- Home

- »

- Agrochemicals & Fertilizers

- »

-

Fungicides Market Size, Share, Industry Trends Report, 2030GVR Report cover

![Fungicides Market Size, Share & Trends Report]()

Fungicides Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Inorganic, Dithiocarbamtes, Biofungicides, Benzimidazoles), By Application (Cereals & Grains, Fruits & Vegetables, Oilseeds & Pulses), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-674-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fungicides Market Summary

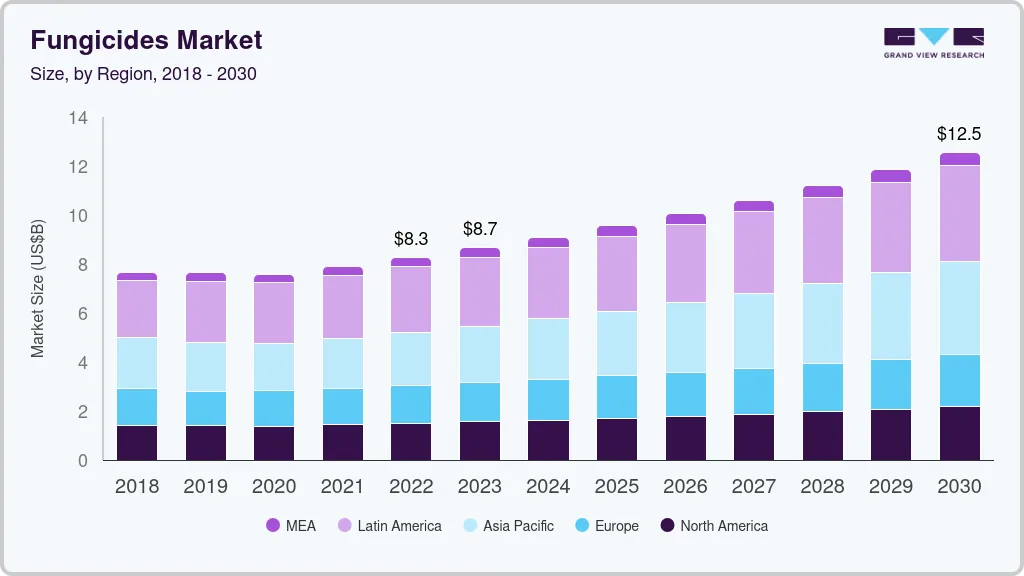

The global fungicides market size was estimated at USD 19.59 billion in 2024 and is projected to reach USD 27.32 billion by 2030, growing at a CAGR of 5.8% from 2025 to 2030. This growth is attributed to the increasing global population driving higher demand for food production, necessitating enhanced crop yields.

Key Market Trends & Insights

- The Asia Pacific fungicides market dominated the global market with the revenue share of 39.1% in 2024.

- Country-wise, The fungicides market in China dominated the Asia Pacific market in 2024.

- By product, the inorganic fungicides segment accounted for the largest revenue share of 29.2% in 2024.

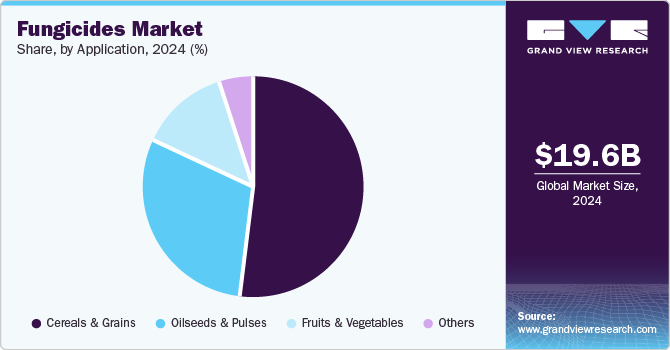

- By application, the cereals and grains segment accounted for the largest revenue share of 51.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 19.59 Billion

- 2030 Projected Market Size: USD 27.32 Billion

- CAGR (2025-2030): 5.8%

- Asia Pacific: Largest market in 2022

In addition, the rising prevalence of fungal diseases threatens crops, making fungicides essential for protecting agricultural output. In addition, advancements in farming technologies and growing awareness among farmers regarding the benefits of fungicides further support market expansion. Moreover, the shift towards sustainable agriculture and integrated pest management practices is fostering the development of innovative fungicide solutions.Fungicides are a crucial category of pesticides widely utilized in agriculture to combat various fungal diseases that threaten crop health. Their primary function is to eliminate fungi and their spores, reducing issues such as blight, rust, and mildew, which can severely damage crops. The growth of the fungicide market is closely linked to the increasing global population and the corresponding demand for food production.

Fungicides are particularly prevalent in cultivating fruits, vegetables, and rice, as they help enhance agricultural yields by controlling fungal growth. The rising consumption of these crops is driven by their health benefits and changing dietary preferences, alongside advancements in poultry farming practices and innovative fungicide formulations. Climate change predictions and the growing incidence of crop diseases further amplify the need for effective fungicides.

Furthermore, consumer health concerns have increased demand for high-quality vegetables, while new farming technologies contribute to improved crop productivity. Despite these positive trends, the fungicide market faces challenges such as increased soil toxicity risks and stringent government regulations regarding product approvals. Nevertheless, the market is expected to thrive in the coming years, particularly with the growing interest in bio-based fungicides that offer sustainable alternatives to traditional chemical options. The fungicide market is poised for significant growth as it adapts to emerging agricultural needs and environmental considerations.

Product Insights

The inorganic fungicides led the market and accounted for the largest revenue share of 29.2% in 2024. These products are often recognized for their effectiveness in controlling various fungal diseases, making them popular among farmers. Furthermore, the increasing demand for high agricultural yields and the need to protect crops from severe infestations drive their usage. Moreover, advancements in formulation technologies have improved the performance and safety profiles of inorganic fungicides, enhancing their appeal in modern agriculture.

The biofungicides segment is expected to grow at a CAGR of 8.9% over the forecast period, owing to rising consumer awareness about environmental sustainability and health concerns associated with synthetic chemicals. In addition, farmers are increasingly adopting biofungicides as they provide effective disease management while minimizing ecological impact. Furthermore, the growing trend towards organic farming and integrated pest management practices further fuels this demand. Moreover, agricultural biotechnology innovations enhance the efficacy and formulation of biofungicides, making them more attractive options for sustainable crop protection strategies.

Application Insights

The cereals and grains segment led the market and accounted for the largest revenue share of 51.9% in 2024 attributed to the increasing demand for staple crops such as corn, wheat, and rice. As these crops are essential for food security, farmers seek effective fungicides to protect them from fungal diseases that can cause significant yield losses. In addition, advancements in fungicide formulations, including high-technology products that offer long-lasting protection, enhance crop quality and productivity. This focus on maximizing yields to meet the needs of a growing population further drives the segment's growth.

The fruits and vegetable application segment is expected to grow at a CAGR of 6.4% over the forecast period, owing to changing dietary preferences and an increase in health-conscious consumers. Farmers increasingly rely on fungicides to safeguard their crops from fungal infections that affect quality and shelf life as demand for fresh produce rises. In addition, innovations in fungicide products, including biofungicides that align with organic farming practices, are also gaining traction. Furthermore, regulatory approvals for new active ingredients enhance the effectiveness of disease management strategies in this segment, driving its expansion.

Regional Insights

The fungicides market in North Americais expected to grow significantly over the forecast period, primarily due to its well-established agricultural sector with advanced farming techniques. In addition, the increasing adoption of integrated pest management (IPM) practices enhances the demand for fungicides as farmers seek sustainable solutions to combat fungal infections. Furthermore, regulatory support for innovative crop protection products further fosters market growth in this region.

U.S. Fungicides Market Trends

The U.S. fungicides market dominated North America with the largest revenue share in 2024 attributed to a strong emphasis on agricultural productivity and technological advancements. Farmers increasingly adopt precision agriculture techniques, integrating fungicide applications with data-driven decision-making to optimize crop health. In addition, the rising awareness of fungal threats to crop yields drives demand for effective fungicide solutions. Moreover, ongoing research into new formulations and active ingredients supports innovation in crop protection strategies, ensuring that U.S. agriculture remains competitive and productive.

Asia Pacific Fungicides Market Trends

The Asia Pacific fungicides market dominated the global market with the largest revenue share of 39.1% in 2024 attributed to rapid urbanization and increasing food demand due to a burgeoning population. Countries such as China and India are major agricultural producers, cultivating diverse crops that require effective disease management solutions. In addition, adopting advanced agricultural practices and technologies and government initiatives to enhance crop productivity further fuels the demand for fungicides. Furthermore, the growing awareness among farmers regarding the benefits of using fungicides to protect yields from fungal diseases significantly contributes to market expansion.

The fungicides market in China dominated the Asia Pacific market and accounted for the largest revenue share in 2024, owing to the country's significant agricultural output and the need for effective crop protection. In addition, the increasing prevalence of fungal diseases and rising consumer demand for high-quality produce drive farmers to adopt fungicides as essential tools for safeguarding their crops. Furthermore, government support for modern agricultural practices and investments in research and development is enhancing the availability of innovative fungicide products.

Latin America Fungicides Market Trends

The Latin America fungicides market is expected to grow at a CAGR of 5.5% from 2025 to 2030, owing to fluctuating climatic conditions that have led to increased disease outbreaks, necessitating effective crop protection measures. In addition, the rising demand for food due to population growth compels farmers to enhance crop productivity, further boosting fungicide usage. Furthermore, the shift towards sustainable agriculture, including adopting biopesticides and integrated pest management practices, also positively influences market dynamics.

Europe Fungicides Market Trends

The fungicides market in Europeis growing steadily due to increasing consumer demand for high-quality food products and stringent regulations promoting sustainable agriculture. Farmers are also turning to fungicides to protect their crops from various fungal diseases while adhering to environmental standards. The emphasis on integrated pest management practices encourages using fungicides as part of holistic farming strategies. Furthermore, advancements in bio fungicide development align with Europe’s shift towards more eco-friendly agricultural practices, further driving the segment growth.

The growth of the France fungicides market is largely influenced by a strong agricultural tradition focused on high-quality produce such as wine grapes and cereals. In addition, the increasing incidence of fungal diseases necessitates effective control measures, prompting farmers to invest in fungicide solutions. France's commitment to sustainable farming practices also drives demand for bio-based fungicides as alternatives to traditional chemical products. Furthermore, government initiatives to improve agricultural efficiency and productivity contribute significantly to fostering a favorable environment for fungicide usage in French agriculture.

Key Fungicides Company Insights

Some of the key players in the market include Nufarm Ltd., FMC Corporation, DuPont, and others. These companies employ various strategies to enhance their competitive edge. Strategic partnerships and collaborations are frequently established to leverage shared expertise and resources, facilitating innovation in product development. In addition, companies focus on launching new fungicide products that meet evolving agricultural needs, emphasizing sustainability and effectiveness. Furthermore, mergers and acquisitions are also common, allowing firms to expand their market presence and diversify their product portfolios.

-

FMC Corporation specializes in developing and manufacturing innovative crop protection solutions, including fungicides, insecticides, and herbicides. The company operates across various segments, focusing on agriculture, turf and ornamental, and professional pest management. FMC’s fungicide portfolio includes advanced products designed to combat multiple fungal diseases affecting key crops such as fruits, vegetables, and grains, reinforcing its commitment to enhancing agricultural productivity and sustainability.

-

DuPont produces various agricultural products, including fungicides that protect crops from fungal threats. The company operates in multiple segments, including agriculture, nutrition, and biotechnology. DuPont's fungicide offerings are integrated into broader crop protection strategies, targeting various crops such as cereals, fruits, and vegetables. By leveraging its extensive research capabilities, DuPont continuously develops innovative solutions that address the evolving challenges faced by farmers in maintaining crop health and maximizing yields.

Key Fungicides Companies:

The following are the leading companies in the fungicides market. These companies collectively hold the largest market share and dictate industry trends.

- Nufarm Ltd.

- FMC Corporation

- DuPont

- BASF Agricultural Solutions

- Cheminova A/S

- Bayer CropScience

- Syngenta AG

- Dow AgroSciences

- Lanxess AG

- Monsanto

- Adama Agricultural Solutions

- Simonis B.V.

Recent Developments

-

In June 2024, BASF Agricultural Solutions announced the launch of Cevya, a new rice fungicide in China. This is the first isopropanol triazole fungicide approved for rice applications in two decades, designed to combat rice false smut and manage fungicide resistance. Cevya's active ingredient, mefentrifluconazole, offers rice growers an innovative solution to enhance crop yields. BASF has conducted extensive field trials since 2020, collaborating with leading agricultural institutions to ensure its effectiveness and safety in disease management.

-

In August 2023, Bayer AG announced a significant investment of EUR 220 million in a new research and development facility at its Monheim site, marking its largest commitment to Crop Protection in Germany in 40 years. This state-of-the-art facility focuses on developing innovative fungicides and other chemicals that prioritize environmental and human safety.

Fungicides Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 20.60 billion

Revenue forecast in 2030

USD 27.32 billion

Growth rate

CAGR of 5.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Indonesia; Brazil; Argentina; South Africa; Egypt

Key companies profiled

Nufarm Ltd.; FMC Corporation; DuPont; BASF Agricultural Solution; Cheminova A/S; Bayer CropScience; Syngenta AG; Dow AgroSciences; Lanxess AG; Monsanto; Adama Agricultural Solutions; Simonis B.V.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fungicides Market Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the Fungicides market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Inorganics

-

Benzimidazoles

-

Dithiocarbamtes

-

Triazoles & diazoles

-

Biofungicides

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Cereals and Grains

-

Oilseeds and Pulses

-

Fruits and Vegetables

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Egypt

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.