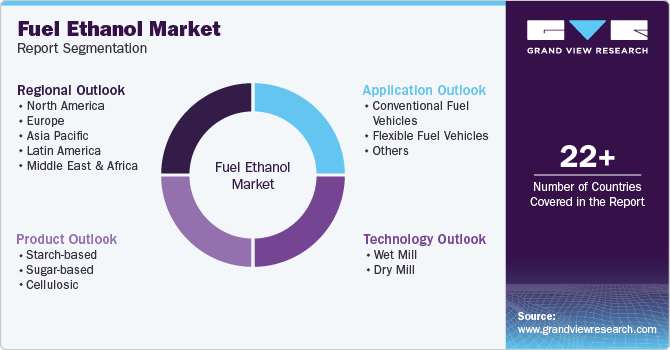

Fuel Ethanol Market Size, Share & Trends Analysis Report By Product (Starch-based, Sugar-based, Cellulosic), By Technology (Wet Mill, Dry Mill), By Application (Conventional Fuel Vehicles), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-604-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Fuel Ethanol Market Size & Trends

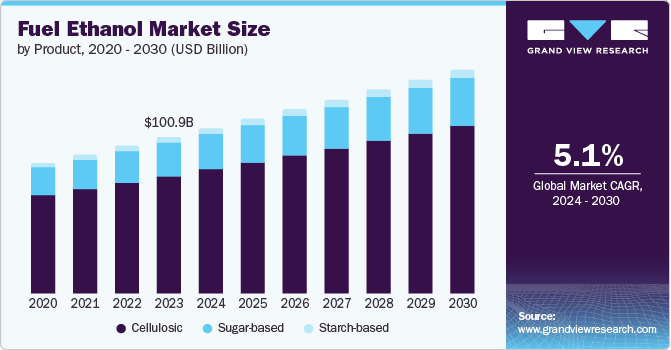

The global fuel ethanol market size was valued at USD 100.9 billion in 2023 and is projected to grow at a CAGR of 5.1% from 2024 to 2030. This growth is driven by increased demand for renewable fuels, growing environmental concerns, and regulations demanding a shift from traditional fossil fuels. In addition, the automotive industry, growing rapidly with the advancement of science and technology, has faced challenges in controlling air pollution. The usage of fuel ethanol has significant advantages, such as improved fuel economy and increased thermal efficiency, which is likely to drive their demand over the forecast period.

In order to minimize the carbon emissions from gasoline in the automotive & transportation industry, the usage of ethanol as a bio-based additive has been increasing over the next couple of years. For instance, in 2022, according to the Ministry of Petroleum and Natural Gas (Government of India), carbon emissions lowered by 318.2 lac tons in the past eight years using biofuels. In addition, advancements in production technology have further helped convert cellulosic biomass to ethanol and make fuel ethanol more cost-effective and scalable. For instance, in March 2024, Blue Biofuels Inc. used cellulose-to-sugar technology to successfully produce commercial cellulosic ethanol from biomass on its cellulose-to-sugar pilot line. Such developments are likely to boost the growth of the fuel ethanol market over the forecast period.

Ethanol acts as an alternative and is more effective as a transportation fuel than other high and volatile-priced conventional fuels. For instance, in May 2024, according to the Renewable Fuels Association, the average national wholesale price of ethanol was around USD 1.20 per gallon lower than the petroleum gasoline blendstock. The low cost of such renewable energy has boosted the market to grow rapidly.

The availability of feedstocks such as corn, sugarcane, wheat, and agricultural waste in major producing regions is enabling increased fuel ethanol production capacity. For instance, the challenges, such as storage and sales associated with the over-production of food grains and sugar, are mitigated with the help of fuel. Moreover, starch-based crops are used for the production of biofuels. For instance, according to the European Technology and Innovation Platform, about 2% of Europe’s grain supply and 0.7% of EU agricultural land has been used to produce renewable ethanol, thereby mitigating the challenges of overproduction of starch crops. These factors are expected to drive growth in the fuel ethanol market.

Product Insights

The starch-based dominated the market and accounted for a market share of 75.2% in 2023. These starch-based products can reduce greenhouse emissions and help control air pollution, which has encouraged their use, driving market demand. For instance- in October 2023, according to the National Renewable Energy Laboratory, the replacement of petroleum-based fuel with sustainable biofuel can produce about 410 and 640 million metric tonnes (Mt) of carbon dioxide equivalent per year of the life cycle, which is 68%-73% reduction in GHG emissions over petroleum-based fuels.

Cellulosic is expected to grow at the fastest CAGR over the forecast period as it can easily be produced from non-food feedstocks such as agricultural waste, forest residues, municipal solid waste, and dedicated energy crops. Technological advancements such as improvements in pretreatment, hydrolysis, and fermentation technologies are making cellulosic ethanol production more efficient and cost-effective. For instance, in February 2023, Nippon Paper Industries Co., Ltd., Green Earth Institute Co., Ltd. and Sumitomo Corporation began a trilateral agreement for the first commercial production of cellulosic bioethanol from woody biomass in Japan, thereby leveraging the segment growth in the near future.

Technology Insights

Wet mill dominated the market and accounted for a market share of 90.6% in 2023. It can be attributed to the ability of wet mill technology to produce a greater variety of by products, high potential for finer particle size reduction, improved physical properties of the final product, and ability to use a wider range of feedstocks, which is expected to boost the segment growth in the future.

The dry mill segment is expected to grow significantly over the forecast period. It can be attributed to the lower capital and operating costs and the ability of the technology to use the entire corn kernel, reducing waste and increasing efficiency. Some key innovations and developments in dry milling are improving efficiency for fuel ethanol production, such as improved automation and control systems, enhanced grinding and separation techniques, and co-product optimization, which has anticipated the market to grow rapidly.

Application Insights

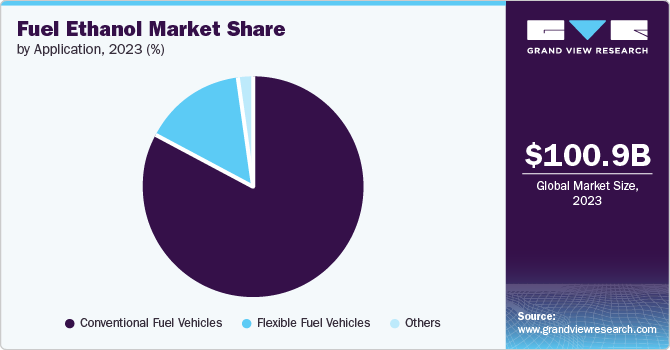

Conventional fuel vehicles dominated the market and accounted for a market share of 83.2% in 2023. This can be attributed to the growing requirements for boosting the fuel economy of these vehicles in several countries, which is expected to increase product consumption in the coming years. Ethanol acts as an anti-knock additive or an octane enhancer and helps the engine be more efficient with modern higher-compression engines. E10 includes a blend of 10% ethanol with unleaded gasoline in conventional vehicles. Thus, the increase in awareness regarding the utilization of ethanol, which has zero to a low negative impact on the environment, is a major contributing factor to boosting the market’s growth.

The flexible fuel vehicles segment is expected to grow at the fastest CAGR during the forecast period. It can be attributed to the environmental benefits of these vehicles as they run on a blend of gasoline and ethanol, which is a cleaner-burning fuel that reduces greenhouse gas emissions and toxic fumes compared to traditional gasoline. Various government initiatives have boosted the market’s growth. For instance, in August 2023, the government of India introduced the Ethanol Blended Petrol (EBP) Programme, with objectives such as savings in foreign exchange, import dependence, and associated environmental benefits, which is expected to directly or indirectly benefit the market’s growth.

Regional Insights

The North America fuel ethanol market dominated in 2023 and accounted for a market share of 56.4%. It can be attributed to the presence of the well-established automotive industry and its strict regulations over particulate emissions. Additionally, stringent environmental laws in this region are promoting a shift from traditional fossil fuels, making fuel ethanol with clean-burning properties a highly attractive option, which is likely to boost market growth in the forecast period.

U.S. Fuel Ethanol Market Trends

The U.S. fuel ethanol market accounted for a 48.4% share of the global market in 2023. It can be attributed to the continuous technological and material advancements used in ethanol production and improving the efficiency and cost-effectiveness of production in the U.S. Various policies/programs and investments to promote the use of ethanol, including blending mandates and incentives for production have been introduced by the government of the U.S. For instance, in June 2023, the U.S. Department of Agriculture, from the Inflation Reduction Act, announced its plan to invest up to USD 500 million to increase the availability of domestic biofuels. For instance, in 2023, according to the Renewable Fuels Association and its ethanol tax policy, it provides for the cost of installing qualified clean-fuel pumps that sell E85 ethanol, giving a 30% credit of up to USD 30,000. All these factors have contributed to the boosting of the fuel ethanol market in the U.S.

Asia Pacific Fuel Ethanol Market Trends

Asia Pacific fuel ethanol market is expected to grow at the fastest CAGR over the forecast period. It can be attributed to the rising number of investments and the various government initiatives and developments for sustainable development. For instance, in 2023, China went on a trial with an annual output of 600,000 tonnes of ethanol production equipment, which is considered as the world’s largest. This equipment increases the added value of coal and provides a feasible way for the low-carbon development of steel and petrochemical industries. For instance, in March 2024, the Ministry of Petroleum and Natural Gas of India announced on E20 program, and with the launch of ETHANOL100 at 183 outlets of Indian Oil, the target of 20% ethanol blending is expected to become closer by 2025-2026.

Europe Fuel Ethanol Market Trends

Europe's fuel ethanol market is expected to grow over the forecast period. It can be attributed to the technological innovations that enhance the competitiveness of ethanol and improve the sustainability of production processes. European governments offer various support mechanisms to promote ethanol production and use, including blending mandates, tax incentives, and subsidies. The demand for ethanol continues to grow, primarily driven by the take-up of super-ethanol E85 and SP95-E10, particularly in France. For instance, in November 2023, ArcelorMittal announced the first industrial production of ethanol by using LanzaTech's carbon biorecycling process.

MEA Fuel Ethanol Market Trends

MEA fuel ethanol market was identified as a lucrative region in 2023. Though it holds a low market share value, it is in greater demand due to growing environmental awareness among the public. South Africa has an abundance of sugarcane, corn, and sorghum cultivation, providing ample feedstock for ethanol production. The temperate climate and diverse landscape in many regions of South Africa ensure favorable conditions for agricultural productivity, supporting ethanol feedstock cultivation. Various government initiatives have helped the country grow in this prospect, thereby fueling the market growth positively. For instance- according to the World Economic Forum, in 2023, South Africa decided to cut fuel taxes on biodiesel to make it more attractive and considered removing taxes on bioethanol.

Key Fuel Ethanol Company Insights

Some of the key companies in the fuel ethanol market include Braskem S.A., BP Plc, Cargill Incorporated, and INEOS. These companies are growing their market revenue by launching new products, collaborations and adopting various other strategies.

-

Cargill is a U.S.-based company that operates in several production facilities and invests in innovative technologies to transform corn biomass into sustainable products. It expanded its global presence by opening a plant in Fort Dodge, Iowa, with its corn-based ethanol business, having the capacity to produce 115 million gallons of ethanol per year.

-

HPCL Biofuels Limited is an Indian-based company with ethanol production primarily aimed at supplying to oil marketing companies for blending with gasoline under India's Ethanol Blending Program. The company focuses on zero-effluent discharge and using renewable energy sources.

Key Fuel Ethanol Companies:

The following are the leading companies in the fuel ethanol market. These companies collectively hold the largest market share and dictate industry trends.

- Braskem S.A.

- BP Plc

- Cargill Incorporated

- INEOS Group Limited

- HPCL Biofuels Limited

- LyondellBasell Industries Holdings BV

- Mitsubishi Chemical Corporation

- SABIC

- Sasol Limited

- Solvay SA

Recent Developments

-

In June 2024, BP Plc acquired bp Bunge Bioenergia for new biofuels projects, which can produce around 50,000 barrels a day of ethanol equivalent using sugarcane with the help of 11 agro-industrial units of bp Bunge Bioenergia across five states in Brazil.

-

In June 2023, Hindustan Petroleum Corporation Limited started a pilot study on vehicles that used ethanol-blended diesel fuel and E27 fuel.

-

In May 2022, Blue Biofuels Inc. started an initiative to produce cellulosic ethanol and sustainable aviation fuel by building Blue Biofuels’ CTS Machines.

Fuel Ethanol Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 106.8 billion |

|

Revenue forecast in 2030 |

USD 144.3 billion |

|

Growth rate |

CAGR of 5.1% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, technology, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, Australia, South Korea, Thailand, Indonesia, Malaysia, Australia, Brazil, Argentina, KSA, South Africa |

|

Key companies profiled |

Braskem S.A., BP Plc, Cargill Incorporated, INEOS Group Limited, HPCL Biofuels Limited, LyondellBasell Industries Holdings BV, Mitsubishi Chemical Corporation, SABIC, Sasol Limited, Solvay SA |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Fuel Ethanol Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the fuel ethanol market report based on product, technology, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Starch-based

-

Sugar-based

-

Cellulosic

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Wet Mill

-

Dry Mill

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional Fuel Vehicles

-

Flexible Fuel Vehicles

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

APAC

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

Indonesia

-

Malaysia

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."