- Home

- »

- Advanced Interior Materials

- »

-

Froth Flotation Equipment Market Size & Share Report, 2030GVR Report cover

![Froth Flotation Equipment Market Size, Share & Trends Report]()

Froth Flotation Equipment Market Size, Share & Trends Analysis Report By Machine Type (Free-flow, Cell-to-cell), By Application (Wastewater Treatment, Paper Recycling, Mineral And Ore Processing), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-364-9

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Froth Flotation Equipment Market Trends

The global froth flotation equipment market size was estimated at USD 344.3 million in 2023 and is projected to grow at a CAGR of 4.2% from 2024 to 2030. The market has been experiencing significant growth, driven by its critical role in the mining industry, particularly in mineral processing. This technology is essential for separating valuable minerals from ore through a process of selective hydrophobicity, which is crucial for enhancing resource recovery and efficiency. The increasing demand for metals such as copper, nickel, and gold, driven by their applications in electronics, renewable energy, and construction, is propelling the market forward.

Moreover, the market is also benefiting from the push toward sustainable and environment-friendly mining practices. There is a growing emphasis on minimizing the environmental impact of mining operations, leading to increased demand for equipment that enhances the efficiency of ore processing while reducing waste and energy consumption.

For instance, the introduction of automated flotation systems and advanced control technologies is helping to optimize flotation processes, reduce reagent usage, and minimize the environmental footprint. As regulatory pressures and sustainability goals continue to shape the industry, the froth flotation equipment market is likely to see continued advancements and demand growth, reflecting the broader trends of innovation and environmental responsibility in mining.

Drivers, Opportunities & Restraints

The market is primarily driven by the surging demand for base and precious metals, which are essential for various industries including electronics, automotive, and renewable energy. Technological advancements in flotation equipment, such as improved flotation cells and reagents, are enhancing efficiency and recovery rates, making the process more attractive to mining companies. Additionally, the need for upgrading outdated equipment and expanding mining operations globally fuels market growth.

The market faces several challenges, including high capital costs and operational expenses associated with advanced flotation systems. The complexity of the technology can lead to increased maintenance and training requirements, which might deter smaller mining operations from investing in state-of-the-art equipment. Additionally, fluctuations in mineral prices and economic downturns can impact the budgets of mining companies, potentially slowing down investment in new flotation technologies.

The market offers substantial opportunities driven by innovations in flotation technology aimed at improving efficiency and reducing environmental impact. Emerging trends like automation and digitalization in flotation processes present opportunities for enhanced performance and cost savings. The development of eco-friendly reagents and energy-efficient systems is also creating new avenues for market growth, aligning with the global push for sustainable mining practices. Furthermore, the expansion of mining activities in developing regions and the increasing focus on recycling and reprocessing of mining waste provide additional growth prospects for advanced flotation equipment.

Machine Type Insights

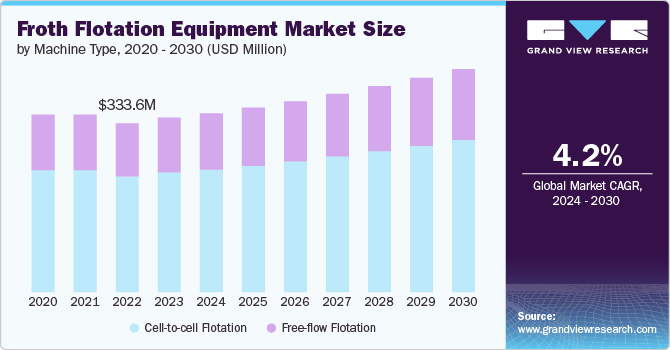

“The demand for cell-to-cell flotation segment is expected to grow at a significant CAGR of 4.1% from 2024 to 2030 in terms of revenue”

The cell-to-cell flotation segment led the market and accounted for 68.5% of the global market revenue share in 2023. The demand for cell-to-cell flotation machines is strong in operations processing complex ores and minerals, where precise control over the flotation stages is crucial for optimizing recovery rates. For example, in copper and gold mining, where ore characteristics can vary widely, the ability to finely tune each cell's conditions helps in maximizing yield. The reliability and proven effectiveness of cell-to-cell flotation systems make them a preferred choice for many large-scale mining operations.

Free-flow flotation machines are gaining traction for their flexibility and ability to handle varying ore types and conditions. Unlike cell-to-cell flotation machine type, free-flow flotation machines allow the slurry to flow freely through the flotation tank, which can lead to reduced maintenance and operational costs. This type of flotation is particularly advantageous in processing larger volumes of ore or in scenarios where the flotation conditions need to be adjusted dynamically.

Application Insights

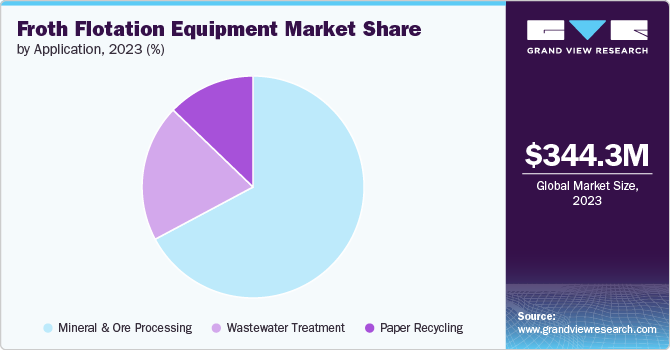

“The demand for wastewater treatment application segment is expected to grow at a significant CAGR of 6.1% from 2024 to 2030 in terms of revenue”

The mineral and ore processing segment accounted for 67.2% of the global market revenue share in 2023. In mineral and ore processing, froth flotation is a critical technique for the separation and concentration of valuable minerals from ore. The process involves adding chemicals that selectively bind to specific minerals, creating hydrophobic surfaces that attach to air bubbles introduced into the flotation cell. The hydrophobic particles rise to the surface and form a frothy concentrate, while the hydrophilic waste material remains in the slurry. This method is widely used in the mining industry for the extraction of metals such as copper, gold, and zinc.

In wastewater treatment, froth flotation equipment is employed to remove suspended oils, solids, and other contaminants from industrial and municipal effluents. The process works by introducing air bubbles into the wastewater, which attach to the contaminants and bring them to the surface as a frothy concentrate. This method is particularly effective for treating oily or greasy wastewater, as well as for separating fine particles that are difficult to settle using conventional methods.

Regional Insights

North America froth flotation equipment market is propelled by a combination of mining activity and technological innovation. The U.S. and Canada, with their extensive mining industries, are significant consumers of froth flotation equipment. In the U.S., regions such as Nevada and Arizona are key mining hubs where froth flotation is essential for processing gold and copper ores. Similarly, Canada’s mining sector, particularly in Quebec and British Columbia, drives demand for advanced flotation technologies to handle a diverse range of mineral ores. The focus on increasing the efficiency of mining operations and meeting stringent environmental regulations in North America further boosts the market for froth flotation equipment.

Asia Pacific Froth Flotation Equipment Market Trends

“China to witness market growth at 4.8% CAGR”

The froth flotation equipment market in Asia Pacific is experiencing robust growth due to the significant mining activities and rapid industrialization across several countries. The region is rich in mineral resources, with countries like Australia, India, and Indonesia leading the way in mining operations. For instance, Australia’s vast mineral deposits and active mining sector drive the need for advanced flotation technologies to process ores efficiently. Additionally, the rising demand for metals and minerals in emerging economies like India and Indonesia further propels the market for froth flotation equipment.

China froth flotation equipment market is estimated to grow at a CAGR of 4.8% over the forecast period. In China, the froth flotation equipment market is driven by the country's extensive mining sector and its focus on improving the efficiency of mineral processing. China is one of the largest producers and consumers of minerals, including copper, lead, and zinc, which fuels the demand for advanced flotation technologies.

Europe Froth Flotation Equipment Market Trends

The froth flotation equipment market in Europe is influenced by both mineral processing needs and environmental regulations. While Europe’s mining sector is not as large as those in other regions, countries like Sweden, Finland, and Spain have active mining operations that require efficient flotation technologies. For example, Sweden's LKAB and Finland’s Boliden are key players in the European mining industry, utilizing froth flotation to process iron ore and base metals.

Key Froth Flotation Equipment Company Insights

Some of the key players operating in the froth flotation equipment market include Metso Outotec, FLSmidth, Yokogawa Electric among others.

-

Metso Outotec is a global leader in sustainable technology and services for the mining, aggregates, recycling, and process industries. Formed through the merger of Metso Minerals and Outotec in July 2020, the company is headquartered in Helsinki, Finland, and operates with a strong focus on advancing sustainable technologies and improving operational efficiencies for its clients.Metso Outotec offers a comprehensive range of products and services, including equipment, systems, and solutions for mineral processing, metal refining, and waste recycling. Its portfolio includes crushers, grinding mills, flotation equipment such as Outotec TankCell Flotation, Outotec SkimAir Flash Flotation and various other machinery essential for mineral and ore processing.

-

FLSmidth is a global provider of sustainable and innovative solutions for the mining and cement industries. Headquartered in Copenhagen, Denmark, the company has a long-standing history dating back to its founding in 1882. FLSmidth offers a comprehensive range of equipment, systems, and services designed to enhance the efficiency and sustainability of mineral processing, cement production, and related industrial processes.FLSmidth provides a broad portfolio of products and services for the mining industry, including crushers, grinding mills, flotation cells, and other mineral processing equipment. The company is known for its advanced technologies in ore beneficiation, including the well-regarded Dorr-Oliver and Eimco flotation cells.

JXSC Jiangxi Copper Corporation, Greyline Instruments Inc. and are some of the emerging market participants in the froth flotation equipment market.

-

JXSC Jiangxi Copper Corporation, commonly known as Jiangxi Copper, is one of China’s largest and most significant copper producers. Headquartered in Jiangxi Province, China, the company was established in 1979 and has since grown into a major player in the global copper industry. Jiangxi Copper engages in the processing of other minerals and metals. The company employs advanced technologies for ore beneficiation, including flotation and hydrometallurgical processes, to improve the efficiency and yield of its operations.

-

Greyline Instruments Inc. is a provider of industrial measurement and process control solutions, specializing in flow measurement, level measurement, and analytical instrumentation. Founded in 1983 and headquartered in Ontario, Canada, the company is known for its innovative technologies and reliable instrumentation solutions.

Key Froth Flotation Equipment Companies:

The following are the leading companies in the froth flotation equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Metso Outotec

- FLSmidth

- Yokogawa Electric

- Endress+ Hauser

- Foxboro

- Eriez Flotation

- JXSC Jiangxi Copper Corporation

- Yantian Jingpeng Mining Technology

- GEA Minerals

- Sandvik

- Boliden Mineral AB

- Myntec

- WEG Equipamentos Elétricos S.A.

- Greyline Instruments Inc.

- Process IQ Pty Ltd.

Recent Developments

-

In December 2023, Metso introduced the Spider Crowder upgrade, designed to tackle the challenges associated with large flotation cells. Recognizing the importance of maintaining high equipment availability and efficiency in the continuous flotation process, this new technology offers advanced froth management capabilities. When paired with a Metso Center Launder, the Spider Crowder promises enhanced metallurgical performance, improved energy efficiency, and better process control.

-

In April 2022, Eriez released a new video showcasing the operation of its HydroFloat Separator technology and highlighting its advantages for mining companies aiming to improve their Environmental, Social, and Corporate Governance (ESG) performance.

Froth Flotation Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 356.3 million

Revenue forecast in 2030

USD 454.9 million

Growth Rate

CAGR of 4.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Machine type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; Russia; Poland; Sweden; China; Indonesia; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Metso Outotec; FLSmidth; Yokogawa Electric; Endress+ Hauser; Foxboro; Eriez Flotation; JXSC Jiangxi Copper Corporation; Yantian Jingpeng Mining Technology; GEA Minerals; Sandvik; Boliden Mineral AB; Myntec; WEG Equipamentos Elétricos S.A.; Greyline Instruments Inc.; Process IQ Pty Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Froth Flotation Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global froth flotation equipment market report on the basis of machine type, application, and region:

-

Machine Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell-to-cell Flotation

-

Free-flow Flotation

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Wastewater Treatment

-

Paper Recycling

-

Mineral And Ore Processing

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Sweden

-

Poland

-

Asia Pacific

-

Indonesia

-

China

-

India

-

Australia

-

South Korea

-

Latin America

-

Brazil

-

Argentina

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Frequently Asked Questions About This Report

b. The global froth flotation equipment market size was estimated at USD 344.3 million in 2023 and is expected to reach USD 356.3 million in 2024

b. The froth flotation equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.2% from 2024 to 2030 to reach USD 454.9 million by 2030

b. The cell-to-cell flotation machine type segment led the market and accounted for 68.5% of the global market revenue share in 2023. The demand for cell-to-cell flotation machines is strong in operations processing complex ores and minerals, where precise control over the flotation stages is crucial for optimizing recovery rates

b. Some of the key players operating in the froth flotation equipment market include Metso Outotec, FLSmidth, Yokogawa Electric, Endress+ Hauser, Foxboro, Eriez Flotation, JXSC Jiangxi Copper Corporation, Yantian Jingpeng Mining Technology, GEA Minerals, Sandvik, Boliden Mineral AB, Myntec, WEG Equipamentos Elétricos S.A., Greyline Instruments Inc., Process IQ Pty Ltd

b. The froth flotation equipment market has been experiencing significant growth, driven by its critical role in the mining industry, particularly in mineral processing. This technology is essential for separating valuable minerals from ore through a process of selective hydrophobicity, which is crucial for enhancing resource recovery and efficiency

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."