- Home

- »

- Renewable Chemicals

- »

-

Furfural Derivatives Market Size And Share Report, 2030GVR Report cover

![Furfural Derivatives Market Size, Share & Trends Report]()

Furfural Derivatives Market (2023 - 2030) Size, Share & Trends Analysis Report By Product By Route (Tetrahydrofuran, Cyclopentanone), By Product By Application (1-5 Pentanediol, Furoic Acid), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-132-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Furfural Derivatives Market Summary

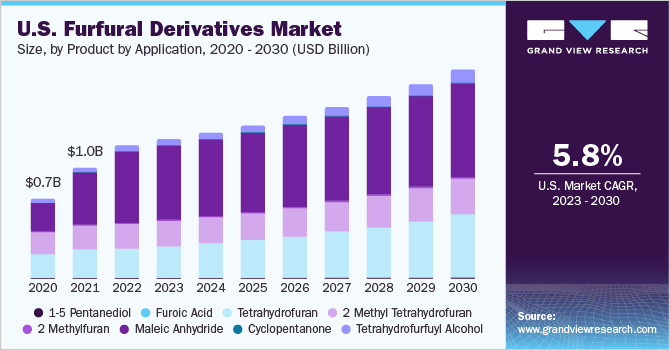

The global furfural derivatives market size was estimated at USD 12.48 billion in 2022 and is projected to reach USD 21.84 billion by 2030, growing at a CAGR of 7.24% from 2024 to 2030. The market growth is attributed to the product’s crucial role in the production of biofuels like biodiesel and biojet fuel.

Key Market Trends & Insights

- Asia Pacific dominated the market with a revenue share of 66.1% in 2022.

- China has been one of the leading consumers of these derivatives globally

- Based on product by application, the tetrahydrofuran (THF) product segment dominated the market with a revenue share of 46.2% in 2022.

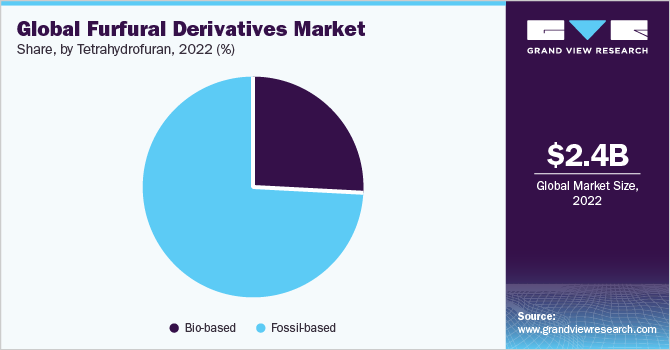

- Based on product by route, the fossil-based route dominated the tetrahydrofuran segment with a revenue share of 68.5% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 12.48 Billion

- 2030 Projected Market Size: USD 21.84 Billion

- CAGR (2024-2030): 7.24%

- Asia Pacific: Largest market in 2022

The global push for renewable and low-carbon energy sources is a significant factor driving the demand for these derivatives. They are commonly used as a solvent in the production of paints, coatings, and varnishes. They help dissolve resins, pigments, and other components, contributing to the formulation of quality coatings.

Furfural derivatives are derived from furfural, which is an organic compound produced from various agricultural byproducts, such as corncobs, oat hulls, and sugarcane bagasse. The manufacturing processes for furfural derivatives can vary depending on various factors, such as the desired product, choice of reactants, catalysts used, and reaction conditions. In addition, stringent safety and environmental protocols are often followed in the production of furfural derivatives to ensure safe and sustainable manufacturing processes.

These products are considered more environmentally friendly alternatives to traditional petrochemical-based compounds. This appeal to sustainability has driven interest in furfural-derived chemicals. In addition, the ongoing research and development efforts of key market participants focused on finding new applications and improving the production processes for furfural derivatives are expected to contribute to their increasing consumption over the forecast period.

Product By Application Insight

The tetrahydrofuran (THF) product segment dominated the market with a revenue share of 46.2% in 2022. This is attributed to the growing utilization of the product in the production of poly-tetramethylene glycol (PTMEG), a polymer widely employed in the manufacturing of urethane elastomers and fibers. The demand for PTMEG has been steadily rising due to its outstanding characteristics, including remarkable flexibility and elasticity.

THF is used as a solvent in coatings, adhesives, and sealants. With the expanding construction and automotive sectors, the demand for these products has increased, thereby boosting the market growth. In addition, the product is utilized in pharmaceutical manufacturing processes, particularly in the synthesis of certain active pharmaceutical ingredients (APIs) and as a reaction medium. The growing pharmaceutical industry across the globe is expected to have a positive impact on the market over the forecast period.

Maleic anhydride was the second-largest product segment and is predicted to grow at a significant growth rate during the forecast period. The product is used in the production of unsaturated polyester resins, which are widely used in the construction industry owing to their low cost & weight and excellent aesthetic value. Moreover, as these composites can be pigmented without losing their structural properties, the demand for these composites is on the rise, and the trend is expected to continue over the forecast period.

Product By Route Insight

The fossil-based route dominated the tetrahydrofuran segment with a revenue share of 68.5% in 2022.The growth is attributed to the adoption of the fully synthetic Reppe process as a main method for producing tetrahydrofuran across the globe due to the dependence of the furfural process on agricultural conditions leading to uncertainty in its supply. In the Reppe method, the initial step involves utilizing ethyne and formaldehyde as the starting materials to generate 1,4-butanediol. Tetrahydrofuran is subsequently produced through the acid-catalyzed dehydration of 1,4-butanediol with the assistance of an acidic ion exchange resin.

Fossil-based tetrahydrofuran can be manufactured to high levels of purity, which is crucial for applications in the pharmaceutical, polymer, and electronics industries where impurities can be detrimental. Also, it is often more cost-effective to produce compared to bio-based alternatives. The abundance of petrochemical feedstocks can contribute to lower production costs.

The bio-based route dominated the 2 methyl tetrahydrofuran segment with a revenue share of 78.8% in 2022.The growth is attributed to the fact that it is generally synthesized by the catalytic hydrogenation of furfural. The production of bio-based 2 methyl tetrahydrofuran often has a lower carbon footprint compared to petroleum-based production, leading to reduced greenhouse gas emissions. It is generally considered less toxic than some traditional solvents, reducing health and safety risks in handling and disposal.

Regional Insights

Asia Pacific dominated the market with a revenue share of 66.1% in 2022. This is attributed to the presence of several agrarian economies in the region producing agricultural wastes that are valuable feedstock for the production of furfural. Several countries in the region have adopted environmentally friendly and sustainable practices. Furfural and its derivatives are considered eco-friendly chemicals, aligning with these initiatives and encouraging their use.

China has been one of the leading consumers of these derivatives globally due to its robust industrial and agricultural sectors. China produces significant amounts of agricultural residues, such as corncobs, rice husks, and bagasse, which are used as feedstocks for furfural production. This readily available source of raw materials contributes to the consumption of furfural and its derivatives.

Europe was the second-largest region and accounted for a revenue share of 12.7% in 2022. The region has some of the most stringent environmental regulations globally, which have encouraged the adoption of eco-friendly chemicals like furfural derivatives in various industries. European countries are increasingly utilizing agricultural residues, such as wheat straw and oat hulls, as feedstocks for furfural production. This contributes to the availability of raw materials for furfural derivatives.

Key Companies & Market Share Insights

Key players are investing in R&D to develop new products, enhance production processes, and improve sustainability. For instance, in September 2023, Pyran scaled up a cost-advantaged biobased alternative to petroleum-based 1,5 pentanediol that is high-performing and sustainable. Companies that prioritize sustainability, environmental responsibility, and green chemistry practices have a competitive advantage, especially in regions with stringent environmental regulations.Some of the prominent players in the global furfural derivativesmarket include:

-

Pyran

-

Pennakem, LLC

-

TransFurans Chemicals bvba

-

BASF SE

-

UBE Corporation

-

Yuanli Chemical Group

-

Hefei Home Sunshine Pharmaceutical Technology Co., Ltd.

-

AB Enterprises

-

Hefei TNJ Chemical Industry Co.,Ltd.

-

International Furan Chemicals B.V.

Furfural Derivatives Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 13.15 billion

Revenue forecast in 2030

USD 21.84 billion

Growth rate

CAGR of 7.24% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in tons, revenue in USD thousand and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product by application, product by route, region

Regional scope

North America; Europe; Asia Pacific; CSA; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Pyran; Pennakem, LLC; TransFurans Chemicals bvba; BASF SE; UBE Corp.; Yuanli Chemical Group; Hefei Home Sunshine Pharmaceutical Technology Co., Ltd.; AB Enterprises; Hefei TNJ Chemical Industry Co. Ltd.; International Furan Chemicals B.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Furfural Derivatives Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the furfural derivatives market report on the basis of product by application, product by route, and region:

-

Product by Application (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

1-5 Pentanediol

-

Polyester Resin

-

Plasticizer

-

Polyurethane

-

Glutaraldehyde

-

Other Applications

-

-

Furoic Acid

-

Plastic Plasticizers

-

Food Preservatives

-

Pharmaceutical Intermediates

-

Other Applications

-

-

Tetrahydrofuran

-

Polytetramethylene Ether Glycol

-

Solvents

-

Other Applications

-

-

2 Methyl Tetrahydrofuran

-

Chemicals

-

Electronics

-

Medical

-

Oil

-

Other Applications

-

-

2 Methylfuran

-

Pharmaceutical

-

Agriculture

-

Chemical

-

Other Applications

-

-

Maleic Anhydride

-

Unsaturated Polyester Resin

-

Furfural

-

Additives (Lubricants & Oil)

-

Copolymers

-

Other Applications

-

-

Cyclopentanone

-

Personal Care Products

-

Electronics

-

Insulating Construction Materials

-

Fuel and Fuel Additives

-

Other Applications

-

-

Tetrahydrofurfuyl Alcohol

-

Resins

-

Solvents

-

Corrosion Inhibitors

-

Other Applications

-

-

-

Product by Route (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

1-5 Pentanediol

-

Bio-based

-

Fossil-based

-

-

Furoic Acid

-

Bio-based

-

Fossil-based

-

-

Tetrahydrofuran

-

Bio-based

-

Fossil-based

-

-

2 Methyl Tetrahydrofuran

-

Bio-based

-

Fossil-based

-

-

2 Methylfuran

-

Maleic Anhydride

-

Bio-based

-

Fossil-based

-

-

Cyclopentanone

-

Bio-based

-

Fossil-based

-

-

Tetrahydrofurfuyl Alcohol

-

-

Regional Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global furfural derivatives market is expected to grow at a compound annual growth rate of 7.2% from 2023 to 2030 to reach USD 21.84 billion by 2030.

b. Asia Pacific dominated the furfural derivatives market with a share of 66.1% in 2022. This is attributable to the presence of several agrarian economies in the region producing agricultural wastes that are valuable feedstocks for the production of furfural.

b. The global furfural derivatives market size was estimated at USD 12.48 billion in 2022 and is expected to reach USD 13.15 billion in 2023.

b. Some key players operating in the furfural derivatives market include Pyran, Pennakem, LLC, TransFurans Chemicals bvba, BASF SE, UBE Corporation, Yuanli Chemical Group, Hefei Home Sunshine Pharmaceutical Technology Co., Ltd., AB Enterprises, Hefei TNJ Chemical Industry Co.,Ltd., and International Furan Chemicals B.V.

b. Key factors that are driving the market growth include the growing demand for sustainable and bio-based chemicals along with the wide range of applications of furfural derivatives in different industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.