Fuel Cells In Aerospace And Defense Market Size, Share & Trends Analysis Report By Product (PEMFC, SOFC), By Application In Aerospace, By Application In Defense, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-696-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

Market Size & Trends

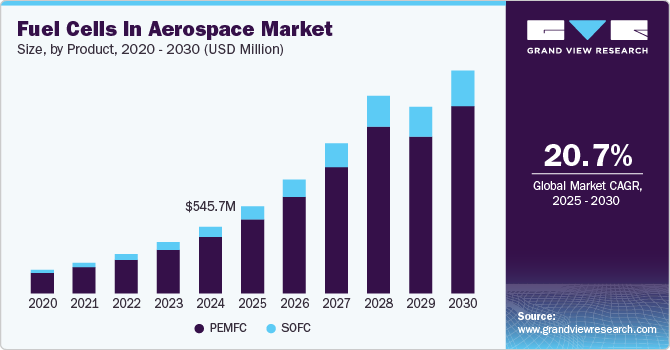

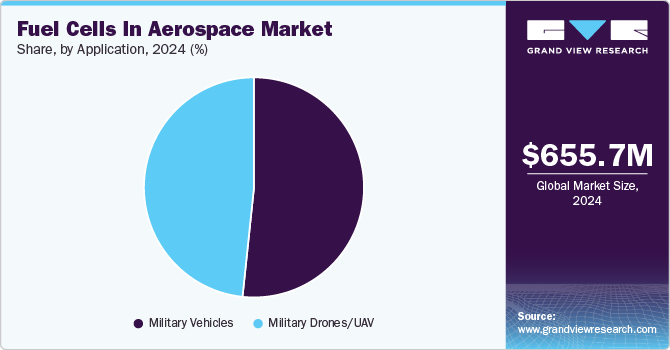

The global fuel cells in aerospace market size was valued at USD 545.7 million in 2024 and is expected to grow at a CAGR of 20.7% from 2025 to 2030. Similarly, the global fuel cells in defense market size was valued at USD 655.7 million in 2024 and is anticipated to grow at a CAGR of 10.5% from 2025 to 2030. The growth of both the aerospace and defense industries can be attributed to the increasing demand for sustainable energy sources, particularly in response to decarbonization efforts, propelling fuel cell adoption. In addition, rising military spending, especially on unmanned aerial vehicles (UAVs), and fuel cell technology advancements enhance efficiency and reduce operational costs. Furthermore, government initiatives and investments in research and development also support this growth, making fuel cells a critical component for future aerospace and defense applications.

Fuel cells convert chemical energy into electrical energy through electrochemical reactions and are expanding in the aerospace and defense sectors due to their efficiency and eco-friendliness. The market is experiencing robust growth driven by a surge in demand from emerging economies and advancements in digital technologies that enhance production and operational maintenance. The rising need for smart storage solutions, decentralized networks, and intelligent automation also contributes to this expansion.

In addition, the post-pandemic economic recovery is stimulating energy consumption and boosting sales across various sectors, including automotive and industrial goods. As nations increasingly seek non-conventional energy sources, fuel cells are recognized as a rapidly growing alternative due to their versatility in utilizing different fuels while minimizing environmental impact. Furthermore, the military sector is particularly focused on the integration of fuel cells in drones, which are becoming essential for modern warfare due to their effectiveness in intelligence and surveillance operations. Solid oxide fuel cells, particularly, enable drones to operate longer with reduced noise and vibrations, making them highly desirable in defense applications.

Moreover, significant investments in the aerospace and defense industries are expected to create substantial opportunities for market growth. These investments facilitate enhanced research and development of fuel cell technologies to improve energy efficiency and sustainability. As a result, fuel cell technology's alignment with the industry's goals of reducing carbon footprints positions it as a critical resource for future advancements in aerospace and defense applications.

Product Insights (Fuel Cells in Aerospace)

The proton exchange membrane fuel cells (PEMFC) dominated global fuel cells in the aerospace market and accounted for the largest revenue share of 84.7% in 2024. This growth can be attributed to their efficiency, compact design, and suitability for various temperature ranges. In addition, PEMFCs are increasingly favored for transportation applications due to their lightweight components and long operational lifetimes, making them ideal for military vehicles and drones. Furthermore, the rising focus on reducing carbon emissions and enhancing energy sustainability further boosts the adoption of PEMFC technology in aerospace applications.

The solid oxide fuel cells (SOFC) are expected to grow at a CAGR of 21.9% over the forecast period, owing to their superior efficiency in generating power, particularly for auxiliary power units in aircraft. In addition, SOFCs are recognized for their ability to convert fuel to electricity with minimal waste, which is essential for modern aerospace applications. Furthermore, the ongoing research and development efforts aimed at improving SOFC technology, alongside increasing military investments in drone capabilities, are expected to drive their growth within the aerospace sector significantly.

Product Insights (Fuel Cells in Defense)

The proton exchange membrane fuel cells (PEMFC) also led the fuel cells in the defense industry and accounted for the largest revenue share of 79.8% in 2024, primarily driven by their lightweight and compact design, making them ideal for portable military applications. In addition, their ability to provide efficient power solutions with low emissions aligns with the defense sector's increasing focus on sustainability and reducing reliance on fossil fuels. Furthermore, advancements in hydrogen production and storage technologies enhance the operational capabilities of PEMFCs, making them suitable for various defense equipment and remote operations.

The solid oxide fuel cells (SOFC) segment is expected to grow at the fastest CAGR of 11.1% over the forecast period, owing to its high efficiency and capability to operate on multiple fuels, which is advantageous for military applications requiring versatile energy sources. Furthermore, SOFCs are particularly valued for their long operational life and reduced noise output, making them suitable for stealth operations. Moreover, the increasing investment in military technologies, including drones and ground vehicles, supports the adoption of SOFCs as a reliable power source, driving their growth in the defense market.

Application Insights (Fuel Cells in Aerospace)

Commercial aircraft held the dominant position in the fuel cells in the aerospace market, with the largest revenue share of 76.6% in 2024, primarily driven by the urgent need to reduce carbon emissions and improve fuel efficiency. As airlines face increasing pressure from regulatory bodies and consumers to adopt greener technologies, fuel cells offer a viable alternative to traditional jet engines. Furthermore, their high energy density and rapid refueling capabilities make them attractive for commercial aviation, enabling longer flights with fewer environmental impacts. Moreover, hydrogen production and storage technology advancements are facilitating their integration into commercial aircraft designs.

Rotorcraft application is expected to grow at a CAGR of 20.9% over the forecast period, owing to the demand for quieter, more efficient flight solutions. Fuel cells significantly reduce noise pollution compared to conventional engines, making them ideal for urban air mobility and other rotorcraft applications. In addition, the ability of fuel cells to provide consistent power output enhances the operational reliability of rotorcraft in various missions, including emergency services and logistics. Furthermore, ongoing research into hybrid systems that combine fuel cells with existing rotorcraft technologies is expected to accelerate their adoption in this sector.

Application Insights (Fuel Cells in Defense)

The military vehicles led the global fuel cells in the defense market and held the largest revenue share of 51.7% in 2024, driven by the increasing demand for sustainable and efficient energy solutions. Fuel cells provide extended operational ranges and quicker refueling than traditional combustion engines, enhancing the mobility and flexibility of military operations. Furthermore, the silent operation of fuel cells-powered vehicles is crucial for stealth missions, allowing for effective reconnaissance and combat strategies.

Military Drones/ UAVs are expected to grow at a CAGR of 11.0% from 2025 to 2030 due to their ability to deliver longer flight times and reduced noise levels. These attributes are essential for surveillance and intelligence-gathering missions where stealth is paramount. In addition, fuel cells also offer a lightweight power source that supports advanced technologies and equipment onboard drones. Furthermore, as military applications increasingly incorporate UAVs for various operations, the reliance on fuel cells technology is expected to grow significantly, driven by ongoing advancements in drone capabilities and operational efficiency.

Regional Insights (Fuel Cells in Aerospace)

North America fuel cells in the aerospace market dominated the global market in the aerospace sector and accounted for the largest revenue share of 37.6% in 2024. This growth can be attributed to the increasing investments in research and development for hydrogen technologies. In addition, major aerospace companies, including Boeing and Lockheed Martin, are actively exploring fuel cells applications to enhance sustainability and reduce emissions, further driving the market expansion.

U.S. Fuel Cells In Aerospace Market Trends

The fuel cells in the aerospace market in U.S. led North America and accounted for the largest revenue share in 2024, driven by strong governmental support and a robust industrial base. The U.S. Department of Energy's initiatives promote innovation in fuel cell technology while leading manufacturers to focus on integrating these systems into commercial and military aircraft. The rising demand for environmentally friendly aviation solutions aligns with national objectives to reduce greenhouse gas emissions, making the U.S. a pivotal player in advancing fuel cells applications within the aerospace sector.

Europe Fuel Cells In Aerospace Market Trends

Europe fuel cells in the aerospace market is expected to grow at the fastest CAGR of 25.8% over the forecast period, owing to stringent environmental regulations to reduce carbon emissions. In addition, the European Union's commitment to sustainability encourages investment in innovative technologies such as fuel cells. Furthermore, collaborations between governments and industry stakeholders foster research initiatives that enhance fuel cells efficiency and performance.

The fuel cells in the aerospace market in UK led the European market and heldthe largest revenue share in 2024, primarily driven by its ambitious climate goals and investment in clean energy technologies. In addition, the UK government’s support for hydrogen initiatives encourages aerospace manufacturers to explore fuel cells as viable alternatives to conventional fuels. Furthermore, ongoing partnerships between academia and industry drive advancements in fuel cell research, positioning the UK as a key player in developing sustainable aviation solutions that align with global environmental objectives.

Asia Pacific Fuel Cells In Aerospace Market Trends

Asia Pacific fuel cells in the the aerospace market is expected to grow significantly over the forecast period, driven by increasing investments from governments and private sectors in clean energy technologies. Countries such as Japan and South Korea are at the forefront of adopting fuel cells for aviation applications due to their commitment to reducing carbon footprints. Furthermore, the expanding aerospace industry in this region fuels the demand for innovative power solutions, making fuel cells an attractive option for future aircraft designs.

The growth of the fuel cells in the aerospace market in China is expected to be driven by government policies promoting green technologies and sustainable aviation practices. Furthermore, the Chinese government's focus on reducing air pollution drives investments in hydrogen fuel cells research and development. Moreover, as China expands its aerospace capabilities, integrating fuel cells into commercial and military aircraft aligns with its goals of achieving energy efficiency and environmental sustainability within the aviation sector.

Regional Insights (Fuel Cells in Defense)

North America fuel cells in the defense market are expected to grow at a CAGR of 10.7% due to strong governmental support and a robust industrial base. The U.S. Department of Defense is actively exploring fuel cells technologies to improve energy efficiency and reduce logistical burdens associated with traditional fuels. Furthermore, collaboration between defense contractors and technology firms drives innovation in fuel cell applications, positioning North America as a leader in developing sustainable energy solutions for military operations.

U.S. Fuel Cells In Defense Market Trends

The fuel cells in the defense market in the U.S. led North America and accounted for the largest revenue share in 2024, primarily driven by significant investments from both government and private sectors. In addition, the U.S. military is increasingly adopting fuel cells for their operational advantages, such as extended range and reduced noise levels in unmanned systems. Furthermore, ongoing research initiatives focused on enhancing fuel cells performance contribute to their integration into various defense applications, aligning with national objectives for energy resilience and sustainability.

Asia Pacific Fuel Cells In Defense Market Trends

Asia Pacific fuel cells in the defense market accounted for the largest revenue share of 33.2% in 2024 within the global market, driven by increasing investments in clean energy technologies and the need for sustainable military operations. In addition, governments are prioritizing the development of hydrogen infrastructure to support fuel cells applications, enhancing energy security and reducing reliance on fossil fuels. Furthermore, the region's focus on modernizing military capabilities aligns with the adoption of fuel cells, which offer efficient power solutions for various defense applications, including ground vehicles and drones.

China Fuel Cells In Defense Market Trends

The fuel cells in defense market in China dominated the Asia Pacific market and accounted for the largest revenue share in 2024, owing to government policies promoting green technologies and military modernization. In addition, the Chinese government’s commitment to reducing emissions drives investments in hydrogen fuel cells research, making it a strategic focus for defense applications. Furthermore, as China expands its military capabilities, integrating fuel cells into vehicles and drones enhances operational efficiency while supporting environmental sustainability goals.

Key Fuel Cells In Aerospace And Defense Company Insights

Key players in the global fuel cells in aerospace and defense industry include Cummins Inc., ElringKlinger AG, GenCell Ltd., and others. These companies employ strategies focused on innovation and collaboration. They also prioritize research and development to enhance fuel cells' efficiency and reduce costs. Furthermore, strategic partnerships with technology firms and government agencies are crucial for advancing hydrogen infrastructure and integrating fuel cells into various applications, ensuring they remain competitive in a rapidly evolving market.

-

Advent Technologies specializes in developing high-temperature proton exchange membrane (HT-PEM) fuel cells tailored for various aerospace and defense applications. Their products range from 1 kW to several hundred kilowatts, designed to power drones, air-taxis, eVTOLs, and auxiliary systems in aircraft. Operating in the clean energy segment, the company focuses on providing sustainable power solutions that enhance operational efficiency while reducing environmental impact, particularly in military and commercial aviation sectors.

-

GenCell Ltd. manufactures fuel cells solutions primarily based on alkaline fuel cells technology, catering to the aerospace and defense markets. Their products are designed for backup power systems and remote power applications, ensuring reliable energy supply in critical situations. GenCell operates in the alternative energy segment, emphasizing the development of eco-friendly solutions that meet the demanding requirements of defense operations.

Key Fuel Cells In Aerospace And Defense Companies:

The following are the leading companies in the fuel cells in aerospace & defense market. These companies collectively hold the largest market share and dictate industry trends.

- Advent Technologies

- Australian Fuel Cells Pty Ltd.

- Cummins Inc.

- ElringKlinger AG

- GenCell Ltd.

- Honeywell International Inc.

- Infinity Fuel Cells and Hydrogen, Inc.

- Intelligent Energy Limited

- Loop Energy Inc.

- Plug Power, Inc.

View a comprehensive list of companies in the Fuel Cells In Aerospace And Defense Market

Recent Developments

-

In May 2023, Advent Technologies and BASF announced a strategic partnership for hydrogen fuel cells systems in Europe through establishing an end-to-end supply chain. This collaboration aims to enhance the production of high-temperature proton exchange membrane (HT-PEM) fuel cells, crucial for aerospace and defense applications. The agreement includes scaling up BASF's Celtec MEA technology production at Advent’s new facility in Greece, promoting sustainable energy solutions and positioning Europe as a leader in hydrogen technology innovation.

-

In March 2023, ZeroAvia reported significant advancements in high-temperature fuel cells technology, achieving record performance with its High Temperature Proton Exchange Membrane (HTPEM) systems. Testing at their UK facility demonstrated a specific power of 2.5 kW/kg, which could enable commercially viable hydrogen-electric propulsion for large aircraft. This innovation aims to enhance fuel cells efficiency and reduce operational costs, positioning ZeroAvia as a leader in zero-emission aviation solutions for the aerospace and defense sectors, particularly for 40-80 seat aircraft and beyond.

Fuel Cells In Aerospace And Defense Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 (Aerospace) |

USD 712.6 million |

|

Revenue forecast in 2030 (Aerospace) |

USD 1.83 billion |

|

Growth rate (Aerospace) |

CAGR of 20.7% from 2025 to 2030 |

|

Market size value in 2025 (Defense) |

USD 726.1 million |

|

Revenue forecast in 2030 (Defense) |

USD 1.20 billion |

|

Growth rate (Defense) |

CAGR of 10.5% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, China, Japan, India, South Korea, Australia, Germany, UK, Italy, Spain, Brazil, UAE, South Africa |

|

Key companies profiled |

Advent Technologies; Australian Fuel cells Pty Ltd.; Cummins Inc.; ElringKlinger AG; GenCell Ltd.; Honeywell International Inc.; Infinity Fuel cells and Hydrogen, Inc.; Intelligent Energy Limited; Loop Energy Inc.; Plug Power, Inc. |

|

Customization scope |

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Fuel Cells In Aerospace & Defense Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global fuel cells in aerospace and defense market report based on product, application, and region:

-

Product Outlook (Aerospace) (Revenue, USD Million, 2018 - 2030)

-

PEMFC

-

SOFC

-

-

Application Outlook (Aerospace) (Revenue, USD Million, 2018 - 2030)

-

Commercial Aircrafts

-

Rotorcrafts

-

-

Product Outlook (Defense) (Revenue, USD Million, 2018 - 2030)

-

PEMFC

-

SOFC

-

-

Application Outlook (Defense) (Revenue, USD Million, 2018 - 2030)

-

Military Drones/UAV

-

Military Vehicles

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Italy

-

UK

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

UAE

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."