Friction Stir Welding Equipment Market Size, Share & Trends Analysis Report By Type (Fixed FSW Equipment, Robotic FSW Equipment), By End-use (Aerospace, Automotive, Railways), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-382-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Market Size & Trends

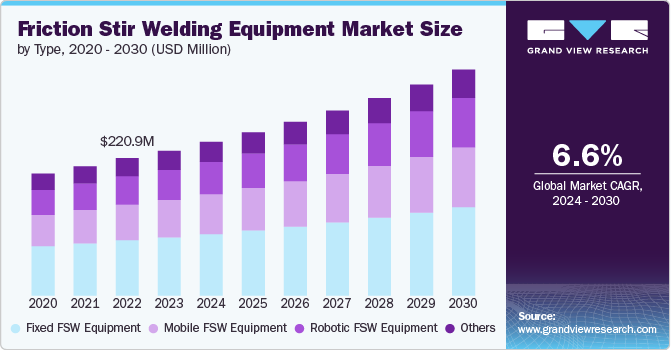

The global friction stir welding equipment market size was estimated at USD 246.9 million in 2024 and is expected to grow at a CAGR of 6.7% from 2025 to 2030. The increasing demand for high-quality, cost-effective, and environment-friendly welding technologies in industries such as aerospace, automotive, and shipbuilding is driving the growth of the friction stir welding (FSW) equipment market. FSW is a solid-state joining process that is particularly effective for welding lightweight alloys, providing superior joint strength and durability.

Technological advancements in FSW equipment, such as robotic and mobile systems development, are presenting significant growth opportunities. These advancements improve the effectiveness and adaptability of FSW processes, enabling their use across various applications. In addition, the growing focus on reducing manufacturing costs and improving product performance is driving the adoption of FSW technology across various industries. The expansion of the aerospace and automotive industries and the need for lightweight and fuel-efficient vehicles are further expected to bolster the market demand.

FSW technology is recognized for its lower energy consumption compared to traditional welding methods, making it an excellent fit for global sustainability goals. As manufacturers aim to meet these goals and adopt more eco-friendly practices, the demand for FSW equipment is expected to increase. The growing need for high-strength, defect-free welds in critical sectors such as aerospace, automotive, and shipbuilding is driving demand for friction stir welding equipment. The rising use of lightweight materials such as aluminum and magnesium alloys in these industries is further contributing to the demand for this equipment. FSW's benefits, including reduced energy use, fewer welding defects, and enhanced mechanical properties, are also expected to support market expansion.

Environmental concerns and stringent regulations regarding emissions and energy consumption are also influencing the friction stir welding (FSW) equipment market. FSW technology is known for its lower energy consumption compared to traditional welding methods, which aligns well with global sustainability goals. As manufacturers seek to comply with these regulations and adopt greener manufacturing processes, the demand for FSW equipment is expected to rise.

Type Insights

Fixed FSW equipment dominated the friction stir welding equipment market and accounted for the largest revenue share of 40.5% in 2024. The growth is driven by its widespread use in manufacturing plants for producing large, consistent welds. These systems are typically used in high-volume production settings, where robust and reliable welding solutions are critical. The demand for fixed FSW equipment is expected to continue to grow due to its efficiency and ability to produce high-quality welds.

The U.S. manufacturing output exceeded expectations in February 2025, driven by a significant increase in motor vehicle production. Factory output rose by 0.9% in February 2025, following a revised 0.1% gain in January 2025, according to the Federal Reserve's report.

The robotic FSW equipment segment is expected to grow at the fastest CAGR of 7.5% over the forecast period. This category of equipment is gaining popularity due to its ability to automate the welding process, resulting in higher precision and consistency. These systems are increasingly used in the automotive and aerospace industries to produce complex and high-precision welds. The integration of robotics in FSW is expected to drive market growth by enhancing productivity and reducing labor costs. According to China Briefing, China's aerospace and commercial space industries are expanding quickly, with the sector expected to reach a value of over USD 900 billion by 2029.

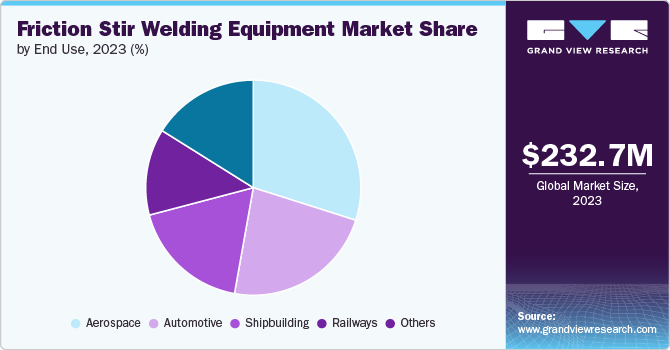

End-use Insights

The aerospace industry led the friction stir welding equipment market with the largest revenue share of 29.7% in 2024. FSW is extensively utilized in the production of aircraft components, including fuselages, wings, and fuel tanks, because of its ability to produce high-strength, defect-free welds. The increasing production of commercial and military aircraft is expected to drive the demand for FSW equipment in this segment. According to ACI World, an electronic payments company, the global passenger traffic is expected to exceed 10 billion passengers in 2025. This marks a 6% increase from 2024 and a rise of over 16% compared to 2019. Avolon has forecasted a 20% increase in aircraft deliveries in 2025.

The automotive industry is expected to grow at the fastest CAGR of 7.3% over the forecast period. It uses the technology for welding lightweight materials. The increasing demand for lightweight and fuel-efficient vehicles is accelerating the use of FSW in automotive production.

The trend toward EVs and the need for lightweight and strong battery enclosures are projected to propel market growth in the coming years. India's electric vehicle (EV) industry is gaining significant momentum, driven by the launch of new models, the expansion of charging infrastructure, and a steady rise in sales. In 2024, nearly 100,000 EVs were sold, marking a 20% increase from the previous year. Meanwhile, total light vehicle sales in India reached approximately 4.9 million units as automakers race to capitalize on the growing demand in this emerging market.

Regional Insights

The North America friction stir welding equipment market led the global market with the largest revenue share of 32.5% in 2024. The region's advanced manufacturing infrastructure and emphasis on high-quality, durable products are key drivers for the adoption of FSW technology. The U.S. and Canada are investing heavily in modernizing their manufacturing capabilities, with a focus on reducing energy consumption and improving environmental performance. The presence of leading aerospace companies and the push for lightweight, fuel-efficient vehicles are expected to sustain the growth of the FSW equipment industry in North America.

U.S. Friction Stir Welding Equipment Market Trends

The U.S. dominated the North America friction stir welding equipment market with the largest revenue share in 2024. The growth is driven by its leading position in the aerospace and automotive industries. The demand for high-strength, lightweight materials in these sectors is a major factor boosting the adoption of FSW technology. The U.S. government’s focus on promoting advanced manufacturing and sustainable industrial practices is also contributing to the growth of the friction stir welding equipment industry. Significant investments in research & development and collaborations between industry and academic institutions are driving innovations in FSW technology.

Asia Pacific Friction Stir Welding Equipment Market Trends

The friction stir welding equipment market in Asia Pacific is estimated to grow at the fastest CAGR of 7.7% over the forecast period. The expansion of the region's industrial sector and rising investments in advanced manufacturing technologies are driving growth. China, Japan, and South Korea are at the forefront of adopting FSW technology, supported by their strong automotive and electronics sectors. The increasing need for lightweight, high-strength materials in these industries is further expected to favor market.

Europe Friction Stir Welding Equipment Market Trends

The European friction stir welding equipment market held a substantial market share in 2024. The growth is driven by the region's strong manufacturing base and focus on advanced manufacturing technologies. Europe is home to several major automotive and aerospace manufacturers, which are increasingly adopting FSW to enhance the performance and quality of their products. Stringent environmental regulations and the push for sustainable manufacturing practices are further accelerating the adoption of energy-efficient FSW technologies in the region.

Key Friction Stir Welding Equipment Company Insights

Some of the major friction stir welding equipment industry players are ETA Technology, YAMAZAKI MAZAK CORPORATION, FOOKE GmbH, and PAR Systems. These companies stay competitive by investing in advanced technology, offering high-quality, cost-effective solutions, and continuously innovating their processes. They focus on building strong customer relationships, diversifying into new industries, and optimizing production efficiency. Additionally, they prioritize sustainability, improving their environmental footprint, and expanding their global presence to meet diverse market demands and regulatory requirements.

-

ETA Technology is a company that provides innovative engineering solutions, focusing on advanced manufacturing processes and automation. They offer a range of products and services, including precision welding, robotics, and custom-designed systems for various industries.

-

YAMAZAKI MAZAK CORPORATION is a manufacturer of advanced machine tools, offering solutions for industries such as aerospace, automotive, and medical. The company specializes in CNC (computer numerical control) machines, automation systems, and related services. It focuses on innovation, precision, and providing integrated manufacturing solutions worldwide.

Key Friction Stir Welding Equipment Companies:

The following are the leading companies in the friction stir welding equipment market. These companies collectively hold the largest market share and dictate industry trends.

- ETA Technology

- YAMAZAKI MAZAK CORPORATION

- FOOKE GmbH

- PAR Systems

- Hitachi Power Solutions Co.,Ltd.

- NITTO SEIKI CO., LTD.

- Grenzebach Group

- Bond Technologies, LLC.

- PTG

- TRA-C industrie.

Recent Developments

-

In March 2025, TWI Ltd and Stirweld hosted a joint event at TWI's Cambridge facility to showcase TWI's advanced tank welding technology with Stirweld's retractable pin Friction Stir Welding (FSW) technology. The event, a part of the UK’s Aerospace Technology Institute (ATI) MASTER project, featured live welding demonstrations and speakers from organizations such as GKN Aerospace. The collaboration aimed to improve aluminum hydrogen storage tank manufacturing for the aerospace sector, reflecting a shared commitment to advancing FSW technology for future industrial needs.

-

In November 2022, Friction Welding Technologies Pvt. Ltd. (FWT) announced its acquisition by Manufacturing Technologies, Inc. (MTI), a leading provider of friction and resistance welding technologies with operations in the US and UK.

Friction Stir Welding Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 262.4 million |

|

Revenue forecast in 2030 |

USD 363.2 million |

|

Growth Rate |

CAGR of 6.7% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; France; Italy; Spain; UK; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa |

|

Key companies profiled |

ETA Technology; YAMAZAKI MAZAK CORPORATION; FOOKE GmbH; PAR Systems; Hitachi Power Solutions Co.,Ltd.; NITTO SEIKI CO., LTD.; Grenzebach Group; Bond Technologies, LLC.; PTG; and TRA-C industrie. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Friction Stir Welding Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global friction stir welding equipment market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed FSW Equipment

-

Mobile FSW Equipment

-

Robotic FSW Equipment

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerospace

-

Automotive

-

Shipbuilding

-

Railways

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global friction stir welding equipment market size was estimated at USD 232.7 million in 2023 and is expected to reach USD 246.9 million in 2024.

b. The global friction stir welding equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.6% from 2024 to 2030 to reach USD 363.2 million by 2030.

b. North America dominated the friction stir welding equipment market with a revenue share of 32.7% in 2023. The region's advanced manufacturing infrastructure and emphasis on high-quality, durable products are key drivers for the adoption of FSW technology.

b. Some of the key players operating in the friction stir welding equipment market include ETA Technology, YAMAZAKI MAZAK CORPORATION, FOOKE GmbH, PAR Systems, Hitachi Power Solutions Co.,Ltd., NITTO SEIKI CO., LTD., Grenzebach Group, Bond Technologies, PTG, Groupe TRA-C industries.

b. The friction stir welding equipment market is driven by increasing demand for high-quality, cost-effective, and environmentally friendly welding technologies in industries such as aerospace, automotive, and shipbuilding.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."