Gaming Console Market Size, Share & Trends Analysis Report By Application (Gaming, Non-gaming), By Product (Nintendo, Xbox), By Distribution Channel (Online, Offline), By Type, By Component, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-089-5

- Number of Report Pages: 185

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Gaming Console Market Size & Trends

The global gaming console market size was valued at USD 24.36 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.5% from 2023 to 2030. The market has seen significant growth driven by a combination of factors, including technological advancements, changing consumer preferences, and an increasing focus on gaming as entertainment. Technological advancements have been a major growth driver in the market. Over the years, consoles manufacturers have continued to innovate and improve the hardware and software technology used in gaming consoles, resulting in more powerful, sophisticated, and immersive gaming experiences. The most significant technological advancement in gaming consoles has been the improvement in graphics technology; from 8-bit graphics in early consoles to 4K resolutions in current consoles, the graphics quality has improved drastically.

This has allowed game developers to create more immersive and realistic game environments. Processing power is another critical component of consoles, allowing for faster loading times and more complex game mechanics. Using multicore processors and powerful graphics processing units has enabled consoles to handle more complex games with more detailed graphics and physics. The development of virtual reality (VR) and augmented reality (AR) technologies has also significantly impacted the market. VR headsets and AR technology have enabled gamers to experience more immersive and interactive gaming environments. Online gaming has been a significant growth driverin the market with the development of online gaming platforms and the increasing popularity of online multiplayer games.

Online gaming has become increasingly accessible to a broader audience, with more people accessing high-speed internet and smartphones. This has enabled gamers to connect and play with others worldwide, making online gaming more social and engaging. The growth of online multiplayer games has also been a major driver of the market. Games like Call of Duty, Fortnite, and FIFA have become extremely popular among gamers who enjoy the competitive and collaborative aspects of playing with others online. Online gaming platforms, such as Xbox Live and PlayStation Network, have made it easier for gamers to connect and play with others online. These platforms offer features, such as matchmaking, voice chat, and social networking, making it easier for gamers to find and connect with others who share their interests.

Game developers play a crucial role in the market’s growth as they create the games that drive demand for new and improved consoles, and the success of a console often depends on the quality and popularity of the games available for it. Game developers are constantly pushing the boundaries of what is possible in gaming, creating new and innovative game mechanics, stories, and worlds. This drives demand for new consoles and encourages existing console owners to upgrade to newer models. Many game developers now develop games for multiple platforms, including consoles, PC, and mobile devices. This allows them to reach a wider audience and maximize their potential revenue; as competition in the gaming market has increased, developers have emphasized producing high-quality games that offer engaging and immersive experiences. This has led to a focus on graphics, sound, and storytelling resulting in more polished and cinematic games.

Product Insights

The PlayStation product segment accounted for a significant market share of over 24% in 2022. The growth of PlayStation is attributed to the constant evolution of its hardware; each generation of PlayStation has seen significant improvements in processing power, graphics capabilities, and user experiences, allowing gamers to enjoy a more immersive and engaging gaming experience. PlayStation has also successfully built a strong lineup of exclusive game titles, which has helped drive demand for its consoles. The company's first-party studios, including Naughty Dog and Guerrilla Games, have produced some of the most popular and critically acclaimed games of recent years, including titles like The Last of US, God of War, and Horizon Zero Dawn.

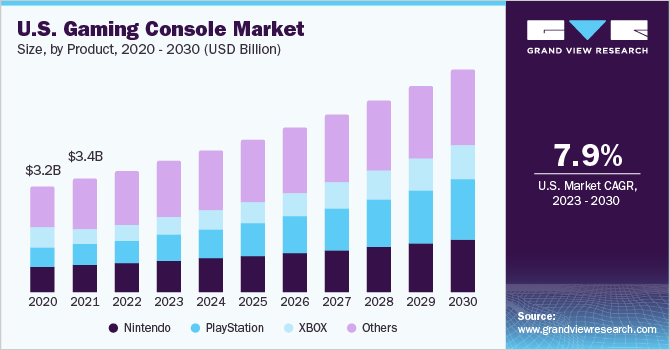

Nintendo's product segment is expected to grow at a significant CAGR of over 10% over the forecast period. Nintendo's growth has been the company's ability to innovate and create unique gaming experiences. Nintendo has a reputation for developing consoles and games that are both accessible and fun, with a focus on innovation and creativity. For example, the company's Wii console, launched in 2006, introduced motion-sensing technology that revolutionized how people play video games. Nintendo has also successfully built a strong lineup of exclusive game titles leading toa high demand for its consoles. The company's first-party studios, including Nintendo EAD and Retro Studios, have produced some of the most popular and critically acclaimed games of recent years, including titles like Super Mario, The Legend of Zelda, and Donkey Kong.

Application Insights

The gaming application segment accounted for the largest market share of over 55% in 2022. Gaming applications have become increasingly important, with many console manufacturers and game developers leveraging the power of applications to create new and innovative gaming experiences. Gaming applications on a console can take many forms, from traditional games to streaming services, social media platforms, and even fitness apps. Many game developers are now creating mobile apps that can be used with console games, providing gamers with new channels and the opportunity to interact with their favorite games. Non-gaming application segment is expected to grow at the highest CAGR of over 8.0% over the forecast period.

Console manufacturers increasingly recognize that gamers want their consoles to offer more than just gaming experiences and are incorporating a range of non-gaming applications into their devices. The primary category of console non-gaming applications is entertainment apps, including streaming services like Netflix, Hulu, and Prime Video. Many gamers use their consoles as their primary entertainment hub, using them to stream movies and TV shows in addition to playing games. Social media applications are another category of non-gaming applications on consoles that have seen growth in recent years. Many console manufacturers have integrated social media platforms like Twitter and Facebook into their consoles, allowing gamers to share their experiences with friends and connect with other players worldwide.

Distribution Channel Insights

The online distribution channel segment accounted for a significant revenue share of over 45.0% in 2022 due to the increasing popularity of online gaming and the convenience of purchasing and downloading games directly from consoles. The PlayStation store allows users to purchase and download games directly onto their consoles, eliminating the need for physical copies. This has become increasingly popular among gamers as it allows them to quickly and easily access various games without leaving their homes. Microsoft Xbox platform also offers an online distribution channel through the Xbox Live Marketplace.

The online distribution channel has also made it easier for console manufacturers to sell more units. With the growth of online distribution channel consoles, manufacturers can now sell directly to consumers reaching a wider audience and increasing sales. The offline distribution channel segment is anticipated to grow at a significant CAGR of more than 5.0% from 2023 to 2030as these storesallow consumers to physically examine and try out the console before making a purchase. This can be particularly important for parents and grandparents buying consoles for their children, as they may need to become more familiar with the online purchasing process or the latest gaming trends.

Offline distribution channel also offers console manufacturers and game developers opportunities to showcase their products in-store and provide personalized customer service. Retailers often hold events and promotions to drive sales, which can help create excitement and buzz around new console releases. In addition, physical copies of games are still widely available through the offline distribution channel. At the same time, many gamers prefer the convenience of purchasing and downloading games directly from the console; some still prefer the physical copies, which can be displayed on a shelf or traded in for credit towards new purchases.

Type Insights

The handheld gaming device segment recorded the highest revenue share of around 30% in 2022 and is also expected to grow at a significant CAGR from 2023 to 2030. The growth is attributed to the rise of mobile gaming. With the increasing popularity of smartphones and tablets, more people are turning to mobile gaming as entertainment. Handheld devices offer a more immersive and responsive gaming experience than mobile devices, as they are designed for gaming and come with features, such as physical buttons and better battery life. Increasing demand for portable gaming solutions, as many gamers prefer the convenience of being able to take their gaming with them wherever they go, whether it's on a long flight or during their daily commute, is driving the growth of the handheld type segment.

Handheld gaming devices are becoming increasingly popular among gamers who value portability and mobility. Moreover, increasing demand for mobile gaming and the convenience of portable gaming solutions boost the segment's growth. Nintendo's dominance in this segment is expected to continue with the access of the Switch, however, new players like Valve may shake up the market and offer gamers even more options in handheld gaming. The hybrid video gaming console segment is predicted to grow at a CAGR of around 9.0% from 2023 to 2030. Hybrid consoles have become a popular choice for gamers who want the best of both worlds, a console that can be used both at home and on the go.

These consoles are designed to provide a seamless gaming experience, with the ability to switch between a traditional console setup and a portable device. The growth is attributed to several factors, such as increasing demand for portable gaming solutions, advancement in technology, and the popularity of mobile gaming. Hybrid consoles offer a unique value proposition allowing gamers to take their gaming with them wherever they go without sacrificing the power and performance of a traditional console. Nintendo is a leading player in the hybrid console market with its popular Nintendo Switch console. It can be used as a traditional console connected to a TV for a large-screen gaming experience or a portable device with detachable controllers and a built-in screen.

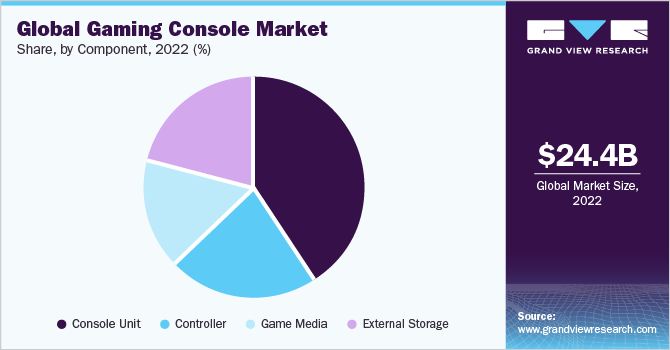

Component Insights

The console unit segment recorded the highest share of around 35.0% in 2022. With the rise of esports and the growing number of game developers producing high-quality games, gamers are demanding consoles with better performance, graphics, and processing power. This has led to a surge in the demand for new and advanced consoles, which has driven the market's growth. The increasing demand for gaming consoles in emerging markets, such as Latin America, due to the growing middle-class population that can afford high-end gaming consoles, will boost sales. Moreover, the COVID-19 pandemic supported console unit growth as with lockdowns and social distancing measures in place, consumers were looking for ways to stay entertained at home, thus many people turned to games as a form of entertainment.

The controller segment is predicted to grow at a CAGR of around 10.0% from 2023 to 2030 due to the increasing technological advancement and demand for more immersive gaming experiences. The controller, such as gamepads, joysticks, and steering wheels, controls and interacts with games on consoles. These controllers play a critical role in providing a seamless and enjoyable gaming experience for users, and as a result, they have become a key component of the market. The growth is attributed to the increasing demand for more advanced and feature-rich controllers. Modern controllers come with various features, such as motion sensors, touchpads, and haptic feedback, which enhance the gaming experience and provide greater immersion for players. As game developers continue producing more sophisticated games, the demand for controllers supporting these games has also increased.

Regional Insights

Asia Pacific accounted for the highest share of over 45.0% in 2022 due to the increasing popularity of gaming among the youth population in the region, particularly in countries, such as China, Japan, South Korea, and India. Gaming is seen as a form of entertainment and a way to relieve stress and as a result, the demand for consoles has been on the rise. The market's growth is also attributed to the increasing adoption of online gaming. With the rapid growth of the internet and mobile devices, more and more gamers in the region are opting for online gaming, which has led to an increase in demand. The growth of the esports industry in the region has also been a key driver of the market.

Esports is a popular form of competitive gaming and has been gaining popularity in countries. As a result, there has been a growing demand for high-performance gaming consoles that can support esports. Sony dominates the market with its PlayStation, which is popular in countries, such as Japan and South Korea, where gaming is a major part of the culture. Microsoft Xbox and Nintendo Switch consoles are also popular in the region, however, they face stiff competition from locals. North America is anticipated to record a significant CAGR of around 9.0% from 2023 to 2030. This is attributed to the popularity of gaming and the increasing demand for high-quality gaming experiences.

According to the Entertainment Software Association, 75% of Americans have at least one gamer in their household, and the average age of a gamer in the U.S. is 35 years old. This growing consumer base has created a significant demand for gaming consoles and related products, driving the regional market. The increasing demand for high-quality gaming experiences is also one of the driving factors for the regional market. Consumers are willing to pay a premium price for consoles that offer advanced graphics, faster processing speeds, and immersive gaming experiences. This has led to the development of more powerful consoles, such as the PlayStation5 and Xbox Series X/S, which offer advanced features and enhanced gaming experiences.

Key Companies & Market Share Insights

The key players are rapidly evolving by heavily investing in research and development to add new features and models to their products. These companies are constantly releasing updates and new console versions to keep up with the changing needs of the gaming industry. Many players collaborate with other companies to expand their reach and offer more comprehensive solutions. Sony's gaming division, including the PlayStation, has been a consistent source of growth for the company. Sony plans to invest more in its gaming division to expand its user base and increase engagement.

Microsoft is also expanding its gaming offerings beyond consoles, with plans to launch Xbox Game Pass on smart TVs and streaming devices. Sony, Microsoft, and Nintendo are all significant players in the market, each with unique strengths and brand identities. In March 2023, Nintendo Co. Ltd. launched its new Switch OLED model with the theme of The Legend of Zelda: Tears of the Kingdon Edition. These models contain a 7-inch OLED screen with 64 GB of internal storage. Some of the key players in the global gaming console market include:

-

Activision Blizzard

-

Atari Inc.

-

Capcom Co. Ltd.

-

Cooler Master Co. Ltd.

-

Corsair Components Inc.

-

Dell Technologies

-

Gameloft SE

-

Hyperkin Inc.

-

HyperX

-

Logitech Inc.

-

Mad Catz Global Ltd.

-

Microsoft Corp.

-

Nintendo Co. Ltd.

-

NVIDIA Corporation

-

Ouya Inc. (Subsidiary of Razer)

-

PlayJam

-

Razer Inc.

-

Redragon

-

Republic of Games

-

Rockstar Games Inc.

-

Sega Holdings Co. Ltd.

-

Sony Corp.

-

SteelSeries

-

Tencent Games

-

Ubisoft Entertainment SA

-

Valve Corp.

Gaming Console Market Report Scope

|

Report Attribute |

Details |

|

The market size value in 2023 |

USD 26.51 billion |

|

The revenue forecast in 2030 |

USD 47.02 billion |

|

Growth rate |

CAGR of 8.5% from 2023 to 2030 |

|

The base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Volume in million units, revenue in USD million/billion, and CAGR from 2023 to 2030 |

|

Report Coverage |

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Product, application, distribution channel, type, component, region |

|

Country scope |

U.S.; Canada; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Mexico; UAE; South Africa; Saudi Arabia |

|

Key companies profiled |

Activision Blizzard; Atari Inc.; Capcom Co. Ltd.; Cooler Master Co. Ltd.; Corsair Components Inc.; Dell Technologies; Gameloft SE; Hyperking Inc.; HyperX, Logitech Inc.; Mad Catz Global Ltd.; Microsoft Corp.; Nintendo Co. Ltd.; NVIDIA Corp.; Ouya Inc.; PlayJam; Razer Inc.; Redragon; Republic of Games; Rockstar Games Inc.; Sega Holdings Co. Ltd.; Sony Corp.; SteelSeries; Tencent Games; Ubisoft Entertainment SA; Valve Corp. |

|

Customization scope |

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Gaming Console Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global gaming console market based on product, application, distribution channel, type, component, and region:

-

Product Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Nintendo

-

PlayStation

-

Xbox

- Others

-

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Gaming

-

Non-gaming

-

-

Distribution Channel Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Online Distribution Channel

-

Offline Distribution Channel

-

-

Type Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Home Video Game Console

-

Handheld Game Console

-

Portable

-

Non-Portable

-

-

Hybrid Video Game Console

-

Plug and Play/Retro Console

-

-

Component Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Console Unit

-

Controller

-

Paddle

-

Joystick

-

Gamepad

-

-

Game Media

-

Game Cartridge

-

Optical Media

-

Digital Distribution

-

Cloud Gaming

-

-

External Storage

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global gaming console market size was estimated at USD 24.36 billion in 2022 and is expected to reach USD 26.51 billion in 2023.

b. The global gaming console market is expected to grow at a compound annual growth rate of 8.5% from 2023 to 2030 to reach USD 47.02 billion by 2030.

b. The Asia Pacific region dominated the global market in 2022 and accounted for more than 46.5% of the revenue for the same year. Ever-increasing smartphone penetration and rising demand for entertainment in the countries such as China, India, and South Korea is a key factor driving regional growth.

b. Key market participants include NVIDIA Corporation, Dell Technologies, Logitech Inc., Microsoft Corporation, Nintendo Co. Ltd., Razer Inc., Sony Corporation, Tencent Games, and Ubisoft Entertainment SA among others.

b. Growing penetration of internet services across the globe, coupled with easy availability and access to games on the Internet, is also expected to keep growth prospects upbeat over the coming years.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."