- Home

- »

- Distribution & Utilities

- »

-

Gas Meter Market Size, Share, Growth & Trends Report 2030GVR Report cover

![Gas Meter Market Size, Share & Trends Report]()

Gas Meter Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Basic, Smart), By Application (Residential, Commercial, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-346-8

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Gas Meter Market Summary

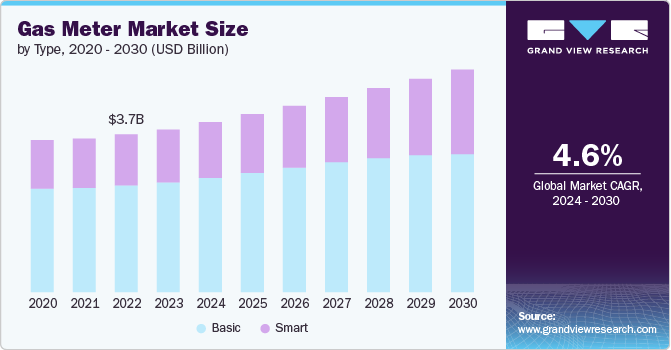

The global gas meter market size was estimated at USD 3.79 billion in 2023 and is projected to reach USD 5.19 billion by 2030, growing at a CAGR of 4.6% from 2024 to 2030. The rise in global demand for natural gas is a major driver, as increasing energy consumption and the shift towards cleaner fuels like natural gas are fueling the need for accurate gas measurement and monitoring.

Key Market Trends & Insights

- North America dominated the global gas meter market and accounted for the largest revenue share of over 35.39% in 2023.

- The gas meter market in the U.S. is characterized by its advanced technology adoption and regulatory-driven growth.

- By type, the basic gas meter segment held the largest revenue share of 67.49% in 2023.

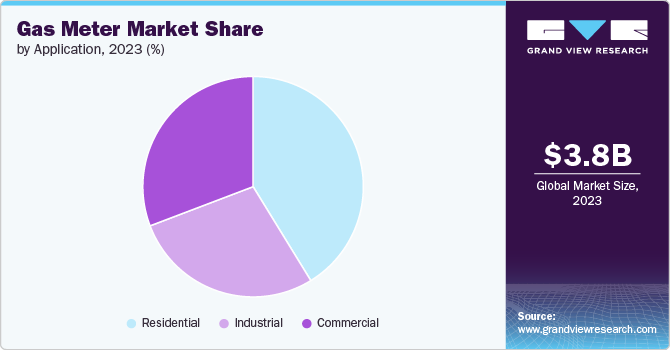

- By application, the residential application segment led the market with the largest revenue share of 41.23% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.79 Billion

- 2030 Projected Market Size: USD 5.19 Billion

- CAGR (2024-2030): 4.6%

- North America: Largest market in 2023

Smart gas meters in particular are seeing growing adoption, as they provide enhanced operational safety, cost savings, and real-time data for gas companies and consumers.

Technological advancements, such as the integration of IoT, 5G, and AI, are enabling the development of more sophisticated and efficient gas meters that can optimize grid operations and energy efficiency. Government initiatives and regulations aimed at promoting energy conservation and sustainability are also propelling the demand for smart gas meters that can help reduce gas consumption and emissions.

Drivers, Opportunities & Restraints

The need for reducing gas losses during transmission and distribution is driving the installation of advanced gas metering solutions across residential, commercial, and industrial sectors. Overall, the convergence of these market drivers is expected to fuel steady growth in the global gas meter market in the coming years.

Government initiatives and regulations promoting smart meter adoption for energy conservation and cost savings are further propelling market growth. Emerging technologies like cellular IoT (NB-IoT) and Low Power Wide Area (LPWA) are expected to revolutionize traditional gas metering, creating new opportunities for manufacturers.

The high cost of smart gas meters compared to traditional meters is a major barrier to adoption, as the installation of advanced metering infrastructure requires significant upfront investments by utilities and consumers. Security and privacy concerns around user data collected by smart meters are also hindering market growth.

Type Insights & Trends

The basic gas meter segment held the largest revenue share of 67.49% in 2023. The global gas meter market is experiencing robust growth, driven by several key factors. The rising demand for natural gas, particularly in emerging economies, is a major driver, as increasing energy consumption and the shift towards cleaner fuels fuel the need for accurate gas measurement and monitoring.

Technological advancements, such as the integration of smart meters, IoT, and data analytics, are enabling more efficient and intelligent gas metering solutions that optimize grid operations and energy efficiency. Government initiatives and regulations promoting energy conservation and sustainability are also propelling the adoption of advanced gas meters across residential, commercial, and industrial sectors.

Application Insights & Trends

The residential application segment led the market with the largest revenue share of 41.23% in 2023. The residential gas meter market is propelled by the increasing adoption of smart gas meters, which offer real-time monitoring, remote meter reading, and improved accuracy. Smart meters appeal to both consumers and utility companies, providing benefits such as enhanced energy efficiency and cost savings.

The commercial gas meter market is experiencing robust growth, driven by several key factors. The increasing adoption of smart gas meters is a major driver, as they enable accurate billing, real-time monitoring of gas consumption, and improved operational efficiency for utilities.

Regional Insights & Trends

North America dominated the global gas meter market and accounted for the largest revenue share of over 35.39% in 2023. Governments in the region are actively implementing policies and programs to promote smart gas meter deployments. This includes subsidies, mandates, and national energy efficiency goals. For example, the U.S. is pushing for large-scale smart meter rollouts to achieve ambitious environmental targets and improve grid management.

North America is a significant market for gas meters. The increasing consumption of natural gas as a cleaner energy source, government initiatives promoting energy efficiency and sustainability, the rise of smart metering technologies that enable real-time monitoring and optimization, and the need to reduce gas losses during transmission and distribution.

U.S. Gas Meter Market Trends

The gas meter market in the U.S. is characterized by its advanced technology adoption and regulatory-driven growth. The market is driven by increasing urbanization, a growing number of residential and commercial natural gas consumers, and stringent regulatory frameworks aimed at improving energy efficiency and safety.

Europe Gas Meter Market Trends

Europe has been at the forefront of smart metering deployment, driven by EU directives and national regulations aimed at improving energy efficiency and reducing carbon emissions. The EU's Third Energy Package mandates the deployment of smart meters for electricity and gas, leading to widespread adoption across member states. This regulatory framework provides a clear mandate for utilities to invest in Smart (AMI) and smart grid technologies.

The UK gas meter market is expected to grow during the forecast period. Smart gas meters in the UK are integral to the development of smart grid infrastructure. These meters facilitate demand response programs, grid optimization, and integration with renewable energy sources. The UK government's initiatives to support a low-carbon economy further drive the adoption of smart meters as part of sustainable energy practices.

The Germany gas meter market is anticipated to witness growth from 2024 to 2030. Germany is heavily invested in renewable energy sources like wind and solar. Gas Meters, with their two-way communication capabilities, can play a crucial role in grid balancing and integrating renewable energy sources into the energy mix. This focus on grid modernization creates a favorable environment for Gas Meter adoption.

Asia Pacific Gas Meter Market Trends

Countries in Asia Pacific, particularly China and India, are witnessing rapid urbanization and infrastructure development, driving the demand for advanced utility metering solutions. Gas Meters play a crucial role in modernizing energy infrastructure, improving efficiency, and supporting sustainable urban development. Advanced metering technologies such as LPWAN (Low Power Wide Area Network), IoT (Internet of Things), and cloud-based analytics are increasingly being integrated into Gas Meters. These technologies enable real-time data monitoring, remote meter reading, and predictive maintenance, enhancing operational efficiency for utilities and improving service delivery to consumers.

The China gas meter market is projected to grow over the forecast period.China's government has been actively promoting the deployment of Gas Meters as part of its broader efforts to modernize utility infrastructure and improve energy efficiency. Policies such as the "Internet Plus" initiative and the Energy Conservation and Emission Reduction Plan incentivize utilities to upgrade to smart metering systems. These initiatives aim to enhance operational efficiency, reduce energy waste, and support sustainable economic development.

The gas meter market in India is poised for growth, driven by several key trends that reflect the country's increasing focus on energy efficiency, technological innovation, and regulatory reforms. India's government has launched several initiatives to promote smart metering as part of its efforts to modernize the energy sector. Programs such as the Smart Meter National Program (SMNP) aim to deploy smart meters across the country to improve energy efficiency, reduce losses in distribution, and enhance financial viability for utilities. These initiatives are supported by regulatory frameworks that encourage utilities to adopt smart metering solutions.

Also, gas meters are integral to India's smart grid initiatives, which aim to modernize the electricity and gas infrastructure and enhance grid reliability. These meters support the integration of renewable energy sources, demand response programs, and predictive maintenance strategies, thereby contributing to a more sustainable and resilient energy system.

Key Gas Meter Company Insights

The Gas Meter market is a highly competitive industry with several key players operating globally.

Key Gas Meter Companies:

The following are the leading companies in the gas meter market. These companies collectively hold the largest market share and dictate industry trends.

- Honeywell International Inc.

- Itron Inc.

- Apator SA

- Diehl Stiftung & Co. KG

- Sensus Worldwide Holdings Limited

- Aclara Technologies LLC

- EDMI Limited

- ABB

- CGI

- General Electric

Recent Developments

-

In April 2024, Vikas Lifecare Ltd (VLL), a joint venture between Genesis Gas Solutions Pvt Ltd (GGSPL) and Indraprastha Gas Ltd (IGL) announced an investment of about USD 1 million to establish a plant in Noida, India for manufacturing Gas Meters. The investment shall further strengthen the company’s market share and aim to produce 1 million Gas Meters annually.

-

In November 2023, Honeywell Inc. launched a 100% hydrogen-capable diaphragm EI5 Gas Meter in the Netherlands. The initiative has been taken to align with the region’s goals outlined in the European Green Deal. The new gas meter is capable of measuring both hydrogen and natural gas. The meter requires less maintenance and eliminates the need for future replacements.

Gas Meter Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.96 billion

Revenue forecast in 2030

USD 5.19 billion

Growth rate

CAGR of 4.6% from 2024 to 2030

Historical data

2018 - 2022

Base Year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Russia; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Honeywell International Inc.; Itron Inc.; Apator SA; Diehl Stiftung & Co. KG; Sensus Worldwide Holdings Limited; Aclara Technologies LLC; EDMI Limited; ABB; CGI; General Electric

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gas Meter Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented gas meter market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Basic

-

Smart

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. .The global gas meter market was estimated at USD 3.79 billion in 2023 and is projected to reach USD 3.96 billion in 2024.

b. The global gas meter market is expected to witness a compound annual growth rate of 4.59% from 2024 to 2030 to reach USD 5.19 billion by 2030.

b. North America emerged as the largest regional segment and accounted for 35.39% of the market in 2023. The increasing consumption of natural gas as a cleaner energy source, government initiatives promoting energy efficiency and sustainability, the rise of smart metering technologies that enable real-time monitoring and optimization, and the need to reduce gas losses during transmission and distribution.

b. Some of the key players operating in the carbon credits market include Honeywell International Inc., Itron Inc., Apator SA, Diehl Stiftung & Co. KG, Sensus Worldwide Holdings Limited, among others.

b. Rise in global demand for natural gas is a major driver, as increasing energy consumption and the shift towards cleaner fuels like natural gas are fueling the need for accurate gas measurement and monitoring. Smart gas meters in particular are seeing growing adoption, as they provide enhanced operational safety, cost savings, and real-time data for gas companies and consumers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.