Functional Safety Market Size, Share & Trends Analysis Report By Device (Safety Switches, Safety Sensors), By System (Emergency Shutdown Systems, Distributed Control Systems), By Industry (Oil & Gas, Power Generation), By Region, & Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-266-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Functional Safety Market Size & Trends

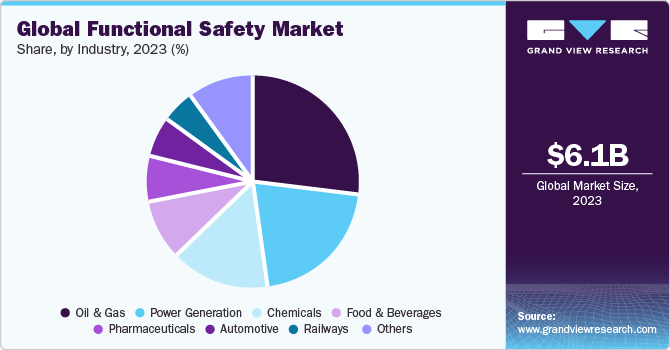

The global functional safety market size was estimated at USD 6.12 billion in 2023 and is projected to grow at a CAGR of 6.3% from 2024 to 2030. The rising demand for industrial automation and awareness of workplace safety drive the market growth. The market focuses on the development, implementation, and maintenance of safety systems that ensure the safe operation of machinery, equipment, and processes in various industries.

The demand for functional safety solutions is growing due to the increased integration of advanced technologies in various industries to boost efficiency and productivity. Companies are increasingly investing in technologies that ensure the safe operation of machinery and equipment, thereby reducing the risk of accidents and ensuring a secure working environment for employees. According to the U.S. Bureau of Labor Statistics, 5,486 workers died of industrial accidents in 2022, which was a 5.7% increase in deaths as compared to 2021.

The increasing awareness of workplace safety has further amplified the need for functional safety solutions across various industries. By investing in functional safety technologies such as safety sensors, programmable safety systems, and safety controllers, companies are mitigating hazards and preventing accidents in the workplace. This approach enhances worker safety, improves operational efficiency, and reduces downtime.

With the rise of Industry 4.0 and the Internet of Things (IoT), businesses are adopting automation to streamline processes, improve accuracy, and boost overall productivity. However, as automation systems become more complex and interconnected, the importance of functional safety standards grows. Implementing robust safety measures safeguards employees and assets and also helps companies comply with regulatory requirements and industry standards.

Market Concentration & Characteristics

The industry growth stage is medium and the pace of the market is accelerating. The functional safety industry is fragmented, featuring several global and regional players. The market players are investing in research & development (R&D) to develop advanced solutions and gain a competitive edge in the market.

The market is characterized by a high degree of innovation, with companies continuously developing cutting-edge solutions to enhance safety measures in various industries. This focus on innovation drives market differentiation and fosters the introduction of new products and services to meet evolving safety requirements. In November 2023, United Safety & Survivability Corporation, a leading provider of advanced safety solutions, launched a Lithium-Ion Battery Failure Detection Sensor that identifies potential failures in their early stages by detecting emitted gases. This sensor can be installed alone or integrated with a fire suppression system to offer a complete detection and suppression solution, establishing a new safety benchmark for electric vehicles across various sectors.

Regulations have a significant impact on the functional safety market, influencing product development, adoption, and compliance requirements. Stringent safety standards and regulations, such as IEC 61508, ISO 26262, and ISO 13849, imposed by governing bodies, necessitate the implementation of robust functional safety measures across industries. Companies are required to adhere to regulatory guidelines to ensure the safety of their operations and employees. Regulatory compliance also serves as a key driver for innovation, pushing companies to develop advanced technologies to meet industry standards.

Device Insights

The safety sensors segment led the market with a share of 25.5% in 2023. The growing adoption of IoT and Industry 4.0 technologies is fueling the demand for advanced safety sensors that provide real-time monitoring, predictive maintenance, and remote diagnostics capabilities. The integration of IoT and Industry 4.0 technologies has revolutionized the way safety sensors operate, enabling them to provide advanced features such as real-time data monitoring and analysis. These capabilities allow companies to proactively identify potential safety risks, predict maintenance requirements, and remotely diagnose issues, thereby minimizing downtime and optimizing operational performance.

The programmable safety systems segment is anticipated to grow at the fastest CAGR over the forecast period, owing to the growing complexity of industrial operations and the need for sophisticated safety solutions. As manufacturing processes become more intricate and interconnected, there is a greater demand for programmable safety systems that adapt to changing conditions, provide flexibility in safety protocols, and integrate seamlessly with existing automation systems.

Systems Insights

The Emergency Shutdown Systems (ESD) segment held the largest revenue share in 2023. Increasing focus on operational safety across industries is driving the adoption of the ESD segment. Companies are prioritizing the implementation of reliable ESD systems to prevent accidents, protect assets, and ensure the safety of personnel in potentially hazardous environments. The need for quick and effective response to emergencies highlights the importance of robust ESD systems that swiftly and automatically shut down critical processes in case of emergencies, minimizing the risk of catastrophic events.

The turbomachinery controls systems segment is expected to witness significant growth over the forecast period.Turbomachinery, including turbines, compressors, and pumps, plays a critical role in various industries such as oil and gas, power generation, petrochemicals, and aerospace. Any malfunction or failure in turbomachinery systems can lead to severe consequences, including production downtime, equipment damage, environmental hazards, and personnel safety risks. Functional safety solutions, including safety instrumented systems (SIS) and safety PLCs, are deployed to mitigate these risks by implementing safety functions that automatically respond to hazardous conditions and bring the system to a safe state, thereby ensuring the safe operation of turbomachinery systems and preventing accidents.

Industry Insights

The oil & gas segment led the market with the largest revenue share in 2023. This can be attributed to the high-risk nature of oil and gas operations. The industry's focus on preventing accidents, protecting personnel, and minimizing environmental risks necessitate the implementation of robust functional safety solutions. Companies in the oil and gas sector invest in advanced safety technologies to ensure the reliability and integrity of their operations, comply with stringent safety regulations, and maintain operational continuity.

The automotive segment is expected to grow at a rapid CAGR over the forecast period. The growing demand for connected and autonomous vehicles is fueling the demand for advanced functional safety technologies in the automotive industry. Connected vehicles rely on complex communication networks and sensors to enable features such as vehicle-to-vehicle (V2V) communication, telematics, and remote diagnostics. Autonomous vehicles require sophisticated safety systems to ensure safe operation, hazard detection, and fail-safe mechanisms. Functional safety solutions play a crucial role in enabling these advanced vehicle technologies, supporting safe and reliable autonomous driving capabilities.

Regional Insights

North America held the largest market share of 34.0% in 2023. The proliferation of AI and ML applications across industries is propelling the demand for advanced functional safety solutions that can ensure safe and reliable operations in complex environments. Companies in North America are harnessing the power of AI and ML to enhance safety protocols, optimize operational efficiency, and mitigate risks in various sectors such as manufacturing, automotive, and healthcare.

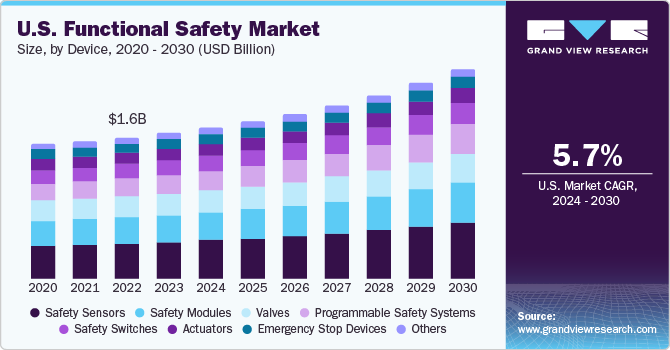

U.S. Functional Safety Market Trends

The U.S. accounted for a revenue share of 27.2% in 2023. The country leads in the development of autonomous vehicles, driving the adoption of functional safety systems by necessitating advanced safety measures to ensure the reliability of autonomous systems. Autonomous vehicle manufacturers adhere to international standards such as ISO 26262, which specifies requirements for functional safety in automotive systems. Compliance with this standard ensures that safety measures are systematically integrated into the vehicle’s development process.

Asia Pacific Functional Safety Market Trends

The Asia Pacific market is anticipated to grow at the fastest CAGR during the forecast period. The region is undergoing rapid urbanization and technological advancement, resulting in a significant rise in the adoption of functional safety solutions for smart city initiatives. As cities in the region embrace digital transformation and interconnected technologies to address urban challenges, the need to ensure the safety and reliability of complex urban systems becomes increasingly crucial. Functional safety plays a pivotal role in safeguarding interconnected infrastructure, such as smart transportation networks, energy grids, and public services, against potential risks and ensuring the seamless operation of smart city solutions.

The China functional safety market is expected to grow at a significant CAGR over the forecast period.China's strategic emphasis on electric vehicles (EVs) as an essential element of sustainable transportation is propelling the demand for functional safety solutions within the burgeoning EV market. As China leads the global shift towards electrification in the automotive sector, ensuring the safety and reliability of electric vehicle systems is critical.

The functional safety market in India is expected to grow significantly over the forecast period owing to the growing awareness and adoption of functional safety practices in manufacturing processes. As companies within the Indian pharmaceutical industry increasingly recognize the critical importance of safety measures, there is a growing focus on ensuring product integrity and compliance with stringent regulations. Functional safety principles are integral to pharmaceutical manufacturing operations, where precision, quality, and safety are essential to producing medications that meet high standards of efficacy and safety for consumers.

Key Functional Safety Company Insights

Some of the key players operating in the market include ABB Ltd.; Rockwell Automation Inc.; and Honeywell International Inc.

-

ABB Ltd. is a Swedish-Swiss multinational corporation that specializes in power and automation technology. The company operates in various industries, including utilities, industry, transport and infrastructure, and others. Their offerings include programmable safety controller Pluto, safety controller Vital, safety relay Sentry, and other safety sensors, drives and switches.

-

Honeywell is a transnational conglomerate that functions in various industries, including building technologies, aerospace, performance materials, and safety and productivity solutions. The company provides innovative solutions for a wide range of applications. Their functional safety offerings include ControlEdge HC900, Fail Safe Controller, Safety Manager, and Safety Manager SC.

Modelwise and Ascent Labs are among the emerging market participants.

-

Modelwise specializes in providing automated functional safety products and solutions for various industries. Functional safety is a critical aspect of product development, particularly in industries such as automotive, aerospace, industrial automation, and medical devices, where the failure of a system could result in serious consequences. Paitron is their key functional safety suite.

-

Ascent Labs specializes in providing products and solutions dedicated to ensuring functional safety. Among its offerings is the ASSURE Risk Management Platform, meticulously crafted to employ secure safety assurance and risk-mitigation principles for intricate systems. This platform facilitates the detection and alleviation of potential failures in assisted and self-driving systems while simultaneously guaranteeing operational safety in the event of such failures.

Key Functional Safety Companies:

The following are the leading companies in the functional safety market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- DEKRA Group

- Emerson Electric Co.

- Endress+Hauser Management AG

- General Electric Company

- HIMA Paul Hildebrandt GmbH

- Honeywell International Inc.

- Omron Corporation

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Yokogawa Electric Corporation

- Modelwise

- Ascent Labs

Recent Developments

-

In October 2023, Rockwell Automation Inc. launched the latest services, systems, hardware, and industrial software and announced plans to showcase them at the Automation Fair 2023 at the Boston Convention and Exhibition Center. The event exhibited functional safety products such as FLEX 5000 I/O, GuardLogix L85ES controller, and 432ES GuardLink EtherNet/IP Adapter.

-

In April 2023, OMRON Corporation launched the NX502 automation & programmable safety systems and the NX-EIP201 EtherNet/IPTM units globally. These controllers offer advanced information and safety control. They utilize OMRON's advanced information processing and large capacity memory to reduce resource disposal losses and shorten lead times when changing production lines.

-

In September 2022, Siemens launched its Fire Safety Digital Services, a comprehensive range of digital and managed services that link fire safety systems to the cloud. This empowers businesses to transition from a reactive, compliance-focused strategy to comprehensive protection through smart safety measures. Through the adoption of these digital services, clients can enhance their ability to identify and prevent hazards, make informed risk management choices, safeguard business operations, and ensure the safety of individuals and valuable assets within their environments.

Functional Safety Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 6.38 billion |

|

Revenue forecast in 2030 |

USD 9.21 billion |

|

Growth rate |

CAGR of 6.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Device, systems, industry, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

ABB Ltd.; DEKRA Group; Emerson Electric Co; Endress+Hauser Management AG; General Electric Company; HIMA Paul Hildebrandt GmbH; Honeywell International Inc.; Omron Corporation; Rockwell Automation Inc.; Schneider Electric SE; Siemens AG; Yokogawa Electric Corporation; Modelwise; Ascent Labs |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Functional Safety Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global functional safety market report based on device, system, industry, and region:

-

Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Safety Sensors

-

Safety Modules

-

Valves

-

Programmable Safety Systems

-

Safety Switches

-

Actuators

-

Emergency Stop Devices

-

Others

-

-

Systems Outlook (Revenue, USD Million, 2018 - 2030)

-

Emergency Shutdown Systems

-

Fire & Gas Monitoring Controls

-

Turbomachinery Controls Systems

-

Burner Management Systems

-

High Integrity Pressure Protection Systems

-

Distributed Control Systems

-

Supervisory Control and Data Acquisition Systems

-

-

Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Power Generation

-

Chemicals

-

Food & Beverages

-

Pharmaceuticals

-

Automotive

-

Railways

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global functional safety market size was estimated at USD 6.12 billion in 2023 and is expected to reach USD 6.38 billion in 2024

b. The global functional safety market is expected to grow at a compound annual growth rate of 6.3% from 2023 to 2030 to reach USD 9.21 billion by 2030

b. North America dominated the functional safety market with a share of 34.0% in 2023. The proliferation of AI and ML applications across industries is propelling the demand for advanced functional safety solutions that can ensure safe and reliable operations in complex environments.

b. Some key players operating in the functional safety market include ABB Ltd.; DEKRA Group; Emerson Electric Co; Endress+Hauser Management AG; General Electric Co.; HIMA Paul Hildebrandt GmbH; Honeywell International Inc.; Omron Corporation; Rockwell Automation Inc.; Schneider Electric SE; Siemens AG; Yokogawa Electric Corporation; Modelwise; Ascent Labs

b. Factors such as rising need for industrial automation and growing awareness of workplace safety are driving the market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."