- Home

- »

- Renewable Chemicals

- »

-

Furfural Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Furfural Market Size, Share & Trends Report]()

Furfural Market (2023 - 2030) Size, Share & Trends Analysis Report By Process (Quaker Batch Process), By Raw Material (Corn Cob), By Application (Furfuryl Alcohol), By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-301-0

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Furfural Market Summary

The global furfural market size was estimated at USD 556.74 million in 2022 and is projected to reach USD 954.36 million by 2030, growing at a CAGR of 7.0% from 2023 to 2030. Increasing demand for furfuryl alcohol due to rising concerns for renewable products is estimated to fuel the market growth in the near future.

Key Market Trends & Insights

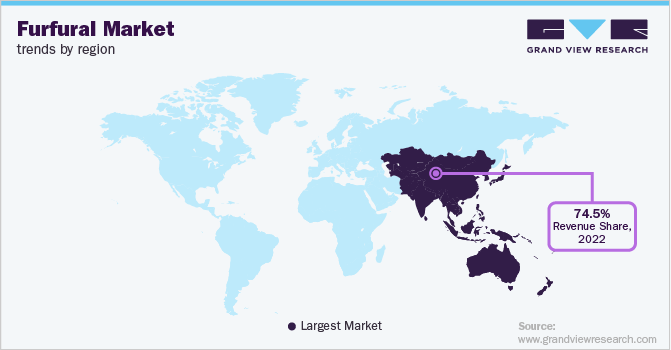

- Asia Pacific dominated the global market with the highest revenue share of 74.5% in 2022.

- By process, the Chinese-based process segment dominated the market with the highest revenue share of 82.0% in 2022.

- By raw material, corn cobs segment dominated the global market with the highest revenue share of 70.5% in 2022.

- By end use, the refineries end-use segment dominated the market with the highest revenue share of 50.8% in 2022.

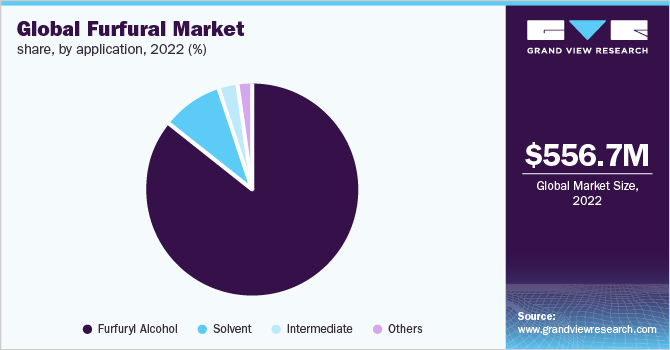

- By application, The furfuryl alcohol segment dominated the market with the highest revenue share of 86.0% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 556.74 Million

- 2030 Projected Market Size: USD 954.36 Million

- CAGR (2023-2030): 7.0%

- Asia Pacific: Largest market in 2022

Furfural is primarily used as a solvent or intermediate in numerous end-use industries, including foundries, pharmaceuticals, paints & coating, agriculture, chemicals, refineries, automotive, construction, and others. The demand for furfural in various refractory materials, such as bricks, fiberglass, and ceramic composites, is expected to increase during the course of the forecasted period due to the growing construction industry. In addition, rising demand for environmental products due to the depletion of fossil fuel resources is expected to drive the market.

Furfural is primarily used as a solvent or intermediate in numerous end-use industries, including foundries, pharmaceuticals, paints & coating, agriculture, chemicals, refineries, automotive, construction, and others. The demand for furfural in various refractory materials, such as bricks, fiberglass, and ceramic composites, is expected to increase during the course of the forecasted period due to the growing construction industry. In addition, rising demand for environmental products due to the depletion of fossil fuel resources is expected to drive the market.

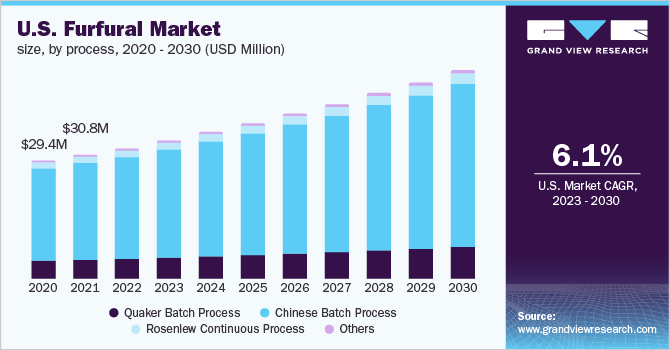

The U.S. is expected to observe considerable growth due to the extensive usage of furfuryl alcohol in plastic and resins. Plastics are utilized in numerous end-user industries due to their less weight, the advantages of low cost, water resistance, and durability. Thus, the demand for furfural alcohol is boosting the furfural market demand. Furthermore, with the growing research activities in the field of rocketry fuel, the consumption of furfuryl alcohol is likely to boost market growth in the coming years.

The U.S. refining sector has shown remarkable growth during the last decade, in terms of increased capacity, increasing investments, and a fine balance of petroleum exports and imports. Exxon Mobil Corporation, Marathon Petroleum Corp., Phillips 66 Company, Valero Energy Corporation, BP PLC, and Chevron Corp. are the key players holding the leading market share in the U.S. petroleum refining sector.

The market had been negatively impacted by the COVID-19 pandemic, owing to a drop in prices since 2020. China is a noteworthy producer of furfural and furfuryl alcohol and accounts for more than 80.0% share of the global production. The outbreak of coronavirus affected the global market, with manufacturers facing issues regarding the availability of supplies until the conditions normalized across the globe. However, key end-use applications including food & beverages, and pharmaceuticals are estimated to fuel the product demand in the near future, considering the stability witnessed in these industries.

Process Insights

The Chinese-based process segment dominated the market with the highest revenue share of 82.0% in 2022. This is attributed to the general use of the Chinese batch process in various small-scale manufacturing facilities, mainly in China, which accounts for a prominent share of the market. A high amount of furfural is manufactured in China, and the Chinese batch process is estimated to produce furfural at a larger scale.

The process usually makes use of corncob as a feedstock. This process contrasts the Quaker batch process wherein the digesters do not spin. The digesters comprise huge cylinders in which steam is delivered at five bars over a static bed, which is around 8 m tall with a diameter of 1.5 m. The process is used on a commercial scale in China and achieves a furfural yield of approx. 30.0-40.0%.

The Quaker batch process is one of the oldest methods used to produce furfural. Quaker Oats Company established the original production process at its Cedar Rapids manufacturing facility in the U.S. The process is not much used nowadays, except for established and top manufacturing plants such as Central Romana Corporation. Central Romana Corporation was established as a joint venture by a Dominican sugar mill and Quaker Oats, for the commercialization of the Quaker batch process to produce furfural.

The Rosenlew continuous process is the most efficient and requires the least amount of maintenance. However, this technique is rarely favored by medium and small-sized companies because of its high steam consumption, low manufacturing yield, and high production costs. Since the Chinese batch procedure is less expensive, most firms favor it.

Raw Material Insights

Corn cobs dominated the global market with the highest revenue share of 70.5% in 2022. This is attributable to corncobs having a high pentosane concentration of about 31.0%; they are utilized as a raw material in the manufacturing of furfural. In addition, the high yield from corncob makes it an ideal raw material and thus, is used in approximately 70.0% of global furfural production. Synthesis of furfural from corncob comprises hydrolysis, pre-treatment, purification, and separation processes. Thus, corncob is the most desirable raw material for furfural production.

Sugarcane bagasse is a majorly used agro-industrial byproduct. Several industrial facilities that process sugarcane, like sugar mills and individual distilleries, may get enormous amounts of sugarcane bagasse at less cost. Significant amounts of sugarcane are grown in Brazil, China, India, and Thailand, which makes bagasse broadly accessible in these nations' economies. Additionally, sugar mills can augment bagasse production to increase the amount that is available for use as a raw material by using a gas-fired boiler. Because it is expensive and challenging to store bagasse, a furfural factory must be situated adjacent to a sugar mill.

End-use Insights

The refineries end-use segment dominated the market with the highest revenue share of 50.8% in 2022. This is attributable to furfural being broadly used as a solvent in petroleum refining, specialist adhesives, and lubricants. It can be transformed by hydrogenation into 2-methyl tetrahydrofuran and 2-methyl furan, which are further used as gasoline additives. Furthermore, the mounting demand for lubricants in the industrial and automotive sectors is expected to augment petroleum refining activities and considerably boost the demand for furfural in the petroleum refining sector.

In the agrochemical sector, furfural is extensively used as a nematicide, insecticide, and fungicide. It is an active component of several nematicides, including crop guards and protectors. In horticulture, the chemical is also applied as a weed killer. Furfural is a contact nematicide that is applied in relatively low concentrations and transported or mechanically integrated into the soil during irrigation. It is relatively safe and easy to use as an agrochemical.

The paints & coatings sector is facing challenges related to environmental pollution, as a significant amount of stone oil products, such as dimethylbenzene and benzene, is used to synthesize paints. Petroleum solvent is a huge threat to the environment as well as to the operating person. Furfural solvents are bio-based and thus, preferably used by manufacturers as a substitute for petroleum-based solvents in the paints & coatings sector. The expansion of the paints & coatings sectors along with stringent regulations and restrictions concerning the use of synthetic chemicals is expected to drive the product demand in the paints & coatings sector.

Furfural is a compound of ascorbic acid (vitamin C), which is a substantial constituent of fruit juices and wines. It is also used as a flavoring agent in a broad range of food products, as well as non-alcoholic and alcoholic beverages. Furfural is added in excess during winemaking to increase the life span of the drink. Food & beverage emerged as one of the prominent manufacturing industries in Europe. This can be attributed to the increasing consumption of wine, beverages, and convenience food products.

Application Insights

The furfuryl alcohol segment dominated the market with the highest revenue share of 86.0% in 2022. This is attributed to furfuryl alcohol being frequently used in the industry as a binder because of the use of foundries. Furan resin, a significant chemical feedstock used in the production of coatings, cement, adhesives, thermoset polymer matrix composites, and casting resins, is largely produced by using furfuryl alcohol. The petroleum and refining industries use furfuryl alcohol, an organic compound that is also used as a solvent.

Furfural has been used for many years as a chemical raw material for the formulation of Nylon 6,6 and Nylon 6. Furfural is also used as a chemical intermediate in the manufacture of tetrahydrofuran and furan. It is predominantly used as an intermediate for producing another furan derivative like furoic acid and pesticides.

The demand for the solvent is anticipated to increase due to the growing usage of furfural as a selective solvent for the refinement of lubricating oils and rosin. Additionally, it serves as a wetting agent in the manufacture of brake linings, refractory materials, abrasive wheels, and a solvent in the extraction of mineral oils. Moreover, it eliminates dienes from several other hydrocarbons found in plastic and nylon. In the near future, solvent expansion is anticipated to be sparked by expanding product demand for solvent-based processes like lubricating oil and butadiene extractions.

Furfural has been used for many years as a chemical raw material for the formulation of Nylon 6, 6 & Nylon 6. Furfural is also used as a chemical intermediate in the manufacture of tetrahydrofuran and furan. It is predominantly used as an intermediate for producing other furan derivatives like furoic acid and pesticides.

Regional Insights

Asia Pacific dominated the global market with the highest revenue share of 74.5% in 2022. This is attributed to the growth in the region due to the huge furfural production, especially in China, along with growth in several end-use industries, including agriculture, food & beverages, pharmaceuticals, and refineries, in the economies of China, India, and Japan.

The Asia Pacific market is further expected to witness high growth on account of the rising consumption of furfural from agriculture; for instance, approximately 58.0% of India's population relies primarily on agriculture for their livelihood, according to the India Brand Equity Foundation (IBEF). The demand for agricultural products is being driven by a large population and expanding rural and urban incomes.

The North American market has observed substantial growth during the last decade due to the presence of well-established chemical and fertilizer manufacturers across the region. Furfural is currently produced by Pennakem LLC in the U.S. Majority of the product is imported from China, the Dominican Republic, and South Africa. In addition, North America is expected to observe considerable growth soon due to the developing pharmaceutical sector and the growing inclusion of this product for drug synthesis.

Key Companies & Market Share Insights

The competition in the global furfural market is highly dependent on the quality of the product, the number of manufacturers & distributors, and their geographical presence. The prominent producers are focusing on formulating bio-based oils, along with various strategic initiatives, including acquisitions & mergers, stepping up their R&D efforts directed at creating novel and inventive solutions and goods, among other things. A number of stakeholders and participants in the market on a global scale are also concentrating on expanding their manufacturing capacities. Some of the key players in the global furfural market include:

-

Illovo Sugar Africa (Pty.) Ltd

-

Linzi Organic Chemical Inc. Ltd.

-

Trans Furans Chemicals bvba

-

Central Romana Corporation

-

DalinYebo

-

Hebeichem

-

KRBL Ltd.

-

Silva team S.p.a.

-

LENZING AG

Furfural Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 595.14 million

Revenue forecast in 2030

USD 954.36 million

Growth rate

CAGR of 7.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD thousand, Volume in tons, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Process, raw material, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Saudi Arabia; South Africa; Turkey

Key companies profiled

Illovo Sugar Africa (Pty.) Ltd; Linzi Organic Chemical Inc. Ltd.; Trans Furans Chemicals bvba; Central Romana Corporation; DalinYebo; Hebeichem; KRBL Ltd.; Silva team S.p.a.; LENZING AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Furfural Market Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global furfural market report based on the process, raw material, application, end-use, and region:

-

Process Outlook (Revenue, USD Thousand; Volume, Tons, 2018 - 2030)

-

Quaker Batch Process

-

Chinese Batch Process

-

Rosenlew Continuous Process

-

Others

-

-

Raw Material Outlook (Revenue, USD Thousand; Volume, Tons, 2018 - 2030)

-

Corn cob

-

Sugarcane Bagasse

-

Sunflower Hull

-

Rice Husk

-

Others

-

-

Application Outlook (Revenue, USD Thousand; Volume, Tons, 2018 - 2030)

-

Furfuryl Alcohol

-

Solvent

-

Intermediate

-

Others

-

-

End-use Outlook (Revenue, USD Thousand; Volume, Tons, 2018 - 2030)

-

Agriculture

-

Paints & Coatings

-

Pharmaceuticals

-

Food & Beverage

-

Refineries

-

Others

-

-

Regional Outlook (Revenue, USD Thousand; Volume, Tons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

Turkey

-

-

Frequently Asked Questions About This Report

b. The global furfural market is expected to grow at a compound annual growth rate of 7.0% from 2023 to 2030 to reach USD 954.36 million by 2030.

b. The Asia Pacific dominated the furfural market with a share of 74.5% in 2022. This is attributable to the rising production and export of furfuryl alcohol, due to the growing demand for furan resins.

b. Some key players operating in the furfural market include Teiling, Central Romana Corp., International Furan Chemicals, TransFurans Chemicals, Penn A Kem LLC, and Sugar Illovo Ltd.

b. Key factors that are driving the furfural market growth include the industry shift toward minimizing dependence on conventional petrochemicals on account of growing environmental concerns.

b. The global furfural market size was estimated at USD 556.74 million in 2022 and is expected to reach USD 595.14 million in 2023.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.