- Home

- »

- Advanced Interior Materials

- »

-

Gas Separation Membrane Market, Industry Report, 2030GVR Report cover

![Gas Separation Membrane Market Size, Share & Trends Report]()

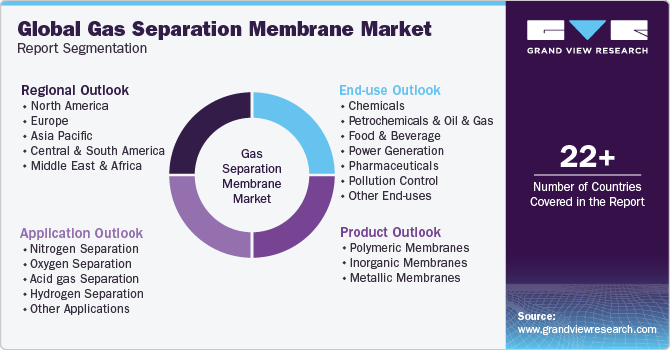

Gas Separation Membrane Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Polymeric Membranes, Inorganic Membranes, Metallic Membranes), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-271-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Gas Separation Membrane Market Summary

The global gas separation membrane market size was valued at USD 1.5 billion in 2024 and is projected to reach USD 2.16 billion by 2030, growing at a CAGR of 6.9% from 2025 to 2030. The gas separation membrane market is anticipated to expand due to the growth of the petrochemical and chemical industries.

Key Market Trends & Insights

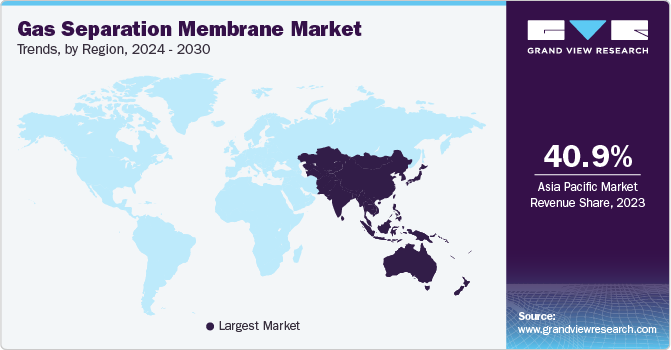

- The gas separation membrane market in Asia Pacific accounted for the largest revenue share of 41.3% in 2024.

- The China gas separation membrane market is projected to grow at a significant CAGR from 2025 to 2030.

- Based on product, the polymeric membranes segment dominated in 2024, accounting for 73.5% of the market share.

- Based on application, the nitrogen gas separation segment dominated the market in 2024.

- Based on end-uses, the petrochemicals and oil & gas segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.5 Billion

- 2030 Projected Market Size: USD 2.16 Billion

- CAGR (2025-2030): 6.9%

- Asia Pacific: Largest market in 2024

Furthermore, strict government regulations and policies focused on lowering greenhouse gas (GHG) emissions are propelling market growth, as membrane technologies provide an energy-efficient method for gas separation. Growing environmental concerns related to climate change are motivating sectors such as chemicals, food & beverage, petrochemicals, and power generation to adopt more sustainable gas separation approaches.

Polymers are essential raw materials in the production of gas separation membranes. Polyethersulfone (PES), polyvinylidene fluoride (PVDF), and polypropylene (PP) are the most commonly used polymers for manufacturing membrane modules. For instance, in January 2022, Toray Industries, Inc., a diversified chemical company, announced the development of a new polymeric separation membrane module designed for the selective and efficient separation of hydrogen from mixed gas streams. This development is poised to invigorate the polymer segment within the gas membrane separation market by offering an advanced material solution for enhanced hydrogen recovery.

The gas separation membrane market is dynamic and highly competitive. Companies are employing strategies such as investments, divestments, and regional expansion to strengthen their market position. However, volatility in raw material prices is expected to be a significant concern for market participants.

Market Concentration & Characteristics

The growth stage of the market is medium, and the growth rate is increasing. The gas separation membrane industry is characterized by a high degree of innovation owing to the potential use of 3D printing techniques to enable the production of membranes in different shapes & designs and in a more precise manner compared to other fabrication methods currently available in the industry. In November 2023, an article published on IOP Science highlights 3D printing as a novel and innovative method for manufacturing reverse osmosis membranes. These membranes are intended for use in water desalination and treatment processes, representing an advancement in the development of 3D-printed membranes for these applications.

The gas separation membrane market features numerous companies actively pursuing capacity expansions and mergers & acquisitions to gain a larger market share. International companies are strategically acquiring small- and medium-sized enterprises to broaden their product offerings and reinforce their market presence.

The gas separation membrane industry is subject to the low impact of regulations owing to the presence of fewer standards, regulations, and guidelines. Few regulations control the market, such as the U.S. Food & Drug Administration 21CFR 177.2910 defines the labeling, usage, and development of ultra-filtration membranes.

The market caters to a wide array of end users across sectors including chemicals, food & beverage, power generation, and petrochemicals, indicating a high concentration of end use applications. Manufacturers should prioritize understanding the specific requirements of these end users and providing effective client services as key factors for success.

Product Insights

The polymeric membranes segment dominated in 2024, accounting for 73.5% of the market share during the forecast period. Polymeric separation membranes are composed of polymeric materials, such as polysulfone, polyimide, polyethylene, or polyvinylidene fluoride (PVDF). The separation process takes place when gas mixtures pass through a membrane under pressure, allowing for the separation of particular gases from a mixture. For instance, in September 2023, Membrane Technology and Research, Inc. (MTR) scaled its carbon capture operations with the establishment of the largest membrane-based plant in Wyoming. This facility will utilize MTR's Polaris polymeric membrane technology to capture over 150 metric tons of CO2 daily. This expansion proves their viability and effectiveness for significant CO2 removal, boosting confidence in the polymeric membrane segment.

The inorganic membrane segment is projected to grow at the fastest CAGR from 2025 to 2030. Inorganic separation membranes are composed of inorganic materials, such as ceramics, metals, and metal oxides. Inorganic gas separation membrane offers high selectivity of gases, thermal and chemical stability, and resistance to fouling, which are driving factors of the segment growth.

Application Insights

The nitrogen gas separation segment dominated the market in 2024. Gas separation membranes are used to separate nitrogen from the air, producing high-purity nitrogen. This nitrogen is used in various industries, including electronics, food and beverage packaging, pharmaceuticals, and chemical processing. Furthermore, the membranes are integrated into nitrogen generation systems to produce nitrogen on-site from compressed air. In February 2023, Evonik, a specialty chemical company, started a new production plant of gas separation membranes in Austria, specifically for hollow-fiber membranes. These membranes are designed for the separation of gases such as methane, nitrogen, and hydrogen. This development by Evonik signifies an increase in the production capacity for nitrogen separation membranes, potentially leading to greater availability and potentially more competitive pricing within the nitrogen separation segment.

The acid gas separation segment is projected to grow at a significant CAGR growth from 2025 to 2030. Gas separation membranes are extensively used in acid separation processes across various industries, including oil and gas production, natural gas processing, chemical manufacturing, and environmental protection. The membranes selectively remove acid gases, such as carbon dioxide (CO2), hydrogen sulfide (H2S), and sulfur dioxide (SO2), from gas streams. These factors are expected to boost the segment growth over the forecast period.

End Use Insights

The petrochemicals and oil & gas segment accounted for the largest revenue share in 2024. The growing use of gas separation membranes for natural gas processing, hydrogen purification, carbon capture & storage, vapor recovery, and natural gas liquefaction is expected to drive segment growth. In May 2024, Air Products, a manufacturer specializing in gas separation and purification membranes, introduced its new PRISM GreenSep liquefied natural gas (LNG) membrane separator. This product is specifically designed for the production of bio-LNG. In the food & beverage industry, gas separation membranes are primarily used for modified atmosphere packaging (MAP) and controlled atmosphere storage (CAS) applications. This helps extend the shelf life and maintain the quality of perishable products.

The power generation segment is expected to grow at a significant CAGR growth from 2025 to 2030 owing to its improved performance efficiency, reduced emissions, and cleaner energy production methods. The product is used for carbon capture & storage, pre-combustion carbon capture, hydrogen purification, oxygen enrichment, and selectively removing impurities, such as carbon dioxide (CO2) and water vapor from natural gas streams. These factors are projected to propel the market growth.

Regional Insights

The North America gas separation membrane market is expected to witness significant growth over the forecast period from 2025 to 2030 owing to the rising investments in modernizing automotive systems, enhancing medical devices, and growing emphasis on developing compact computers.

U.S. Gas Separation Membrane Market Trends

The gas separation membrane industry in the U.S. accounted for the largest share in 2024. This growth is attributed to the U.S. government initiatives to encourage sustainable manufacturing processes in industries such as food & beverage and power generation, which are expected to play a pivotal role in the growth of gas membrane separation.

Europe Gas Separation Membrane Market Trends

The gas separation membrane market in Europe is expected to grow at a significant CAGR from 2025 to 2030 owing to stringent environmental regulations and government initiatives aimed at reducing air and water pollution, as well as mitigating greenhouse gas (GHG) emissions. Furthermore, the pharmaceutical industry is one of the significant contributors to the demand for gas membrane separation.

Asia Pacific Gas Separation Membrane Market Trends

The gas separation membrane market in Asia Pacific accounted for the largest revenue share of 41.3% in 2024 owing to rising demand, rapid industrialization coupled with stringent regulations set by various governments to maintain environmental quality. Moreover, as pollution levels continue to rise and concerns about the environment grow, the demand for wastewater treatment technologies is expected to increase in the region over the next few years.

The China gas separation membrane market is projected to grow at a significant CAGR from 2025 to 2030. Rapid industrialization and economic development have led to increased product demand in various industries, including oil and gas, petrochemicals, chemicals, and steel production. In addition, the presence of environmental NGOs in China including China Biodiversity Conservation, Friends of Nature, and Green Development Foundation that implement various measures to curb pollution is driving the product growth.

Middle East & Africa Gas Separation Membrane Market Trends

The gas separation membrane industry is projected to grow at a significant CAGR from 2025 to 2030, driven by significant product demand in Saudi Arabia, Qatar, and the UAE. These countries face increasing environmental challenges stemming from extensive exploration, drilling, and extraction activities. The escalating oil and gas production in the region has resulted in considerable air and water pollution, which is expected to increase the demand for gas separation membranes in wastewater treatment applications. As a result, strict government regulations focused on limiting pollutant emissions are anticipated to further stimulate the expansion of the gas separation membrane industry in this market.

Key Gas Separation Membrane Company Insights

Some of the key players operating in thegas separation membrane market include UBE Corporation, Air Liquide Advanced Separations, Air Products and Chemicals, Inc., DIC CORPORATION, and FUJIFILM Corporation. These organizations are focusing on increasing the customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers & acquisition, capacity expansion, and product enhancement to align with changing regulations.

-

GMT Membrantechnik GmbH is a German-based company specializing in the development, manufacturing, and distribution of membrane filtration systems and components. The company focuses on membrane technology solutions for various industries, including water and wastewater treatment, food and beverage, pharmaceuticals, biotechnology, and chemical processing.

-

UBE Corp. is engaged in the production of machinery, industry chemicals, battery materials, and fine chemicals. The company offers a CO2 separation, H2 separation, organic vapor dehydration, N2 separation, and dehumidification membrane module.

Key Gas Separation Membrane Companies:

The following are the leading companies in the gas separation membrane market. These companies collectively hold the largest market share and dictate industry trends.

- Air Liquide Advanced Separations

- Air Products and Chemicals, Inc.

- Atlas Copco AB

- DIC CORPORATION

- Evonik Industries AG

- FUJIFILM Corporation

- GENERON

- GMT Membrantechnik GmbH

- JSC Grasys.

- Honeywell International Inc.

- Mahler AGS GmbH

- Parker Hannifin Corp

- SLB

- UBE Corporation

Recent Developments

-

In December 2024, Toray Industries announced the establishment of a pilot production line for its all-carbon CO2 separation membrane at their Shiga Plant, marking progress towards large-scale manufacturing of this technology. This development signals a promising advancement for the gas membrane separation market, potentially offering a more efficient and robust solution for carbon capture.

-

In November 2023, Air Products has announced that over 2,000 seagoing vessels globally now use their membrane-based nitrogen generation systems. This widespread adoption highlights Air Products' significant market share and strong competitive position in the maritime sector. This news underscores the effectiveness and reliability of gas separation membrane technology for critical onboard applications, further validating its potential and driving growth within the broader gas separation membrane market.

-

In January 2023, UBE Corporation announced an expansion of its gas separation membrane hollow fiber and module production facilities, expected to be operational by mid-2025, increasing capacity by roughly 1.8 times. This strategic move aims to capitalize on growing demand within the environmental and power sectors. The increased production capacity will enhance the availability of gas separation membranes, potentially lowering costs and accelerating their adoption in key application areas, thus positively impacting market growth.

Gas Separation Membrane Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.55 billion

Revenue forecast in 2030

USD 2.16 billion

Growth Rate

CAGR of 6.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Australia; Brazil; Saudi Arabia

Key companies profiled

Air Liquide Advanced Separations; Air Products and Chemicals, Inc.; Atlas Copco AB; DIC CORPORATION; Evonik Industries AG; FUJIFILM Corporation; GENERON; GMT Membrantechnik GmbH; JSC Grasys.; Honeywell International Inc.; Mahler AGS GmbH; Parker Hannifin Corp; SLB; UBE Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gas Separation Membrane Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gas separation membrane market report based on product, application, end use and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Polymeric Membranes

-

Inorganic Membranes

-

Metallic Membranes

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Nitrogen Separation

-

Oxygen Separation

-

Acid gas Separation

-

Hydrogen Separation

-

Other

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemicals

-

Petrochemicals and Oil & Gas

-

Food & Beverage

-

Power Generation

-

Pharmaceuticals

-

Pollution Control

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global gas separation membrane market size was estimated at USD 1.41 billion in 2023 and is expected to reach USD 1.47 billion in 2024.

b. The global gas separation membrane market is expected to grow at a compound annual growth rate of 6.6% from 2024 to 2030 to reach USD 2.16 billion by 2030.

b. Polymeric gas separation membrane led the market and accounted for 73.3% share of the revenue in 2023 owing to its scalability, ease of fabrication, cost-effectiveness, and flexibility in design.

b. Some of the key players operating in the gas separation membrane market include Air Liquide Advanced Separations, Air Products and Chemicals, Inc., DIC CORPORATION, and FUJIFILM Business Innovation Corp.

b. The key factors that are driving the global gas separation membrane market include utilizing Membrane for nitrogen separation, oxygen separation, acid gas separation, and hydrogen separation in industries such as petrochemicals, chemicals, pharmaceuticals, and oil & gas.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.