- Home

- »

- Distribution & Utilities

- »

-

Gas Insulated Transformer Market, Industry Report, 2030GVR Report cover

![Gas Insulated Transformer Market Size, Share, & Trends Report]()

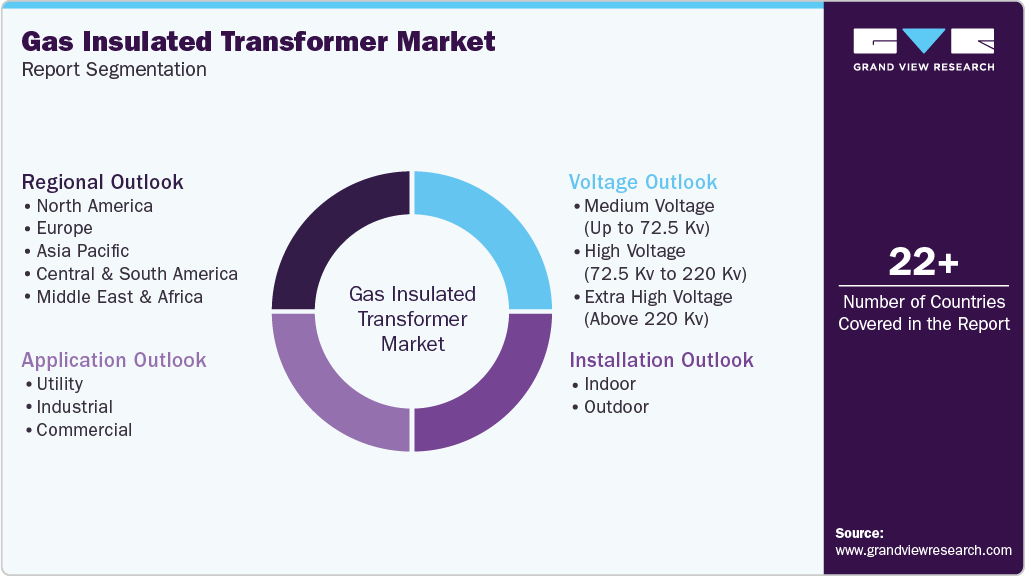

Gas Insulated Transformer Market (2025 - 2030) Size, Share, & Trends Analysis Report By Voltage (Medium Voltage, High Voltage, Extra High Voltage), By Installation (Indoor, Outdoor), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-368-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Gas Insulated Transformer Market Summary

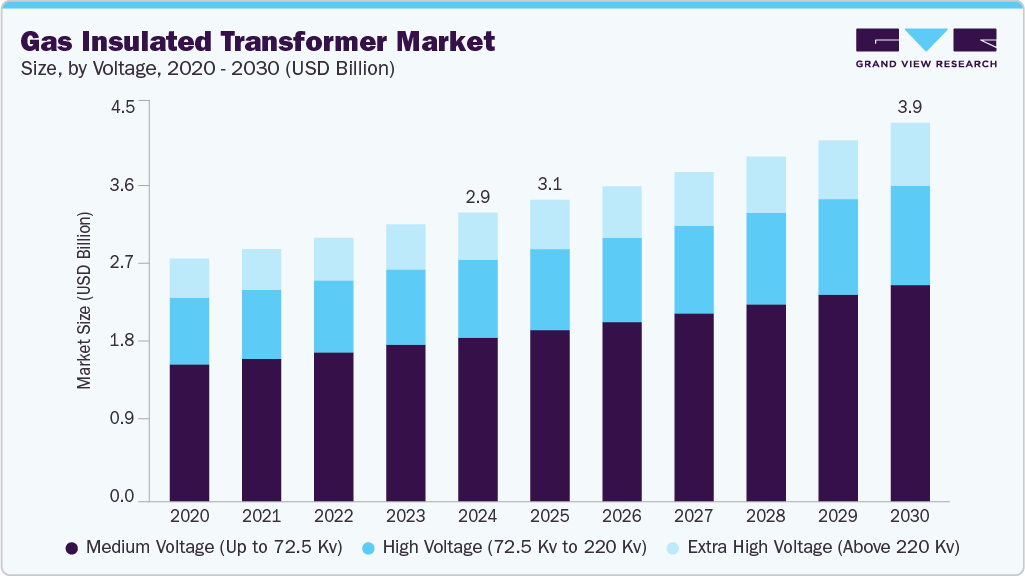

The global gas insulated transformer market size was estimated at USD 2.95 billion in 2024 and is projected to reach USD 3.87 billion by 2030, growing at a CAGR of 4.7% from 2025 to 2030. Rising electricity demand, driven by industrialization, urbanization, and an increase in the use of electrical appliances, necessitates efficient and reliable power distribution systems, thus driving market growth.

Key Market Trends & Insights

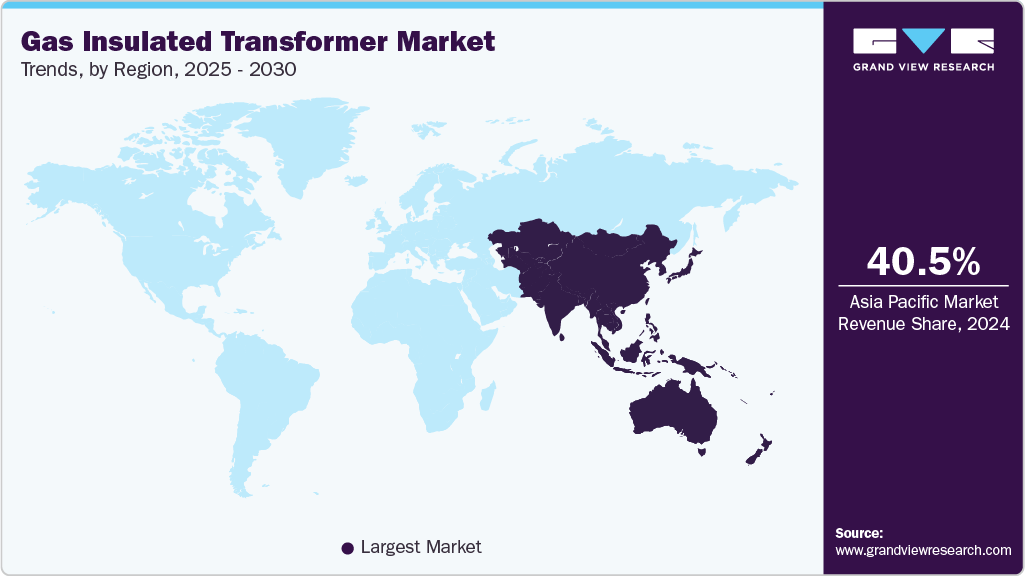

- Asia Pacific dominated the global industry with a revenue share of 40.53% in 2024.

- China held the largest share in the Asia Pacific region in 2024.

- By voltage, the medium voltage segment registered the largest revenue share of 56.7% in 2024.

- By installation, the indoor installation segment accounted for the highest market share in 2024.

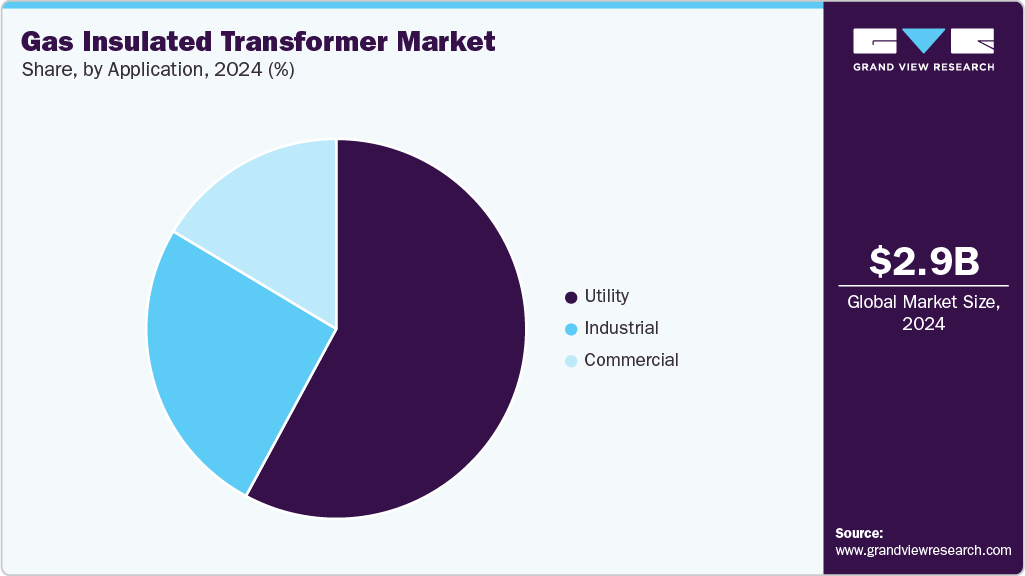

- By application, the utility segment dominated with the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.95 Billion

- 2030 Projected Market Size: USD 3.87 Billion

- CAGR (2025-2030): 4.7%

- Asia Pacific: Largest market in 2024

Gas Insulated Transformers (GITs) are an advanced solution in the electrical power sector, specifically developed to meet the rising demand for compact, safe, and efficient power distribution, especially in urban and environmentally sensitive regions. Unlike traditional Oil-immersed Transformers (OITs), GITs use Sulfur Hexafluoride (SF6) gas as the main insulation and cooling medium. The fundamental concept of GITs involves enclosing the transformer's active components within a sealed metallic casing filled with SF6 gas. SF6 gas possesses exceptional dielectric strength and thermal characteristics, which are nonflammable and nonexplosive. This property removes the need for extensive fire suppression systems, oil collection tanks, and firewalls that are typically needed for OITs, enabling GITs to be installed in the same space as Gas Insulated Switchgear (GIS) for a highly compact substation layout.

The global gas insulated transformer industry is experiencing significant growth driven by the increasing demand for compact and efficient power transmission solutions in urban areas. GITs offer a smaller footprint than traditional oil-filled transformers, making them ideal for substations in densely populated cities. For example, in metropolitan areas such as Tokyo and New York City, utilities increasingly turn to GITs to upgrade their aging infrastructure while minimizing the physical space required, thus positively influencing the market.

Furthermore, an increasing emphasis on environmental sustainability and safety is anticipated to drive the growth of gas insulated transformer market in the coming years. GITs using environmentally friendly gases as alternatives to SF6 have lower fire hazards and reduced environmental effects than oil-filled transformers. This aligns with strict environmental regulations and corporate sustainability objectives.

In addition, the swift growth of renewable energy sources and the need for grid modernization fuel the market. With the growing integration of solar and wind farms into the power grid, there is a heightened demand for efficient and dependable transformer technology to manage the variable nature of these energy sources. GITs are suited for these applications due to their exceptional performance in extreme conditions and the capability to accommodate rapid load fluctuations.

Market Concentration & Characteristics

The industry growth stage is medium, and the pace of market growth is accelerating. The gas insulated transformer industry is partially concentrated. Although many regional and specialized companies exist, the market is primarily led by a few large multinational firms. Key competitors, including Siemens Energy, Hitachi Energy, ABB, Mitsubishi Electric, and GE Vernova, have substantial research and development resources, comprehensive product offerings, strong brand identity, and global distribution networks.

The market demonstrates a high level of innovation, particularly focused on creating technologies free from SF6 to meet strict environmental regulations and advance digitalization and monitoring systems. The influence of regulations is also high, as environmental policies play a major role in shaping product development and market trends. Mergers and acquisitions are relatively low in terms of direct purchases of major companies. However, the market often observes strategic alliances and joint ventures that aim to combine expertise and advance technological boundaries. End-use concentration is high, with the utility sector holding the largest market share. The industrial and commercial sectors are adopting these technologies due to their safety, compactness, and reliability requirements.

Voltage Insights

The medium voltage segment registered the largest revenue share of 56.7% in the gas insulated transformer industry in 2024. These transformers are favored for their compact design and enhanced safety features, making them ideal for densely populated areas. They are often employed in commercial buildings, underground substations, and small to medium-sized industrial facilities gas-insulated

The extra high voltage segment is expected to grow at the fastest CAGR of 5.1% over the forecast period. These transformers are designed for the highest capacity and most demanding applications in the power industry. They are critical for long-distance transmission and the interconnection of power grids. Their advanced insulation and cooling technologies allow them to operate efficiently under high stress and load conditions, making them indispensable for national grids, intercontinental power links, and large power generation stations.

Installation Insights

The indoor installation segment accounted for the highest market share in 2024. These transformers are designed for use within buildings or other enclosed spaces. They are particularly beneficial in urban areas where space is limited, and environmental conditions can be controlled. Due to their enclosed design, they offer enhanced safety features, such as reduced risk of fire and lower maintenance requirements.

The outdoor segment is expected to grow at a significant rate over the forecast years. They are built to withstand harsh environmental conditions and are typically installed in open areas such as power plants, substations, and outdoor industrial sites. They are crucial for utilities and industries requiring durable, low-maintenance solutions for transmitting and distributing electrical power over long distances. Their installation often involves additional protective measures to ensure safety and efficiency in diverse outdoor settings.

Application Insights

The utility segment dominated with the highest market share in 2024 and is expected to grow significantly over the forecast period. This segment primarily involves power generation, transmission, and distribution. Utilities use GIT to ensure the reliable and efficient delivery of electricity over long distances. The growing electricity demand, the increasing movement of large-scale substations underground, and the expansion of smart grid technologies drive the adoption of the gas insulated transformer industry.

The industrial sector is projected to grow at a significant CAGR during the forecast period. In this sector, GIT is employed to power manufacturing plants, processing facilities, and other heavy-duty applications that require robust and reliable electrical systems. Industrial processes require a dependable power supply to avoid expensive interruptions. The enclosed and maintenance-friendly design of GIT ensures consistent performance, even in demanding industrial environments such as high electrical loads. Data centers specifically prefer GITs for their high reliability and minimal upkeep needs to maintain uninterrupted operations. Steel, chemical, and automotive industries benefit from GITs due to their compact design, low maintenance costs, and ability to withstand harsh environmental conditions.

Regional Insights

The North America gas insulated transformer marketheld a significant share of 20.4% of the global market in 2024. Transformers in North America are nearing or have exceeded their expected lifespans, driving the demand for modern, efficient alternatives such as GITs. This creates a substantial market for GIT, which offer improved reliability and reduced maintenance requirements compared to the traditional oil-filled transformers.

U.S. Gas Insulated Transformer Market Trends

The U.S. gas insulated transformer market is experiencing growth, propelled by the need to upgrade outdated infrastructure, incorporate rapidly growing renewable energy sources, and address the rising electricity demand. A significant trend is the transition toward eco-friendly solutions free of SF6 gas. The increasing digitalization to facilitate smart grid integration and a rising need for compact, highly dependable substations in industrial environments, such as data centers, drive the U.S. market. Major companies are making strategic investments to cater to this demand. GE Vernova plans to invest nearly USD 600 million in U.S. manufacturing plants to enhance grid equipment production, and in March 2025, ABB announced an investment of USD 120 million in two U.S. facilities to support key industries, including data centers and utilities.

Europe Gas Insulated Transformer Market Trends

Europe gas insulated transformer market held a significant share in 2024. Europe has been at the forefront of adopting environmentally friendly and energy-efficient technologies. Gas insulated transformers, which typically use SF6 or newer eco-friendly gases, align well with Europe's stringent environmental regulations and sustainability goals. Countries such as Germany, France, and the UK have been investing heavily in upgrading their power infrastructure to meet carbon reduction targets. As per an article in June 2024, Wilson Power Solutions achieved a 62% 3-year sustained growth rate, reaching USD 127 million by April 2024. The company produces energy-efficient transformers that minimize energy waste and carbon dioxide emissions, aligning with Europe's sustainability goals.

Asia Pacific Gas Insulated Transformer Market Trends

APAC gas insulated transformer market dominated the global industry with a revenue share of 40.53% in 2024 and is expected to grow at a significant CAGR of 5.2% over the forecast period. Rapid industrialization and urbanization across many Asian countries drive significant growth in electricity demand. Countries such as China, India, and Southeast Asian nations are expanding their power infrastructure to meet the needs of the growing population and economies. The transition toward cleaner energy sources, particularly the rapid expansion of solar, wind, and hydropower, necessitates advanced transformer technologies. GITs are vital for connecting renewable energy plants to the grid due to their ability to handle fluctuating loads, operate reliably in harsh environments, and minimize environmental impact. Moreover, their compact size also aids in the construction of new substations in remote or space-constrained locations near generation sites. In densely populated cities such as Shanghai and Mumbai, where space is at a premium, these transformers allow for more efficient use of limited real estate.

China gas insulated transformer market held the largest share in the Asia Pacific region in 2024. This share is attributable to the rapid industrialization and urbanization, leading to a surge in power demand, necessitating significant investments in power infrastructure. The country's ambitious plans to upgrade and expand its electrical grid have created a massive domestic market for GITs. For example, China's State Grid Corporation has initiated the construction of a significant Ultra-high Voltage Direct Current (UHVDC) transmission line with an investment of USD 2.84 billion. This line would operate at 800 kV with a capacity of 8 GW. This 1,069 km line will connect Yan’an in Shaanxi Province to Hefei in Anhui Province. The project is set to integrate with the 1.2 GW Yuexi pumped-storage hydropower plant, currently under construction in Anhui Province, which comprises four 300 MW units and requires an investment of USD 1.04 billion. This domestic demand allows Chinese manufacturers to achieve economies of scale and gain extensive experience in GIT production.

Key Gas Insulated Transformer Company Insights

Some key players operating in the market are MEIDENSHA CORPORATION, ARTECHE, Siemens Energy, Hitachi Energy Ltd., and Mitsubishi Electric Corporation. These businesses concentrate on innovation in automation and materials, R&D, promoting sustainability, extending influence through collaborations, and entering new markets. In addition, they are progressively utilizing digital technologies to improve efficiency and deliver enhanced customer value.

-

Siemens Energy, based in Munich, Germany, is a prominent global energy technology company established in 2020 following its spin-off from Siemens's Gas and Power division. The firm offers extensive products and services throughout the energy value chain, including gas and steam turbines, power transmission systems, and renewable energy solutions through its majority-owned subsidiary Siemens Gamesa Renewable Energy, which is set to be acquired by TPG-led consortium as per an article in Economic Times in March 2025.

-

Arteche, established in 1946 and located in Mungia, Spain, is a global enterprise that develops equipment and solutions for the electric power industry, covering generation, transmission, and distribution. With around 2,500 employees spread across four continents, Arteche functions in more than 175 countries. The company provides a range of products, including instrument transformers, power grid automation, and solutions for network reliability, supported by one of the largest ultra-high voltage laboratories in Europe.

Key Gas Insulated Transformer Companies:

The following are the leading companies in the gas insulated transformer market. These companies collectively hold the largest market share and dictate industry trends.

- MEIDENSHA CORPORATION

- ARTECHE

- Mitsubishi Electric Corporation

- Toshiba International Corporation

- Siemens Energy

- Hitachi Energy Ltd.

- GE Grid Solutions, LLC

- TAKAOKA TOKO CO., LTD.

- Fortune Electric Co., Ltd.

- Dalian Huayi Electric Power Electric Appliances Co.,Ltd

- HYOSUNG HEAVY INDUSTRIES

- NISSIN ELECTRIC Co., Ltd.

- Transpower Engineering Ltd.

Recent Developments

-

In May 2025, Hitachi Energy launched the world’s first SF6-free 550 kV Gas Insulated Switchgear (GIS), which is set to be supplied to the Central China Branch of the State Grid Corporation of China (SGCC). This initiative marks a significant advancement in reducing carbon emissions in the power grid and is vital in supporting China's goal of achieving carbon neutrality by 2060. The EconiQ GIS uses a sustainable gas mixture that eliminates SF6 emissions while maintaining the dependable performance and compact design typical of traditional solutions. This suggests a transition toward the use of eco-friendly and sustainable gases within this sector.

-

In July 2024, Mitsubishi Electric received an order from Kansai Transmission and Distribution, Inc. for its newly developed 84kV dry air insulated switchgear. This product is significant for being greenhouse gas-free and using synthetic dry air and vacuum interrupters in place of Sulfur Hexafluoride (SF₆). The equipment is expected to be delivered by March 2026. Mitsubishi Electric's launch of SF₆-free switchgear marks an important change toward environmentally friendly solutions in the GIT market. The company's innovation establishes it as a leader in this shift, which could impact industry standards and motivate other manufacturers to create comparable technologies. This move aligns with the broader market trend of integrating sustainable practices, which is anticipated to drive growth and innovation within the GIT sector.

-

In February 2024, Siemens Energy planned to address the national shortage of power transformers in the U.S. by investing USD 150.0 million to expand operations in Charlotte, North Carolina. This investment aims to meet the growing demand for transformers, crucial for grid expansion and energy transition. The new factory will produce transformers, enabling reliable electricity transmission and grid stability. The project is supported by a Job Development Investment Grant from the state of North Carolina. It is expected to begin construction in 2024, with the first transformers set to be manufactured in early 2026.

-

In May 2022, Arteche and Hitachi Energy Ltd. announced the finalization of an agreement signed in December 2021 to establish Arteche Hitachi Energy Instrument Transformers S.L., the successor of Arteche Gas Insulated Transformers (AGIT). Arteche holds a 51.0% majority stake. This strategic move was aimed at allowing the two companies to collaborate in the sustainable gas insulated transformer market, strengthening Arteche’s position in the field of instrument transformers for GIS substations and voltage transformers for ancillary services.

Gas Insulated Transformer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.08 billion

Revenue forecast in 2030

USD 3.87 billion

Growth rate

CAGR of 4.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Voltage, installation, application, region

Regional scope

North America, Europe, Asia Pacific, Middle East & Africa, Central & South America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; UAE.

Key companies profiled

MEIDENSHA CORPORATION; ARTECHE; Mitsubishi Electric Corporation; Toshiba International Corporation; Hitachi Energy Ltd.; GE Grid Solutions, LLC; TAKAOKA TOKO CO., LTD.; Fortune Electric Co., Ltd.; Siemens Energy; Dalian Huayi Electric Power Electric Appliances Co.,Ltd; HYOSUNG HEAVY INDUSTRIES; NISSIN ELECTRIC Co.,Ltd.; Transpower Engineering Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gas Insulated Transformer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global gas insulated transformer market report on the basis of voltage, installation, application, and region:

-

Voltage Outlook (Revenue, USD Million, 2018 - 2030)

-

Medium Voltage (Up to 72.5 Kv)

-

High Voltage (72.5 Kv to 220 Kv)

-

Extra High Voltage (Above 220 Kv)

-

-

Installation Outlook (Revenue, USD Million, 2018 - 2030)

-

Indoor

-

Outdoor

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Utility

-

Industrial

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.