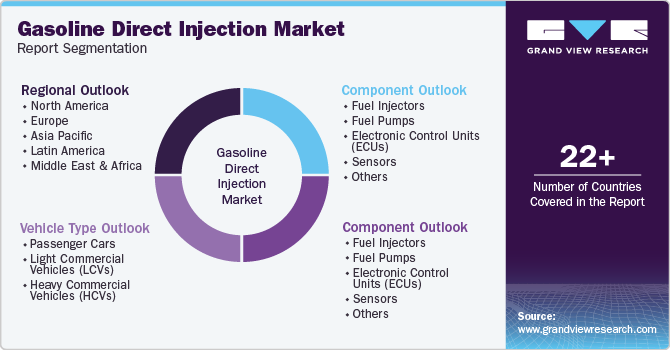

Gasoline Direct Injection Market Size, Share & Trends Analysis Report By Engine Type (4-cylinder, 6-cylinder), By Vehicle Type (Passenger Car, LCV), By Component Type, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-415-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Gasoline Direct Injection Market Trends

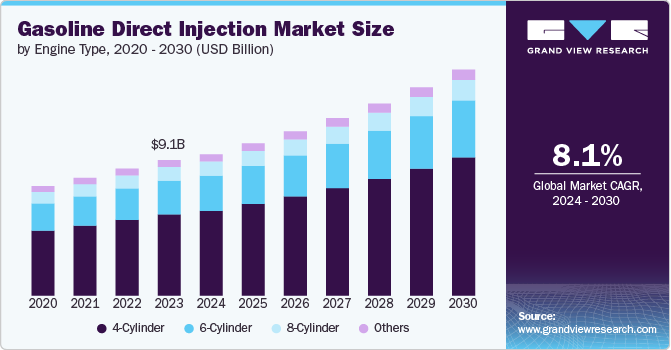

The global gasoline direct injection market size was estimated at USD 9.13 billion in 2023 and is projected to reach at a CAGR of 8.1% from 2024 to 2030. The increasing demand for fuel-efficient and high-performance engines in passenger and commercial vehicles is driving the adoption of gasoline direct injection across the automotive industry. gasoline direct injection (GDI) systems offer improved fuel economy, lower emissions, and enhanced engine performance, making them a preferred choice among automakers aiming to meet stringent environmental regulations.

The gasoline direct injection market is also witnessing significant growth due to advancements in engine technologies and the rising trend of downsized engines without compromising power output. As consumers and manufacturers alike seek to balance performance with fuel efficiency, GDI systems have emerged as a critical technology in modern vehicle design. The expanding electric vehicle (EV) market presents both a challenge and an opportunity for the GDI market, as hybrid electric vehicles (HEVs) increasingly incorporate GDI technology for optimized fuel use.

Technological advancements in GDI systems, such as the development of high-pressure fuel injectors and turbocharging techniques, are expected to play a pivotal role in the market's growth trajectory. These innovations not only boost engine performance but also contribute to better fuel economy, making GDI systems an attractive choice for both automakers and consumers. Furthermore, the expanding automotive industry in emerging economies, coupled with the growing middle-class population, is likely to create substantial opportunities for the market.

Drivers, Opportunities & Restraints

The primary driver for the gasoline direct injection market is the increasing global demand for fuel-efficient vehicles, driven by rising fuel prices and environmental concerns. GDI technology offers significant improvements in fuel economy and lower emissions, making it an ideal choice for modern vehicles. Additionally, stringent emission regulations in regions such as Europe and North America are compelling automakers to adopt GDI systems to meet regulatory requirements, further driving market growth.

Opportunities in the market are abundant, particularly with the ongoing advancements in engine technologies and the integration of electronic control units (ECUs) and sensors. The development of hybrid GDI systems and the potential for GDI technology to be combined with alternative fuels present exciting growth avenues. Furthermore, the increasing production of vehicles in emerging markets, where GDI technology is still in the early stages of adoption, offers significant potential for market expansion.

However, the market faces several restraints, including the high cost of GDI systems compared to traditional fuel injection systems. The complexity of GDI technology, which requires precise calibration and maintenance, may also pose challenges for widespread adoption, especially in cost-sensitive markets. Additionally, concerns related to particulate emissions in GDI engines could impact market growth, as regulators and manufacturers work to address these issues.

Engine Type Insights

“The Cylinder engine segment is expected to grow at a CAGR of 8.3% from 2024 to 2030 in terms of revenue”

The 4-cylinder engine segment led the market and accounted for 59.8% of the global revenue share in 2023, due to its widespread use in passenger cars and LCVs. These engines are favored for their optimal balance between power output and fuel efficiency, making them the go-to choice for manufacturers aiming to meet stringent emission norms while delivering robust performance. The segment is expected to witness steady growth as demand for fuel-efficient vehicles continues to rise globally.

The 6-cylinder engine segment is expected to reach at a significant CAGR from 2024 to 2030, primarily driven by its application in mid-range and luxury vehicles. These engines offer a higher power output than 4-cylinder engines, catering to consumers seeking enhanced performance and driving experience. The segment is anticipated to grow steadily as automotive manufacturers increasingly adopt GDI technology in their 6-cylinder engines to meet emission standards without compromising vehicle performance.

Component Insights

“The Engine Control Units (ECUs) segment is expected to grow at a significant CAGR of 9.2% from 2024 to 2030”

The fuel injectors segment led the market, accounting for 38.1% of the global revenue share in 2023. Fuel injectors are a critical component in the GDI system and are responsible for delivering precise amounts of fuel directly into the combustion chamber. This segment is expected to witness robust growth due to the increasing adoption of GDI technology across various vehicle types. As manufacturers strive to improve engine efficiency and reduce emissions, the demand for advanced fuel injectors that offer better atomization and fuel delivery precision is anticipated to rise.

Engine Control Units (ECUs) are essential for managing the GDI system and controlling the timing and quantity of fuel injection to optimize engine performance. The ECU segment is poised for substantial growth as GDI technology becomes more prevalent in modern vehicles. The increasing complexity of engine management systems and the need for precise control over fuel injection parameters are expected to boost demand for advanced ECUs in the market.

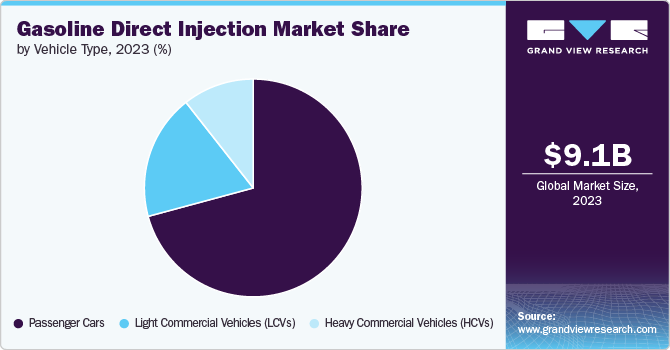

Vehicle Type Insights

“The light commercial vehicles segment is expected to grow at a significant CAGR of 9.4% from 2024 to 2030 in terms of revenue”

The passenger cars segment accounted for 70.1% of the global revenue share in 2023. GDI technology is increasingly being adopted in passenger cars to enhance fuel economy and reduce emissions, in line with tightening environmental regulations. The segment is expected to continue its dominance as manufacturers focus on developing GDI-equipped passenger cars that offer a blend of performance, efficiency, and lower emissions.

Light Commercial Vehicles (LCVs) are another significant segment in the market, driven by the need for more efficient and powerful engines in commercial applications. GDI technology helps LCVs achieve better fuel efficiency and performance, which is crucial for businesses that rely on these vehicles for transportation and logistics. The segment is anticipated to grow as the demand for LCVs increases, particularly in urban and suburban areas.

Regional Insights

North America gasoline direct injection market is driven by the high adoption rate of advanced automotive technologies. The region's stringent emission standards and a strong focus on fuel efficiency have propelled the demand for GDI systems in vehicles. The presence of major automotive manufacturers and a well-established automotive industry further contribute to the region's dominance in the GDI market.

Asia Pacific Gasoline Direct Injection Market Trends

“China to witness market growth at 8.7% CAGR”

Asia Pacific gasoline direct injection market is one of the fastest-growing markets, driven by the increasing demand for vehicles in emerging economies such as China and India. The region's expanding automotive industry and rising consumer awareness of fuel efficiency are key factors fueling the adoption of GDI technology. Additionally, government initiatives aimed at reducing vehicle emissions are expected to further boost the GDI market in Asia Pacific.

The gasoline direct injection market in China is a rapidly emerging market for Gasoline Direct Injection (GDI) technology, driven by the country's booming automotive industry and the government's stringent emission regulations. As the world's largest automotive market, China has seen a significant increase in the adoption of GDI systems, particularly in passenger cars and light commercial vehicles.

Europe Gasoline Direct Injection Market Trends

The gasoline direct injection market in Europe holds a significant share of the global market, primarily due to the region's strict environmental regulations and the automotive industry's commitment to reducing carbon emissions. European automakers are at the forefront of adopting GDI technology to meet the stringent emission targets set by the European Union. The region's emphasis on sustainability and fuel efficiency is expected to drive the continued growth of the GDI market.

Key Gasoline Direct Injection Company Insights

Some key players operating in the market include Marelli Holdings Co., Ltd., Robert Bosch GmbH, Denso, and Continental AG, among others.

-

Marelli Holdings Co., Ltd. is a supplier in the automotive sector, known for its advanced technology and innovation in powertrain systems, including Gasoline Direct Injection (GDI) systems. The company's GDI technology is designed to enhance fuel efficiency and reduce emissions, meeting the growing demand for eco-friendly and high-performance vehicles.

-

Robert Bosch GmbH is a globally recognized leader in automotive technology, offering a comprehensive range of products and solutions, including gasoline direct injection (GDI) systems. Bosch's GDI systems are renowned for their precision, reliability, and contribution to improving engine efficiency and lowering emissions. The company leverages its deep expertise in automotive electronics and a robust innovation pipeline to stay at the forefront of the GDI market.

-

Denso Corporation is a prominent automotive supplier with a strong focus on developing advanced technologies, including gasoline direct injection (GDI) systems. Denso's GDI systems are engineered to deliver superior fuel efficiency, enhanced engine performance, and reduced environmental impact. The company's commitment to innovation and quality has made it a trusted partner for major automotive manufacturers worldwide.

-

Continental AG is a key player in the automotive industry, known for its innovative solutions in powertrain technology, including Gasoline Direct Injection (GDI) systems. Continental's GDI systems are designed to optimize fuel combustion, improve engine efficiency, and reduce emissions, aligning with the global shift towards more sustainable automotive technologies.

Key Gasoline Direct Injection Companies:

The following are the leading companies in the gasoline direct injection market. These companies collectively hold the largest market share and dictate industry trends.

- Marelli Holdings Co., Ltd.

- Robert Bosch GmbH

- Denso

- Continental AG

- Delphi Technologies.

- Hitachi Astemo, Ltd

- Stanadyne Holdings

- Keihin

- Infineon Technologies

- GP Performance

Recent Developments

-

In December 2023, Stanadyne, a prominent global supplier of fuel and air management systems, announced the expansion of its performance and specialty product line with the introduction of its patented Goliath 350-bar gasoline direct injection (GDI) performance fuel injector.

-

In December 2023, Marelli introduced its latest fuel system designed for hydrogen propulsion, featuring a patented injector design and an advanced Engine Control Unit. This cutting-edge solution is tailored for hydrogen engines, which utilize hydrogen as fuel and produce zero CO2 emissions. This innovation represents a promising advancement in eco-mobility, aligning with the growing demand for sustainable automotive technologies.

Gasoline Direct Injection Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 9.52 billion |

|

Revenue forecast in 2030 |

USD 15.23 billion |

|

Growth rate |

CAGR of 8.1% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

|

Segments covered |

Engine type, component, vehicle type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; France; Italy, UK; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

Marelli Holdings Co., Ltd.; Robert Bosch GmbH; Denso; Continental AG; Delphi Technologies; Hitachi Astemo, Ltd; Stanadyne Holdings; Keihin; Infineon Technologies; GP Performance |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Gasoline Direct Injection Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the gasoline direct injection market on the basis of engine type, vehicle type, component, and region:

-

Engine Type Outlook (Revenue, USD Million; 2018 - 2030)

-

4-Cylinder

-

6-Cylinder

-

8-Cylinder

-

Others

-

-

Component Outlook (Revenue, USD Million; 2018 - 2030)

-

Fuel Injectors

-

Fuel Pumps

-

Electronic Control Units (ECUs)

-

Sensors

-

Others

-

-

Vehicle Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Passenger Cars

-

Light Commercial Vehicles (LCVs)

-

Heavy Commercial Vehicles (HCVs)

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global gasoline direct injection market size was estimated at USD 9.13 billion in 2023 and is expected to reach USD 9.52 billion in 2024.

b. The global gasoline direct injection market, in terms of revenue, is expected to grow at a compound annual growth rate of 8.1% from 2024 to 2030 to reach USD 15.23 billion by 2030.

b. Asia Pacific dominated the gasoline direct injection market with a revenue share of 37.7% in 2023, driven by the increasing demand for vehicles in emerging economies such as China and India.

b. Some of the key players operating in the gasoline direct injection market include Marelli Holdings Co., Ltd., Robert Bosch GmbH, Denso, Continental AG, Delphi Technologies. Hitachi Astemo, Ltd, Stanadyne Holdings, Keihin, Infineon Technologies, GP Performance.

b. The demand for gasoline direct injection is driven by increasing demand for fuel-efficient and high-performance engines in passenger and commercial vehicles is driving the adoption of gasoline direct injection across the automotive industry.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."