Furniture, Fixtures, And Equipment Market Size, Share & Trends Analysis Report By Product (Furniture, Fixtures), By End Use (Hospitality, Offices), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-478-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Furniture, Fixtures, And Equipment Trends

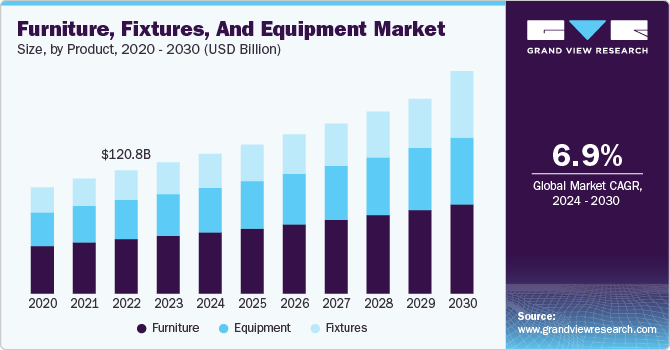

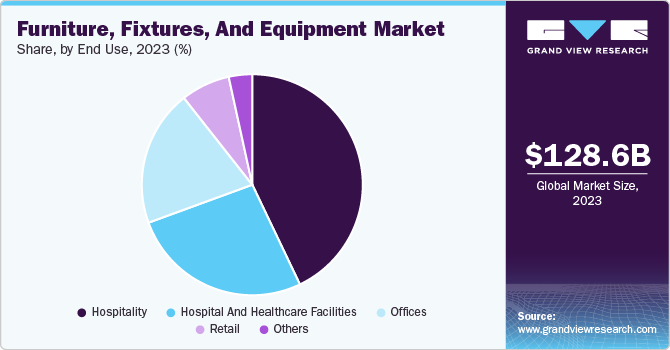

The global furniture, fixtures, and equipment market size was estimated at USD 128.61 billion in 2023 and is projected to grow at a CAGR of 6.9% from 2024 to 2030. The global market is experiencing notable growth, driven by multiple factors across industries such as hospitality, healthcare, education, and residential sectors. As these industries expand and evolve, there is a growing demand for high-quality and customized FF&E solutions that meet the unique requirements of diverse projects. The hospitality sector, in particular, has been a key driver, with the rising trend of luxury hotels, resorts, and restaurants emphasizing aesthetic design and functionality to enhance customer experience.

In addition, the increasing number of new construction and renovation projects in developed and developing regions is fueling the market as businesses and consumers prioritize modern, well-designed interiors.

The furniture market for hospitals and healthcare facilities is vital for creating functional, sterile, and aesthetically pleasing environments. Key furniture items, such as patient beds, exam stools, waiting room chairs, and over-bed tables, enhance comfort and accessibility for patients while supporting healthcare staff's workflow. The market's focus is on durability, chemical resistance, and adherence to cleanliness standards. In addition, the furniture must meet ADA (Americans with Disabilities Act Standards for Accessible Design) accessibility requirements, ensuring inclusivity for all patients. Healthcare facilities regularly update their furniture to maintain a professional and welcoming atmosphere, recognizing the significant role physical environments play in improving patient outcomes and staff efficiency.

Technological advancements are significantly shaping the FF&E market, allowing manufacturers to offer innovative, sustainable, and smart solutions. Integration of technology into furniture and fixtures, such as smart lighting systems, IoT-enabled furniture, and energy-efficient equipment, is becoming more prevalent. These innovations not only improve operational efficiency but also cater to the growing demand for sustainability. Companies are increasingly focusing on eco-friendly materials and production processes, responding to consumer preferences for environmentally conscious products. This shift towards sustainability is creating new opportunities in the market, especially as more businesses commit to green building certifications like LEED (Leadership in Energy and Environmental Design) and WELL Building Standards.

The expansion of the real estate and construction sectors, particularly in emerging markets, is another significant factor contributing to the FF&E market’s growth. Urbanization and infrastructural developments in regions such as Asia-Pacific, the Middle East, and Latin America are generating increased demand for residential and commercial FF&E. In these markets, rising disposable incomes and evolving consumer lifestyles are encouraging investment in premium and customized furnishings. Moreover, government initiatives promoting affordable housing and smart city projects are likely to further boost market growth, as FF&E remains an integral component of such projects.

In the current FF&E landscape, office furniture procurement is increasingly driven by sustainability and adaptability. Companies are prioritizing furniture with green credentials, including lifecycle-based designs, responsibly sourced materials, and sustainable manufacturing practices. Trends such as furniture as a service (FaaS) and remanufacturing are gaining traction, allowing businesses to reduce upfront costs and environmental impact while maintaining flexibility for changing office needs. This shift supports the broader move towards a circular economy, where reusing and refurbishing furniture not only extends product lifecycles but also offers significant cost savings.

Customization and modularity are also emerging as major trends in the market, as businesses and homeowners alike seek flexible, space-efficient solutions. Modular furniture, which can be easily reconfigured or expanded, is gaining popularity in the corporate and residential sectors. This trend is particularly evident in urban areas where space constraints demand more adaptable interior designs. The increasing emphasis on personalized interior environments, whether in corporate offices, educational institutions, or hospitality spaces, is pushing manufacturers to offer more tailored, project-specific FF&E packages.

Product Insights

Furniture accounted for a market share of 52.19% in 2023. In the global market, there is a growing demand for furniture that supports open, collaborative work environments. Companies are investing in flexible, modular designs that facilitate dynamic workspaces and promote team interaction. Furniture trends include ergonomic seating, versatile workstations, and collaborative zone furnishings that align with agile office concepts. As remote work patterns evolve, offices are being designed to accommodate fewer fixed desks and more informal meeting areas. This change reflects a broader emphasis on creating adaptable, sustainable, and aesthetically pleasing office environments that meet both functional and environmental goals.

Hospitals prioritize standardization in furniture procurement to streamline operations, reduce costs, and align with organizational values. The categorization of FF&E is crucial for accurate budgeting and procurement, with user input and leadership support playing pivotal roles. Moreover, group purchasing organizations (GPOs) help healthcare institutions secure advantageous pricing structures driven by volume and project-based purchases. Furniture in healthcare settings also considers environmental impact, life expectancy, and patient satisfaction, as these factors can influence both patient comfort and hospital reimbursement scores, making it an integral part of healthcare infrastructure.

The demand for fixtures is projected to grow at a CAGR of 8.3% from 2024 to 2030. Fixtures procurement in hospitals and healthcare facilities involves sourcing and acquiring essential equipment and furnishings, such as medical carts, storage units, and patient room fixtures. The focus is on ensuring high standards of functionality, safety, and durability to support effective healthcare delivery and patient care.

Fixtures include products such as lights, window treatments, partitions, dividers, and signage. The procurement trends for office fixtures are increasingly leaning towards sustainable and customizable solutions. Businesses are prioritizing eco-friendly materials and adaptable designs that enhance workspace functionality while aligning with green building standards. Features like modular dividers and innovative partition systems are in demand for their versatility in creating distinct work zones and enhancing privacy.

End Use Insights

The demand for FF&E among hospitality establishments held a market share of 42.91% in 2023. The demand for FF&E in the hospitality sector is growing due to the industry's increased focus on enhancing guest experiences through design and functionality. Hotels, resorts, and other hospitality businesses are investing in high-quality, aesthetically pleasing furnishings and fixtures to create distinctive environments that align with brand identity and customer expectations. With rising competition and the proliferation of boutique and luxury accommodations, the need for customized, design-centric FF&E solutions has become critical. In addition, the trend towards sustainability and smart technology integration in hospitality spaces is further driving demand, as properties aim to offer both environmental efficiency and a seamless, modern guest experience.

The demand for FF&E among offices is anticipated to grow at a CAGR of 7.9% from 2024 to 2030. In the office environment, the growth in demand for FF&E is being fueled by the shift towards flexible workspaces and the rising importance of employee well-being. Modern office designs emphasize collaborative spaces, ergonomic furniture, and multifunctional fixtures to enhance productivity and accommodate a more dynamic workforce. As businesses adopt open-plan offices and hybrid work models, there is a growing need for modular, adaptable FF&E that can be easily reconfigured to meet changing needs. Furthermore, companies are increasingly focusing on creating healthier, more comfortable environments for their employees. This has spurred the demand for ergonomically designed furniture and fixtures that promote well-being and support long-term productivity.

Regional Insights

The furniture, fixtures, and equipment (FF&E) market in North America held a share of 35.98% of the global revenue in 2023. In North America, outside the U.S., demand for FF&E is being fueled by the significant growth in sectors such as hospitality, education, and healthcare, particularly in Canada and Mexico. The hospitality industry, in particular, is witnessing increased investment in boutique and luxury hotels, which require customized and aesthetically appealing FF&E solutions to attract discerning travelers. In addition, as more companies prioritize employee well-being and productivity, the corporate sector is investing in ergonomic furniture and technology-integrated fixtures to create adaptive and efficient workspaces. Meanwhile, the healthcare industry’s ongoing infrastructure modernization, including the development of senior living facilities and hospitals, is also driving the demand for specialized, durable, and functional FF&E products.

U.S. Furniture, Fixtures, And Equipment Market Trends

The furniture, fixtures, and equipment (FF&E) market in the U.S. is expected to grow at a CAGR of 7.0% from 2024 to 2030. In the U.S., the growing demand for FF&E is driven by robust expansion across the real estate, hospitality, and corporate sectors. With increasing investments in commercial construction, including hotels, offices, and mixed-use developments, there is a heightened need for high-quality, functional, and design-forward furnishings. The rise of boutique hotels and co-working spaces, coupled with the growing importance of sustainability and wellness in interior design, is pushing businesses to invest in modern, eco-friendly FF&E solutions. Furthermore, the shift towards hybrid work models in the corporate world is leading to greater demand for modular and flexible office furniture that supports both in-person collaboration and remote work environments.

Asia Pacific Furniture, Fixtures, And Equipment Market Trends

Asia Pacific furniture, fixtures, and equipment (FF&E) market accounted for a revenue share of around 29.08% in the year 2023. In the Asia-Pacific region, rapid urbanization and infrastructure development are major drivers of FF&E demand. As cities expand and new residential, commercial, and hospitality projects emerge, there is an increasing need for innovative and flexible furniture and fixtures that cater to smaller, more efficient living and working spaces. The region’s booming hospitality sector, particularly in countries like China, India, and Southeast Asia, is also pushing demand for customized, design-centric FF&E solutions as hotels seek to differentiate themselves in a highly competitive market. In addition, growing consumer spending power and evolving lifestyle preferences are encouraging greater investment in premium, eco-friendly, and technologically advanced FF&E products across both residential and commercial sectors.

Europe Furniture, Fixtures, And Equipment Market Trends

The Europe furniture, fixtures, and equipment (FF&E) market is projected to grow at a CAGR of 5.7% from 2024 to 2030. In Europe, the market is expanding due to a strong emphasis on sustainability and energy efficiency in both residential and commercial construction. Governments across the region are implementing green building regulations and offering incentives for eco-friendly construction, encouraging businesses to invest in sustainable FF&E solutions. The rise of smart cities and the increasing number of refurbishment and renovation projects in heritage properties also contribute to this demand, as modern, technology-integrated furnishings are needed to update existing spaces. In addition, the hospitality industry’s focus on offering distinctive, design-oriented experiences to meet the expectations of an increasingly discerning clientele has further boosted demand for high-end, customized FF&E in the region.

Key Furniture, Fixtures, And Equipment Company Insights

The competitive landscape of the FF&E market is characterized by the presence of a diverse range of players, including multinational corporations, regional manufacturers, and specialized boutique firms. Large global companies dominate the market with their extensive distribution networks, strong brand equity, and ability to offer comprehensive, turnkey solutions encompassing design, production, and installation. These firms often leverage economies of scale and advanced technological capabilities to provide innovative, sustainable, and customizable products, positioning themselves as preferred partners for large-scale commercial projects.

Conversely, regional and boutique firms compete by offering tailored, highly specialized products that cater to niche segments or unique design preferences, often prioritizing craftsmanship, customization, and local market expertise. Many of these smaller players are gaining market share by focusing on sustainable and eco-friendly materials, as well as by fostering close relationships with clients in the hospitality, corporate, and residential sectors.

Key Furniture, Fixtures, And Equipment Companies:

The following are the leading companies in the furniture, fixtures, And equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Kimball International Inc.

- Global Furniture Group

- Steelcase Inc.

- Herman Miller, Inc.

- Stryker Medical

- Ashley Furniture Industries, Inc.

- Inter IKEA Systems B.V.

- Century Furniture LLC.

- Haworth International, Ltd

- Teknion

Recent Developments

-

In March 2024, IKEA unveiled MITTZON, designed to address evolving work trends. MITTZON featured 85 products focusing on flexibility, ergonomics, and sustainability. Its acoustic screens use recyclable wood fiber for sound absorption. The screens feature a removable, machine-washable cover and are made from 85-95% renewable wood fiber, offering effective sound absorption. Lightweight and movable with lockable castors, it is ideal for flexible room division. The screen can be stacked when not in use and includes a whiteboard/pinboard that attaches to clamps, allowing notetaking and picture display on both sides. With a total thickness of 50 mm, it provides ideal acoustic performance.

-

In November 2023, Innovations in Lighting, a Los Angeles-based custom lighting manufacturer, introduced Elisterno Outdoors, a high-end line of UL wet-rated outdoor chandeliers, at the Boutique Design Show in New York (BDNY). The new product line received a highly positive reception from the design community. Aimed at both residential and commercial markets, Elisterno Outdoors caters to the increasing demand for curated outdoor spaces by seamlessly combining luxury with durability. The line is particularly suited to businesses such as hotels, restaurants, and event venues, offering a sophisticated solution for enhancing outdoor environments.

Furniture, Fixtures, And Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 137.02 billion |

|

Revenue forecast in 2030 |

USD 204.92 billion |

|

Growth Rate |

CAGR of 6.9% from 2024 to 2030 |

|

Actuals |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, Australia & New Zealand, South Korea, Brazil, and South Africa |

|

Key companies profiled |

Kimball International Inc.; Global Furniture Group; Steelcase Inc.; Herman Miller, Inc.; Stryker Medical; Ashley Furniture Industries, Inc.; Inter IKEA Systems B.V.; Century Furniture LLC.; Haworth International, Ltd; Teknion |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

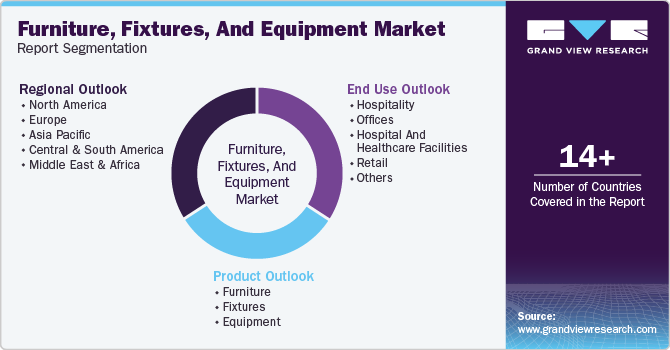

Global Furniture, Fixtures, And Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global furniture, fixtures, and equipment (FF&E) market report based on product, end use, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Furniture

-

Fixtures

-

Equipment

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitality

-

Offices

-

Hospital and Healthcare facilities

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."