- Home

- »

- Drilling & Extraction Equipments

- »

-

Fuel Transfer Pumps Market Size Report, 2022-2030GVR Report cover

![Fuel Transfer Pumps Market Size, Share & Trends Report]()

Fuel Transfer Pumps Market (2022 - 2030) Size, Share & Trends Analysis Report By Type (AC FTP, DC FTP), By Mounting (Fixed, Portable), By Motor Type, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-501-4

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global fuel transfer pumps market size was estimated at USD 1.71 billion in 2021 and is anticipated to grow at a compounded annual growth rate (CAGR) of 4.5% from 2022 to 2030. Rising urbanization, technological developments, fast-paced industrialization, and growth in infrastructure are the major factors contributing to the increased demand for fuel, is expected to have a positive impact on growth.

Strict lockdowns implemented by the governments across the globe, in light of the onset of the COVID-19 pandemic in 2020 adversely affected the industry growth due to the closure or limited functioning of industries such as transportation, construction, mining, chemical, agriculture among others. However, due to unending government initiatives, the COVID-19 pandemic had a limited short-term impact on few industries.

Rising awareness regarding energy conservation and mitigating pollution, during COVID-19 pandemic is expected to prompt market participants to develop highly energy-efficient fuel transfer pumps. Factors such as increasing awareness regarding eco-friendly products, stringent regional, national, and international frameworks are expected to boost the demand for eco-friendly products which compels the fuel transfer pump manufacturers to opt for such practices which reduces burden on the environment.

Fuel transfer pumps help in the controlled transfer of fuel. Continuous developments in the manufacturing techniques of fuel transfer pumps have led to an increase in the applications of these pumps. Growing oil & gas consumption worldwide is expected to have a positive impact on the industry during the forecast period.

Emerging economies in the Asia Pacific, including China and India, are experiencing rapid urbanization and industrialization over the past few years, and the trend is expected to continue during the forecast period. The growth and evolution witnessed by leading industrial verticals, such as chemical, construction, and automotive, have subsequently boosted demand for this product.

Over the forecast period, rising sales of electric vehicles are expected to stifle the growth of the market. Because these cars run on electricity, they do not require any refilling. As a result, the market for fuel transfer pumps is likely to be restrained by the rising use of electric vehicles over the forecast period.

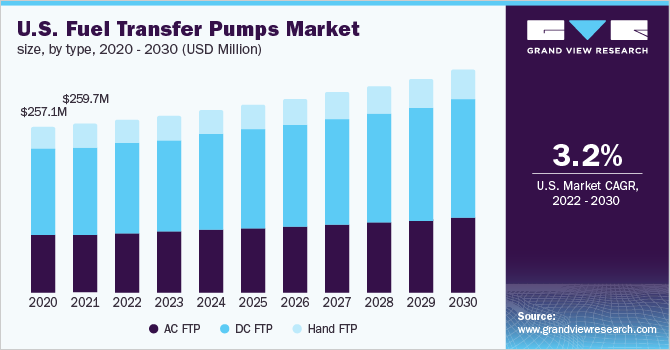

Type Insights

DC segment led the market and accounted for 49.6% of the global fuel transfer pumps revenue in 2021. Mobile vehicles, earth-moving machines, and construction yards all employ these pumps as principal systems. The benefits provided by these pumps, such as compact size, durability, and flexibility in terms of usage, have led to increased penetration.

DC segments are ideal for portable applications, including tank and barrel mounting. Moreover, the products aid in safe & easy transfer of fuels for applications that do not involve AC power. These are available as individual 12-volt transfer pumps as well as in kits including diesel fuel nozzles & diesel hoses. DC segments is equipped with components such as dispensing pipes, handles, dispensing nozzles, and power cables

The demand for the AC segment is expected to witness growth at a CAGR of 4.3% over the forecast period. AC segment are ideally designed for transferring a diversified array of fuels and oil products, such as biodiesel, diesel, and Diesel Exhaust Fluid (DEF), among other oils. These pumps are used to transfer fuel in heavy equipment, heavy construction, fleet operation, and large farming applications.

AC segment for heavy-duty applications cater to requirements such as all-cast iron construction and thermal protection. In addition, these products include various features such as varied temperature ranges for pump operation, operation suitability at different voltages including 115V & 230V. In addition, they offer different fuel delivery rates. AC segment are ideal for use in fuel management systems.

Mounting Insights

The fixed segment have led the market and accounted for 53.4% of the global fuel transfer pumps revenue in 2021 owing to their adaptability and suitability for a diverse range of heavy equipment applications Agriculture, automotive, garage, transportation, chemicals, and construction are just a few of the industries that employ fixed pumps.

Owing to their compact and sturdy structure, good performance for heavy gear, and reliability, fixed electric segment are ideal for industrial applications. Furthermore, the product is mostly employed in refueling stations, where the stationary fuel tank is located at a fixed site and a power supply is available. Furthermore, because of their dependability in low-temperature applications, the use of fixed pumps is projected to grow.

The demand for portable segment is expected to witness growth at a CAGR of 5.0% over the forecast period. The voltage ranges for portable gasoline products are typically 110 V to 220 V. Low voltage diesel refueling pumps come with cables and crocodile chips to make connecting to the car battery as simple as possible. These pumps can dispense a wide range of fuels, including gasoline, diesel, and gasoline.

12 V DC power segment are ideal for mobile applications such as refueling tanks in truck beds. A 24 V DC power pump, on the other hand, is suited for commercial duty line applications. They are also lightweight and provide easy fuel transfer. As a result of its adaptability and availability for a wide range of applications, demand for diverse portable segment is predicted to rise.

Motor Insights

12V DC segment led the industry and accounted for 32.7% of the global fuel transfer pumps revenue in 2021. These pumps are majorly used in light oil pumping applications such as biodiesel, diesel, and kerosene, 12V DC segment are used in applications where the flow rate required is in the range of 8 to 15 gallons per minute (GPM).

12V DC segment are used in locations where the mains power is unavailable and refueling is required. These products have clips and cables for connecting them with the vehicle’s battery while refueling. Hence, these pumps are majorly portable and suitable for off-site, remote, and mobile fueling in construction and agriculture industries.

The demand for 115V AC segment is expected to witness growth at a CAGR of 4.3% over the forecast period. 115V AC segment operate on motors compatible with single-phase mains power range upto120V AC. These pumps are majorly used in fixed applications where the required suction capacity is high, for instance, in applications involving the transfer of medium-high viscosity fuels up to 500 centimeters per second (cm²/s).

24V DC segment are used in applications where the required flow rate is in the range of 15 to 20 gallons per minute (GPM). These pumps find applications in construction and agriculture industries for refueling large vehicles such as agricultural and large plant equipment. In addition, these pumps are used for refueling the machinery in mining quarries and oil & gas exploration activities.

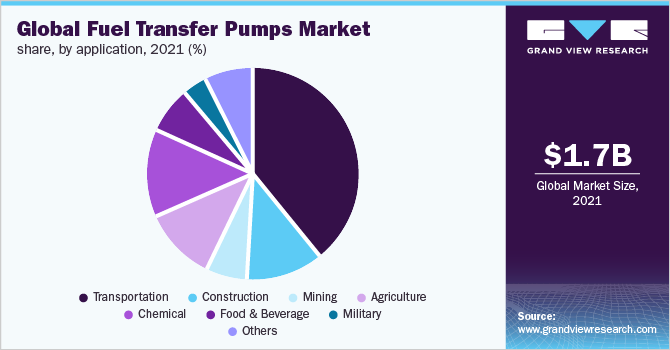

Application Insights

The transportation application segment has led the market and accounted for 40.1% of the global industrial pumps market revenue share in 2021. The transportation industry includes a diversified array of transport modes such as marine, road, air, and rail transport. The increased number of such modes of transport is likely to generate the need for refueling, thereby encouraging the number of fuel stations. This, in turn, is expected to propel the industry's demand.

The construction sector is expected to be one of the fastest-growing segments, owing to factors including technical developments, rising modular construction projects, and better equipment availability. Gasoline products are commonly employed in a variety of large and small construction equipment for fuel dispensing.

The demand for these products in the chemical industry is likely to grow at a CAGR of 5.6% over the forecast period. Fuel transfer pumps are critical for dispensing fuel that is necessary for the operation of various machines. Companies in the sector are producing and distributing industry-specific products. Pumps for the chemical industry, for example, are made by manufacturers like Sotera and Fill-Rite.

A diverse range of these products suitable for dispensing fluids into food & beverage equipment that are regularly operated is available. The rising food & beverage industry owing to the growing consumer demand is, in turn, expected to augment the demand for transfer pumps used for fuel dispensing in the food & beverage industry over the forecast period.

Regional Insights

The Asia Pacific led the market and accounted for 45.1% of the global revenue share in 2021. In countries like China, Japan, and India, factors including strong economic growth, increased corporate investment spending, and high advances in manufacturing production are driving the expansion of the fuel transfer pumps market. Furthermore, high levels of vehicle production and sales are projected to boost refueling demand, resulting in gasoline pump industry expansion in the region.

The pandemic in North America led to an economic downturn resulting in governments announcing various economic stimulus packages. This is expected to increase the infrastructural development activities in the region augmenting the demand for these products in construction. However, the current Russia Ukraine crisis may dampen the economic activity due to inflation and raw material price volatility which is likely to affect these products in the region.

The ongoing structural reforms in Argentina and policy continuities in Peru are expected to impact the construction & other sectors over the forecast period. Moreover, the COVID-19 stimulus announced by countries such as Peru is also expected to revive the mining industry. All these factors are expected to affect industry growth positively since the fate of end-use industries tends to dictate their trends to a significant extent.

The government of economies in the Middle East has framed policies to promote investments in the automotive industry. Moreover, growing demand for passenger and commercial vehicles in the Middle East coupled with rising consumer expenditure on automobile purchasing is anticipated to demand refueling stations in the region. These factors, thereby, are expected to drive the demand for these products over the forecast period.

Key Companies & Market Share Insights

The competition in the fuel transfer pumps market is anticipated to be intense and is characterized by the demand for advanced and reliable products. Increasing customer expectations have led to increased spending in R&D activities to improve the quality of these products along with advanced process control. Overall, the industry is highly competitive and dependent on technological advancements and product developments.

Key market players strive to achieve new application developments to gain a competitive advantage over their competitors. Prominent players in the industry have released innovative technologies that are predicted to alter these industries. Great Plains Industries (GPI) Inc., for example, introduced the G20 gasoline transfer pump, which features Quick-Fit Modular connection points that make mounting accessories quick and easy. GPI has also released a zero-loss suction pipe with triple-seal technology. Some prominent players in the global fuel transfer pumps market include:

-

Great Plains Industries, Inc

-

Tuthill Transfer Systems (TTS

-

Graco Inc

-

Piusi S.p.A

-

INTRADIN

-

YUANHENG MACHINE CO., LTD

-

ARO (Ingersoll-Rand plc)

-

GESPASA - TOT COMERCIAL S.A

-

Creative Engineers (Malhar Pumps

-

MACH POWERPOINT PUMPS INDIA PVT. LTD.

Fuel Transfer Pumps Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1.76 billion

Revenue forecast in 2030

USD 2.51 billion

Growth Rate

CAGR of 4.5% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Type, mounting, motor type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; U.K.; China; Japan; India; Australia; Brazil; Argentina; UAE; Saudi Arabia

Key companies profiled

Great Plains Industries, Inc; Tuthill Transfer Systems (TTS), Graco Inc; Piusi S.p.A, INTRADIN, YUANHENG MACHINE CO., LTD; ARO (Ingersoll-Rand plc); GESPASA - TOT COMERCIAL S.A; Creative Engineers (Malhar Pumps); MACH POWERPOINT PUMPS INDIA PVT. LTD.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global fuel transfer pumps market on the basis of type, mounting, motor type, application, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

AC Fuel Transfer Pump

-

DC Fuel Transfer Pump

-

Hand Fuel Transfer Pump

-

-

Mounting Outlook (Revenue, USD Million, 2017 - 2030)

-

Fixed

-

Portable

-

-

Motor Type Outlook (Revenue, USD Million, 2017 - 2030)

-

12V DC

-

24V DC

-

115V AC

-

230V AC

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Construction

-

Mining

-

Agriculture

-

Chemical

-

Military

-

Transportation

-

Food & Beverage

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

U.K.

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global fuel transfer pumps market size was estimated at USD 1.71 billion in 2021 and is expected to be USD 1.76 billion in 2022

b. The fuel transfer pumps market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.5% from 2022 to 2030 to reach USD 2.51 billion by 2030.

b. The Asia Pacific dominated the fuel transfer pumps market with a revenue share of 35.9% in 2021, Factors such as robust economic growth, an increase in business investment spending, and strong gains in manufacturing output are leading the market growth

b. Some of the key players operating in the fuel transfer pump market include Great Plains Industries, Inc, Tuthill Transfer Systems (TTS), Graco Inc, Piusi S.p.A, INTRADIN, YUANHENG MACHINE CO., LTD, ARO (Ingersoll-Rand plc), GESPASA - TOT COMERCIAL S.A, Creative Engineers (Malhar Pumps), MACH POWERPOINT PUMPS INDIA PVT. LTD.

b. Key factors that are driving the fuel transfer pump market growth include increasing demand for high-pressure fueling systems for heavy machinery, including construction equipment, trucks, and plant equipment coupled with growing oil & gas consumption

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.