to point-of-care (PoC) tests, which are likely to support the segment's growth.

The point-of-care segment is anticipated to show lucrative growth of 5.0% over the forecast period. The segment growth is propelled by rising demand for POC tests, technological advancements, faster turnaround times, and reduced complexity, alongside the introduction of advanced endoscopic devices like laser speckle contrast imaging (LSCI) for GI examination.

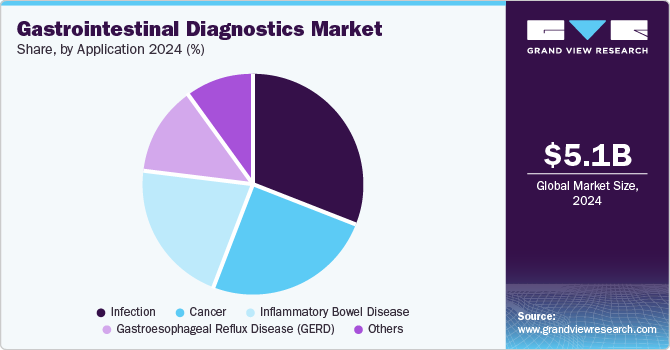

Application Insights

The infection segment dominated the market in 2024. The segment accounted for 31.5% of the global market. The rising prevalence of gastric infections, including C. difficile, salmonella, shigella, and H. pylori, along with increased diagnosis rates and heightened public awareness, are key factors propelling market growth. For instance, the CDC reports that C. difficile infections impact 1 in 6 individuals in the U.S. This growing concern regarding GI infections is driving demand for effective diagnostic solutions.

The cancer segment is projected to witness the fastest growth of 5.1% in the coming years, driven by the rising incidence of colorectal cancer; government initiatives focused on cancer management, and advancements in diagnostic technology. As per the statistics published by the International Agency for Research on Cancer, there were 968,784 new cases of stomach cancer in the year 2022, and are likely to reach 1,189,732 by the year 2030. With such lucrative growth in a number of cases, the demand for the GI diagnostics market is expected to show promising growth.

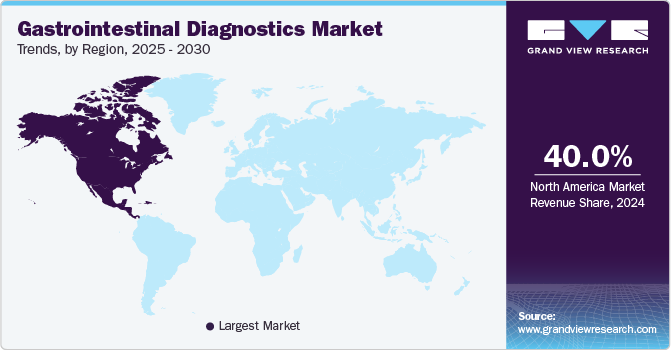

Regional Insights

The North America gastrointestinal diagnostics market dominated and accounted for a 40.0% share in 2024. The regional demand is expected to grow due to the high prevalence of gastrointestinal disorders, increased awareness of these conditions, and a robust healthcare infrastructure. In addition, the presence of major players and their strategic initiatives are likely to drive further expansion in this segment over the coming years. The launch of novel products within the region is also one of the major factors for regional growth. For instance, in January 2024, ELITechGroup SAS launched GI Bacterial PLUS ELITe MGB Kit for diagnosing gastrointestinal bacterial infections, targeting pathogens such as Campylobacter, Clostridium difficile, Salmonella, Shigella, and Yersinia enterocolitica.

U.S. Gastrointestinal Diagnostics Market Trends

The U.S. gastrointestinal diagnostics market is projected to grow significantly during the forecast period, driven by the prevalence of gastrointestinal disorders, such as colorectal cancer and various infections, which in turn is driving demand for advanced diagnostic solutions. In addition, heightened awareness among healthcare providers and patients regarding early diagnosis and management of these conditions is contributing to regional expansion.

Europe Gastrointestinal Diagnostics Market Trends

The Europe gastrointestinal diagnostics market is expected to show lucrative growth owing to significant product launches that aim to enhance diagnostic capabilities and improve patient care. For instance, in April 2023, Olympus recently introduced its EndoClot product line, which includes innovative solutions for managing hemostasis during endoscopic procedures. These products, designed for use in the gastrointestinal tract, utilize advanced polymer technologies for effective sealing and bleeding control, thereby enhancing the safety and efficacy of gastrointestinal procedures.

The UK gastrointestinal diagnostics market is projected to grow during the forecast period driven by increasing funding for research. For instance, the National Institute for Health Research (NIHR) has allocated nearly USD 54.4 million to establish new HealthTech Research Centres, focusing on innovative diagnostic technologies. These centers aim to improve early disease detection and patient management, particularly for conditions like cancer and gastrointestinal disorders.

The France gastrointestinal diagnostics market is expected to experience substantial growth during the forecast period, driven by robust healthcare infrastructure increasing awareness regarding stomach cancer diagnosis.

The Germany gastrointestinal diagnostics market is projected to expand during the forecast period as the regional market is seeing innovations in imaging techniques and microbiome analysis, which contribute to improved diagnostic capabilities and treatment options for gastrointestinal disorders. The combination of technological advancements and a growing awareness of gastrointestinal health issues positions Germany as a key player in the expanding gastrointestinal diagnostics market

Asia Pacific Gastrointestinal Diagnostics Market Trends

The Asia Pacific gastrointestinal diagnostics market is expected to experience the highest growth rate of 5.6% CAGR during the forecast period. Rising incidences of gastrointestinal disorders, including irritable bowel syndrome, colorectal cancer, and inflammatory bowel disease, are driving demand for effective diagnostic solutions. Additionally, increasing awareness about preventive healthcare, along with improving healthcare infrastructure and access to advanced diagnostic technologies, is contributing to market expansion.

The China gastrointestinal diagnostics market is projected to expand throughout the forecast period, driven by rising awareness of gastrointestinal health, coupled with government initiatives to improve healthcare access and infrastructure. Technological advancements, such as the development of innovative diagnostic tools and non-invasive testing methods, are enhancing the accuracy and efficiency of diagnostics.

The Japan gastrointestinal diagnostics market is anticipated to grow during the forecast period, primarily due to the aging population, which has led to an increase in gastrointestinal disorders such as colorectal cancer and gastrointestinal infections. Japan's healthcare system emphasizes preventive care, fostering a greater focus on early detection and regular screening programs.

Latin America Gastrointestinal Diagnostics Market Trends

The Latin America gastrointestinal diagnostics market is expected to experience significant growth throughout the forecast period. The rising prevalence of gastrointestinal diseases, including infections, inflammatory bowel diseases, and colorectal cancer, is driving demand for effective diagnostic solutions. Increasing public awareness about gastrointestinal health and the importance of early detection is further propelling the market.

The Brazil gastrointestinal diagnostics market is projected to expand during the forecast period, primarily driven by expanding healthcare infrastructure, along with government initiatives aimed at enhancing access to healthcare services supporting the market growth. Additionally, rising health awareness among the population regarding the importance of early diagnosis and preventive care contributes to increased screening rates.

Middle East & Africa Gastrointestinal Diagnostics Market Trends

The Middle East & Africa gastrointestinal diagnostics market is expected to show promising growth over the forecast period. Increasing awareness of gastrointestinal health and the importance of early detection among the population is further propelling market growth. Moreover, government initiatives aimed at promoting preventive healthcare and regular screening programs contribute to the market's expansion for gastrointestinal diagnostics.

Saudi Arabia Gastrointestinal Diagnostics Market Trends

The Saudi Arabia gastrointestinal diagnostics market is anticipated to experience substantial growth during the forecast period. The rising prevalence of gastrointestinal diseases, such as colorectal cancer and hepatitis, has fueled the demand for advanced diagnostic solutions. Saudi Arabia's commitment to enhancing healthcare infrastructure through initiatives like Vision 2030 is likely to promote better access to medical services and technologies.

Key Gastrointestinal Diagnostics Company Insights

The competitive scenario in the gastrointestinal diagnostics industry is high, with key players offering diverse testing solutions for testing purposes. Major companies, including Abbott Laboratories, Siemens Healthineers, and Roche, leverage their extensive research and development capabilities to introduce advanced diagnostic technologies and expand their product portfolios. These firms often engage in mergers and acquisitions to enhance their technological capabilities and market reach. Additionally, a growing number of startups are entering the market, focusing on niche areas such as non-invasive testing and personalized diagnostics, further intensifying competition.

Key Gastrointestinal Diagnostics Companies:

The following are the leading companies in the gastrointestinal diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- BIOMERIEUX

- F. Hoffmann-La Roche Ltd.

- Abbott

- Beckman Coulter, Inc.

- DiaSorin S.p.A

- Siemens Healthineers AG

- QIAGEN

- Meridian Bioscience

- Hologic, Inc.

View a comprehensive list of companies in the Gastrointestinal Diagnostics Market

Recent Developments

-

In January 2024, ELITechGroup launched the GI Bacterial PLUS ELITe MGB Kit for the diagnosis of gastrointestinal bacterial infections. The assay is capable of detecting Shigella spp, Campylobacter spp, Salmonella spp, Yersinia enterocolitica, and Clostridium difficile

-

In October 2024, F. Hoffmann-La Roche Ltd announced that they had received U.S. FDA approval for VENTANA CLDN18 (43-14A) RxDx assay for gastric adenocarcinoma.

-

In June 2024, QIAGEN expanded its portfolio by launching QIAstat-Dx Gastrointestinal Panel 2 within the U.S. With this launch, the company is expected to gain a competitive position in the overall gastrointestinal (GI) infection diagnosis market.

Gastrointestinal Diagnostics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 5.32 billion |

|

Revenue forecast in 2030 |

USD 6.56 billion |

|

Growth Rate |

CAGR of 4.3% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

October 2024 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

test type, technology, application, test location, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Spain, Italy, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, Saudi Arabia, Kuwait, UAE, South Africa. |

|

Key companies profiled |

BIOMERIEUX; F. Hoffmann-La Roche Ltd.; Abbott; Beckman Coulter, Inc.; DiaSorin S.p.A; Siemens Healthineers AG; QIAGEN; Meridian Bioscience; Hologic, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Gastrointestinal Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gastrointestinal diagnostics market report based on test type, technology, application, test location, region:

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Endoscopy

-

Blood test

-

H. pylori test

-

Calprotectin test

-

Immunoglobulin A test

-

Others

-

-

Technology Outlook (Revenue, USD Million; 2018 - 2030)

-

ELISA

-

PCR

-

Microbiology

-

Others

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Infection

-

Inflammatory Bowel Disease

-

Gastroesophageal Reflux Disease (GERD)

-

Cancer

-

Others

-

-

Test Location Outlook (Revenue, USD Million, 2018 - 2030)

-

Central laboratories

-

Point-of-Care

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global gastrointestinal diagnostics market size was valued at USD 5.08 billion in 2024 and is expected to reach USD 5.32 billion in 2025.

b. The global gastrointestinal diagnostics market is expected to grow at a compound annual growth rate of 4.30% from 2025 to 2030 to reach USD 6.56 billion by 2030.

b. North America dominated the gastrointestinal diagnostics market with a share of 39.97% in 2024. This is attributable to the increasing prevalence of gastrointestinal diseases, rising awareness about GI disorders, and better healthcare infrastructure.

b. Some key players operating in the gastrointestinal diagnostics market include BIOMERIEUX, F. Hoffmann-La Roche Ltd, Abbott, Beckman Coulter, Inc, DiaSorin S.p.A, Siemens Healthineers AG, QIAGEN, Meridian Bioscience, Hologic, Inc, and others.

b. Key factors that are driving the gastrointestinal diagnostics market growth include technological advancements in GI diagnostics, increasing prevalence of diseases, increasing approval of novel tests, and government favorable initiatives among others.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."