- Home

- »

- Next Generation Technologies

- »

-

Full-body Scanner Market Size, Share, Growth Report, 2030GVR Report cover

![Full-body Scanner Market Size, Share & Trends Report]()

Full-body Scanner Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (X-ray, Millimeter Wave), By Type (Single View, Dual View, 3D View), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-406-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Full-body Scanner Market Summary

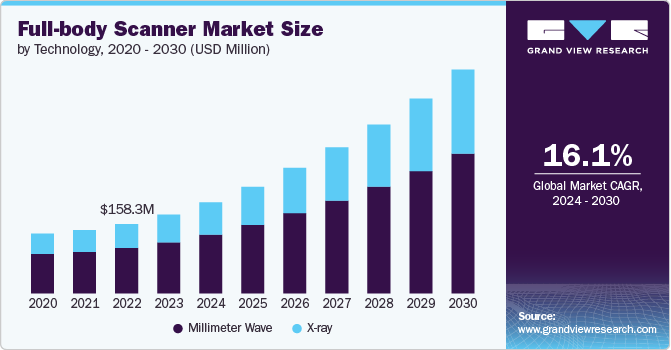

The global full-body scanner market size was estimated at USD 179.4 million in 2023 and is projected to reach USD 510.3 million by 2030, growing at a CAGR of 16.1% from 2024 to 2030. The market growth is attributed to the growing demand for advanced security measures in public and private spaces with the rise in global security threats, such as terrorism and smuggling.

Key Market Trends & Insights

- The full-body scanner market in North America accounted for the highest revenue share of nearly 32% in 2023.

- The full-body scanner market in the U.S. is anticipated to grow at a CAGR of around 14% from 2024 to 2030.

- By technology, the millimeter wave segment dominated the market in 2023 with a market share of around 65%.

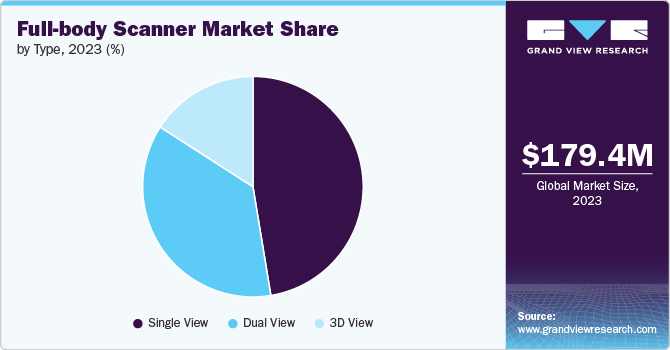

- By type, the single view segment held the highest revenue share in 2023.

- By end use, the airports segment held the highest revenue share in 2023.

Market Size & Forecast

- 2024 Market Size: USD 179.4 Million

- 2030 Projected Market Size: USD 510.3 Million

- CAGR (2025-2030): 16.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Full-body scanners offer an effective solution for detecting concealed weapons, explosives, and other contraband, making them a vital component of modern security infrastructure. Enhanced security protocols in airports, government buildings, and other high-risk areas are driving the adoption of these scanners. This augmented focus on security helps in reducing the risk of potential threats, driving growth in the market.Moreover, innovations in scanning technology, such as millimeter-wave and backscatter X-ray systems, have significantly improved the accuracy, speed, and safety of full-body scanners. These advancements enable more precise detection of prohibited items while ensuring minimal health risks to individuals undergoing screening. As technology continues to evolve, the enhanced features and functionalities of newer scanner models are attracting more users. Improved imaging quality and reduced scanning times are particularly appealing to high-traffic areas, thereby driving market growth.

Governments and international bodies have implemented stringent security regulations and standards that mandate the use of advanced screening technologies in various sectors. Compliance with these regulations is crucial for organizations to maintain their operational licenses and avoid hefty fines. Full-body scanners, being compliant with these regulations, are becoming essential in sectors like aviation, corrections, and critical infrastructure. The enforcement of such mandates ensures a steady demand for these devices, thereby driving market growth.

In addition, full-body scanners are increasingly being used in public health applications, such as detecting illegal imports in correctional facilities and ensuring safety in large public events. The ability to screen individuals without physical contact is particularly valuable in minimizing the spread of contagious diseases. As awareness of public safety and health rises, the adoption of non-intrusive screening methods such as full-body scanners gains momentum. This dual utility in security and health further bolsters the market's expansion, fueling growth for the market.

Furthermore, the global increase in air travel necessitates enhanced security measures to handle the rising passenger volumes efficiently. Full-body scanners offer a rapid and reliable method to screen large numbers of passengers, reducing wait times and improving the overall travel experience. Airports across the globe are investing in these scanners to meet the demands of growing passenger traffic and to ensure compliance with international security standards. This surge in air travel is a significant driver for the full-body scanner market, as it supports the need for robust and scalable security solutions.

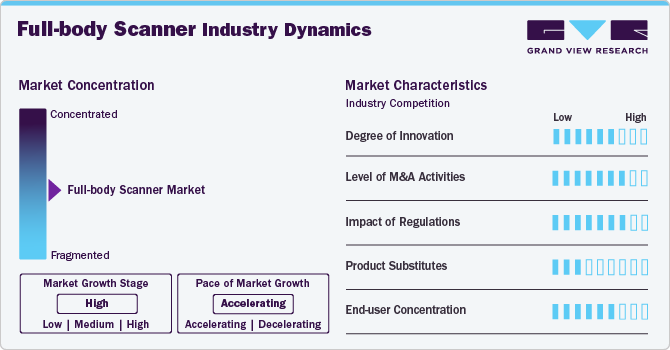

Market Concentration & Characteristics

The degree of innovation is high in the market. The degree of innovation within the market significantly transforms security and safety procedures, enhancing detection capabilities while ensuring privacy and comfort for individuals. As these innovational strides improve the efficiency and accuracy of scanners, they not only bolster security measures but also foster consumer trust and acceptance, paving the way for widespread adoption in various sectors.

The impact of regulations is high. Regulations in the market play a crucial role in shaping its evolution, ensuring that technological advancements align with ethical standards and privacy laws. By setting stringent guidelines, these regulations not only protect individual rights but also drive manufacturers to innovate within defined boundaries, balancing security needs with personal privacy.

The level of mergers & acquisitions in the market is high. The market is also being influenced by the rising number of mergers and acquisitions, which help companies increase market share, expand the customer base, and strengthen product portfolios.

The impact of product substitutes is low to moderate. The presence of product substitutes in the market introduces competition, compelling companies to continuously innovate and improve their offerings. This dynamic ensures that technology evolves to meet consumer demands for efficiency, privacy, and safety, ultimately enhancing the overall market landscape and providing diverse options to end users.

The end user concertation is high in the market. High end-user concentration in the market signals a reliance on a narrow customer base, potentially stifling market diversity and innovation. However, it also encourages manufacturers to tailor their products closely to the specific needs and preferences of these key segments, thereby improving user satisfaction and operational efficiency in targeted sectors.

Technology Insights

The millimeter wave segment dominated the market in 2023 with a market share of around 65%, driven by its non-ionizing radiation, which is safer for human health. The increasing demand for enhanced security in airports and public venues, coupled with advancements in imaging accuracy, is fueling its adoption. As regulations favor non-invasive and privacy-focused security solutions, the market for millimeter wave technology is expanding rapidly. This growth is expected to continue, particularly in regions with stringent security measures, thereby driving the segment growth.

The X-ray segment is expected to record the highest CAGR of over 17% from 2024 to 2030 due to increasing security concerns across various sectors, including airports and critical infrastructure. This growth is driven by advancements in X-ray imaging techniques, which offer enhanced detection capabilities and greater accuracy. In addition, the adoption of dual-view and 3D X-ray systems is contributing to the segment's expansion as they provide more comprehensive scans. This trend is expected to continue as security measures become more stringent globally.

Type Insights

The single view segment held the highest revenue share in 2023, due to its cost-effectiveness and simplicity in screening operations. The segment growth is driven by the demand for quick, efficient security checks in various environments, such as airports and public facilities. Technological advancements and increasing security concerns further boost its adoption. Despite competition from more advanced scanners, single view systems continue to be a preferred choice for many applications, propelling the segment growth forward.

The 3D view segment is estimated to register the highest growth rate from 2024 to 2030, due to its advanced imaging capabilities, which provide detailed and comprehensive views of scanned objects. This growth is driven by increasing demand for enhanced security and accurate detection in high-security areas such as airports and critical infrastructures. Technological advancements and the ability of 3D scanners to offer better threat assessment and faster processing are further fueling this segment's expansion.

End-use Insights

The airports segment held the highest revenue share in 2023, due to increasing security concerns and the need for enhanced passenger screening processes. Airports are investing in advanced full-body scanners to improve detection capabilities and streamline security checks, accommodating higher passenger volumes efficiently. The rise in air travel and stringent regulations are driving this expansion. In addition, technological advancements in full-body scanning solutions are making them more effective and cost-efficient, further boosting their adoption in airports.

The critical infrastructures segment is estimated to register the highest growth rate from 2024 to 2030, due to increasing security demands at vital facilities such as power plants, water treatment facilities, and communication hubs. The heightened focus on safeguarding these critical assets from threats drives investments in advanced scanning technologies. Enhanced security measures are being implemented to address evolving threats and ensure the safety and integrity of essential services. As a result, the demand for innovative full-body scanners in this segment is expected to rise significantly.

Regional Insights

The full-body scanner market in North America accounted for the highest revenue share of nearly 32% in 2023. In North America, the growth of the market is primarily fueled by heightened security concerns and stringent government policies for aviation safety. The region's significant investment in airport infrastructure modernization also plays a crucial role in adopting these advanced screening technologies.

U.S. Full-body Scanner Market Trends

The full-body scanner market in the U.S. is anticipated to grow at a CAGR of around 14% from 2024 to 2030. The U.S. market succeeds in stringent Transport Security Administration (TSA) regulations and heightened airport security measures due to increased terrorism threats.

Asia Pacific Full-body Scanner Market Trends

The full-body scanner market in Asia Pacific is anticipated to grow at the highest CAGR of over 17% from 2024 to 2030. The Asia Pacific market for full-body scanners is driven by rapid airport development and the increasing adoption of cutting-edge security solutions to accommodate the booming air travel sector. In addition, the region's focus on enhancing security measures for large public events and critical infrastructure acts as a catalyst for growth.

The full-body scanner market in India is estimated to record a significant growth rate from 2024 to 2030. India's market growth is propelled by rapid airport infrastructure development and a government push for enhanced security measures in response to rising passenger traffic.

The China full-body scanner market is expected to grow considerably from 2024 to 2030. In China, the full-body scanner market is boosted by substantial investments in airport infrastructure and a strong government focus on public security and surveillance.

The full-body scanner market in Japan is projected to witness a considerable growth rate from 2024 to 2030. Japan's market benefits from technological advancements and the government's commitment to maintaining high-security standards in preparation for international events and air travel safety.

Europe Full-body Scanner Market Trends

The full-body scanner market in Europe accounted for a notable revenue share in 2023. Europe's market benefits from stringent regulatory frameworks mandating advanced security screening procedures across transportation hubs. The increasing focus on countering terrorism and managing the flow of migrants through border controls also substantially contributes to the market's expansion.

The full-body scanner market in the UK is projected to grow considerably from 2024 to 2030. The UK sees growth in its full-body scanner market driven by strict aviation security regulations and the adoption of advanced security technologies post-Brexit to bolster border control.

The Germany full-body scanner market is expected to record significant growth from 2024 to 2030. Germany's market growth is supported by its leading role in adopting new technologies for enhanced security at airports and public spaces across the European Union.

Middle East & Africa (MEA) Full-body Scanner Market Trends

The full-body scanner market in the Middle East & Africa (MEA) region is anticipated to grow at a significant CAGR of around 16% from 2024 to 2030. The MEA region witnesses growth in the market due to rising investments in airport security infrastructure and the need to bolster safety measures amidst geopolitical tensions. The region's strategic focus on becoming a hub for international travel further fuels the adoption of these technologies.

The full-body scanner market in Saudi Arabia accounted for a considerable revenue share in 2023. Saudi Arabia's market is expanding due to increased government spending on security infrastructure amidst efforts to diversify its economy and grow its tourism sector.

Key Full-body Scanner Company Insights

Some of the key players operating in the market are L3Harris Technologies, Inc., Tek84 Inc., and LINEV Group, among others.

-

L3Harris Technologies, Inc. is a global aerospace and defense technology company. It engages in the development of a wide array of technology solutions, including tactical communications, electronic warfare, and avionics, catering to both government and commercial customers worldwide.

-

Tek84 Inc. is a company specializing in security and detection technology. It develops products for a variety of applications, including contraband detection, people screening, and critical infrastructure protection, with a focus on utilizing advanced imaging technologies.

Westminster Group Plc, Brijot Imaging Systems, and Nuctech Technology Co., Ltd., among others, are some of the emerging market participants in the full-body scanner market.

-

Westminster Group Plc operates across the global market, offering security and safety solutions. Its diverse portfolio includes the provision of managed services and technology-based security solutions, targeting a wide range of sectors such as aviation, maritime, and critical infrastructure.

-

Brijot Imaging Systems, a company in the security technology sector, specializes in the development and production of passive millimeter wave imaging technology. Their systems are designed to detect concealed objects on individuals without physical contact, catering to the needs of public safety and security.

Key Full-body Scanner Companies:

The following are the leading companies in the full-body scanner market. These companies collectively hold the largest market share and dictate industry trends.

- Rapiscan Systems, Inc.

- Tek84 Inc.

- Westminster Group Plc

- Smiths Detection Group Limited

- L3Harris Technologies, Inc.

- Mistral Solutions Pvt. Ltd.

- LINEV Group

- Brijot Imaging Systems

- Nuctech Technology Co., Ltd.

- Braun and Company Limited

Recent Developments

-

In March 2023, Tek84 Inc. acquired Integrated Defense and Security Solutions (IDSS) Corp., an airport scanner technology company. This deal combined top-tier x-ray scanning technologies designed to defend against various security threats, such as contraband, human trafficking, and terrorism.

-

In December 2022, officials at the LaSalle County Jail accepted a proposal from Tek84 Inc. to install an X-ray full-body scanner. This technology is intended to discover prohibited items being carried by inmates.

-

In March 2022, Smiths Detection announced their HI-SCAN 10080 XCT, an advanced X-ray computed tomography system designed for scrutinizing hold luggage and air freight, has received certification from the United States Transportation Security Administration (TSA) to be included in the Air Cargo Screening Technology List (ACSTL).

Full-body Scanner Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 207.9 million

Revenue forecast in 2030

USD 510.3 million

Growth rate

CAGR of 16.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Rapiscan Systems, Inc.; Tek84 Inc.; Westminster Group Plc; Smiths Detection Group Limited; L3Harris Technologies, Inc.; Mistral Solutions Pvt. Ltd.; LINEV Group; Brijot Imaging Systems; Nuctech Technology Co., Ltd.; Braun Company Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Full-body Scanner Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global full-body scanner market report based on technology, type, end-use, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

X-ray

-

Backscatter X-ray

-

Transmission X-ray

-

-

Millimeter Wave

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Single View

-

Dual View

-

3D View

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Airports

-

Transport

-

Metro & Railway Stations

-

Critical Infrastructures

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

Frequently Asked Questions About This Report

b. The global full-body scanner market size was estimated at USD 179.4 million in 2023 and is expected to reach USD 207.9 million in 2024.

b. The global full-body scanner market is expected to grow at a compound annual growth rate of 16.1% from 2024 to 2030 to reach USD 510.3 million by 2030.

b. The North America region accounted for the largest share of over 32% in the full-body scanner market in 2023 and is expected to continue its dominance in the coming years.

b. Some key players operating in the full-body scanner market include Rapiscan Systems, Inc., Tek84 Inc., Westminster Group Plc, Smiths Detection Group Limited, L3Harris Technologies, Inc., Mistral Solutions Pvt. Ltd., LINEV Group, Brijot Imaging Systems, Nuctech Technology Co., Ltd., Braun and Company Limited.

b. Key factors that are driving the full-body scanner market growth include the growing demand for advanced security measures in public and private spaces with the rise in global security threats, such as terrorism and smuggling.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.