- Home

- »

- Homecare & Decor

- »

-

Gardening Hand Tools Market Size & Share Report, 2030GVR Report cover

![Gardening Hand Tools Market Size, Share & Trends Report]()

Gardening Hand Tools Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Pruning Tools, Digging Tools, Weeding Tools, Striking Tools, Watering Tools), By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-474-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Gardening Hand Tools Market Size & Trends

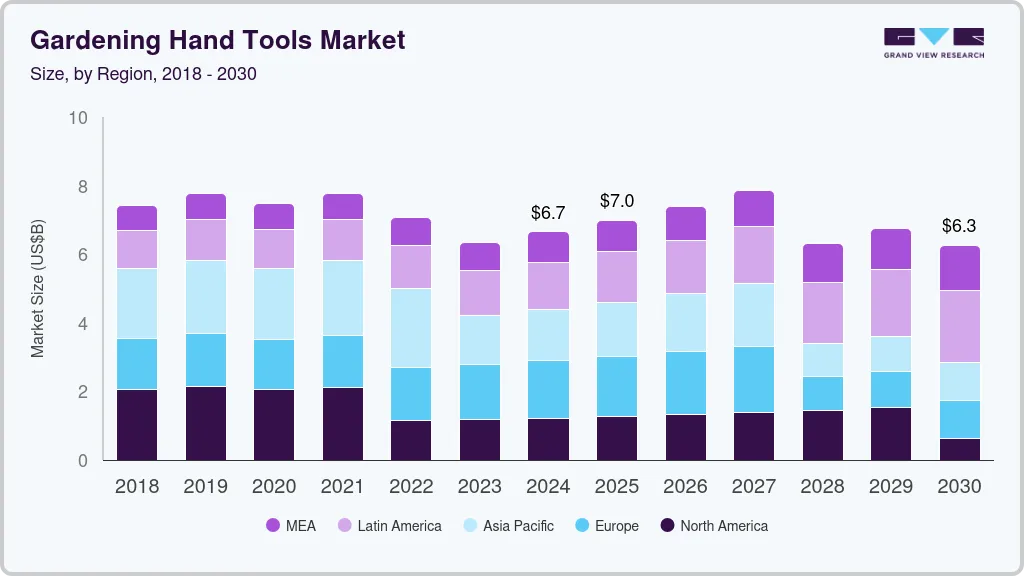

The global gardening hand tools market size was valued at USD 6.65 billion in 2024 and is expected to grow at a CAGR of -2.2% from 2025 to 2030. The market has witnessed significant growth in recent years, driven by increasing interest in home gardening and the rise of DIY gardening projects. As more individuals engage in gardening for both leisure and sustainability, the demand for high-quality, ergonomic tools continues to rise. This trend is further accelerated by the growing number of urban households adopting gardening as a hobby, contributing to a robust demand for pruners, trowels, and other hand tools specifically designed for small-scale gardening activities.

DIY gardening has become a central driver in the market, with consumers increasingly seeking tools that allow for ease of use and versatility. The surge in DIY projects, particularly among younger demographics, has fostered a preference for hand tools that enable home gardeners to create and maintain green spaces without the need for professional services. This shift has expanded the market’s customer base beyond traditional gardeners to include hobbyists and eco-conscious individuals who view gardening as a sustainable practice.

In addition, the rising trend of sustainability and eco-friendly living has pushed consumers toward self-sufficient practices like DIY gardening, further supporting market expansion. Gardening hand tools designed for sustainable practices, such as tools made from recyclable or durable materials, are seeing increased demand. Manufacturers are responding by offering environmentally friendly products, which appeal to consumers focused on minimizing their ecological footprint while engaging in home gardening.

The Axiom 2024 Gardening Outlook Study reveals a notable surge in home gardening interest across the U.S., with both time and financial investment in gardening activities increasing throughout 2023-a trend projected to persist into 2024. This growing enthusiasm for home gardening is anticipated to drive a corresponding rise in demand for gardening hand tools. As more individuals dedicate themselves to enhancing their outdoor spaces, the need for high-quality, durable tools will expand, particularly those that support efficiency and ease of use. Additionally, the increased focus on sustainability and self-sufficiency through gardening is likely to foster consumer interest in innovative, ergonomically designed tools, further stimulating market growth in this segment.

Technological advancements in tool design and manufacturing are also playing a critical role in market growth. The integration of ergonomic features into gardening hand tools has improved user comfort and efficiency, making them more appealing for DIY gardening enthusiasts. These innovations, coupled with the availability of diverse tool sets designed for specific tasks, have attracted a wide range of customers, from beginners to experienced gardeners, helping to sustain market momentum.

According to data from Ruby Home Luxury Real Estate, approximately 55%, or 71.5 million, U.S. households maintain a garden, positioning the U.S. among the top three nations globally in terms of gardening participation. This widespread interest in gardening is expected to significantly drive the demand for gardening hand tools. As more households engage in gardening activities, there will be a corresponding need for high-quality, durable tools to support various gardening tasks. The rising trend of gardening as a popular hobby and a sustainable lifestyle choice further emphasizes the importance of reliable hand tools, which are essential for maintenance, cultivation, and plant care. This, in turn, will fuel market growth as consumers seek efficient, ergonomically designed tools to enhance their gardening experience.

The COVID-19 pandemic has significantly impacted consumer behavior, leading to a resurgence of interest in home improvement projects, including DIY gardening. As more people spent time at home during lockdowns, gardening emerged as a popular activity for relaxation and self-sufficiency. This shift has boosted demand for gardening hand tools, with manufacturers capitalizing on the growing trend by introducing new products tailored to the evolving needs of the gardening community.

Product Insights

Pruning tools led the market with the largest revenue share of 34.69% in 2023. The increasing popularity of home gardening and landscaping as a leisure activity, particularly among urban dwellers, has significantly boosted the need for high-quality, ergonomic pruning tools. Additionally, the rising trend of sustainable gardening practices, which emphasize the importance of plant health and growth management, has underscored the necessity of precise pruning tools for effective maintenance.

Moreover, the expansion of commercial landscaping projects, including public parks, urban green spaces, and hospitality sectors, has further fueled demand for durable, professional-grade pruning tools. Technological advancements, such as lightweight designs and improved blade materials, also contribute to heightened consumer preference, enhancing both efficiency and ease of use. As a result, manufacturers are increasingly focusing on innovative product developments to meet the evolving needs of both residential and commercial users, thereby driving market growth for pruning tools.

The demand for weeding tools is projected to grow at a CAGR of 7.8% from 2024 to 2030. Increasing awareness around sustainable gardening practices, particularly the use of manual tools to minimize chemical herbicide usage, has positioned weeding tools as essential for environmentally conscious consumers. As home gardening and urban farming trends expand globally, the need for efficient, ergonomic tools to maintain weed-free landscapes has risen sharply, particularly in residential applications.

Additionally, the growth of commercial landscaping, agricultural, and horticultural sectors has elevated the demand for durable, high-performance weeding tools designed for large-scale weed management. Innovations in design, such as lightweight materials, multi-functional capabilities, and improved ergonomic features, are also enhancing consumer adoption by increasing ease of use and effectiveness. This combination of sustainability trends, market expansion, and product advancements is driving sustained growth in the weeding tools segment.

Application Insights

The demand for gardening hand tools for residential applications accounted for the largest market share of 63.69% in 2023. In the residential sector, the rising demand for gardening hand tools is closely linked to the growing interest in home gardening and landscaping as a hobby. As more individuals embrace gardening for its therapeutic benefits, aesthetic enhancement, and as part of eco-friendly living, the need for high-quality, ergonomic tools has surged. The shift towards urban gardening, including small-scale vegetable plots, rooftop gardens, and backyard beautification, has further intensified demand as homeowners seek precise and easy-to-use tools for planting, pruning, and general maintenance. Additionally, heightened awareness around sustainable practices, such as reducing reliance on mechanical equipment, has positioned traditional hand tools as a preferred choice for residential consumers.

The commercial segment is anticipated to grow at a CAGR of 7.7% from 2024 to 2030. In the commercial sector, the demand for gardening hand tools is driven by the expansion of professional landscaping services, horticulture, and green infrastructure projects. According to the statistics published by the National Association of Landscape Professionals, the U.S. landscaping services market stood at USD 153 Billion in 2024. The rising growth of commercial landscaping services translates to a high demand for gardening hand tools. Commercial operators require durable, efficient tools that can withstand heavy usage in maintaining large-scale green spaces, including public parks, golf courses, and corporate landscaping projects. As businesses and municipalities increasingly invest in green spaces for both aesthetic and environmental reasons, the need for specialized, professional-grade hand tools for tasks like pruning, weeding, and planting has risen. Furthermore, the growing emphasis on sustainable landscaping practices has led to increased demand for manual tools that reduce the carbon footprint, aligning with eco-conscious business models.

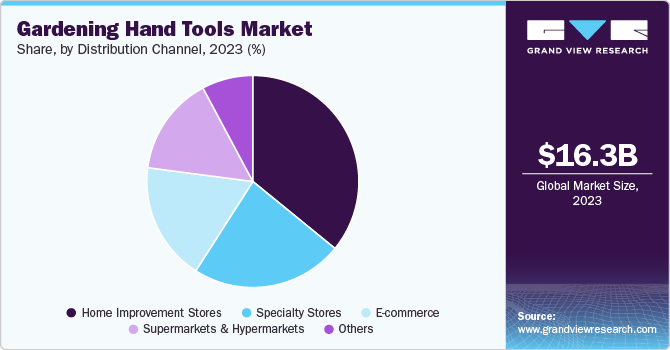

Distribution Channel Insights

The sales through home improvement stores accounted for a share of 35.89% in 2023. The growth in sales of gardening hand tools through Home Improvement Stores can be attributed to the increasing consumer preference for hands-on shopping experiences, particularly for DIY and gardening projects. These stores offer a diverse range of tools, allowing customers to physically evaluate the quality, ergonomics, and suitability of the products before purchase. Additionally, home improvement retailers often provide expert advice, in-store demonstrations, and personalized recommendations, enhancing the customer experience and confidence in selecting the right tools. The rising trend of weekend home improvement projects, combined with targeted promotional efforts by these stores, such as bundling offers and loyalty programs, has further bolstered sales.

The e-commerce sales are projected to grow at a CAGR of 7.8% over the forecast period of 2024 to 2030. The expansion of e-commerce as a sales channel for gardening hand tools is primarily driven by the convenience it offers to both residential and commercial customers. Online platforms allow consumers to browse a wide array of products, compare prices, read detailed reviews, and access comprehensive product information, all from the comfort of their homes. The rise of digital marketing strategies, personalized recommendations, and easy delivery options has made e-commerce a preferred purchasing route, particularly during and after the pandemic when in-store shopping was restricted. Additionally, e-commerce channels often provide competitive pricing, exclusive discounts, and diverse product selections, attracting both novice gardeners and professional landscapers.

Regional Insights

North America gardening hand tools market held a share of 37.29% of the global revenue in 2023. In North America, beyond the U.S., the demand is similarly propelled by a burgeoning interest in environmental sustainability and organic gardening. Canada, in particular, has seen an increase in community gardening initiatives, urban green spaces, and public landscaping projects, which drive the need for both residential and professional-grade gardening tools. As more homeowners and commercial entities invest in green infrastructure, the market for durable, efficient hand tools has expanded.

U.S. Gardening Hand Tools Market Trends

The gardening hand tools market in the U.S. is expected to grow at a CAGR of 6.9% from 2024 to 2030. In the U.S., the demand for gardening hand tools is driven by the increasing popularity of home improvement and gardening as leisure activities. With a strong cultural inclination towards maintaining personal outdoor spaces, American consumers are investing in tools to enhance the aesthetic appeal of gardens and lawns. The rise of urban farming, sustainable gardening, and the trend of DIY landscaping projects have further fueled demand as more individuals seek high-quality, ergonomic tools for both small-scale gardening and larger landscaping tasks.

Asia Pacific Gardening Hand Tools Market Trends

The gardening hand tools market in Asia Pacific accounted for a revenue share of 23.0% of the global revenue in 2023. In the Asia-Pacific region, the demand for gardening hand tools is growing due to rapid urbanization and an increasing focus on green living and sustainability. Countries like China, Japan, and India are witnessing a surge in urban gardening, with residents cultivating rooftop gardens, indoor plants, and small urban plots as part of a broader movement toward self-sufficiency and environmental stewardship. Additionally, rising disposable incomes and the growing popularity of landscaping in residential and commercial real estate developments have further driven demand for high-quality gardening tools. The expansion of e-commerce platforms in the region has also made it easier for consumers to access a wide range of gardening products, boosting overall market growth.

Europe Gardening Hand Tools Market Trends

The gardening hand tools market in Europe is projected to grow at a CAGR of 5.8% from 2024 to 2030. In Europe, the market is influenced by longstanding cultural traditions of gardening, particularly in countries like the UK, Germany, and France, where gardening is a widely embraced pastime. The region's focus on environmental sustainability, biodiversity, and urban green initiatives has intensified the need for effective, eco-friendly gardening tools. European consumers are increasingly seeking high-quality, precision tools that align with organic gardening practices, while municipalities invest in green urban spaces to enhance livability.

Key Gardening Hand Tools Company Insights

The competitive landscape of the market is characterized by a mix of global leaders, regional players, and specialized niche brands, all vying for market share through innovation, product quality, and distribution strategies. Major companies like Fiskars, Stanley Black & Decker, and Husqvarna dominate the global market, leveraging their extensive product portfolios, strong brand recognition, and advanced manufacturing capabilities to maintain a competitive edge. These industry leaders focus on developing ergonomically designed, durable tools with features such as lightweight materials and improved grip for enhanced user comfort, which cater to both residential and professional users.

At the same time, regional players and niche manufacturers like Spear & Jackson, Corona Tools, and Wolf-Garten are focusing on providing specialized products that cater to local preferences and specific gardening needs. Many companies are also emphasizing sustainability by producing tools made from eco-friendly materials and integrating environmentally responsible manufacturing processes.

Key Gardening Hand Tools Companies:

The following are the leading companies in the gardening hand tools market. These companies collectively hold the largest market share and dictate industry trends.

- Fiskars Corporation

- Stanley Black & Decker, Inc.

- FELCO SA

- The Husqvarna Group

- Spear & Jackson

- Ames Companies Inc.

- Corona Tools

- Burgon & Ball

- Wolf-Garten USA

- A.M. Leonard, Inc.

Recent Developments

-

In April 2023, FELCO, the global leader in gardening tools, launched an innovative collection of gardening hand tools aimed at enhancing the gardening experience for both professional landscapers and home gardeners. This newly launched range featured meticulously crafted tools, including a cultivator, weeder, trowel, fork, and the Swiss Hori-Hori. Each tool was designed with precision to perform specific gardening tasks, ensuring maximum efficiency and ease of use for a variety of horticultural needs. This new offering underscored FELCO’s commitment to delivering high-quality tools that optimized both functionality and user experience in the gardening space.

-

In December 2023, Stanley Black & Decker announced the execution of a definitive agreement to divest its STANLEY Infrastructure division, including its attachments and handheld hydraulic tools business, to Epiroc AB for a cash consideration of $760 million.

Gardening Hand Tools Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.99 billion

Revenue forecast in 2030

USD 6.25 billion

Growth rate

CAGR of 6.7% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Fiskars Corporation; Stanley Black & Decker, Inc.; FELCO SA; The Husqvarna Group; Spear & Jackson; Ames Companies Inc.; Corona Tools; Burgon & Ball; Wolf-Garten USA; A.M. Leonard, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gardening Hand Tools Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gardening hand tools market report on the basis of product, application, distribution channel, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pruning Tools

-

Digging Tools

-

Weeding Tools

-

Striking Tools

-

Watering Tools

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Supermarkets and Hypermarkets

-

Home Improvement Stores

-

Specialty Stores

-

E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global gardening hand tools market was estimated at USD 16.26 billion in 2023 and is expected to reach USD 17.06 billion in 2024.

b. The global gardening hand tools market is expected to grow at a compound annual growth rate of 6.7% from 2024 to 2030 to reach USD 25.17 billion by 2030.

b. North America dominated the gardening hand tools market with a share of 37.29% in 2023. The growth is driven by an increase in community gardening initiatives, urban green spaces, and public landscaping projects, which drive the need for residential and professional-grade gardening tools. As more homeowners and commercial entities invest in green infrastructure, the market for durable, efficient hand tools has expanded.

b. Some of the key players operating in the gardening hand tools market include Fiskars Corporation, Stanley Black & Decker, Inc., FELCO SA, The Husqvarna Group, Spear & Jackson, Ames Companies Inc., Corona Tools, Burgon & Ball, Wolf-Garten USA, and A.M. Leonard, Inc.

b. The gardening hand tools market has witnessed significant growth in recent years, driven by increasing interest in home gardening & the rise of DIY gardening projects, and a growing number of urban households adopting gardening as a hobby.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.