- Home

- »

- Advanced Interior Materials

- »

-

Galley Equipment Market Size, Share & Trends Report, 2030GVR Report cover

![Galley Equipment Market Size, Share & Trends Report]()

Galley Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Aviation Galleys, Ship Galleys), By Fit (Line Fit, Retro Fit), By Application (Aviation, Marine), By Region And Segment Forecasts

- Report ID: GVR-4-68040-358-3

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Galley Equipment Market Size & Trends

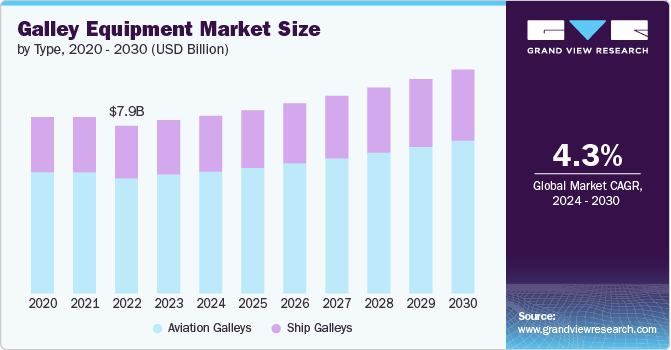

The global galley equipment market size was estimated at USD 8,125.0 million in 2023 and is projected to grow at a CAGR of 4.3% from 2024 to 2030. The demand for galley equipment is driven by the expansion of the aviation industry, the increasing number of aircraft deliveries, and the rising demand for enhanced passenger experience and comfort.

Galley equipment includes a range of products such as ovens, coffee makers, refrigeration units, and other kitchen appliances that are essential for food preparation and service in aircraft. Moreover, technological advancements in galley equipment, such as lightweight materials, energy-efficient systems, and compact designs, are also contributing to market growth. The emphasis on improving fuel efficiency and reducing the weight of aircraft is driving the adoption of advanced galley equipment.

Galleys serve as crucial hubs for food preparation, storage, and in-flight service delivery. Airlines are continuously striving to enhance passenger comfort and satisfaction, which includes offering a variety of food and beverage options during flights. Modern aircraft galleys are designed to optimize space utilization, accommodate diverse catering needs, and ensure quick turnaround times between flights.

Similarly, in the maritime industry, ship galleys play a pivotal role in supporting crew and passenger dining experiences aboard vessels. Ship galleys are not only essential for preparing and serving meals but also for adhering to stringent safety and hygiene standards. Cruise ships, for instance, require galleys capable of serving thousands of passengers multiple meals a day while maintaining quality and variety in dining options.

Drivers, Opportunities & Restraints

The market is driven by several factors, including the growth of the global aviation industry, increasing aircraft deliveries, and the rising demand for improved passenger comfort and experience. The demand for lightweight, energy-efficient, and compact galley equipment that can enhance the operational efficiency of aircraft is also contributing to market growth. Furthermore, the trend towards customization and the adoption of advanced technologies such as IoT and smart appliances in galley equipment present significant opportunities for market expansion.

The high cost of advanced galley equipment and the stringent regulatory requirements for safety and certification may pose challenges to market growth. In addition, the impact of economic downturns and fluctuations in raw material prices can also affect the market growth.

Despite these challenges, there are numerous opportunities for growth, particularly with the increasing focus on enhancing passenger experience and the development of new aircraft models with advanced cabin designs.

Type Insights

“The demand for ship galleys segment is expected to grow at a significant CAGR of 4.6% from 2024 to 2030 in terms of revenue”

Based on type, the aviation galleys segment led the market with the revenue share of 68.51% in 2023. Aviation galleys equipment plays a pivotal role in meeting the diverse culinary needs of airline passengers during flights. Airlines invest in state-of-the-art galley equipment to deliver a variety of inflight catering options efficiently and safely. This includes advanced ovens, chillers, coffee makers, and galley inserts that enhance service delivery and turnaround times between flights, contributing to overall operational efficiency and passenger satisfaction.

The demand for ship galleys equipment and aviation galleys equipment is on the rise due to increasing emphasis on passenger experience, operational efficiency, and regulatory compliance in both maritime and aviation sectors. Ship galleys equipment is crucial for cruise ships and maritime vessels to efficiently prepare and serve meals to passengers and crew, ensuring high standards of food quality, variety, and safety compliance. Advanced ship galley equipment integrates modern cooking appliances, refrigeration systems, and storage solutions designed to handle large-scale meal preparation while optimizing space and energy efficiency onboard.

Fit Insights

“The demand for retro fit segment is expected to grow at a significant CAGR of 4.0% from 2024 to 2030 in terms of revenue”

Based on fit, the line fit segment led the market with the revenue share of 65.4% in 2023. Line fit galley equipment, which is installed during the original manufacturing of aircraft or ships, reflects the latest innovations and design specifications tailored to specific models. This equipment is preferred for its seamless integration with new builds, offering airlines and shipbuilders the advantage of incorporating cutting-edge technologies from the outset.

The demand for retro fit galley equipment is driven by the need to modernize older fleets or vessels with more efficient, space-saving, and technologically advanced solutions. For instance, airlines may retrofit galleys to accommodate changes in passenger preferences or regulatory requirements, such as enhancing food service capabilities or improving energy efficiency. Similarly, cruise lines retrofit ship galleys to optimize space utilization and enhance onboard dining experiences without the expense of purchasing new vessels.

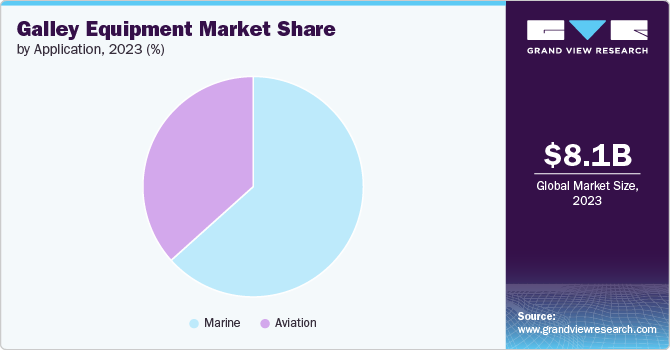

Application Insights

“The demand for aviation application segment is expected to grow at a significant CAGR of 4.2% from 2024 to 2030 in terms of revenue”

Based on application, the marine segment led the market with the largest revenue share of 63.36% in 2023. Galley equipment in the marine industry serves a crucial role in providing sustenance and comfort for crew members and passengers aboard various vessels, including cruise ships, ferries, and naval vessels. Marine galleys are equipped with specialized cooking appliances, refrigeration units, storage systems, and sanitation facilities designed to operate efficiently in the challenging maritime environment. These galleys must adhere to stringent safety and hygiene standards to ensure the well-being of onboard personnel and compliance with international maritime regulations.

In aviation segment, the galley equipment plays a pivotal role in ensuring the comfort and well-being of passengers during flights. Aircraft galleys are compact yet efficient spaces equipped with specialized appliances and storage solutions tailored to meet the unique challenges of inflight catering. These galleys must comply with strict safety regulations while also maximizing space utilization to accommodate varying aircraft configurations and passenger capacities.

Regional Insights

“China to witness fastest market growth at 5.1% CAGR”

The galley equipment market in North America is driven by the region's robust aviation and maritime sectors, characterized by a focus on technological innovation. U.S. airlines invest in cutting-edge galley solutions to enhance on board service efficiency and accommodate the diverse preferences of domestic and international travellers. The North American cruise industry, particularly in the Caribbean and Alaska regions, prioritizes on board dining experiences as a key component of passenger satisfaction. Cruise lines invest in state-of-the-art ship galley equipment to deliver gourmet dining options and culinary experiences that rival land-based restaurants.

Asia Pacific Galley Equipment Market Trends

Asia Pacific dominated the galley equipment market with the revenue share of 37.6% in 2023. It is due to the rapid expansion of both aviation and maritime industries. In aviation, airlines in countries like Japan, South Korea, Australia, and India are upgrading their fleets to enhance passenger services and operational efficiency. The Asia Pacific region is home to some of the world's busiest air routes, prompting airlines to invest in advanced galley equipment that can optimize inflight catering capabilities and accommodate the region's diverse culinary preferences. In addition, the growth of tourism and leisure travel in Southeast Asia has bolstered the demand for cruise ships, leading to increased investments in ship galley equipment that can support luxury dining experiences and onboard amenities.

The galley equipment market in China is estimated to grow at a significant CAGR of 5.1% over the forecast period. The demand for galley equipment in China is influenced by the rapid growth of its aviation and maritime sectors. Chinese airlines prioritize efficiency and passenger comfort, driving the demand for advanced galley solutions that can handle increasing passenger volumes and diverse culinary preferences. Moreover, China's booming cruise industry has fuelled demand for sophisticated ship galleys equipped to cater to the needs of a growing number of cruise passengers. As Chinese consumers increasingly prioritize travel experiences, the demand for high-quality galley equipment continues to rise, supported by investments in new vessels and fleet expansions.

Europe Galley Equipment Market Trends

The galley equipment market in Europe is driven by the region's established aviation and maritime industries, which prioritize sustainability, efficiency, and passenger comfort. European airlines focus on offering premium inflight dining experiences and adhere to stringent environmental regulations, prompting investments in eco-friendly galley solutions that minimize carbon footprints and food waste. As European travellers increasingly seek personalized and high-quality travel experiences, the demand for innovative galley equipment continues to grow, supported by investments in fleet modernization and sustainability initiatives.

Key Galley Equipment Company Insights

Some of the key players operating in the market include B/E Aerospace Inc., Bucher Group, Diehl Stiftung & Co. Kg, among others.

-

Bucher Group, headquartered in Niederweningen, Switzerland, is a global technology company specializing in a diverse range of industries, including agriculture, aviation, and transportation. Founded in 1807, Bucher has grown into a leading provider of innovative solutions and systems across its various divisions. The company operates globally with production facilities, sales offices, and service centers across Europe, North America, Asia, and other regions. The company's international presence allows it to serve a diverse customer base and adapt to regional market needs effectively

-

Diehl Stiftung & Co. KG, commonly known as Diehl Group, is a German technology company with a diversified portfolio spanning multiple industries. Founded in 1902 and headquartered in Nürnberg, Germany, Diehl operates globally with a focus on developing high-tech solutions for various sectors including defense, aerospace, automotive, industrial, and household appliances.The company provides aircraft systems and interior solutions for commercial and military aviation. This includes cabin lighting, avionics, cabin management systems, and connectivity solutions. Diehl Aviation is a prominent supplier of aircraft cabin lighting systems and aircraft equipment

Jeitek, Kang Li Far East Pte Ltd. are some of the emerging market participants in the global market.

-

Jeitek Automation Equipment Co., Ltd., based in Shenzhen, China, specializes in the design, manufacturing, and distribution of automation equipment and solutions. Established in 2006, Jeitek focuses on providing high-quality automation products and services across various industries, including electronics manufacturing, automotive, medical devices, and consumer electronics. The company's product portfolio includes precision automation equipment such as robotic systems, assembly machines, testing equipment, and custom automation solutions tailored to meet specific customer requirements

-

Kang Li Far East Pte Ltd, headquartered in Singapore, is a provider of integrated supply chain solutions and services specializing in the marine, offshore, and oil & gas industries. With a presence spanning over three decades, Kang Li Far East has established itself as a trusted partner for procurement, logistics, and project management services across Asia Pacific. The company offers a comprehensive range of products including marine equipment, ship spare parts, industrial tools, and safety equipment

Key Galley Equipment Companies:

The following are the leading companies in the galley equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Aerolux Limited

- Air Cabin Engineering Inc.

- Aluminox S.A.

- B/E Aerospace Inc.

- Bucher Group

- Diehl Stiftung & Co. Kg

- Diethelm Keller Aviation Pte Ltd.

- Jamco Corporation

- Jeitek

- Kang Li Far East Pte Ltd.

- Loipart AB

- Meili Marine USA

- Zodiac Aerospace Ltd.

Recent Developments

-

In April 2023, Welbilt Marine introduced GalleyCare, a holistic marine service package encompassing support, maintenance, repair (inclusive of spare parts), and galley technology monitoring to ensure seamless operations through regular upkeep

-

In February 2022, Bucher delivered the initial batch of bespoke stowages and galleys to Airbus Toulouse for integration into STARLUX's new A330-900neo

Galley Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8,424.7 million

Revenue forecast in 2030

USD 10,874.1 million

Growth rate

CAGR of 4.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Type, fit, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Aerolux Limited; Air Cabin Engineering Inc.; Aluminox S.A.; B/E Aerospace Inc.; Bucher Group; Diehl Stiftung & Co. Kg; Diethelm Keller Aviation Pte Ltd.; Jamco Corporation; Jeitek; Kang Li Far East Pte Ltd.; Loipart AB; Meili Marine USA; Zodiac Aerospace Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Galley Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global galley equipment market report based on type, fit, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Aviation Galleys

-

Single-aisle

-

Twin-aisle

-

Business General Aviation

-

-

Ship Galleys

-

Surface Ships

-

Amphibious Ships

-

Passenger Vessels

-

Others

-

-

-

Fit Outlook (Revenue, USD Million, 2018 - 2030)

-

Line Fit

-

Retro Fit

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Aviation

-

Marine

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global galley equipment market size was estimated at USD 8,125.0 million in 2023 and is expected to reach USD 8,424.7 million in 2024.

b. The galley equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.3% from 2024 to 2030 to reach USD 10,874.1 million by 2030.

b. Asia Pacific dominated the galley equipment market with a revenue share of 37.6% in 2023. The market is witnessing significant growth due to the rapid expansion of both aviation and maritime industries. In aviation, airlines in countries like Japan, South Korea, Australia, and India are upgrading their fleets to enhance passenger services and operational efficiency.

b. Some of the key players operating in the galley equipment market include Aerolux Limited, Air Cabin Engineering Inc., Aluminox S.A., B/E Aerospace Inc., Bucher Group, Diehl Stiftung & Co. Kg, Diethelm Keller Aviation Pte Ltd., Jamco Corporation, Jeitek, Kang Li Far East Pte Ltd., Loipart AB, Meili Marine USA, Zodiac Aerospace Ltd.

b. The demand for galley equipment is driven by the expansion of the aviation industry, the increasing number of aircraft deliveries, and the rising demand for enhanced passenger experience and comfort. Moreover, technological advancements in galley equipment, such as lightweight materials, energy-efficient systems, and compact designs, are also contributing to market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.