- Home

- »

- Homecare & Decor

- »

-

Furniture Market Size, Share, Trends, Industry Report, 2033GVR Report cover

![Furniture Market Size, Share & Trends Report]()

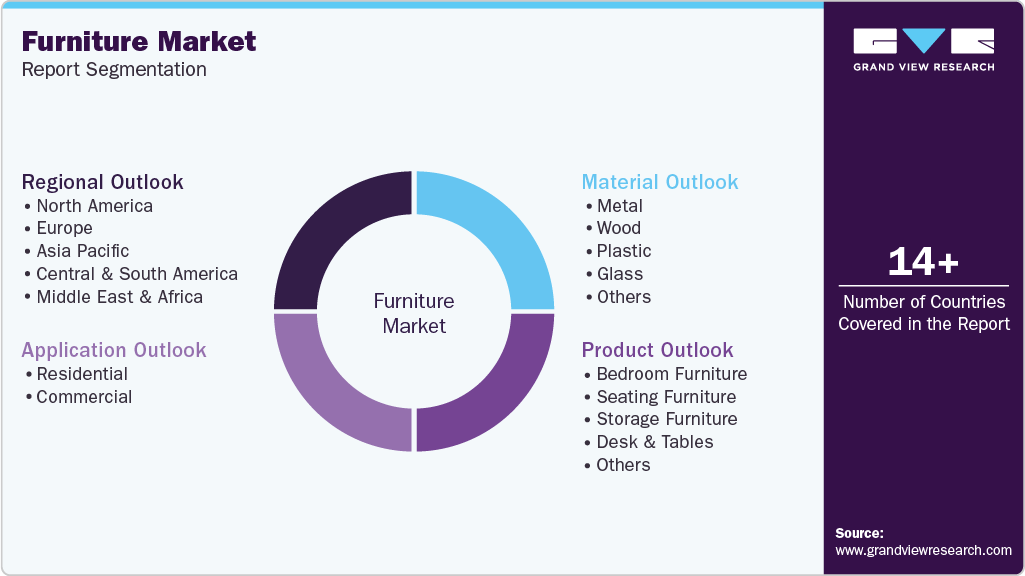

Furniture Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Bedroom Furniture, Seating Furniture, Storage Furniture), By Material (Metal, Wood, Plastic, Glass), By Application, By Region and Segment Forecasts

- Report ID: GVR-2-68038-647-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Furniture Market Summary

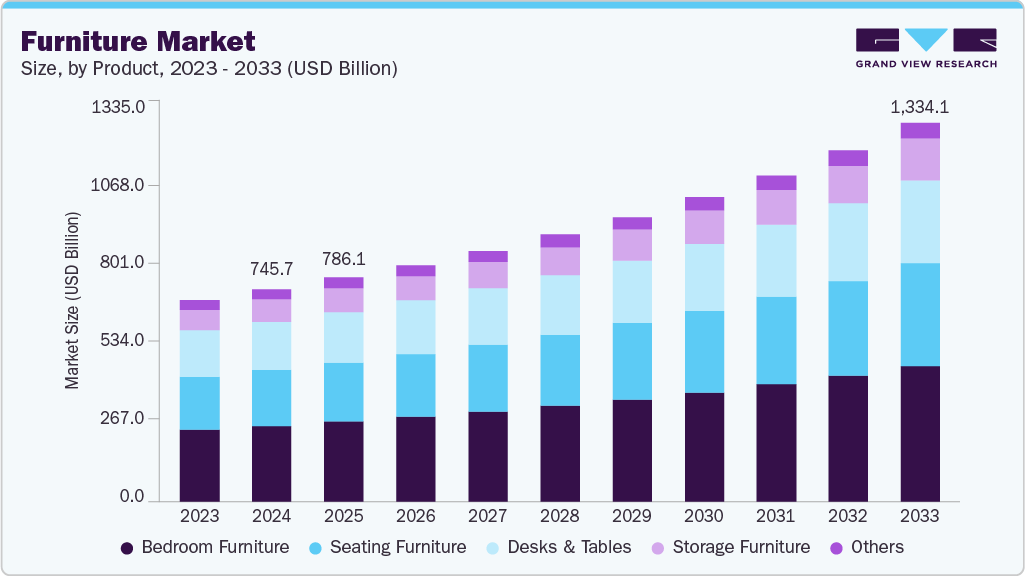

The global furniture market size was estimated at USD 745.65 billion in 2024 and is projected to reach USD 1,334.08 billion by 2033, growing at a CAGR of 6.8% in the forecast period from 2025 to 2033. The market is driven by rising demand for home furnishings, expansion in the real estate sector, and evolving consumer preferences for modular, sustainable, and tech-enabled furniture solutions.

Key Market Trends & Insights

- The Asia Pacific furniture market held the highest industry share of 38.23% in 2024.

- The U.S. furniture market is anticipated to grow at a CAGR of 6.2% over the forecast period.

- By product, the bedroom furniture segment had the highest market share of 35.69% in 2024.

- By material, the wood segment accounted for about 39.39% share in 2024.

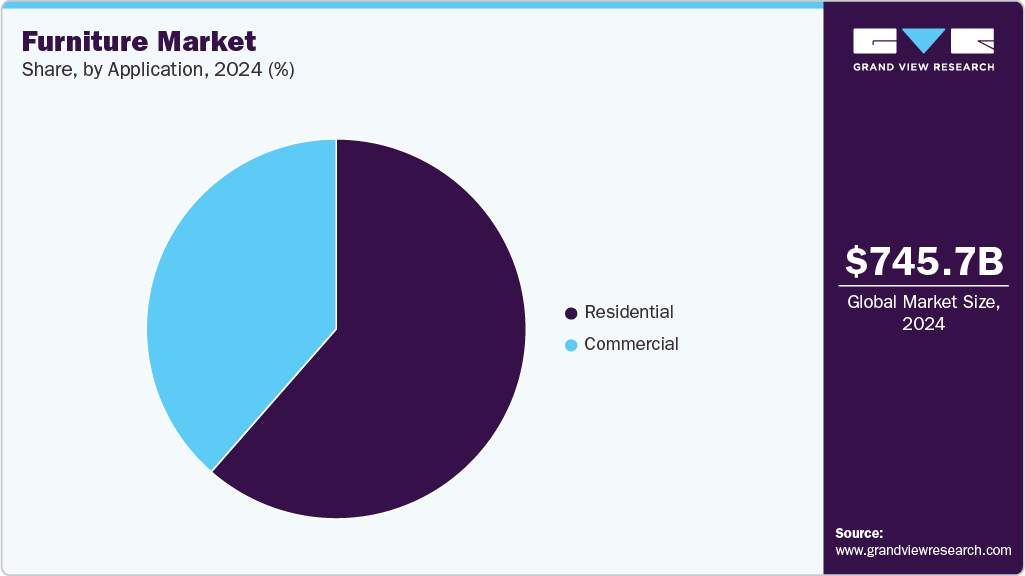

- By application, the residential segment accounted for about 61.44% of the global market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 745.65 Billion

- 2033 Projected Market Size: USD 1,334.08 Billion

- CAGR (2025-2033): 6.8%

- Asia Pacific: Largest market in 2024

Technological advancements are playing a critical role in reshaping the furniture industry. Smart furniture integrated with IoT (Internet of Things) capabilities, such as desks with wireless charging or beds monitoring sleep patterns, is gaining popularity. These innovations enhance convenience and align with consumer preferences for tech-driven lifestyles. For instance, Sleep Number’s 360 Smart Bed is a leading example of tech-enabled furniture. It uses sensors to monitor sleep patterns, adjust firmness automatically, and provide health insights via a connected app.Residential and infrastructural development, such as the construction of churches, community centers, hospitals, and government buildings, continues to drive demand for furniture. In addition, government regulations, particularly for furniture used in healthcare settings, require manufacturers to design products that meet specific standards. For example, the British Contract Furnishing Association mandates that hospital wooden furniture be finished with high-quality clear lacquer. This lacquer enhances the furniture’s durability and contains antimicrobial properties that help inhibit the growth of harmful microorganisms, ensuring a safer and more hygienic environment.

Moreover, several Middle Eastern governments, particularly Saudi Arabia, are prioritizing the growth of the real estate sector through extensive residential and commercial development initiatives aimed at strengthening their economies. As outlined in Saudi Arabia’s National Transformation Plan, the country aims to construct over 555,000 residential units, approximately 275,000 hotel rooms, more than 4.3 billion square meters of retail space, and around 6.1 billion square meters of new office space by 2030.

Environmental concerns and awareness about sustainable living push manufacturers to adopt eco-friendly materials and production practices. Consumers are increasingly interested in recyclable, biodegradable, and sustainably sourced materials. As a result, the market is seeing a rise in demand for "green furniture" that supports environmentally responsible choices. Green furniture uses recycled, biodegradable, or sustainably sourced materials, such as reclaimed wood, bamboo, rattan, or FSC-certified timber. Emeco is a U.S.-based furniture company known for its iconic “Navy Chair,” now made using recycled aluminum. Emeco also produces chairs made from reclaimed Coca-Cola PET bottles, promoting the idea of repurposing waste into durable, high-quality furniture.

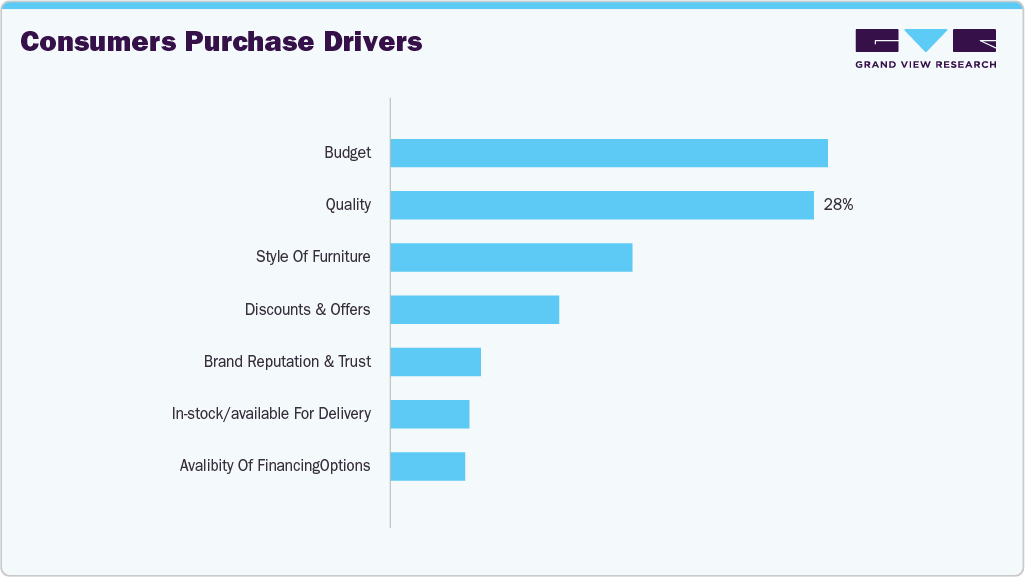

Consumer Insights & Surveys

According to the survey conducted by Home News Now, of nearly 1,900 consumers around the country, consumers prioritize budget and quality as the most important factors when purchasing furniture, underscoring their desire for value-driven, durable products. Style also plays a significant role, showing that design aesthetics matter, though not as much as affordability and reliability. Discounts and promotions influence a notable share of buyers, highlighting the impact of strategic pricing. Meanwhile, factors like brand trust, product availability, and financing options rank lower, suggesting they are secondary considerations unless the purchase is large or urgent. Overall, practicality and value dominate consumer decision-making.

Product Insights

Bedroom furniture accounted for 35.69% of the global furniture market in 2024. The rise of urbanization, real estate development, and rental housing also boosts the need for bedroom furnishings. Moreover, consumer interest in comfort, style, and customization fuels purchases, while trends such as minimalist design or space-saving solutions keep the material appealing.

Shifting consumer preference towards high-end furniture products owing to technological advancements in the home furnishing industry, is a key factor driving the growth of the beds segment. Moreover, rising attention towards gaining trending bedroom styles has influenced major bedroom renovation projects and is expected to propel the market growth over the forecast period.

Demand for storage furniture is projected to rise at a CAGR of 7.5% from 2025 to 2033The rapid growth of storage furniture, including wardrobes, dressers, cabinets, shelves, TV stands, and other units such as drawers and chests, is driven by a combination of urbanization, lifestyle shifts, and changing consumer needs. As urban living spaces become increasingly smaller, a growing demand for compact, space-efficient, and multifunctional furniture helps maximize limited space. Additionally, consumers spend more on home improvement post-pandemic, and storage furniture offers an affordable way to upgrade interiors. Integrating technology in entertainment units and shelving, along with growing environmental awareness and interest in DIY and sustainable solutions, also shapes purchasing behavior.

Material Insights

In terms of revenue, the wood segment held the dominant industry share of 39.39% in 2024. This growth is anticipated to accelerate as wood is one of the naturally available raw materials used in the production of almost all types of furniture products worldwide. Wooden furniture is primarily produced by processing raw timber. The three main categories of wooden panels are plywood, fiberboard, and particleboard.

The plastic segment is estimated to grow with the fastest CAGR of 7.7% over the forecast period. Rapidly increasing demand for low-priced designer furniture across the globe is accelerating market growth. Moreover, the increasing demand for high-performance plastic material is expected to lead to rapid growth of the market in the upcoming years. Furthermore, manufacturers are launching innovative and well-designed plastic furniture to accelerate the lucrative growth of the industry over the forecast period.

Application Insights

The residential segment contributed to the largest revenue share of 61.44% in 2024 and is expected to grow with a CAGR of 6.7% from 2025 to 2033. The residential segment is projected to proliferate over the forecast period due to increasing demand for furniture in the living room and bedroom and rising real estate construction projects initiated by governments, especially in urban areas. For instance, the Ministry of Housing and Urban Affairs in India is responsible for initiating and approving infrastructure development in urban towns and other metropolitan cities of India.

The commercial segment is expected to grow at the fastest CAGR of 7.1% from 2025 to 2033. High demand from offices and hotels is projected to bode well for the expansion. Rising demand for office space and the expansion of the hospitality sector can further fuel the demand for products. Furthermore, the rising furniture requirement in restaurants, coffee shops, and bars, among others, is also accelerating the market growth.

Regional Insights

North American furniture market captured 29.07% of the global revenue in 2024. Sustainability is a major driving force in the furniture industry in North America. Consumers increasingly seek eco-friendly options, prompting manufacturers to use recycled materials and adopt greener production methods. This shift is especially evident in high-end and modular furniture segments. At the same time, there's a rising demand for modular and multifunctional furniture driven by urban living and hybrid work lifestyles. Compact, space-saving designs like foldable desks and storage-integrated pieces are gaining popularity for their versatility and practicality. For instance, IKEA has a significant presence in North America and actively focuses on sustainability and modular design. IKEA is also known for its modular and multifunctional furniture, such as the PLATSA storage system and BRIMNES beds with built-in storage, which are designed to maximize space and adapt to small or flexible living areas.

U.S. Furniture Market Trends

The U.S. furniture market is anticipated to grow at a CAGR of 6.2% from 2025 to 2033. The U.S. furniture industry is transforming significantly, shaped by changing market dynamics and consumer preferences. Manufacturers are turning to recycled materials and eco-conscious production methods as sustainability becomes a top priority. At the same time, there's growing interest in modular, multifunctional, and tech-integrated furniture that offers space efficiency and affordability. This shift is further supported by rising demand for home furnishings, with the average U.S. household spending between USD 1,200 and 2,000 annually and 67% planning to renovate or redecorate in the coming years.

Asia Pacific Furniture Market Trends

The Asia Pacific dominated the furniture market with a share of 38.23% in 2024. This growth can be attributed to the increasing disposable income of the upper and middle-class population. Moreover, the increasing demand for living room furniture, followed by bedroom, kitchen, and dining furniture, is projected to accelerate the market growth. In addition, the growth is driven by the booming real estate industry, coupled with government-initiated housing projects. Furthermore, the rapid urbanization, coupled with the growth of the IT industry in this region, is expected to propel market growth over the forecast period.

Middle East & Africa Furniture Market Trends

Middle East & Africa is expected to witness the second-fastest CAGR of 7.0% from 2025 to 2033. The growth of the regional industry can be attributed to several countries, including the UAE and Saudi Arabia, which are aggressively investing in developing infrastructure to attract international tourists and create opportunities for economic growth. For instance, in Dubai, the government is expected to invest significantly in infrastructure to attract many visitors. This is a contributing factor to regional industry growth.

Key Furniture Company Insights

The presence market is characterized by the of a few established players and new entrants characteg players are increasing their focus on the growing trend of furniture trend in the market are diversifying their service offerings to maintain market share.

-

IKEA is a Swedish-founded multinational company known for its affordable, flat-pack, ready-to-assemble furniture, home accessories, and kitchen appliances. Established in 1943 by Ingvar Kamprad, IKEA has grown into one of the world’s largest furniture retailers, operating in over 50 countries. The brand is recognized for its minimalist Scandinavian design, cost-effective manufacturing, and sustainable practices.

-

Restoration Hardware is a high-end American home furnishings company that offers luxury furniture, lighting, textiles, and décor. Founded in 1979 and headquartered in Corte Madera, California, RH is known for its upscale, timeless aesthetic that blends classic and modern design. RH targets affluent consumers and emphasizes quality craftsmanship, exclusivity, and a lifestyle-oriented brand image.

Key Furniture Companies:

The following are the leading companies in the furniture market. These companies collectively hold the largest market share and dictate industry trends.

- IKEA

- Ashley Furniture Industries Inc.

- RH (Restoration Hardware)

- Williams-Sonoma, Inc.

- La-Z-Boy Inc.

- Raymour & Flanigan

- American Signature

- Oppein Home Group Inc.

- Jason Furniture (HangZhou) Co., Ltd.

- Steelcase Inc.

Recent Developments

-

In April 2025, Italian design house Paola Lenti introduced “Alma,” a groundbreaking outdoor seating collection developed in collaboration with Argentine designer Francisco Gomez Paz. The range includes an armchair, two-seater, and three-seater sofas, all engineered through generative algorithms and CNC-machined stainless-steel frames, complemented by an elastic mesh that eliminates traditional padding. Importantly, Alma’s cushions use biodegradable recycled polyester fiber, presenting an eco-friendly, polyurethane-free alternative that underscores the brand’s commitment to sustainability.

-

In February 2024, La‑Z‑Boy Incorporated announced a significant investment in its presence at the industry’s major trade shows by extending leases for its High Point Market and Las Vegas Market showrooms and planning substantial renovations. The upgrades include a modern, high-tech redesign of its La‑Z‑Boy flagship showroom and the England Furniture space in High Point, aimed at enhancing presentation, comfort, and style ahead of High Point Market in April 2024.

-

In December 2024, RH opened its largest Gallery, Newport Beach, a 97,000-square-foot, four-level design and retail destination at Fashion Island in California. This flagship space exemplifies RH's evolution from a traditional luxury furniture retailer to a fully immersive lifestyle brand. The Gallery features an expansive showcase of RH Interiors, Modern, Outdoor, Baby & Child, and TEEN collections and a curated selection of antiques.

-

In November 2024, RH opened RH Raleigh, The Gallery at North Hills, a 60,000 sq ft, three-level immersive luxury hub in Raleigh’s North Hills district. The flagship venue blends expansive RH Interiors and contemporary, Modern, and Outdoor collections with rare antiques and global artifacts, all set within a striking glass‑and‑steel structure featuring courtyards edged with Japanese boxwoods and European-style landscaping.

Furniture Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 786.13 billion

Revenue forecast in 2033

USD 1,334.08 billion

Growth rate

CAGR of 6.8% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, application, region

Regional Scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Brazil; South Africa

Key companies profiled

IKEA; Ashley Furniture Industries Inc.; RH (Restoration Hardware); Williams-Sonoma, Inc.; La-Z-Boy Inc.; Raymour & Flanigan; American Signature; Oppein Home Group Inc.; Jason Furniture (HangZhou) Co., Ltd; Steelcase Inc.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Furniture Market Report Segmentation

This report forecasts revenue growth at the global level and analyzes the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global furniture market report by product, material, application, and region.

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Bedroom Furniture

-

Mattresses

-

Beds

-

Nightstands

-

-

Seating furniture

-

Chairs

-

Sofa & Couches

-

Others (lounges & recliners, etc.)

-

-

Storage furniture

-

Wardrobes & Dressers

-

Cabinets & Shelves

-

TV Stands/Entertainment Units

-

Others (Drawers, Chests, etc.)

-

-

Desk and Tables

-

Others

-

-

Material Outlook (Revenue, USD Billion, 2021 - 2033)

-

Metal

-

Wood

-

Plastic

-

Glass

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global furniture market was estimated at USD 745.65 million in 2024 and is expected to reach USD 786.13 million in 2025.

b. The global furniture market is expected to grow at a compound annual growth rate of 6.8% from 2025 to 2033 to reach USD 1,334.08 million by 2033.

b. The Asia Pacific dominated the furniture market with a share of 38.23% in 2024. This growth can be accredited to the increasing disposable income of the upper and middle-class population. Moreover, the increasing demand for living room furniture followed by bedroom and kitchen and dining furniture is projected to accelerate the market growth.

b. Some of the key players in the furniture market is - IKEA; Ashley Furniture Industries Inc.; RH (Restoration Hardware); Williams-Sonoma, Inc.; La-Z-Boy Inc.; Raymour & Flanigan; American Signature; Oppein Home Group Inc.; Jason Furniture (HangZhou) Co., Ltd; Steelcase Inc.

b. The furniture market is driven by rising demand for home furnishings, expansion in the real estate sector, and evolving consumer preferences for modular, sustainable, and tech-enabled furniture solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.