- Home

- »

- Consumer F&B

- »

-

Functional Chewing Gums Market, Industry Report, 2030GVR Report cover

![Functional Chewing Gums Market Size, Share & Trends Report]()

Functional Chewing Gums Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Smoking Cessation, Oral Health, Fitness & Well-being, Others), By Distribution Channel (Hypermarkets & Supermarkets, Convenience Stores), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-074-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Functional Chewing Gums Market Summary

The global functional chewing gums market size was estimated at USD 2.17 billion in 2024 and is projected to reach USD 3.76 billion by 2030, growing at a CAGR of 9.7% from 2025 to 2030. Consumers are increasingly becoming more focused on their wellness and looking for functional products to deliver health benefits.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Asia Pacific region is expected to register the fastest CAGR from 2025 to 2030.

- By product, smoking cessation chewing gums dominated the market with 41.1% of the revenue share in 2024.

- By distribution channel, the online segment is anticipated to be the fastest growing segment from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 2.17 Billion

- 2030 Projected Market Size: USD 3.76 Billion

- CAGR (2025-2030): 9.7%

- North America: Largest market in 2024

Functional chewing gums are marketed as offering advantages beyond those provided by their conventional counterparts, such as improving oral health and offering stress relief, energy boost, and digestion support. Moreover, extensive promotion of these products through retail stores and social media platforms has helped drive customer awareness, aiding the growth of the functional chewing gums industry.

The increasing focus on oral and dental health worldwide has been a major driver for market expansion in recent years. According to the Oral Health Foundation, chewing sugar-free gum helps stimulate saliva production, which clears away food and rinses bacteria. It strengthens the teeth while also reducing acid in the mouth, which weakens tooth enamel. Gums containing fluoride, xylitol, or other ingredients that promote oral hygiene are being marketed by dentists and healthcare professionals. The ease of chewing gum for on-the-go dental care, especially after meals, has contributed to the increasing preference for products with additional benefits. Another area where functional chewing gums have found extensive application is fitness, as some products can help consumers manage weight when combined with other prescriptions. The growing number of gym-goers has created a major opportunity for companies, as they can incorporate ingredients such as caffeine to provide a quick energy boost and enhance endurance, focus, and alertness, making it ideal for pre-workout usage.

In recent years, there have been several innovations in functional chewing gums that have enabled their expanded application scope. Gums formulated with vegan-friendly ingredients that provide the same functional benefits without animal-derived ingredients such as gelatin have become popular. Many consumers prefer gums that are made with organic, non-GMO substances and are free from artificial sweeteners, colors, and preservatives. These offerings cater to the demand for clean-label and natural products. As facial fitness becomes a trend among the health-conscious demographic, there has been an emergence of products that claim to provide a chiseled jawline to elevate the appearance of the skin, making it more youthful. For instance, JAWCKO is a U.S.-based company that develops chewing gums promoting oral health and facial fitness. The company sells four variants of its products currently in the U.S., with plans to expand to Canada, Mexico, and Europe in the near future. These developments are expected to ensure the healthy expansion of the functional chewing gums industry.

Product Insights

The smoking cessation chewing gums segment accounted for the largest revenue share of 41.1% in the global market in 2024. As per the World Health Organization, tobacco is known to cause more than 8 million deaths annually, which includes around 1.3 million people who are exposed to passive smoking. Rising awareness about the harms of smoking and implementation of initiatives that encourage quitting this lifestyle have helped drive segment growth. Smoking cessation gums are suggested by medical professionals, while smokers are registered in Nicotine Replacement Therapy programs. These solutions deliver nicotine to the smokers’ body to lower withdrawal symptoms during cessation and act as a substitute oral function to lessen the urge to smoke. The availability of nicotine gums in a range of flavors, including mint, fruit, and cinnamon, further drives their appeal among consumers.

Meanwhile, the oral health segment is anticipated to grow at the highest CAGR during the forecast period. Consumers are becoming more aware of the long-term benefits of preventive dental care. Chewing gums that help prevent cavities, reduce plaque, and promote overall oral hygiene have gained popularity as a proactive approach to dental health. Moreover, increased public awareness campaigns from dental professionals and oral health organizations about the importance of oral hygiene and the role of chewing gums in maintaining oral health have helped boost demand. The widespread prevalence of bad breath (halitosis) further drives segment demand, with a report by Cleveland Clinic stating that this condition impacts 25% of the global population. Ingredients such as menthol, eucalyptus, and spearmint are often used to mask bad breath, making these gums particularly popular among consumers looking for convenient breath freshening solutions.

Distribution Channel Insights

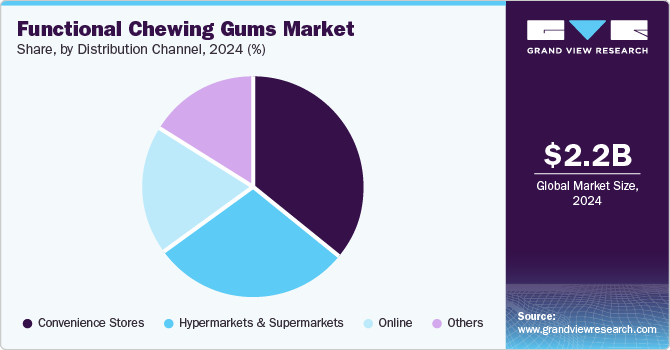

The convenience stores segment accounted for the largest revenue share in the global market in 2024, as these products are extensively sold through such outlets to customers living nearby or casually visiting such stores. Consumers who frequently take walks after heavy meals visit these stores to purchase chewing gums to maintain fresh breath and improve their oral health. The increasing availability of these stores has made them a highly convenient option for buying chewing gums along with various other daily necessities.

The online segment is expected to grow at the highest CAGR from 2025 to 2030 in the global functional chewing gums industry. The increasing presence of market competitors on e-commerce platforms such as Amazon and product promotions through social media channels are expected to boost market revenue through this segment. Third-party sellers offer a wide range of products, both from major manufacturers and local producers. These sellers establish a strong supply chain that extends beyond geographical borders, leading to a wider availability of products for consumers purchasing online. Several value-added services, such as discounted prices, cash-on-delivery, and paybacks offered by e-retailers, further strengthen the appeal of online channels.

Regional Insights

The North America functional chewing gums market accounted for the largest global revenue share of 38.1% in 2024. The region has a substantial demographic of smokers who want to quit smoking, driving demand for smoking cessation products such as nicotine gums. Furthermore, the shift towards health and wellness-based lifestyle practices has driven the appeal of functional chewing gums that can provide nutritional value. The emergence of natural and clean-label movements in economies such as the U.S. and Canada have further compelled consumers to seek oral health gums made with natural ingredients, such as natural sweeteners (xylitol and plant extracts) and essential oils (peppermint and eucalyptus).

U.S. Functional Chewing Gums Market Trends

The U.S. functional chewing gums market accounted for a dominant revenue share in the regional market in 2024 due to the rising popularity of wellness-focused lifestyle practices. The fast-growing trend of preventive healthcare has made consumers very proactive in effectively managing their wellness and health. Functional chewing gums, which offer benefits such as cavity prevention, stress relief, and energy boosts, are viewed as convenient solutions to support overall wellness. Additionally, the steadily growing proportion of smokers who want to quit smoking has created major growth avenues for the industry. According to a report by the Centers for Disease Control and Prevention (CDC), in 2022, around 68% of U.S. smokers stated that they wanted to quit the habit. Moreover, over half of the country’s adults stated that they had tried to quit smoking during the previous year (2021). These factors are expected to create a sizeable demand for products such as nicotine gums in the country.

Europe Functional Chewing Gums Market Trends

Europe functional chewing gums market accounted for a substantial revenue share in the global market in 2024. The integration of various health and wellness products into everyday life among regional consumers has created growth opportunities for this market. Functional chewing gums are appealing as they fit into a broader wellness routine, offering benefits such as stress relief, immunity support, and cognitive enhancement. Rising interest in fitness and sports activities has resulted in increased sales of functional gums with electrolytes, BCAAs (branched-chain amino acids), and caffeine. These types of gums are being marketed as performance enhancers, offering hydration, increased energy, and muscle recovery support for active consumers and athletes.

Asia Pacific Functional Chewing Gums Market Trends

The Asia Pacific region is expected to grow at the highest CAGR during the forecast period. Economies such as India, China, and Japan have witnessed a sharp growth in awareness regarding oral and dental hygiene, driving demand for products that can help prevent cavities, control plaque, and maintain fresh breath for longer periods. Moreover, increasing urbanization and busy lifestyles have highlighted the need for chewing gums that can offer instant functional benefits such as boosting energy or improving mental focus. The growing prevalence of digestive issues such as bloating, indigestion, and constipation among regional consumers has further enhanced the availability of products containing probiotics, prebiotics, or digestive enzymes, creating growth avenues for the market.

China functional chewing gums market accounted for a leading revenue share in the Asia Pacific market in 2024. The high proportion of the smoking population and the prevalence of unhealthy lifestyle practices have created a fast-expanding market for functional chewing gums in the economy. According to the WHO, the country is home to around 300 million smokers, which is approximately one-third of the overall global number. In May 2021, the WHO China Office and the National Health Commission’s Planning and Information Department introduced the country’s World No Tobacco Day (WNTD) 2021 campaign along with the launch of the ‘China Cessation Platform’ mini program. The Healthy China 2030 strategy has set an objective to lower the rate of smokers aged 15 years and above by 20% before 2030. Additionally, the Healthy China Action Plan introduced by the Healthy China Promotion Committee has listed tobacco control as a priority. These factors are expected to boost the availability and adoption of products such as smoking cessation gums in the country.

Key Functional Chewing Gums Company Insights

Some major companies involved in the global functional chewing gums industry include Haleon Group of Companies, Peppersmith, and REV GUM, among others.

-

Haleon is a UK-based multinational consumer healthcare company that has several well-known brands, including Sensodyne toothpaste, Centrum vitamins, and Advil painkillers. The company’s brands cater to 5 major categories - Oral Health, Vitamins, Minerals, and Supplements (VMS), Respiratory Health, Pain relief, Digestive Health, and other products. Nicorette is a company brand under the Respiratory Health division that develops nicotine replacement therapy (NRT) products such as lozenges and gums to help people quit smoking. Nicorette’s chewing gums are available in a range of flavors, which include Original, Mint, Spearmint Burst, Fruit Chill, Cinnamon Surge, and White Ice Mint.

-

Peppersmith is a UK-based mint and gum brand that focuses on providing innovative oral health solutions. The company is noted for using natural ingredients and xylitol, which is a sugar substitute that helps improve dental health by reducing cavities and promoting healthier teeth and gums. Peppersmith offers a variety of products that include chewing gums made with 100% xylitol that are available in multiple flavors, as well as mints and pastilles that promote oral health. It also offers subscription services that enable customers to receive gum and mint deliveries every 4 weeks, 8 weeks, or 12 weeks.

Key Functional Chewing Gums Companies:

The following are the leading companies in the functional chewing gums market. These companies collectively hold the largest market share and dictate industry trends.

- CAFOSA

- Haleon Group of Companies (Nicorette)

- Gumlink Confectionery Company A/S

- LOTTE

- Mars, Incorporated

- Ainsworth Dental (Miradent)

- Liquid Core Store

- Peppersmith

- REV GUM

- Hager & Werken GmbH & Co. KG

- Perfetti Van Melle Holding B.V.

Recent Developments

-

In August 2024, Liquid Core Gum Company announced the launch of the EDGE functional gum line, which includes four EDGE Performance formulations available in three flavors and three EDGE Wellness formulations. The lineup leverages a packaging format developed using sustainable cardboard tubes that are highly portable and robust. The newly launched gums utilize the Liquid Core delivery system, which leads to effective and rapid delivery of functional products.

-

In October 2023, Perfetti Van Melle announced that it had acquired the gum business of Mondelēz International in the U.S., Canada, and Europe. The acquisition includes the gum brands Stimorol, Trident, Dentyne, V6, Hollywood, Bubbaloo, Chiclets, and Bubblicious in the three regions, along with noted candy brands such as La Vosgienne and Cachou Lajaunie from Europe. Moreover, Perfetti Van Melle received Mondelēz International’s manufacturing facilities in Illinois, the U.S., and Skarbimierz, Poland, as part of this deal.

Functional Chewing Gums Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.36 billion

Revenue forecast in 2030

USD 3.76 billion

Growth rate

CAGR of 9.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; Argentina; UAE; South Africa

Key companies profiled

CAFOSA; Haleon Group of Companies (Nicorette); Gumlink Confectionery Company A/S; LOTTE; Mars, Incorporated; Ainsworth Dental (Miradent); Liquid Core Store; Peppersmith; REV GUM; Hager & Werken GmbH & Co. KG; Perfetti Van Melle Holding B.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Functional Chewing Gums Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global functional chewing gums market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Smoking Cessation

-

Oral Health

-

Fitness & Well-being

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.