- Home

- »

- Consumer F&B

- »

-

Fruit And Vegetable Juice Market Size, Industry Report, 2033GVR Report cover

![Fruit And Vegetable Juice Market Size, Share & Trends Report]()

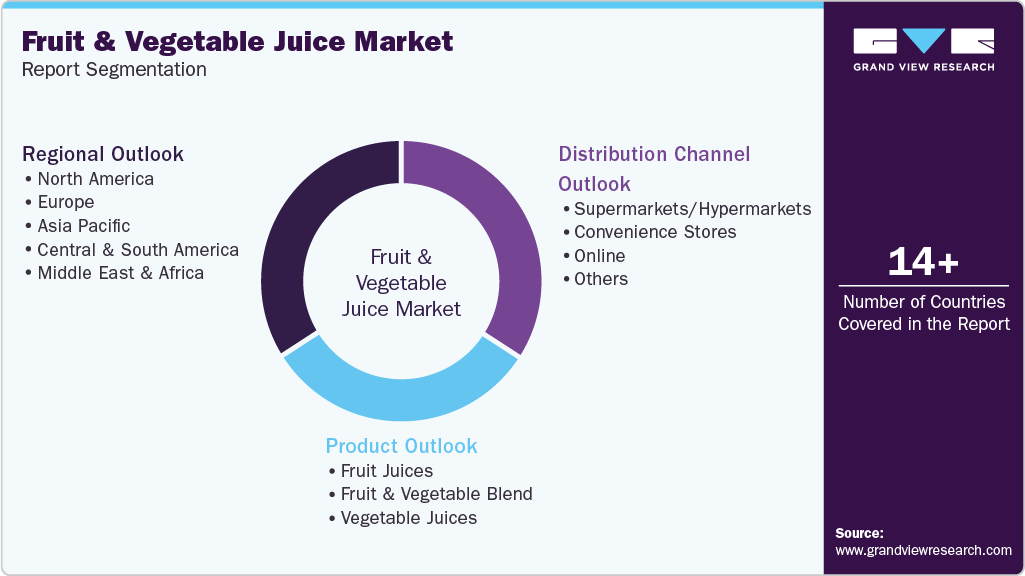

Fruit And Vegetable Juice Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Fruit Juices, Fruit & Vegetable Blend, Vegetable Juices), By Distribution Channel (Supermarkets/ Hypermarkets, Convenience Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-074-3

- Number of Report Pages: 112

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Fruit & Vegetable Juice Market Summary

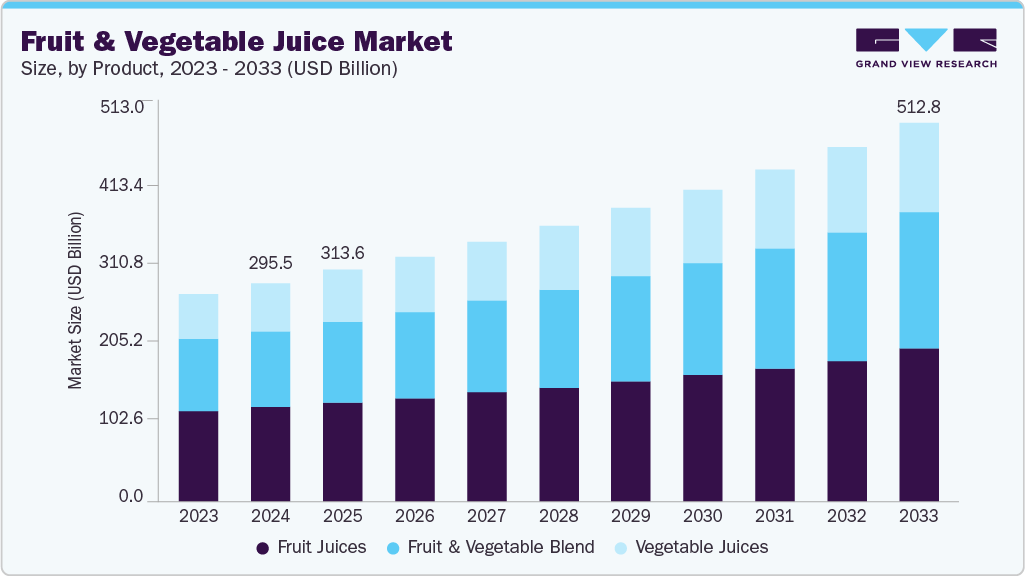

The global fruit and vegetable juice market size was valued at USD 295.49 billion in 2024 and is expected to reach USD 512.81 billion by 2033, growing at a CAGR of 6.3% from 2025 to 2033. An increase in fruit juice consumption, shifting consumer preferences, the move toward healthier diets, and the emergence of cold-pressed juices are key drivers propelling global market growth.

Key Market Trends & Insights

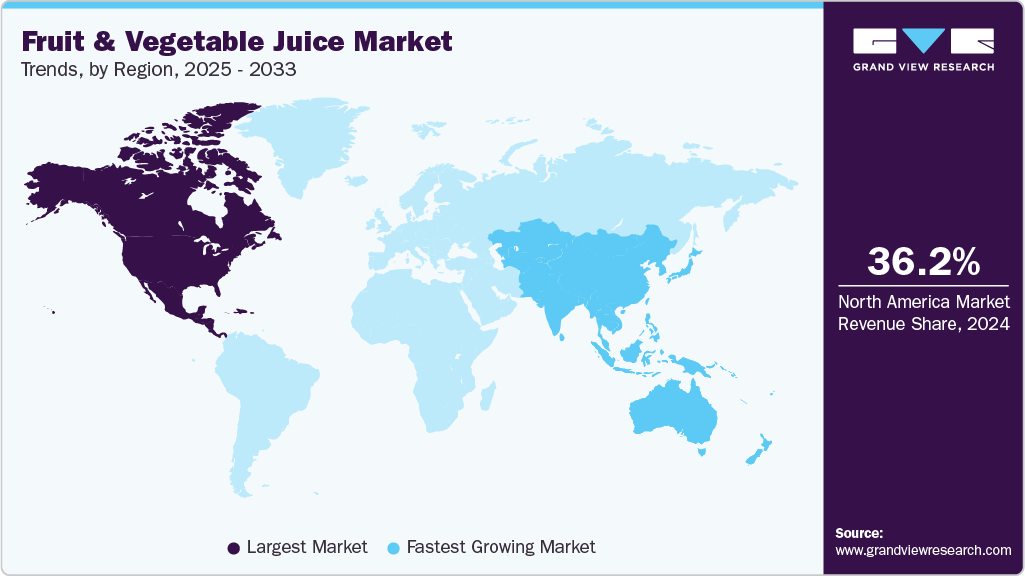

- North America held the largest share of the global fruit and vegetable juice market in 2024, accounting for 36.2%.

- The U.S. led the North American market in 2024, holding the largest market share with 80.5%.

- Based on product, the fruit juices segment held the largest market share, accounting for 43.3%.

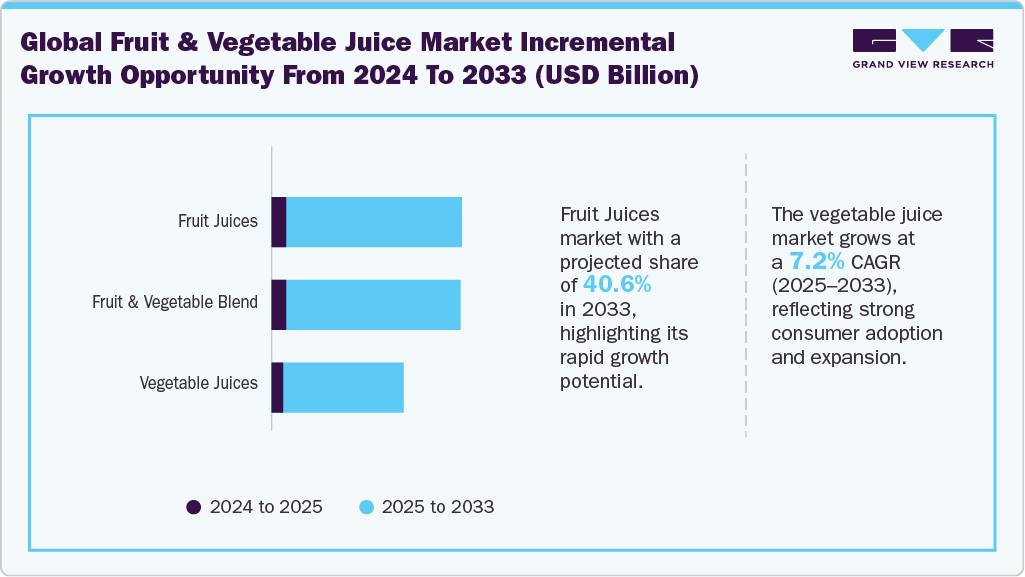

- By product, the vegetable juices segment is expected to witness the fastest CAGR of 7.2% during the forecast period.

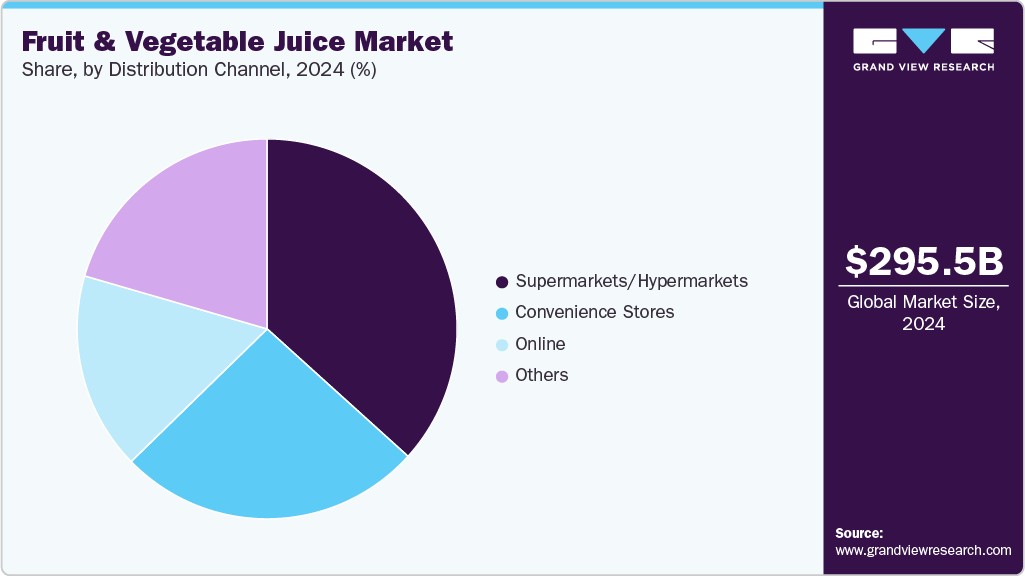

- By distribution channel, the supermarkets/hypermarkets led the market and accounted for a share of 36.7% in 2024.

Key Market Trends & Insights

- 2024 Market Size: USD 295.49 Billion

- 2033 Projected Market Size: USD 512.81 Billion

- CAGR (2025-2033): 6.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The global fruit and vegetable juice market is being driven by growing health consciousness and the demand for natural, nutrient-rich beverages. Urbanization and rising disposable incomes have led consumers to seek convenient yet wholesome drink options. Innovations in packaging and extended shelf-life technologies are also boosting market appeal. Additionally, expanding retail channels and increased awareness through digital media are supporting market penetration.Growing concerns about lifestyle-related diseases are driving consumers to choose functional beverages like fruit and vegetable juices. The rise of plant-based diets is further boosting demand for these natural drink options. Data published in February 2025 shows that about 72% of millennials want to increase their intake of plant-based foods. Government efforts to promote healthy eating are also encouraging juice consumption. Additionally, the launch of exotic flavors and organic options is attracting a broader consumer audience.

Furthermore, the demand for clean-label products without artificial additives is significantly shaping consumer choices in the juice market. Technological advances in juice extraction and preservation are improving product quality and shelf life. According to data published in April 2024, Blue Tree Technologies, a startup based in Israel, developed a unique patented method that lowers sugar content in natural drinks such as fruit juice, milk, and beer, while maintaining their original flavor and clean-label integrity. The rise of on-the-go lifestyles is increasing the popularity of ready-to-drink fruit and vegetable juices. Additionally, growing awareness of environmental sustainability is encouraging consumers to choose eco-friendly and plant-based beverage options.

Consumer Insights For Fruit And Vegetable Juice

Product Insights

In 2024, fruit juices held the largest share of 43.3% in the global fruit and vegetable juice market revenue. Fruit juices are rich in essential vitamins, minerals, antioxidants, and nutrients that provide numerous health benefits. Regular intake can help bolster the immune system, support heart health, and give a quick energy boost. While whole fruits are generally healthier, juices serve as a convenient way to increase fruit and vegetable consumption. To meet growing demand, companies are adopting innovative strategies to expand their market share. According to data released in April 2025, Minute Maid partnered with WWE in the U.S. as the franchise’s Official Juice Partner. The multi-year “Bring the Juice” campaign was launched through event branding, limited-edition packaging, digital content, and live activations at WrestleMania 41, SummerSlam, and Raw.

The vegetable juice market is expected to grow at the fastest CAGR of 7.2% from 2025 to 2033. Health-conscious consumers are increasingly incorporating fresh vegetables into their meals and drinks. Vegetable juices have become popular as a key part of fitness and nutrition routines, making them a regular choice for those seeking wellness benefits. Combinations like spinach and parsley juices are now common in daily diets, signaling a growing preference for more nutritious beverage options. According to data published in February 2024, James White Drinks in the UK launched Veg It, a vegetable juice blend featuring eight pressed vegetables, including carrot, beetroot, celery, sauerkraut, leek, cress, parsley, and tomato, to fill the gap left by V8 and provide a nutritious, low-sugar alternative.

Distribution Channel Insights

The sales of fruit and vegetable juices through supermarkets and hypermarkets accounted for the largest share, approximately 36.7% of global revenue in 2024. These retail formats play a vital role in boosting fruit and vegetable juice sales because of their wide product variety and strong brand recognition. Their ability to offer competitive prices and regular promotions attracts a diverse range of consumers. High foot traffic in these stores also increases product visibility, encouraging impulse buys. Easy access to both international and local juice brands improves consumer choice. Moreover, in-store marketing and sampling campaigns help educate customers and encourage trial of new or premium juice products.

The sales of fruit and vegetable juices through online distribution channels are projected to grow at the fastest CAGR of 7.4% from 2025 to 2033. Online platforms are significantly increasing fruit and vegetable juice sales by offering convenience and doorstep delivery, appealing to busy lifestyles. The availability of a wide variety of products, including niche and premium brands, attracts health-conscious consumers. Personalized recommendations and targeted advertising boost customer engagement and encourage repeat purchases. Subscription models and discounts further motivate consumers to buy juices online. Additionally, the growth of health and wellness e-commerce platforms has increased the visibility and accessibility of juice products.

Regional Insights

North America accounted for the largest market share of 36.2% in 2024. Rising health consciousness and increasing demand for convenient, nutrient-rich beverages are propelling the market in North America. The surge in plant-based diets and clean-label product trends further boost consumption. Additionally, advancements in cold-press and extraction technologies enhance juice quality and shelf life. Government initiatives promoting wellness and nutrition also support market growth.

U.S. Fruit and Vegetable Juice Market Trends

The U.S. led the North American fruit and vegetable juice market in 2024, holding the largest market share with 80.5% of the region’s total revenue. In the U.S., a growing awareness of the immunity-boosting properties of fruit and vegetable juices drives consumer preference. The expanding organic and non-GMO juice segment attracts health-focused buyers. Moreover, the rise of e-commerce platforms facilitates easier access to diverse juice products. Strategic marketing campaigns by major brands emphasizing functional benefits fuel market penetration.

Europe Fruit and Vegetable Juice Market Trends

The fruit and vegetable juice market in Europe is projected to grow at a CAGR of 6.1% from 2025 to 2033. Europe’s fruit and vegetable juice market benefits from stringent regulations on food safety and organic certifications, ensuring high product standards. Consumers’ increasing inclination towards natural and additive-free juices stimulates demand. The popularity of detox and weight management trends also plays a key role. Furthermore, innovations in packaging sustainability appeal to environmentally conscious buyers.

The fruit and vegetable juice market in Germany is projected to grow at the fastest CAGR of 5.4% from 2025 to 2033. Germany's juice market growth is driven by strong consumer preference for locally sourced and seasonal produce juices. The country’s focus on reducing sugar content in beverages aligns with public health goals, fostering reformulated juice products. Rising demand for cold-pressed and raw juices reflects a shift towards premium quality. Additionally, Germany's well-established retail infrastructure supports widespread distribution.

Asia Pacific Fruit and Vegetable Juice Market Trends

The fruit and vegetable juice market in the Asia Pacific is projected to grow at the fastest CAGR of 7.4% from 2025 to 2033. In the Asia Pacific, rapid urbanization and rising disposable incomes encourage consumption of health-oriented fruit and vegetable juices. Traditional medicine influences preference for functional ingredients such as turmeric and ginger in juices. Expanding modern retail and foodservice sectors improve product availability. Furthermore, top companies are progressively embracing sustainable sourcing, environmentally friendly packaging, and digital technologies to align with changing consumer demands and maintain a competitive edge in the rapidly evolving global fruit beverages market. For instance, in December 2024, Dabur India collaborated with Ball Corporation to launch Réal Bites juice, with real fruit chunks, in India, now available in fully recyclable 185 ml aluminum cans that offer an extended shelf life of up to one year compared to traditional packaging.

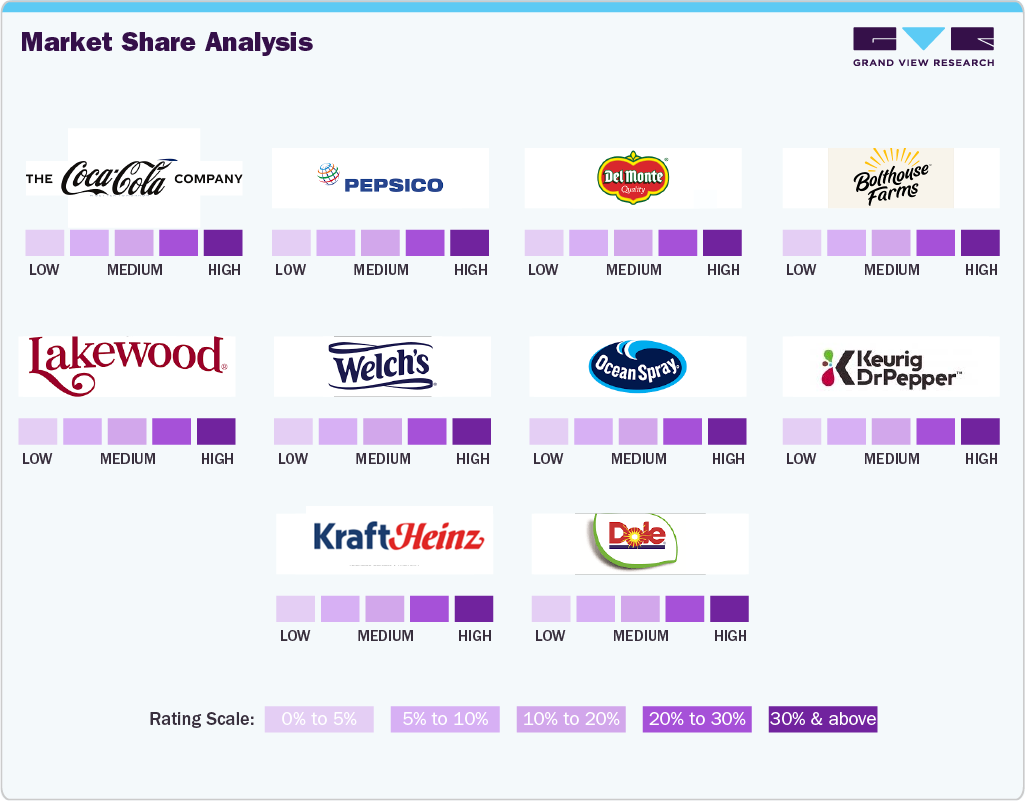

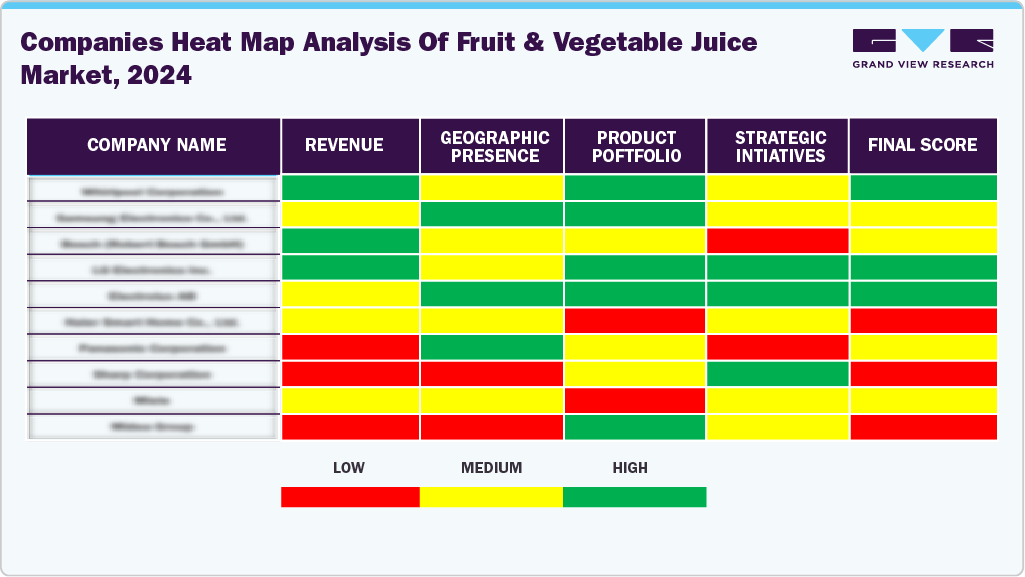

Key Fruit And Vegetables Juice Company Insights

Many brands in the global fruit and vegetable juice market have recognized untapped opportunities within their product portfolios and are actively working to capitalize on these gaps. This includes launching innovative designs, expanding customization options, and tailoring marketing strategies to align with evolving consumer tastes and cultural trends. By addressing niche segments and emerging preferences, these brands aim to increase their market share and strengthen their competitive positioning worldwide.

Key Fruit And Vegetable Juice Companies:

The following are the leading companies in the fruit & vegetable juice market. These companies collectively hold the largest market share and dictate industry trends.

- The Coca‑Cola Company

- PepsiCo

- Fresh Del Monte

- Bolthouse Farms, Inc.

- Lakewood Organic Juices

- Welch's

- Ocean Spray

- Keurig Dr Pepper Inc.

- The Kraft Heinz Company

- Dole Packaged Foods, LLC

Recent Developments

-

In July 2025, PIM Brands introduced Welch’s Juicefuls Fusions in the U.S. The dual‑flavor fruit snack featured a chewy fruit exterior paired with a contrasting juicy center, available in Watermelon & Lemon, Green Apple & Peach, and Blueberry & Raspberry. It was gluten‑ and peanut‑free, naturally colored, and fortified with vitamins A, C, and E.

-

In December 2024, Ocean Spray Cranberries (USA) partnered with Dyla Brands to launch a zero‑sugar, powdered drink‑mix line. Featuring White Cran × Strawberry, Cran × Grape, and White Cran × Peach flavors made from real cranberry juice powder, the portfolio delivered 100 % daily vitamin C in convenient on‑the‑go stick packs.

-

In March 2024, The Coca‑Cola Company’s brand Minute Maid’s Zero Sugar category launched its first global marketing campaign emphasizing the drink’s great taste and zero sugar. The campaign highlights the brand's success without traditional marketing, showcasing its popularity and quality through lighthearted content. Minute Maid Zero Sugar offers many flavors, such as Mango Passion, Fruit Punch, Lemonade, and more.

Fruit And Vegetable Juice Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 313.62 billion

Revenue forecast in 2033

USD 512.81 billion

Growth rate

CAGR of 6.3% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional Scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

The Coca‑Cola Company; PepsiCo; Fresh Del Monte; Bolthouse Farms, Inc.; Lakewood Organic Juices; Welch's; Ocean Spray; Keurig Dr Pepper Inc.; The Kraft Heinz Company; Dole Packaged Foods, LLC

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fruit And Vegetable Juice Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global fruit and vegetable juice market report on the basis of product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Fruit Juices

-

Fruit & Vegetable Blend

-

Vegetable Juices

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Supermarkets/ Hypermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fruit and vegetable juice market size was estimated at USD 295.49 billion in 2024 and is expected to reach USD 313.62 billion in 2025.

b. The global fruit and vegetable juice market is expected to grow at a compound annual growth rate (CAGR) of 6.3 % from 2025 to 2033 to reach USD 512.81 billion by 2033.

b. The fruit juices market accounted for a revenue share of 43.3% in 2024, driven by increasing health awareness, a growing preference for natural, organic beverages, convenience, innovative flavors, and rising disposable incomes.

b. Some key players operating in the global fruit and vegetable juice market include The Coca‑Cola Company, PepsiCo, Fresh Del Monte, Bolthouse Farms, Inc., Lakewood Organic Juices, Welch's, Ocean Spray, Keurig Dr Pepper Inc., The Kraft Heinz Company, and Dole Packaged Foods, LLC.

b. Key factors driving growth in the global fruit and vegetable juices market include rising consumer awareness of health and wellness, increasing demand for convenient and nutritious beverages, and a growing preference for natural and organic juice products. Technological advancements in juice extraction, packaging, and preservation are enhancing product quality and shelf life. Additionally, the expansion of e-commerce and ready-to-drink segments, along with shifting dietary trends toward plant-based and functional beverages, are further accelerating market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.