Functional Textile Finishing Chemicals Market Size, Share & Trends Analysis Report By Product (Antimicrobial/Anti-inflammatory, Flame Retardant, Repellant & Release, Temperature Regulation), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-432-1

- Number of Report Pages: 135

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

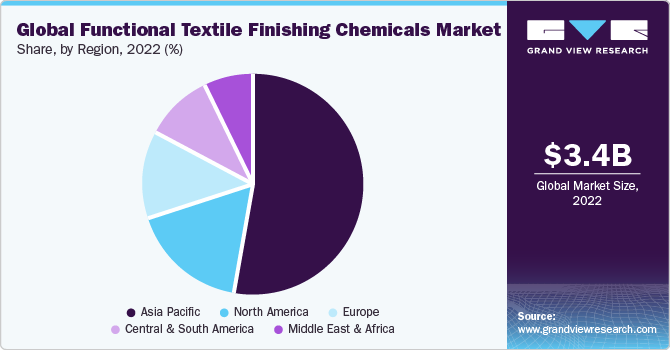

The global functional textile finishing chemicals market size was valued at USD 3.36 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030. A textile functional finishing agent comprises epoxy polyether lateral chains and a water-soluble polysiloxane with polyether, integrated with organic properties, particularly antimicrobial and anti-inflammatory substances, catalysts, and cross-linking agents. Through a surface modification process, novel textile products are produced, which alters the fabric's performance properties such as adhesion, optical appearance, and hydrophilicity. This process involves the use of various functional finishing agents such as flame-resistant, soil release, water and stain repellent, crease-resistant, durable press, and others.

However, stringent environmental guidelines regarding the harmful impacts of chemicals are expected to emerge as a key restraint to the overall market development. Water shortages and supply of polluted water caused by rigorous activities performed in the fabric industry is anticipated to have far-reaching regional consequences in the manufacturing countries. Moreover, strict environmental regulations including Emission Trading System (ETS) that are implemented to restrict the excessive usage of toxic fabric chemicals is anticipated to hinder market growth.

Global performance textile finishing manufacturers are adopting advanced technologies for the improvement of clothing to meet growing consumer demands as per their end-use specifications. However, product sustainability mainly depends on the raw materials and the functionality it offers. Utilization of performance finishing determines the product end-use and helps to heighten its shelf-life.

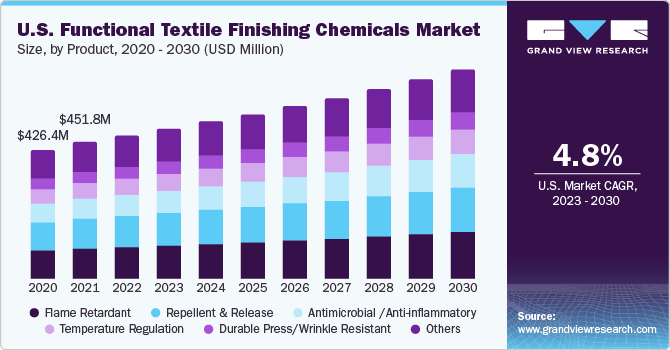

Textile specialty performance dying agents have the capability to improve fabric versatility by making it stronger, durable, and enhancing its original physical properties. The U.S. functional textile finishing agents industry is driven by the presence of key multinational producers; continuous R&D work to discover cutting edge techniques, including nano-coatings, enzyme immobilization, and encapsulation; and the development of protective garments.

Increasing concerns regarding the damage caused by exposure to sunlight, microbes, pesticides, chemicals, pollutants, and UV lights have heightened the demand for protective fabrics in the country. Furthermore, the implementation of advanced techniques to produce smart, interactive, and intelligent clothing, coupled with the expansion of production lines to support the growing textile demand, are some of the factors boosting the industry’s growth.

In the United States, as the demand for alternate specialty finishing agents, and eco-friendly & cost-effective technologies is rising among manufacturers, the demand for garments offering optimum protection & efficiency has also amplified. Rising purchasing power and consumer spending towards high-quality fabric products, especially in Mexico and Canada, are expected to influence industry growth in North America in the coming years positively.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 53.3% in 2022. Increasing textile chemical production in emerging economies, including India, China, Bangladesh, and Vietnam, along with favorable government initiatives undertaken to promote this industry, are factors anticipated to drive regional market growth. Moreover, the increasing utilization of smart textiles such as anti-microbial and flame-retardant fabrics is expected to benefit and have a positive impact on the Asian market.

Key manufacturers are focusing on restructuring their business portfolios, increasing production lines, and financing to develop niche products. The formation of strict regulatory frameworks promoting the usage of shielding fabrics in the healthcare industry and macroeconomic factors such as rapid urbanization, along with the burgeoning population in major regional economies, are responsible for triggering strong market growth in Asian countries.

On the other hand, the Middle East & Africa region is expected to expand at a CAGR of 5.5% during the forecast period. The demand for functional textile finishing chemicals in this region is driven by factors such as the growing regional population, increasing urbanization, and a rising middle-class demographic with greater purchasing power. Additionally, there is a growing awareness of the importance of advanced textile finishes that offer benefits such as water repellency, stain resistance, and antimicrobial properties, in this region.

Product Insights

The repellent and release segment held the largest revenue share of 21.9% in the functional textile finishing chemicals market in 2022. Water-repellent chemicals prevent water from penetrating fabrics, while still allowing moisture or air to pass through. Durable water repellents and resistant agents are applied as topical finishes to fibers, offering protection against water, stains, oil, soil, insects, and other unwanted substances.

Traditional methods of applying specialty finishes often result in undesirable characteristics such as a loss of fabric feel and drape, added weight, poor durability, lack of mechanical strength, and reduced wearer comfort. To overcome these limitations, advanced techniques are employed to create innovative textile products with exceptional properties, providing protection against staining, discoloration, and deterioration in quality.

Functional coating methods offer a versatile alternative to conventional dyeing approaches, as they can be used with various fabric types, enable the combination of different functionalities in a subtle manner, and require only small quantities of additives.

Demand for temperature-regulated fabrics is also expected to witness high growth over the forecast period. Textile manufacturers are involved in producing microencapsulated thermoregulation finishes that continuously emit and absorb heat energy depending on the ambient temperature.

The antimicrobial/anti-inflammatory segment is expected to advance at the fastest CAGR of 6.2% over the forecast period. These specialized finishes offer distinct advantages, particularly in the context of health and hygiene. Antimicrobial agents help inhibit the growth of bacteria, fungi, and other microorganisms on textile surfaces, making them ideal for products in healthcare settings, sportswear, and other environments where hygiene is of paramount importance.

Key Companies & Market Share Insights

Companies are actively investing in new product development, business alliances, collaborations, and other strategic initiatives to gain a competitive edge in the market. The primary reason for such industry approaches is to increase the supplier base and production capacity of companies to sustain competition over the long term.

Key Functional Textile Finishing Chemicals Companies:

- Dow

- Bayer AG

- BASF SE

- Sumitomo Chemical Co., Ltd.

- Huntsman International LLC

- Kemira

- Evonik Industries AG

- OMNOVA Solutions Inc.

- Lubrizol Corporation

Recent Developments

-

In October 2022, TEIJIN FRONTIER CO., LTD. unveiled a cutting-edge automated production facility in Thailand, specifically designed for manufacturing polyester filaments. This advanced facility is equipped with multi-spindle spinning machines, allowing for the incorporation of functional agents into the polyester filament yarn. The company expects the facility to reach its full production capacity of about 1,500 tons of polyester filaments per year by March 2024

-

In May 2022, HeiQ Materials AG and Alchemie Technology joined forces to create HeiQ Life, a botanical odor control solution. This innovative product utilizes the Novara digital finishing technology, which boasts remarkable sustainability features, consuming 92 percent less water and 84 percent less energy compared to traditional methods. HeiQ Life can be applied to all types of textiles and seamlessly integrates with other finishes, including fabric softeners and wicking agents, without encountering any compatibility issues. This groundbreaking product is anticipated to play a crucial role in mitigating pollution caused by the textile industry, while also reducing production costs

Functional Textile Finishing Chemicals Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 3.54 billion |

|

Revenue forecast in 2030 |

USD 5.09 billion |

|

Growth rate |

CAGR of 5.3% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Report update |

October 2023 |

|

Quantitative units |

Volume in kilotons, revenue in USD million/billion, and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Taiwan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Egypt |

|

Key companies profiled |

Dow; Bayer AG; BASF SE; Sumitomo Chemical Co., Ltd.; Huntsman International LLC; Kemira; Evonik Industries AG; OMNOVA Solutions Inc.; Lubrizol Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Functional Textile Finishing Chemicals Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global functional textile finishing chemicals market report on the basis of product, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Antimicrobial /Anti-inflammatory

-

Flame retardant

-

Repellent and Release

-

Temperature Regulation

-

Durable Press/Wrinkle Resistant

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Taiwan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global functional textile finishing chemicals market size was estimated at USD 3.36 billion in 2022 and is expected to reach USD 3.54 billion in 2023.

b. The global functional textile finishing chemicals market is expected to grow at a compound annual growth rate of 5.3% from 2023 to 2030 to reach USD 5.1 billion by 2030.

b. Asia Pacific dominated the functional textile finishing chemicals market with a share of 53.3% in 2022. This is attributable to the increasing demand for innovative and advanced functional textiles from automotive and other prominent end-use industries in the region.

b. Some key players operating in thefunctional textile finishing chemicals market include Dow Chemical Company, Bayer AG, BASF SE, Sumitomo Chemicals Co., Ltd, Huntsman International LLC, Kemira, Evonik Industries, Omnova Solutions Kiri Industries Limited, and Lubrizol Corporation

b. Key factors that are driving the market growth include growth in demand for biological control finishes such as antimicrobial or anti-inflammatory textile finishing products across the globe.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."