Gabapentin Market Size, Share & Trends Analysis Report By Dosage Form (Tablet, Capsule, Oral Solution), By Type (Generic, Branded), By Application, By Distribution Channel, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-043-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Gabapentin Market Size & Trends

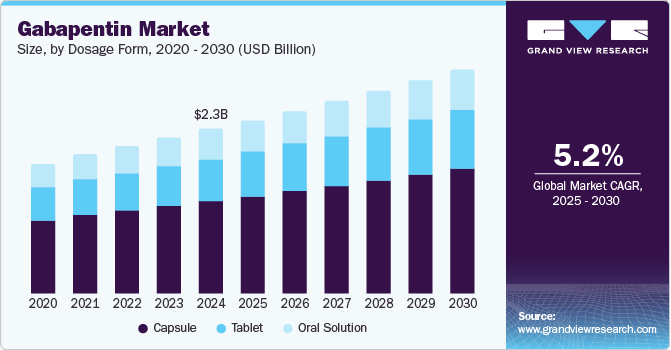

The global gabapentin market size was estimated at USD 2.25 billion in 2024 and is projected to grow at a CAGR of 5.2% from 2025 to 2030. According to the American Academy of Neurology, neuropathic pain prevalence stood at an estimated 9.2% in the general population, escalating to nearly 20% to 30% among individuals with diabetes. This spike highlights significant public health concerns as conditions such as diabetic neuropathy, exacerbated by lifestyle changes and demographic shifts, become more prevalent. Moreover, the geriatric population, projected to constitute nearly 20% of the U.S. population by 2024, is more susceptible to chronic pain and neurological disorders, leading to increased prescriptions for Gabapentin as an effective pain management solution.

Further fueling market demand, Gabapentin’s expanding applications beyond its original indication for epilepsy have gained traction. Medical professionals are increasingly prescribing the drug off-label for conditions such as anxiety and bipolar disorder, thus broadening its market appeal. Moreover, healthcare providers are favoring Gabapentin over traditional opioids as a pain management strategy. This shift is largely driven by the need to mitigate the risks associated with opioid addiction and dependency, positioning Gabapentin as a safer alternative.

Government initiatives and awareness campaigns are also pivotal in driving market growth. The World Health Organization’s Global Action Plan, introduced in July 2023, seeks to improve access to care for neurological disorders, emphasizing coordinated multi-sectoral efforts. Moreover, the U.S. National Plan, updated in 2023, underscores the importance of public education and awareness in tackling Alzheimer’s disease-a significant contributor to neurological disorders. These initiatives promote treatment accessibility and raise awareness about Gabapentin and its potential benefits.

Finally, the increasing demand for generic formulations is positively impacting the Gabapentin market, particularly in developing regions. As generic drugs become more popular due to their affordability and accessibility, this trend is expected to significantly boost the market, especially in the Asia Pacific region. Coupled with ongoing pharmaceutical R&D investments to enhance Gabapentin formulations through alternative delivery methods, the market is well-positioned for continued growth, meeting the rising demand for effective pain management solutions.

Dosage Form Insights

Capsules dominated the market and accounted for a share of 56.1% in 2024. This is attributed to their ease of administration, which makes them ideal for patients, including children and the elderly. Capsules ensure precise dosing and are favored by healthcare providers for convenience and expedited absorption, thereby improving patient compliance.

Oral solutions are expected to grow at the fastest CAGR of 5.3% over the forecast period due to their adaptable dosing capabilities, making them particularly suitable for patients who struggle with swallowing pills, such as children and the elderly. Moreover, the oral solution facilitates precise dose titration, enhancing efficacy and patient compliance in managing neuropathic pain and epilepsy.

Type Insights

Generic gabapentin led the market with a revenue share of 90.1% in 2024. Generics provide a cost-effective alternative to branded medications, expanding accessibility for a wider patient demographic. The expiration of patents for brand-name gabapentin has intensified competition, lowering prices and incentivizing healthcare providers to prescribe generics, particularly in cost-sensitive markets, amidst the rising incidence of neuropathic pain and epilepsy.

Branded gabapentin is anticipated to grow rapidly over the forecast period. Branded medications, including Neurontin, are frequently regarded as superior in quality and efficacy, fostering trust among physicians and patients. Furthermore, pharmaceutical companies allocate resources for marketing and developing innovative formulations, enhancing patient adherence, and broadening these medications' therapeutic applications.

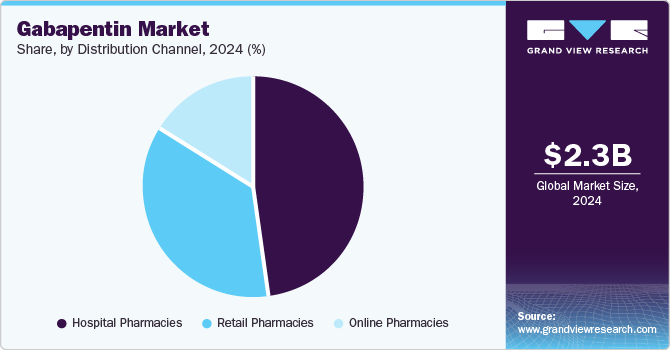

Distribution Channel Insights

Hospital pharmacies dominated the market and accounted for a share of 47.6% in 2024, serving as key healthcare facilities for treating chronic conditions such as epilepsy and neuropathic pain. The implementation of electronic prescription systems improves workflow efficiency and enhances patient satisfaction and medication accuracy. Moreover, the established trust between patients and hospital pharmacies encourages medication sourcing from these outlets, ensuring better access to essential treatments such as gabapentin.

Online pharmacies are projected to grow at the fastest CAGR of 7.9% over the forecast period. The global market is witnessing a significant trend toward online purchasing, fueled by the rising adoption of telehealth and e-prescriptions. This shift offers patients enhanced convenience and accessibility, enabling them to acquire medications without the necessity of in-person visits, in alignment with broader digital healthcare developments.

Application Insights

Applications in epilepsy held the largest market share of 49.9% in 2024, owing to its proven efficacy as an anticonvulsant essential for seizure management in individuals with epilepsy. With around 50 million people affected globally, rising diagnosis rates and the increasing need for dependable treatment options significantly contribute to the growing demand for gabapentin in this segment.

Applications in neuropathic pain are expected to register the fastest growth of 5.5% over the forecast period, fueled by its effectiveness in treating conditions such as postherpetic neuralgia and diabetic neuropathy. Gabapentin is frequently prescribed for these pain types, with studies showing that 30%-40% of patients achieve substantial pain relief, thereby enhancing its attractiveness to healthcare providers and patients.

Regional Insights

North America gabapentin market dominated the global market with a revenue share of 33.7% in 2024. North America exhibits a high prevalence of neurological disorders and neuropathic pain conditions, supported by a robust healthcare infrastructure, comprehensive insurance coverage, and substantial research and development investments. Furthermore, growing awareness among healthcare providers regarding gabapentin’s efficacy is facilitating its increased adoption across various applications.

U.S. Gabapentin Market Trends

The gabapentin market in the U.S. dominated North America in terms of revenue share in 2024. The country has a significant patient population affected by conditions such as epilepsy and neuropathic pain. Elevated prescription rates, stemming from healthcare professionals’ increasing recognition of gabapentin’s benefits, substantially drive demand. Moreover, the availability of both branded and generic options improves patient accessibility.

Europe Gabapentin Market Trends

Europe gabapentin market held a substantial market share in 2024, aided by heightened awareness of neurological disorders and an aging demographic vulnerable to conditions addressed by gabapentin. Furthermore, advantageous reimbursement policies and a strong emphasis on mental health are bolstering the demand for effective treatments, positioning gabapentin as a preferred option among healthcare providers in the region.

The gabapentin market in Germany is expected to grow rapidly in the forecast period, supported by a strong healthcare system and substantial investment in pharmaceutical research. The aging population, along with rising diagnoses of neuropathic pain and epilepsy, fuels the demand for effective treatments such as gabapentin. Moreover, regulatory support plays a crucial role in market growth by ensuring the consistent availability of medications.

Asia Pacific Gabapentin Market Trends

Asia Pacific gabapentin market is expected to register the fastest CAGR of 6.4% in the forecast period. The region is witnessing an upward trend in healthcare expenditures and heightened awareness of neurological disorders. The expanding population, especially in countries such as India and China, contributes to the increased prevalence of conditions treated by gabapentin. Furthermore, advancements in healthcare infrastructure are enhancing access to medications.

The gabapentin market in India is expected to register the fastest CAGR of 6.6% in the Asia Pacific gabapentin market over the forecast period, driven by a notable increase in neurological disorders and chronic pain cases within its vast population. Enhanced healthcare spending and improved access to medications are pivotal factors in this expansion. Moreover, rising awareness of gabapentin’s efficacy across various applications is leading to increased prescriptions by healthcare providers, further fueling market demand.

Key Gabapentin Company Insights

Some key companies operating in the market include Zydus Pharmaceuticals, Inc.; GLENMARK PHARMACEUTICALS LTD.; Sun Pharmaceutical Industries Ltd., and Ascend Laboratories LLC, among others. Companies are pursuing strategic initiatives, including product launches, mergers, and partnerships, to strengthen market presence, amid rising generic competition and ongoing investments in R&D for improved formulations.

-

Glenmark Pharmaceuticals Ltd. engages actively in the production and marketing of generic formulations for neuropathic pain and epilepsy, prioritizing product diversification and accessibility by leveraging robust research and development capabilities to address increasing market demand.

-

Apotex Inc. manufactures generic Gabapentin formulations for indications such as neuropathic pain and seizures, prioritizing affordability and availability. This approach enhances the competitive landscape by offering cost-effective alternatives to branded medications, thereby improving patient access to essential treatments.

Key Gabapentin Companies:

The following are the leading companies in the gabapentin market. These companies collectively hold the largest market share and dictate industry trends.

- Zydus Pharmaceuticals, Inc.

- GLENMARK PHARMACEUTICALS LTD.

- Sun Pharmaceutical Industries Ltd.

- Ascend Laboratories LLC

- Apotex Inc.

- Teva Pharmaceutical Industries Ltd

- Aurobindo Pharma

- Amneal Pharmaceuticals LLC.

- Cipla

- B.P. Pharma

- Assertio Holdings, Inc.

- Arbor Pharmaceuticals, LLC (Azurity Pharmaceuticals, Inc.)

- Pfizer Inc.

Recent Developments

-

In August 2024, Sun Pharmaceutical Industries Limited invested up to USD 15 million in Pharmazz Inc. to support Sovateltide’s Phase 3 trial for treating acute cerebral ischemic stroke in the U.S.

-

In January 2024, Zydus Lifesciences received USFDA approval to manufacture and market once-daily Gabapentin Tablets, 300 mg and 600 mg, for managing Postherpetic Neuralgia, with immediate launch planned.

Gabapentin Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.38 billion |

|

Revenue forecast in 2030 |

USD 3.07 billion |

|

Growth rate |

CAGR of 5.2% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Dosage form, type, application, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

Zydus Pharmaceuticals, Inc.; GLENMARK PHARMACEUTICALS LTD.; Sun Pharmaceutical Industries Ltd.; Ascend Laboratories LLC; Apotex Inc.; Teva Pharmaceutical Industries Ltd; Aurobindo Pharma; Amneal Pharmaceuticals LLC.; Cipla; B.P. Pharma; Assertio Holdings, Inc.; Arbor Pharmaceuticals, LLC (Azurity Pharmaceuticals, Inc.); Pfizer Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Gabapentin Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gabapentin market report based on dosage form, type, application, distribution channel, and region:

-

Dosage Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablet

-

Capsule

-

Oral Solution

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Generic

-

Branded

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Epilepsy

-

Neuropathic Pain

-

Restless Legs Syndrome

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

- Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."