Functional Bakery Ingredients Market Size, Share & Trends Analysis Report By Ingredients (Encapsulates, Enrichments, Delivery Systems), By Application (Bread Products), By Functionality (Nutritional Fortification), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-527-0

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Functional Bakery Ingredients Market Trends

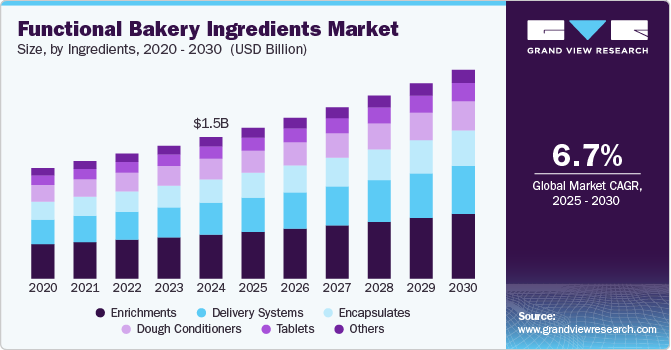

The global functional bakery ingredients market size was estimated at USD 1.54 billion in 2024 and is anticipated to grow at a CAGR of 6.7% from 2025 to 2030. A key trend is the rising consumer awareness of health and wellness, prompting a shift towards bakery products that offer added nutritional benefits. This includes ingredients that enhance the fiber content and protein levels or provide essential vitamins and minerals, catering to increasingly health-conscious consumers seeking guilt-free indulgences. Manufacturers are responding by incorporating ingredients like whole grains, sprouted grains, prebiotics, and probiotics to enhance the perceived health profile of their baked goods.

The increasing prevalence of food allergies and intolerances, particularly gluten sensitivity and dairy intolerance, drives the overall bakery ingredients market growth. This has led to a surge in demand for gluten-free and dairy-free bakery products made with functional ingredients like gluten-free flours (rice, almond, tapioca), plant-based milk alternatives (almond milk, soy milk, coconut milk), and innovative stabilizers and emulsifiers. These ingredients allow manufacturers to produce palatable and appealing free-from-bakery items that cater to a growing population with specific dietary needs. The innovation in this space is rapid, with new ingredients and formulations constantly being developed to improve the taste and texture of these alternative baked goods.

Furthermore, the growing demand for convenience foods and ready-to-eat (RTE) bakery products drives the need for functional ingredients that improve shelf life, texture, and overall eating quality. Functional ingredients such as enzymes, emulsifiers, and preservatives are crucial in maintaining the freshness and stability of packaged bakery items, especially in regions with longer distribution chains and hotter climates. This trend is further amplified by the increasing urbanization and busy lifestyles, leading consumers to seek quick and convenient meal options, which include fortified and readily available bakery products.

Consumers increasingly demand transparency and traceability in their food choices, leading manufacturers to seek natural, non-GMO, and ethically sourced ingredients. This trend drives the demand for plant-based proteins, natural sweeteners, and clean-label preservatives derived from natural sources, such as fermentation extracts or plant-based oils. Companies are increasingly investing in research and development to identify and utilize sustainable and clean alternatives to traditional synthetic bakery ingredients to meet the growing demands of environmentally and health-conscious consumers.

The increasing globalization of food markets and rising disposable incomes in developing countries also contribute significantly to market expansion. As dietary habits evolve and Western-style eating patterns become more prevalent, the demand for healthier and more convenient bakery products is expected to grow exponentially in regions like Asia Pacific and Central & South America. This presents significant opportunities for multinational food companies and ingredient suppliers to capitalize on the growing consumer base and the increasing awareness of the benefits of functional bakery ingredients.

Ingredients Insights

Functional bakery enrichments accounted for a revenue share of 31.0% in 2024, driven by increasing consumer awareness of the health benefits associated with fortified foods. Consumers actively seek products that offer added nutritional value beyond basic sustenance, leading to a greater incorporation of vitamins, minerals, and fiber into baked goods. This trend is fueled by growing concerns about nutrient deficiencies in modern diets, aging populations seeking to maintain health and vitality, and a general interest in preventative healthcare. Key growth areas within enrichments include vitamin D fortification, essential mineral additions like iron and calcium, and increased fiber content through ingredients like beta-glucan and resistant starch. The rise in vegan and vegetarian diets also contributes as individuals look to enriched baked goods to supplement nutrients often found in animal products.

Functional bakery encapsulates are anticipated to witness a growth rate of 7.2% from 2025 to 2030 due to their ability to protect sensitive ingredients, control release, and enhance functionality within baked goods. Encapsulation technology is particularly valuable for preserving bakery ingredients' flavor, aroma, and bioactivity that might otherwise degrade during baking or storage. This allows bakers to incorporate a wider range of functional ingredients, such as probiotics, omega-3 fatty acids, and delicate spices, without sacrificing their desired properties. Moreover, encapsulates can provide controlled release mechanisms, allowing for targeted delivery of specific ingredients at specific points during the baking process or even upon consumption, opening doors to innovative product development and enhanced consumer experiences.

Application Insights

The bread products segment accounted for a revenue share of 38.1% in 2024. Consumers are increasingly seeking bread that offers more than just basic nutrition. They desire products enriched with fiber, whole grains, protein, and prebiotics to support gut health, weight management, and overall well-being. This demand is fueled by growing awareness of the link between diet and health conditions such as diabetes, heart disease, and obesity. Furthermore, innovation in the gluten-free bread market is a significant growth driver, with consumers actively searching for better-tasting and nutritionally superior gluten-free options made with ingredients like ancient grains, tapioca starch, and modified starches that enhance texture and nutritional value. Clean-label ingredients are also paramount, with a growing preference for natural alternatives to synthetic improvers and preservatives.

The cookies & biscuits application is estimated to grow at a CAGR of 7.1% from 2025 to 2030, driven by the desire for indulgence with health benefits. Consumers are increasingly searching for better-for-you cookies and biscuits with reduced sugar content, healthier fats and oils, and added fiber or protein. This demand is particularly strong among health-conscious millennials and Gen Z consumers, who are actively seeking snacks that align with their wellness goals. Incorporating functional bakery ingredients like stevia, monk fruit, and erythritol as sugar replacements, along with whole grain flour and nut butter, is becoming increasingly prevalent.

Functionality Insights

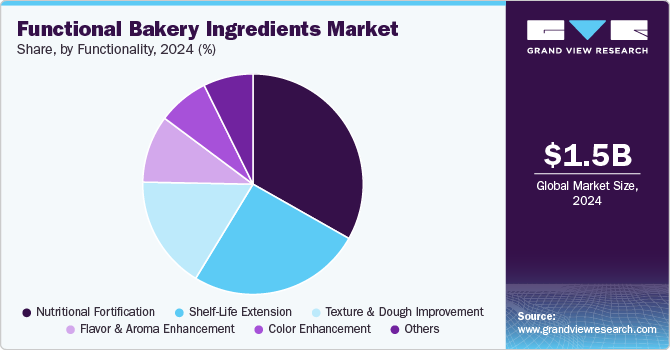

The functional bakery ingredients for nutritional fortifications accounted for a revenue share of 33.2% in 2024, propelled by a growing consumer awareness of the link between diet and health. Consumers increasingly seek bakery products that offer added health benefits beyond basic sustenance, driving manufacturers to incorporate ingredients like vitamins, minerals, fiber, and protein. This trend is further fueled by the rising prevalence of nutrient deficiencies in developing countries and the increasing aging population in developed nations, creating a significant market for fortified bakery goods. Furthermore, specific dietary trends, such as gluten-free, vegan, and keto diets, have opened new avenues for fortification to compensate for potential nutrient gaps associated with these eating patterns, thereby broadening the functional bakery ingredient application.

The shelf-life extension segment is estimated to grow at a CAGR of 7.0% from 2025 to 2030. The trend towards shelf-life extension aligns well with the growth of the packaged and convenience food sectors. As consumers lead increasingly busy lifestyles, they are seeking bakery products that offer ease of use and extended freshness. This drives the demand for ingredients that inhibit microbial growth, prevent oxidation, and maintain moisture levels in baked goods. Moreover, longer shelf-life reduces food waste throughout the supply chain, from production and distribution to retail and consumer consumption. This translates into cost savings for manufacturers and retailers and a reduced environmental footprint through decreased spoilage and disposal. Besides, consumers also benefit from less frequent shopping trips and the ability to store bakery items for longer periods without compromising quality.

Regional Insights

The functional bakery ingredients market in North America held over 30.9% of the global revenue in 2024, driven by a growing consumer awareness of health and wellness, leading to increased demand for products with added nutritional benefits. Consumers actively seek bakery items with higher fiber content, reduced sugar, and fortified with vitamins and minerals. Gluten-free options also remain a significant segment, though the focus is expanding beyond just eliminating gluten to incorporating ingredients that improve these products' overall nutritional profile and taste. Furthermore, the rise of vegan and plant-based diets fuels the need for functional ingredients that can replace animal-derived components while maintaining the desired texture and structure of baked goods.

U.S. Functional Bakery Ingredients Market Trends

The functional bakery ingredients market in the U.S. is expected to grow at a CAGR of 6.2% from 2025 to 2030, owing to the heightened emphasis on specific health concerns like obesity and diabetes. This drives a particularly strong demand for ingredients that help control blood sugar levels and promote weight management, such as resistant starch and prebiotics. The popularity of ketogenic and paleo diets has also significantly influenced ingredient choices, leading to increased use of alternative flours (almond, coconut) and sweeteners that align with these dietary restrictions. The U.S. market is also very sensitive to marketing claims, with consumers actively seeking products highlighting specific health benefits. Besides, the food service sector plays a crucial role in shaping demand in the U.S. Bakeries, restaurants, and cafes increasingly incorporate functional ingredients into their menus to cater to health-conscious customers.

Europe Functional Bakery Ingredients Market Trends

The functional bakery ingredients market in Europe is expected to grow at a CAGR of 6.9% from 2025 to 2030, characterized by a strong emphasis on sustainability and traceability. Consumers are increasingly concerned about the environmental impact of food production and are looking for sustainably sourced ingredients. This translates to a higher demand for organic, non-GMO, and Fair Trade-certified ingredients. Government regulations around health claims and labeling are also more stringent in Europe, which influences the types of functional ingredients that manufacturers can use and how they can market their products.

Germany functional bakery ingredients market is set to grow at a CAGR of about 6.8% from 2025 to 2030. Traditional baking remains popular, but there's growing interest in incorporating functional ingredients to enhance the nutritional profile of classic recipes. Consumers are highly discerning and demand transparency in the supply chain, favoring locally sourced and organically grown ingredients. The "free-from" trend, particularly gluten-free and lactose-free, is well-established, leading to demand for alternatives that maintain the taste and texture of traditional German baked goods. Furthermore, the German market is receptive to innovative bakery products that cater to specific dietary needs, such as sports nutrition and weight management. Strict regulations regarding food additives and processing methods further influence this market's choice of functional ingredients.

The functional bakery ingredients market in the UK is set to grow at a CAGR of about 6.6% from 2025 to 2030, driven by the growing prevalence of health conditions like obesity and cardiovascular disease. This fuels demand for bakery products with reduced sugar, salt, and fat content. The government's initiatives to promote healthier eating habits, such as sugar taxes and front-of-pack labeling, also influence consumer choices and manufacturer formulations. The rise of veganism and plant-based diets is particularly pronounced in the UK, creating a strong demand for functional ingredients that can replace animal products in baking.

France functional bakery ingredients market presents a unique dynamic, balancing a strong tradition of artisanal baking with a growing interest in healthier options. While traditional breads and pastries remain staples, there's increasing demand for functional ingredients that enhance the nutritional value without compromising the taste and texture that French consumers expect. The emphasis is often on incorporating natural and locally sourced ingredients to maintain the authenticity and "terroir" of the baked goods. Ingredients like fibers, prebiotics, and whole grains are increasingly incorporated into bakery products. While the free-from trend is present, it's often approached with a focus on improving the overall nutritional profile rather than simply eliminating allergens.

Asia Pacific Functional Bakery Ingredients Market Trends

The functional bakery ingredients market in Asia Pacific is set to grow at a CAGR of about 7.3% from 2025 to 2030, driven by rising disposable incomes, urbanization, and increasing awareness of health and wellness. The demand for bakery products is expanding beyond traditional offerings, with consumers seeking Western-style breads, cakes, and pastries. This creates opportunities for functional ingredients that can enhance these products' nutritional value and appeal. The aging population in several countries, like Japan and South Korea, also drives demand for bakery products with specific nutritional needs.

Japan functional bakery ingredients market is set to grow at a CAGR of more than 7.2% from 2025 to 2030. The demand is high for bakery products fortified with calcium, vitamin D, and collagen to support bone health and overall well-being. The focus is often on subtle enhancements to traditional Japanese baking techniques and flavors. Moreover, the emphasis on health and beauty is particularly strong in Japan. Functional ingredients like antioxidants and probiotics are increasingly incorporated into bakery products to promote healthy skin and gut function. Besides, consumers are also willing to pay a premium for products with high-quality ingredients and proven health benefits.

The functional bakery ingredients market in China is set to grow at a CAGR of about 7.5% from 2025 to 2030, driven by a rapidly expanding middle class and increasing urbanization. The demand for Western-style baked goods is growing, particularly among younger consumers. This creates opportunities for functional ingredients that can enhance these products' nutritional value and appeal. Moreover, rising disposable incomes also enable consumers to purchase more premium bakery items with added health benefits. Functional ingredients like herbal extracts and traditional ingredients known for their health-promoting properties are increasingly incorporated into bakery products.

Central & South America Functional Bakery Ingredients Market Trends

The functional bakery ingredients market in Central & South America is set to grow at a CAGR of about 6.2% from 2025 to 2030, driven by increasing urbanization, a growing middle class, and rising awareness of health and wellness. While traditional baking practices remain prevalent, a growing demand for enhanced bakery products offers improved nutritional benefits, particularly among younger consumers. The demand is also growing for products made with locally sourced ingredients, reflecting a desire to support local farmers and promote healthier eating habits.

Middle East & Africa Functional Bakery Ingredients Market Trends

The functional bakery ingredients market in the Middle East & Africa is set to grow at a CAGR of about 5.4% from 2025 to 2030, driven by a growing population, rising disposable incomes, and increasing awareness of health and wellness. The demand for bakery products is expanding, with consumers seeking out both traditional and Western-style baked goods. Lifestyle changes, such as increased urbanization and a greater consumption of processed foods, contribute to a rise in health concerns, fueling the demand for functional ingredients.

Key Functional Bakery Ingredients Company Insights

-

Key companies, including dsm-firminich, Kerry Group plc, Cargill, Incorporated, Archer Daniels Midland Company (ADM), Ingredion, Corbion N.V., International Flavors & Fragrances Inc., Tate & Lyle PLC, Lesaffre Group, and BASF SE hold significant positions in the market. These companies boast extensive product portfolios, significant R&D investments, and well-established distribution networks. Their strategies often revolve around developing innovative ingredients catering to consumer demand for healthier, cleaner-label, value-added baked goods. This includes new product launches focused on ingredients that enhance texture, improve shelf life, reduce fat and sugar content, and provide nutritional fortification. Many are also actively pursuing acquisitions and strategic partnerships to expand their product offerings and geographic reach.

-

Beyond organic growth, mergers and acquisitions are a prevalent strategy for companies aiming to consolidate their market position. For example, the acquisition of smaller, innovative ingredient suppliers provides access to niche technologies and specialized product lines. Furthermore, R&D investment is crucial for staying ahead in this dynamic market, with leading companies dedicating significant resources to developing novel ingredients and optimizing existing formulations. Collaborations with research institutions and other industry players are also common, enabling companies to accelerate innovation and address emerging market trends.

Key Functional Bakery Ingredients Companies:

The following are the leading companies in the functional bakery ingredients market. These companies collectively hold the largest market share and dictate industry trends.

- dsm-firminich

- Kerry Group plc

- Cargill, Incorporated

- Archer Daniels Midland Company (ADM)

- Ingredion

- Corbion N.V.

- Tate & Lyle PLC

- International Flavors & Fragrances Inc.

- Lesaffre Group

- BASF SE

Recent Developments

-

In October 2024, Crespel & Deiters Group, a functional wheat ingredients expert, announced it had devised an innovative way to enhance the nutritional profile of baked goods, including pizza and pasta. The company introduced Lory Starch Elara, a resistant wheat starch that increases fiber content while reducing carbohydrates in products such as burger buns and cookies. This ingredient, characterized by its low water-binding capacity and few calories, allows manufacturers to create healthier options with optimal taste and texture. In addition, Crespel & Deiters highlighted its Lory Protein range, which provides high-protein content and is suitable for various baking applications.

-

In May 2024, ADM launched ADMbuydirect.com, a new online storefront. The website aims to offer enhanced accessibility and convenience to producers across the U.S. food industry while buying essential ingredients. The website provides a streamlined procurement platform and delivery in 48 states across the U.S.

-

In April 2024, International Flavors & Fragrances Inc. opened a new co-creation center in Wageningen, Netherlands. This center is expected to improve the company’s capabilities in research and innovation. This center's presence in an area characterized by multi-national organizations from the food industry and an increasing number of new establishments is significant.

Functional Bakery Ingredients Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.64 billion |

|

Revenue forecast in 2030 |

USD 2.28 billion |

|

Growth rate (revenue) |

CAGR of 6.7% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Ingredients, application, functionality,region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; South Africa |

|

Key companies profiled |

dsm-firminich; Kerry Group plc; Cargill, Incorporated; Archer Daniels Midland Company (ADM); Ingredion; Corbion N.V.; International Flavors & Fragrances Inc.; Tate & Lyle PLC; Lesaffre Group; BASF SE |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Functional Bakery Ingredients Market Report Segmentation

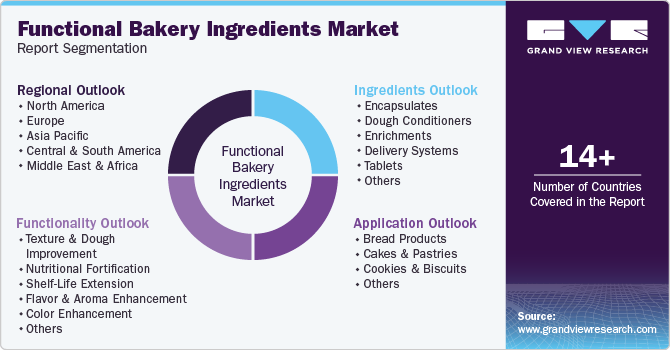

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global functional bakery ingredients market report based on ingredients, application, functionality, and region:

-

Ingredients Outlook (Revenue, USD Million, 2018 - 2030)

-

Encapsulates

-

Dough Conditioners

-

Enrichments

-

Delivery Systems

-

Tablets

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bread Products

-

Cakes & Pastries

-

Cookies & Biscuits

-

Others

-

-

Functionality Outlook (Revenue, USD Million, 2018 - 2030)

-

Texture & Dough Improvement

-

Nutritional Fortification

-

Shelf-Life Extension

-

Flavor & Aroma Enhancement

-

Color Enhancement

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global functional bakery ingredients market was estimated at USD 1.54 billion in 2024 and is expected to reach USD 1.64 billion in 2025.

b. The global functional bakery ingredients market is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2030 to reach USD 2.28 billion by 2030.

b. North America dominated the functional bakery ingredients market with a share of 30.9% in 2024, driven by a growing consumer awareness of health and wellness, leading to increased demand for products with added nutritional benefits. Consumers are actively seeking bakery items with higher fiber content, reduced sugar, and fortified with vitamins and minerals.

b. Some of the key market players in the functional bakery ingredients market are dsm-firminich, Kerry Group plc, Cargill, Incorporated, Archer Daniels Midland Company (ADM), Ingredion, Corbion N.V., International Flavors & Fragrances Inc., Tate & Lyle PLC, Lesaffre Group, and BASF SE.

b. The market for functional bakery ingredients has grown significantly in recent years due to a shift toward bakery products with additional nutritional benefits and growing consumer awareness of health and wellness. This includes ingredients that enhance fiber content and protein levels or provide essential vitamins and minerals, catering to increasingly health-conscious consumers seeking guilt-free indulgences. Manufacturers are responding by incorporating ingredients like whole grains, sprouted grains, prebiotics, and probiotics to enhance the perceived health profile of their baked goods.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."