Frequency Converter Market Size, Share & Trends Analysis Report By Type (Static, Rotary), By Phase (Single Phase, Three Phase), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-387-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Frequency Converter Market Size & Trends

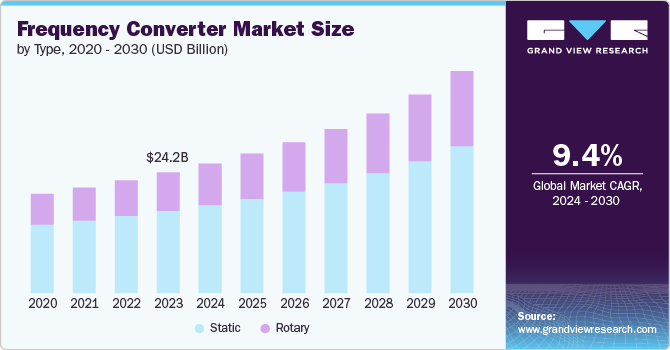

The global frequency converter market size was estimated at USD 24.18 billion in 2023 and is expected to grow at a CAGR of 9.4% from 2024 to 2030. The market is experiencing increased demand due to several key factors. One significant driver is the emphasis on energy efficiency. Frequency converters, or variable frequency drives, adjust the speed of electric motors to align with operational needs, leading to reduced energy consumption and lower operational costs. This aligns with broader goals of minimizing energy use and operational expenses.

Additionally, Infrastructure development also plays a role in the growing demand for frequency converters. Projects involving water treatment facilities, HVAC systems, and transportation networks rely on these devices to enhance operational efficiency and maintain system performance. The expansion of infrastructure projects contributes to the increasing requirement for frequency converters across various sectors. Moreover, the growth of industrial automation is another key factor driving demand. As industries increasingly adopt automated processes, frequency converters play a crucial role in regulating motor speeds and ensuring the seamless operation of these systems. Their ability to enhance process efficiency and performance makes them a vital component in contemporary manufacturing setups.

Recent advancements in the market highlight several key technology trends. One notable development is the integration of frequency converters with Internet of Things (IoT) technology and Industry 4.0 frameworks. This integration allows for real-time monitoring and remote control of systems, as well as predictive maintenance capabilities. These features contribute to improved operational efficiency and reduced downtime by enabling more proactive management of equipment. Additionally, frequency converters are increasingly featuring advanced connectivity options. Support for various communication protocols, such as Ethernet, Profibus, and Modbus, is enhancing their ability to integrate with other industrial systems. This improved connectivity allows for more flexible and adaptable system architectures.

However, the market encounters several notable restraints that can affect its growth and adoption. One significant restraint is the high initial cost associated with these devices. The expense of purchasing and installing advanced frequency converters can be substantial, which may deter businesses, particularly smaller enterprises, from making investments. This high upfront cost can be a major barrier to widespread adoption. Additionally, the complexity involved in integrating frequency converters into existing systems also presents a challenge. This process can be intricate and requires specialized knowledge for proper configuration and maintenance. Companies lacking this expertise may face difficulties during integration, potentially leading to increased costs and longer implementation times.

Type Insights

The static segment held the largest market share of 68.2% in 2023. Based on the type, the market is segmented into static and rotary frequency converters. Static frequency converters feature fewer moving parts compared to dynamic or rotating types, which significantly reduces the likelihood of mechanical failures. This inherent reliability is crucial for applications requiring uninterrupted operation, as it minimizes downtime and maintenance needs.

Additionally, the low maintenance requirements of static frequency converters further bolster their market position. With fewer moving components, static converters experience less wear and tear, leading to reduced maintenance needs and lower operational costs over their lifespan. This aspect is particularly appealing for users looking to minimize long-term maintenance expenses.

The rotary segment registered the highest CAGR of 10.3% over the forecast period. Rotary frequency converters are capable of handling higher power levels compared to static converters. This makes them particularly suitable for applications that require significant power conversion, such as large industrial machines and high-capacity systems. The growing demand for such high-power applications is driving the growth of the rotary frequency converter segment.

Additionally, these converters are known for their robust performance and reliability in demanding environments. Rotary frequency converters are well-suited for applications where continuous and stable power supply is critical. Their ability to operate effectively under challenging conditions supports their increased adoption in industries such as aerospace, defense, and heavy manufacturing.

Phase Insights

The three phase segment held the largest market share of 65.4% in 2023. Three phase frequency converters offer better motor control compared to single-phase converters. They provide more precise control over motor speed and torque, which enhances the performance and reliability of industrial equipment. This advanced motor control capability contributes to their extensive use in applications where precise and efficient operation is critical. Additionally, the demand for three phase frequency converters is high in various industries, including manufacturing, automotive, and energy. These industries often require robust and reliable power conversion solutions to support their operations. The widespread use of three phase systems in these sectors drives the large market share of three-phase converters.

The single phase segment registered a significant CAGR of 8.2% over the forecast period. Single phase frequency converters are widely used in residential settings and small businesses. Their growing adoption in these areas, driven by an increase in residential automation and small-scale industrial processes, contributes to the market growth. Additionally, single phase frequency converters are generally more affordable than their three-phase counterparts. This cost advantage makes them a popular choice for applications where budget constraints are a concern, contributing to their significant CAGR.

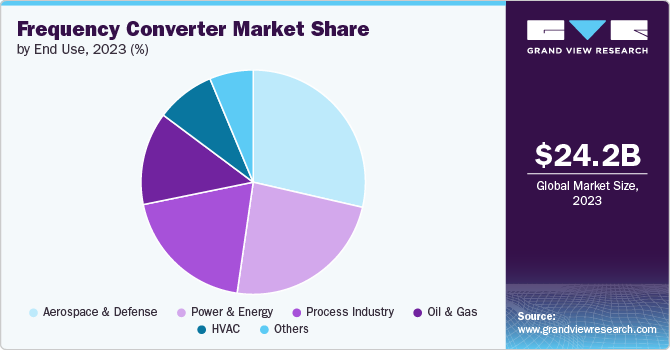

End Use Insights

The aerospace & defense segment held the largest market share of 28.6% in 2023. Based on the end use, the market is segmented into aerospace & defense, power & energy, process industry, oil & gas, HVAC, and others. The aerospace & defense sectors demand high-performance and highly reliable frequency converters to ensure the smooth operation of critical systems. These applications require converters that can handle substantial power levels and operate flawlessly under extreme conditions, which drives the significant market share for this segment.

The process industry segment registered the highest CAGR of 11.0% over the forecast period. Process industries, including chemical, pharmaceutical, and food processing, are under pressure to improve energy efficiency and reduce operational costs. Frequency converters help achieve these goals by enabling precise control of motor speeds, which reduces energy consumption and operational expenses. The push for cost-effective and energy-efficient solutions contributes to the sector's high CAGR.

Additionally, the process industry is increasingly adopting automation technologies to enhance efficiency and productivity. Frequency converters play a crucial role in automating process control by adjusting the speed of motors and optimizing energy usage. This growing trend towards automation drives higher demand for frequency converters in the process sector.

Regional Insights

North America frequency converter market is projected to grow at a significant CAGR of 9.6% over the forecast period. North America is at the forefront of technological advancements in frequency converters, focusing on innovations that improve efficiency, reduce maintenance costs, and enhance operational performance. This innovation drives replacement and upgrade cycles, further stimulating demand. Additionally, North America is investing heavily in renewable energy sources, such as wind and solar power. Frequency converters are integral to the efficient operation of these renewable energy systems, driving demand as the region transitions towards cleaner energy sources.

U.S. Frequency Converter Market Trends

The frequency converter market in the U.S. held the largest share of 69.5% in 2023, in the North America region. The industrial and manufacturing sectors in the U.S. are substantial and continue to expand. Frequency converters are essential for optimizing motor control and improving energy efficiency in various industrial applications, from automotive manufacturing to heavy machinery. The growth of these sectors fuels the demand for frequency converters. Additionally, the modernization and upgrading of infrastructure, including HVAC systems, water treatment plants, and transportation networks, involves the integration of advanced frequency converters. These upgrades enhance system performance and reliability, contributing to the market's growth.

Asia Pacific Frequency Converter Market Trends

Asia Pacific frequency converter marketaccounted for the largest revenue share of 35.1% in 2023 and is expected to continue its dominance over the forecast period. The Asia Pacific region has experienced significant industrial growth over the past decades. Countries such as China, India, and South Korea have heavily invested in expanding and modernizing their industrial infrastructure. This rapid industrialization has driven demand for frequency converters to support various industrial applications, contributing to the region's dominant market share. Additionally, the manufacturing sector in Asia Pacific is vast and diverse, encompassing industries such as automotive, electronics, textiles, and machinery. The extensive use of frequency converters in these manufacturing processes to optimize motor control and improve energy efficiency has fueled the large revenue share of the region.

Europe Frequency Converter Market Trends

The frequency converter market in Europe is characterized by several dynamics that influence its growth and development. Europe is known for its stringent environmental regulations and ambitious sustainability goals. The European Union's directives on energy efficiency, emissions reduction, and renewable energy drive the demand for frequency converters. These devices help industries meet regulatory requirements by optimizing energy use and reducing carbon footprints.

For instance, the European Union has set ambitious targets for improving energy efficiency, as highlighted by the Energy Efficiency Directive (EED). In response, many European companies are upgrading their systems to include frequency converters. For example, Vestas, a company specializing in the wind energy sector, uses frequency converters in its turbines to optimize performance and increase energy output, aligning with Europe's energy efficiency goals.

Key Frequency Converter Company Insights

Some of the key companies operating in the market include Siemens, General Electric Company, among others.

- Siemens is a multinational conglomerate comprising Siemens AG as the parent company and its subsidiaries. The company has several production facilities, sales offices, distribution centers, and R&D centers located across the globe. Siemens operates through various divisions, including gas & power, energy management, wind power & renewable, mobility, digital factory, process industries, building technology, power generation services, healthcare, and financial services. The company has a strong global presence with 289 manufacturing plants spread across regions including North America, Europe, Latin America, Asia Pacific, and the Middle East.

NR Electric and Aplab Limited are some of the emerging market companies in the target market.

- Aplab Limited is an Indian company specializing in the design, development, and manufacturing of electronic equipment and components. Aplab Limited has multiple product divisions, including UPS systems, test and measurement instruments, banking and retail automation, and power conversion and controls. The company offers its products and services to various industries, namely education and research, avionics and space research, defense, banking and financial services, retail, telecom and broadcasting services, the manufacturing industry, and more.

Key Frequency Converter Companies:

The following are the leading companies in the frequency converter market. These companies collectively hold the largest market share and dictate industry trends.

- NR Electric

- Georator Corporation

- APLAB Ltd

- ABB Ltd

- Danfoss

- Siemens

- KGS Electronics

- SELCO USA, INC.

- General Electric Company

- Magnus Power

Recent Developments

-

In February 2024, Danfoss announced that it had acquired the 1500 VDC converter technology and the team from Ampner Oy, a company specializing in electrical engineering solutions, to enhance its electrification portfolio. This acquisition supports the company's expansion in energy storage and smart grids, aiming to meet 2030 climate targets and decarbonization goals. The technology would bolster Danfoss's offerings in battery energy storage systems, contributing to the global energy transition by providing reliable renewable energy and reducing fossil fuel dependence.

-

In January 2023, Siemens announced the launch of its new G120 Smart Access Module for the Sinamics G120 drive series. This module allows for wireless commissioning, diagnostics, and maintenance by connecting mobile devices to the drives via Wi-Fi. It supports various control units and enables easy setup and control through any standard web browser, enhancing convenience and efficiency for users by providing features like parameterization, error detection, and drive settings transfer.

Frequency Converter Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 25.95 billion |

|

Revenue forecast in 2030 |

USD 44.51 billion |

|

Growth rate |

CAGR of 9.4% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Million/Billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, phase, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

NR Electric; Georator Corporation; APLAB Ltd; ABB Ltd; Danfoss; Siemens; KGS Electronics; Aelco; General Electric Company; Magnus Power |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Frequency Converter Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global frequency converter market report based on type, phase, end use, and region.

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Static

-

Rotary

-

-

Phase Outlook (Revenue, USD Million, 2017 - 2030)

-

Single Phase

-

Three Phase

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Aerospace & Defense

-

Power & Energy

-

Process Industry

-

Oil & Gas

-

HVAC

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global frequency converter market size was estimated at USD 24.18 billion in 2023 and is expected to reach USD 25.95 billion in 2024.

b. The global frequency converter market is expected to grow at a compound annual growth rate of 9.4% from 2024 to 2030 to reach USD 44.51 billion by 2030.

b. The static frequency convertor segment claimed the largest market share of 68.2% in 2023 in the frequency converter market, driven by various factors, including the expansion of the aerospace and defense industry, the increasing use of frequency converters in applications like temperature, flow, and pressure control, and the demand for consumer electronics.

b. Some of the prominent players in the frequency converter market are NR Electric, Georator Corporation, APLAB Ltd, ABB Ltd, Danfoss, Siemens, KGS Electronics, Aelco, General Electric Company, Magnus Power.

b. The frequency converter market is driven by factors such as growing industrial automation, increasing demand for energy-efficient systems, technological advancements in frequency conversion technology, expanding infrastructure projects, and stringent energy efficiency regulations.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."