- Home

- »

- Electronic & Electrical

- »

-

Garment Steamer Market Size, Share, Industry Report, 2030GVR Report cover

![Garment Steamer Market Size, Share & Trends Report]()

Garment Steamer Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Clothes, Curtains, Carpets), By Distribution Channel (Supermarket/Hypermarket, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-344-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Garment Steamer Market Summary

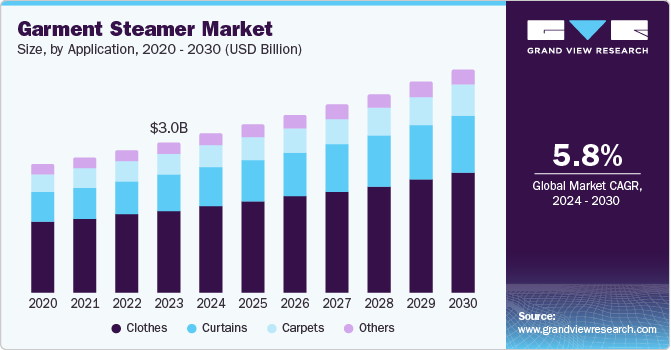

The global garment steamer market size was valued at USD 3.01 billion in 2023 and is projected to reach USD 4.46 billion by 2030, growing at a CAGR of 5.8% from 2024 to 2030. A rising customer preference for efficient and convenient fabric care solutions drives this growth.

Key Market Trends & Insights

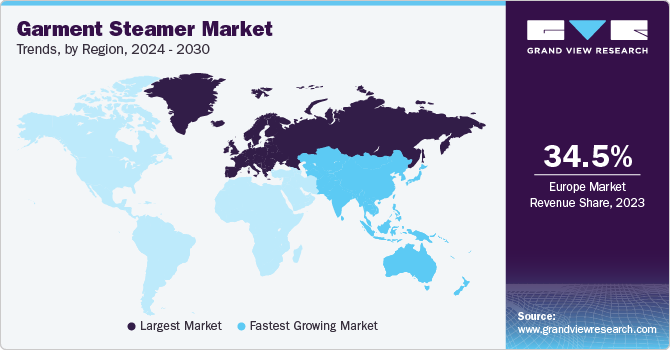

- Europe garment steamer market dominated the global market with a share of 34.5% in 2023.

- The garment steamer market in the U.S. is estimated to have substantial CAGR during the forecast period.

- Based on application, the clothes segment accounted for the largest revenue share of 54.8% in 2023.

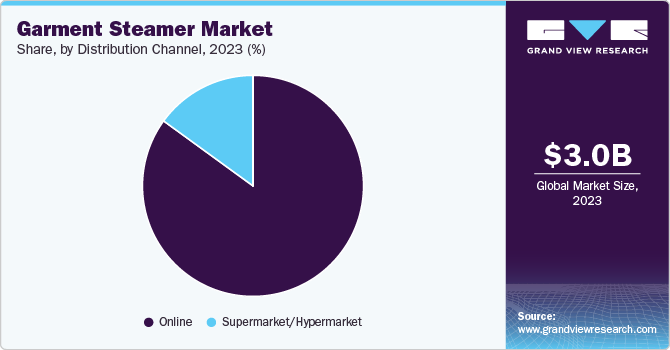

- Based on distribution channl, the online segment held the largest market share of 84.9% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.01 Billion

- 2030 Projected Market Size: USD 4.46 Billion

- CAGR (2024-2030): 5.8%

- Europe: Largest market in 2023

- Asia Pacific: Fastest growing market

As lifestyles become increasingly fast-paced, individuals are seeking alternatives to traditional ironing methods that can save time and effort. Garment steamers have emerged as a popular choice, offering a quick and effective way to remove wrinkles from clothing, curtains, and other textiles without the hassle of setting up an ironing board. One of the key factors contributing to the rise of garment steamers is their user-friendly design. Many models of garment steamers are lightweight and portable, making them ideal for urban dwellers with limited storage space or for travelers who need to freshen up their clothes on the go.

The market is characterized by various products, including handheld and upright steamers, each catering to different customer needs. Handheld steamers are favored for their portability and ease of use, while upright models are often preferred for larger garments and bulk steaming tasks. Moreover, the commercial sector is increasingly adopting garment steamers, especially in the hospitality and retail industries, where maintaining a polished appearance is important. Steam garments allow clothes to be placed directly on hangers, enhancing their appeal and allowing users to achieve professional-level results with minimal effort. This convenience influences busy professionals and families who require the time-saving benefits.

In addition, the demand for advanced home appliances is rising as customers seek innovative products that enhance their daily routines. Companies are introducing features such as energy-efficient designs, multifunctionality, and enhanced steaming capabilities to meet the changing demands of customers. Collaborations and strategic partnerships are common as manufacturers seek to expand their market reach and improve distribution channels. As technology advances, we can expect more innovations in the market that will enhance user experience and establish garment steamers as necessary household appliances.

Application Insights

The clothes segment dominated the market and accounted for the largest revenue share of 54.8% in 2023. The clothes segment of the garment steamers is a key driver of market growth, as is the increasing customer demand for efficient fabric care solutions. Garment steamers attained popularity for their ability to quickly remove wrinkles and refresh clothing, including delicate fabrics that traditional irons may damage. This versatility appeals to a wide audience, from busy professionals to families, who appreciate the time-saving benefits of these steamers. Moreover, the growth is supported by rising disposable incomes and changing lifestyles, with customers investing in home appliances that enhance their daily routines. Also, the trend toward eco-friendly and energy-efficient products aligns with customer preferences for sustainable living, as many modern steamers consume less energy than conventional ironing methods.

The curtains segment is predicted to grow substantially over the forecast period, driven by the increasing demand for efficient fabric care solutions for windows, both commercial and residential. Due to their large surface areas, Curtains become dirty and dusty more quickly than other fabrics, making them necessary for regular cleaning and maintenance. Garment steamers have emerged as a convenient and effective solution for refreshing curtains, as they can remove wrinkles, dust, and odors with minimal effort. One of the key advantages of using garment steamers for curtains is their ability to clean fabrics easily without effort by removing them or extensive preparation. This feature particularly appeals to customers who value convenience and time-saving solutions, further increasing the garment steamers market in the upcoming period.

Distribution Channel Insights

The online segment held the largest market share of 84.9% in 2023. The online distribution channel for garment steamers is rapidly gaining traction, reflecting a significant shift in consumer purchasing behavior. This growth is largely driven by the increasing penetration of the internet and the rising popularity of e-commerce platforms, which provide consumers with convenient access to a wide range of products, including garment steamers. In addition, the platform to compare prices, read reviews, and access detailed product information online enhances the shopping experience and drives consumer preference toward online purchases.

The supermarket/hypermarket segment is projected to grow significantly over the forecast period. Supermarkets and hypermarkets play a vital role in the garment steamer market, contributing significantly to overall sales due to their extensive product offerings and high foot traffic. These retail environments allow consumers to conveniently browse and compare various brands and models, facilitating informed purchasing decisions. The visibility of garment steamers in-store often leads to impulse purchases, as shoppers may be enticed by the convenience of finding these products during their regular grocery trips. Moreover, the presence of well-known brands in supermarkets helps build brand awareness and loyalty among consumers. Despite the rise of online shopping, the convenience of one-stop shopping and the ability to physically inspect products will likely ensure that supermarkets and hypermarkets remain essential distribution channels for garment steamers in the coming years.

Regional Insights

Europe garment steamer marketdominated the global market and accounted for the largest revenue share of 34.5% in 2023. Europe is a significant market for garment steamers, driven by a strong fashion industry and increasing consumer demand for efficient fabric care solutions. The region is characterized by high fashion consciousness, with consumers seeking convenient methods to maintain their clothing. Countries such as Germany, the UK, and France lead the market, with Germany emerging as the largest contributor due to its robust apparel market and rising household expenditure on smart home appliances. The increasing working population in Europe also plays a crucial role in the growth of the garment steamer market, as busy lifestyles drive the preference for quick and effective cleaning solutions. The market is expected to benefit from the rising trend of eco-friendly appliances as consumers become more conscious of sustainability, expanding the garment steamers market.

North America Garment Steamer Market Trends

North America garment steamer marketis expected to grow significantly over the forecast period. North America has emerged as a leading region in the garment steamer market. It is expected to account for significant growth due to its robust textile and garment industry, particularly in the U.S. and Canada. The large-scale production of apparel in manufacturing hubs pushes the demand for effective fabric care solutions, with consumers increasingly favoring garment steamers over traditional irons for convenience and efficiency. The region's growth is further supported by busy lifestyles, where consumers seek quick and easy methods to maintain their garments.

U.S. Garment Steamer Market Trends

The garment steamer in the U.S. is estimated to have substantial growth during the forecast period. One of the primary drivers of the garment steamer market is the shift in consumer preferences toward products that offer quick and easy solutions for wrinkle removal and fabric care. Modern lifestyles, characterized by busy schedules, have led consumers to favor garment steamers over traditional irons, as steamers allow for rapid de-wrinkling of clothes, curtains, and other fabrics without requiring extensive setup or effort. The portability and lightweight design of many steamers also cater to the needs of frequent travelers and urban people with limited storage space, further enhancing their appeal and resulting in higher sales of garment steamers.

Asia Pacific Garment Steamer Market Trends

The garment steamer market in Asia Pacificis anticipated to rise significantly over the forecast period. The Asia-Pacific region is experiencing robust growth in the garment steamer market, driven by increasing disposable incomes, urbanization, and changing consumer lifestyles. Countries such as China, India, and South Korea are at the forefront of this expansion, with an increasing middle-class population adopting modern household appliances for convenience and efficiency. The demand for handheld and upright garment steamers is particularly strong, as these products cater to the needs of busy households looking for quick and effective fabric care solutions, further enabling the market growth of garment steamers.

Key Garment Steamer Company Insights

Some key companies in the garment steamer market include Haier Group, Koninklijke Philips N.V., Rowenta, CHIGO, Midea Group, Conair LLC, Jiffy Steamer Company, LLC, and AB Electrolux. These companies focus on development with continuous innovations and product enhancements to benefit customers by improving the overall experience.

-

Haier Group emphasizes on smart technology integration, offering products that enhance user convenience and efficiency. Haier's garment steamers are designed to provide effective wrinkle removal while being energy-efficient and user-friendly.

-

Conair LLC focuses on delivering innovative and practical solutions that cater to the needs of consumers seeking convenience and efficiency. Conair's steamers are designed to quickly eliminate wrinkles and refresh fabrics, making them ideal for busy lifestyles.

Key Garment Steamer Companies:

The following are the leading companies in the garment steamer market. These companies collectively hold the largest market share and dictate industry trends.

- Haier Group

- Koninklijke Philips N.V.

- Rowenta

- CHIGO

- Midea Group.

- Conair LLC

- Jiffy Steamer Company, LLC

- AB Electrolux

- Panasonic Marketing Middle East & Africa FZE

- FLYCO.

- Pursteam.

Recent Developments

-

In December 2023,Philips introduced a new garment steamer: The Philips 7000 series handheld with a moving steam head—STH7040/80. This newly launched steamer is equipped with OptimalTEMP technology, which ensures it can be used on any ironable fabric without the risk of burns. The steamer is designed to last up to 70% longer than standard models and can kill up to 99.99% of bacteria, helping refresh clothes and remove odors.

-

In April 2023, Conair Steam & Press with Turbo launched a garment care appliance designed to remove wrinkles from fabrics efficiently. This innovative steamer features a turbo boost function for enhanced steam output, allowing users to tackle tough wrinkles quickly. The device is compact and easy to use, making it suitable for home use or travel. Conair emphasizes the steamer's ability to refresh garments while being gentle on fabrics, ensuring effective and convenient garment care.

Garment Steamer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.18 billion

Revenue forecast in 2030

USD 4.46 billion

Growth Rate

CAGR of 5.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

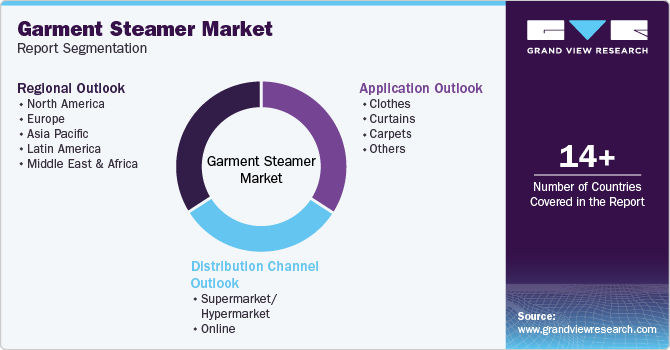

Segments covered

Application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, India, Japan, Australia, South Korea, Brazil, Argentina, South Africa, UAE

Key companies profiled

Haier Group; Koninklijke Philips N.V.; Rowenta; CHIGO; Midea Group.; Conair LLC; Jiffy Steamer Company, LLC; AB Electrolux; Panasonic Marketing Middle East & Africa FZE; FLYCO.; Pursteam.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Garment Steamer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global garment steamer market report based on application, distribution channel, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Clothes

-

Curtains

-

Carpets

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarket/Hypermarket

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.