Friction Modifiers Market Size, Share & Trends Analysis Report By Type (Organic, Inorganic), By Application (Commercial Vehicles, Passenger Vehicles), By Region (North America, Europe, Asia Pacific), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-339-9

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Friction Modifiers Market Size & Trends

The global friction modifiers market size was estimated at USD 987.65 million in 2023 and is projected to grow at a CAGR of 3.8% from 2024 to 2030. Friction modifiers, also known as boundary lubrication additives, are oil-soluble chemicals used in lubricants for transmission and internal combustion engine applications. Their primary function is to reduce wear and friction in machine components by preventing solid surfaces from coming into direct contact, thus minimizing friction and wear. These additives play a crucial role in the boundary lubrication regime, where they form a protective layer to reduce friction and prevent metal-to-metal contact, contributing to the overall efficiency and longevity of machinery.

The demand for product has been driven by the need to minimize energy losses due to friction, thereby enhancing fuel economy and reducing wear on critical components. As the automotive industry continues to prioritize higher fuel efficiency and reduced emissions, the importance of product in lubrication solutions has grown significantly. These additives are essential for achieving smoother operation, enhanced durability, and improved performance in a wide range of applications, from passenger vehicles to heavy-duty industrial machinery.

The demand for product is closely linked to the need for increased fuel efficiency and reduced emissions in the automotive industry. As manufacturers strive to develop more fuel-efficient vehicles in compliance with stringent environmental regulations, the use of product becomes crucial. These additives play a vital role in enhancing overall fuel economy, efficiency, and equipment lifespan, making them indispensable in the pursuit of sustainable development through reduced CO2 emissions.

Moreover, the market's growth is expected to be particularly pronounced in the Asia Pacific region, driven by the increasing demand for the automotive industry in this area. Overall, the product market is poised for substantial expansion, with a strong emphasis on meeting the evolving needs of the automotive and industrial sectors.

Application Insights

Commercial vehicle applications dominated the market with a revenue share of 64.1% in 2023. With the increasing sales of commercial vehicles, there is a corresponding rise in the consumption of lubricants, thereby boosting the demand for friction modifiers. The transportation lubricants segment, particularly in the context of commercial vehicle lubricants, is expected to be a dominant application for friction modifiers, contributing to the market's growth.

The application of product in passenger vehicles is crucial for enhancing fuel efficiency, reducing friction, and addressing environmental concerns. This aligns with the industry's focus on sustainability and performance improvement, underscoring the significance of product in this segment. The increasing production volume of passenger cars, coupled with the booming automotive industry, are key driving factors for the global friction modifiers market, further emphasizing the importance of the passenger vehicles segment.

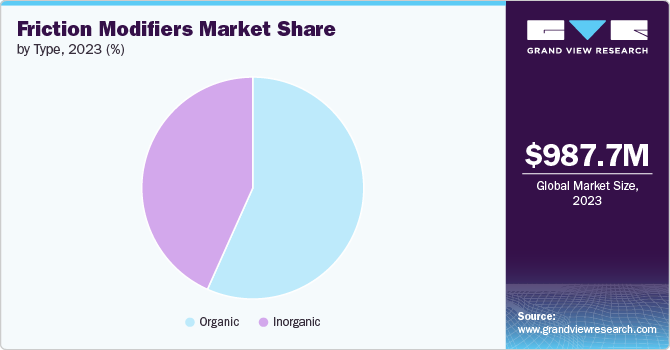

Type Insights

Organic dominated the market with a revenue share of 57.3% in 2023. Organic friction modifiers, derived from naturally occurring or synthetic organic compounds, have gained significant traction in the market. These additives are characterized by their ability to form a protective boundary film on metal surfaces, reducing friction and wear.

Organic friction modifiers, such as fatty acids, esters, and amides, offer excellent lubrication properties and are widely used in automotive and industrial applications. Their environmentally friendly nature and compatibility with a wide range of base oils make them a preferred choice for lubricant formulations aimed at reducing energy consumption and enhancing equipment longevity.

In contrast, inorganic products are derived from mineral-based compounds and metallic salts. These additives function by altering the surface properties of metal components, thereby reducing friction and wear. Inorganic friction modifiers, including molybdenum disulfide and graphite, offer high temperature stability and exceptional load-carrying capacity, making them suitable for heavy-duty applications such as industrial gear oils and metalworking fluids. Their ability to withstand extreme operating conditions and provide long-lasting lubrication solutions positions them as essential components in high-performance lubricant formulations across various industrial sectors.

Regional Insights

Asia Pacific Friction Modifiers Market Trends

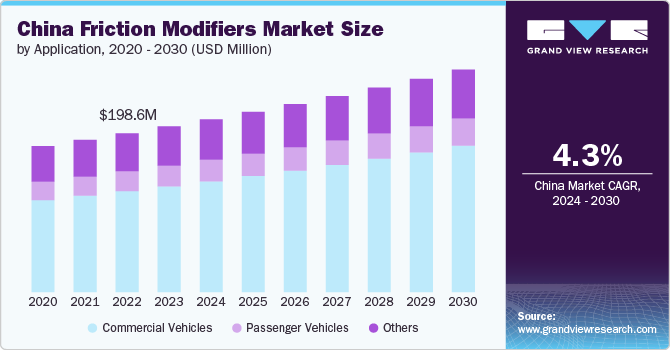

Asia Pacific dominated the market with a revenue share of 35.8% in 2023. Asia-Pacific has been leading the worldwide product market and is anticipated to continue its dominance in the coming years. This trend is largely attributed to the region's robust automotive production, with China standing out as the largest global producer of automobiles.

The friction modifiers market in China is experiencing significant growth. This is primarily driven by the largest global producer of automobiles and has significantly impacted the consumption of lubricants, subsequently affecting the demand for friction modifier additives. The slight decline in automotive production volume in recent years has led to an estimated decrease in the usage and demand for market across different sectors.

North America Friction Modifiers Market Trends

The North America region has a strong presence of major industries such as automotive, aerospace, and manufacturing, which are significant consumers of friction modifiers. The technological advancements in the automotive industry have fueled the growth of the market in North America, with increasing vehicle production directly influencing the demand for market globally.

Europe Friction Modifiers Market Trends

The increase in automotive production due to a rise in consumer demand for fuel-efficient vehicles is expected to boost the demand for market in Europe. Additionally, shifting trends toward the electrification of road passenger transports are likely to become more significant over the following years as more nations implement policies to lower carbon, particulate, and other emissions.

Key Friction Modifiers Company Insights

Some of the key players operating in the market include Cabot Corporation, Sensient Imaging Technologies, Kornit DigitalMarabu GmbH & Co. KG, INX International Ink Co., Nazdar, Nutec digital Ink, Siegwerk Druckfarben AG & Co. KgaA.

-

Cabot Corporation is renowned for delivering innovative performance solutions to a diverse range of industries. Cabot's product line includes rubber and specialty-grade carbon blacks, inkjet colorants, aerogel, specialty compounds, fumed metal oxides, and activated carbon.,

-

INX International Ink Co. is a global manufacturer of high-performance printing inks and coatings for commercial, packaging, and digital print applications. As a subsidiary of Sakata INX worldwide operations, INX offers its product portfolio across locations in North America, South America, and Europe.

Key Friction Modifiers Companies:

The following are the leading companies in the friction modifiers market. These companies collectively hold the largest market share and dictate industry trends.

- INX International Ink Co.

- Kornit DigitalMarabu GmbH & Co. KG

- Nazdar

- Nutec digital Ink

- Sensient Imaging Technologies

- Siegwerk Druckfarben AG & Co. KgaA

- Sun Chemical

- Toyo Ink Co., Ltd.

- Wikoff Color Corporation

- Whitmore Manufacturing, LLC.

- Amcor plc

- HARVES Co., Ltd.

- Wihuri Group

- Sigma Plastics Group

- American Packaging Corporation.

- Cosmo Films Ltd.

- GMM Development Limited.

- Curtiss-Wright Corporation.

Recent Developments

-

In April 2023, Afton Chemical launched its "Dicyclopentadiene (DCPD) Friction Modifier" with a focus on enhancing fuel efficiency and providing enhanced wear protection for automotive engines.

-

In January 2024, Shell U.K. Limited acquired MIDEL and MIVOLT from M&I Materials Ltd. The products of the latter two will be produced and distributed as part of Shell’s Lubricants portfolio. The acquisition will help Shell to strengthen its position in Transformer Oils, which finds use in offshore wind parks, utility companies, and power distribution.

-

In September 2023, TotalEnergies Lubrifiants accelerated the inclusion of recycled plastics (50% PCR high-density polyethylene) in its lubricant’s bottles, following a pilot project launched in 2021 called Quartz Xtra bottles. This aims at contributing to a circular economy and in decline of usage of virgin plastic.

Friction Modifiers Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.03 billion |

|

Revenue forecast in 2030 |

USD 1.28 billion |

|

Growth rate |

CAGR of 3.8% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; Italy; France; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia |

|

Key companies profiled |

INX International Ink Co.; Kornit DigitalMarabu GmbH & Co. KG; Nazdar; Nutec digital Ink; Sensient Imaging Technologies; Siegwerk Druckfarben AG & Co. KgaA; Sun Chemical; Toyo Ink Co., Ltd.; Wikoff Color Corporation; Whitmore Manufacturing; LLC.; Amcor plc; HARVES Co., Ltd.; Wihuri Group; Sigma Plastics Group; American Packaging Corporation.; Cosmo Films Ltd.; GMM Development Limited.; Curtiss-Wright Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Friction Modifiers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global friction modifiers market report based on type, application, and region:

-

Type Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Organic

-

Inorganic

-

-

Application Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Commercial Vehicles

-

Passenger Vehicles

-

Others

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global friction modifiers market was valued at USD 987.65 million in 2023 and is projected to reach USD 1.03 billion by 2024

b. The global friction modifiers market is expected to grow at a compound annual growth rate of 3.8% from 2024 to 2030, reaching USD 1.28 billion by 2030.

b. Asia Pacific dominated the market segment with a revenue share of 36.0% in 2023. Asia-Pacific has been leading the worldwide product market and is anticipated to continue its dominance in the coming years. This trend is largely attributed to the region's robust automotive production, with China standing out as the largest global producer of automobiles.

b. Some key players operating in the friction modifiers market include INX International Ink Co., Kornit DigitalMarabu GmbH & Co. KG, Nazdar, Nutec digital Ink, Sensient Imaging Technologies, Siegwerk Druckfarben AG & Co. KgaA, Sun Chemical, Toyo Ink Co., Ltd., Wikoff Color Corporation, Whitmore Manufacturing, LLC., Amcor plc, HARVES Co., Ltd., Wihuri Group, Sigma Plastics Group, American Packaging Corporation., Cosmo Films Ltd., GMM Development Limited. and Curtiss-Wright Corporation.

b. Key factors that are driving the market growth is that friction modifiers, also known as boundary lubrication additives, are oil-soluble chemicals used in lubricants for transmission and internal combustion engine applications.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."