- Home

- »

- Consumer F&B

- »

-

Freeze-dried Fruits And Vegetables Market Size Report, 2030GVR Report cover

![Freeze-dried Fruits And Vegetables Market Size, Share & Trends Report]()

Freeze-dried Fruits And Vegetables Market Size, Share & Trends Analysis Report By Type (Freeze-dried Fruits, Freeze-dried Vegetables), By Nature, By Form, By Distribution Channel (B2B, B2C), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-445-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

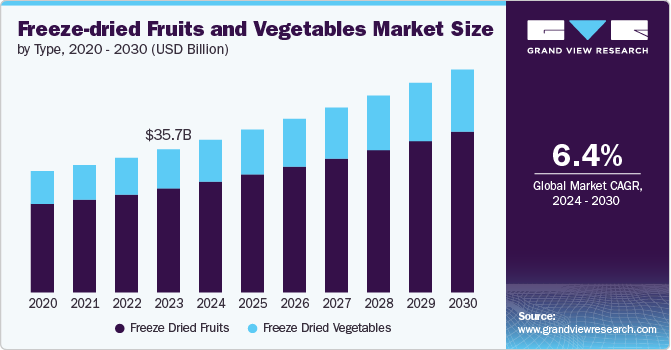

The global freeze-dried fruits and vegetables market size was estimated at USD 35.73 billion in 2023 and is expected to grow at a CAGR of 6.4% from 2024 to 2030. The market demand and consumption for freeze-dried fruits and vegetables are on the rise due to several key factors and trends that align with modern consumer preferences. One of the primary drivers is the growing health consciousness among consumers. As people become more aware of the importance of nutrition and wellness, they seek out snacks that are both healthy and convenient.

Freeze-dried fruits and vegetables retain most of their original nutrients, including vitamins, minerals, and fiber, making them an appealing choice for health-focused individuals. Additionally, these products often have clean labels, with no added sugars, preservatives, or artificial ingredients, catering to the demand for natural and wholesome food options. Convenience and portability are also major factors contributing to the increasing popularity of freeze-dried fruits and vegetables. In today’s fast-paced world, consumers are looking for easy-to-carry, shelf-stable snacks that they can enjoy on the go.

Freeze-dried products are lightweight, have a long shelf life, and do not require refrigeration, making them ideal for busy lifestyles, travel, and outdoor activities. Their versatility in cooking and baking also adds to their appeal, as they can be easily incorporated into a wide range of dishes, from smoothies to salads to baked goods. The rise in plant-based and vegan diets is another significant trend driving demand for freeze-dried fruits and vegetables. As more consumers shift towards plant-based eating for health, environmental, or ethical reasons, they seek convenient, plant-based snacks and ingredients that align with their dietary preferences. Freeze-dried options fit well within these categories and are gaining popularity as a healthy snacking choice. Moreover, advancements in freeze-drying technology have improved the quality, texture, and flavor of these products, making them more attractive to a wider audience.

Additionally, the expansion of e-commerce and retail distribution has played a crucial role in increasing the availability and visibility of freeze-dried fruits and vegetables. Online retail platforms and direct-to-consumer channels have made it easier for consumers to access a diverse range of these products, while brick-and-mortar stores are also stocking more options to meet growing demand. As a result, freeze-dried fruits and vegetables are becoming a mainstream choice for health-conscious consumers looking for convenient, nutritious, and versatile food options. These combined factors suggest that the market for freeze-dried fruits and vegetables will continue to expand in the coming years.

Type Insights

Freeze-dried fruits accounted for a revenue share of 72.6% in 2023. With busier lifestyles, there is a growing demand for on-the-go snacks that are both healthy and convenient. Freeze-dried fruits fit this demand perfectly as they are lightweight, easy to carry, and can be consumed without preparation. This makes them a preferred choice for people who want to maintain a healthy diet while managing a hectic schedule.

The freeze-dried vegetables segment is expected to grow at a CAGR of 6.7% from 2024 to 2030. Freeze-dried vegetables have a much longer shelf life compared to fresh vegetables because the freeze-drying process removes most of the water content, which prevents microbial growth and spoilage. This makes them an excellent option for consumers who want to stock up on vegetables without worrying about them spoiling, providing convenience for quick meal preparation and reducing food waste.

Nature Insights

Conventional freeze-dried fruits & vegetables accounted for a revenue share of 69.3% in 2023. Conventional freeze-dried fruits and vegetables are versatile ingredients used in a wide range of culinary applications, from snacking to cooking and baking. They retain most of their flavor and nutritional value, making them suitable for adding to smoothies, cereals, trail mixes, soups, and ready-to-eat meals. This versatility makes them a popular choice among home cooks, chefs, and food manufacturers.

The organic freeze-dried fruits & vegetables market is expected to grow at a CAGR of 6.8% from 2024 to 2030. Consumers are becoming more aware of the health and environmental benefits of organic products, which are grown without synthetic pesticides, fertilizers, or genetically modified organisms (GMOs). Organic freeze-dried fruits and vegetables cater to this growing demand for clean-label products, free from artificial additives and chemicals, appealing to health-conscious consumers who prioritize natural and wholesome food choices.

Form Insights

Powdered & granule freeze-dried fruits & vegetables accounted for a revenue share of 42.1% in 2023. Freeze-dried powders and granules have a longer shelf life than fresh or frozen counterparts, as most of the moisture is removed, reducing the risk of spoilage. They are lightweight, easy to store, and do not require refrigeration, making them an ideal option for consumers who want to maintain a stock of fruits and vegetables with minimal storage requirements.

Sliced & cubes freeze-dried fruits & vegetables is expected to grow at a CAGR of 7.1% from 2024 to 2030. Sliced and cubed freeze-dried fruits and vegetables offer a convenient, ready-to-eat format that is ideal for snacking, meal preparation, and adding to various dishes. Consumers can enjoy the texture and flavor of fresh produce without the need for washing, peeling, or cutting, making them a popular choice for busy individuals and families looking for quick and healthy snack options. Sliced and cubed freeze-dried products maintain a crunchy texture and vibrant taste, making them appealing for use in cereals, trail mixes, salads, and as toppings for yogurt and desserts.

Distribution Channel Insights

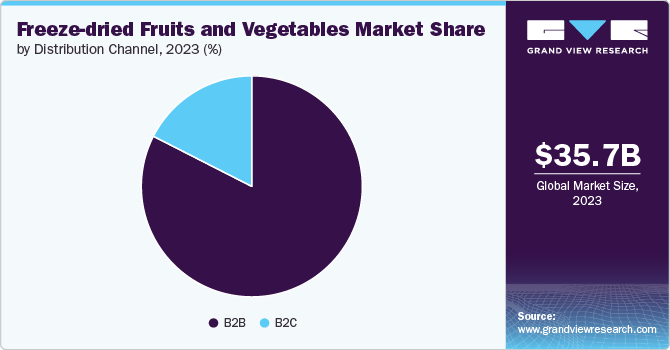

Sales through B2B accounted for a revenue share of 82.5% in 2023. Freeze-dried fruits and vegetables are highly versatile ingredients used in various food products across multiple industries, including the food and beverage, nutraceutical, and bakery sectors. Manufacturers prefer these ingredients because they maintain their flavor, color, texture, and nutritional value during processing, making them ideal for ready-to-eat meals, snacks, cereals, soups, sauces, and health supplements. This adaptability drives demand in the B2B sector as companies look to innovate and diversify their product offerings.

The B2C segment is expected to grow with a CAGR of 6.8% from 2024 to 2030. B2C channels, such as supermarkets, convenience stores, and online retail platforms, offer the convenience of purchasing freeze-dried fruits & vegetables along with other household items in one place. Consumers can easily access these channels for their daily shopping needs, making it simple to buy freeze-dried fruits & vegetables without the need for bulk purchases or business accounts. Online platforms, in particular, provide the added convenience of home delivery, which is appealing to consumers looking for easy and quick access to products.

Regional Insights

North America freeze-dried fruits and vegetables market is expected to grow at a CAGR of 6.0% from 2024 to 2030. North American consumers are becoming increasingly health-conscious, with a strong focus on consuming natural, nutritious, and minimally processed foods. Freeze-dried fruits and vegetables retain most of their original nutrients, making them a desirable choice for those looking to incorporate more vitamins, minerals, and antioxidants into their diets. This aligns with the growing demand for healthier snack alternatives and meal ingredients that contribute to overall wellness.

U.S. Freeze-dried Fruits And Vegetables Market Trends

The freeze-dried fruits and vegetables market in the U.S. is growing. With busy lifestyles and the need for quick and easy meal solutions, consumers in the U.S. are seeking convenient food options that do not compromise on nutrition. Freeze-dried fruits and vegetables are lightweight, easy to store, and require minimal preparation, making them ideal for on-the-go snacking, meal kits, and emergency preparedness. This convenience factor drives demand among consumers looking for healthy, ready-to-eat options.

Asia Pacific Freeze-dried Fruits And Vegetables Market Trends

Asia Pacific freeze-dried fruits and vegetables market accounted for a revenue share of 37.1% in 2023. As disposable incomes rise and lifestyles become more fast-paced, there is a growing preference for convenient and ready-to-eat food options in Asia Pacific. Freeze-dried fruits and vegetables fit well with this trend, as they can be easily added to meals, snacks, and instant foods. Their long shelf life and ease of storage further enhance their appeal in a region where convenience is becoming a significant factor in food choices.

Europe Freeze-dried Fruits And Vegetables Market Trends

The European freeze-dried fruits and vegetables market is expected to grow at a CAGR of 6.5% from 2024 to 2030. The plant-based movement is gaining momentum in Europe, with more people adopting vegetarian, vegan, or flexitarian diets. Freeze-dried fruits and vegetables are plant-based and fit well with these dietary preferences. Additionally, there is a growing demand for clean label products-foods that are free from artificial ingredients, preservatives, and additives. Freeze-dried fruits and vegetables cater to this demand as they are often perceived as natural and free from unwanted additives.

Key Freeze-dried Fruits And Vegetables Company Insights

The market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the types used while strictly adhering to international regulatory standards.

Key Freeze-dried Fruits And Vegetables Companies:

The following are the leading companies in the freeze-dried Fruits and vegetables market. These companies collectively hold the largest market share and dictate industry trends.

- Nestlé

- Asahi Group Holdings, Ltd.

- European Freeze Dry

- The Greenyard Group

- Döhler Group

- Van Drunen Farms

- Wise Company (ReadyWise)

- OFD Foods, Inc. (formerly Oregon Freeze Dry)

- Harmony House Foods, Inc.

- Mercer Foods, LLC

- Paradise Fruits Solutions GmbH & Co. KG

Recent Developments

-

In June 2024, Moon Store, an Indian retail brand, introduced two new freeze-dried fruit flavors: mango and strawberry. These innovative products are now available for purchase on the company's website. In addition to the mango and strawberry flavors, Moon Store offers a range of other freeze-dried fruit options, catering to diverse consumer preferences. The brand aims to provide healthy and convenient snacking alternatives that are both delicious and nutritious.

Freeze-dried Fruits And Vegetables Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 38.08 billion

Revenue forecast in 2030

USD 55.21 billion

Growth rate

CAGR of 6.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, nature, form, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; UAE

Key companies profiled

Nestlé; Asahi Group Holdings, Ltd.; European Freeze Dry; The Greenyard Group; Döhler Group; Van Drunen Farms; Wise Company (ReadyWise); OFD Foods, Inc. (formerly Oregon Freeze Dry); Harmony House Foods, Inc.; Mercer Foods, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Freeze-dried Fruits And Vegetables Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global freeze-dried fruits and vegetables market report based on the type, nature, form, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Freeze Dried Fruits

-

Berries

-

Apples

-

Grapes

-

Mango

-

Pineapple

-

Others

-

-

Freeze Dried Vegetables

-

Tomatoes

-

Peas

-

Beans

-

Corn

-

Carrot

- Others

-

-

-

Nature Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder & Granules

-

Minced & Chopped

-

Slice & Cubes

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

B2C

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global freeze-dried fruits and vegetables market size was estimated at USD 35.73 billion in 2023 and is expected to reach USD 38.08 billion in 2024.

b. The global freeze-dried fruits and vegetables market is expected to grow at a compounded growth rate of 6.4% from 2024 to 2030 to reach USD 55.21 billion by 2030.

b. Sliced & cubes freeze-dried fruits & vegetables is expected to growth with a CAGR of 7.1% from 2024 to 2030. As consumers become more health-conscious, there is an increasing demand for snacks that are both nutritious and satisfying. Sliced and cubed freeze-dried fruits and vegetables provide a wholesome alternative to traditional snacks, offering the natural sweetness of fruits and the nutritional benefits of vegetables without added sugars, fats, or preservatives.

b. Some key players operating in freeze-dried fruits and vegetables market include Nestlé, Asahi Group Holdings, Ltd., European Freeze Dry, The Greenyard Group, Döhler Group, and others.

b. Key factors that are driving the market growth include rising ready to eat meal options and increasing health consciousness among consumers

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."