- Home

- »

- Consumer F&B

- »

-

Freeze-dried Food Market Size, Share & Growth Report, 2030GVR Report cover

![Freeze-dried Food Market Size, Share & Trends Report]()

Freeze-dried Food Market (2022 - 2030) Size, Share & Trends Analysis Report By Product (Fruits, Vegetables, Meat, Poultry & Seafood), By Distribution Channel (B2B, B2C), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-960-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Freeze-dried Food Market Summary

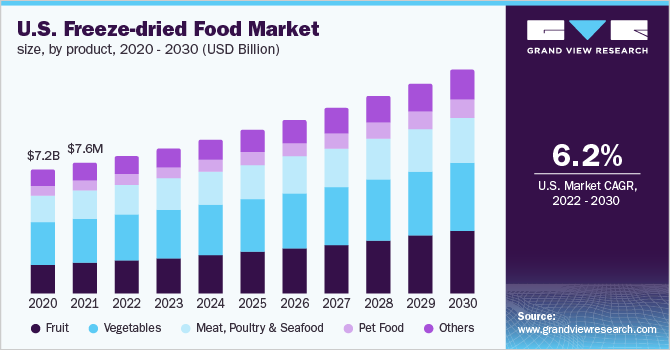

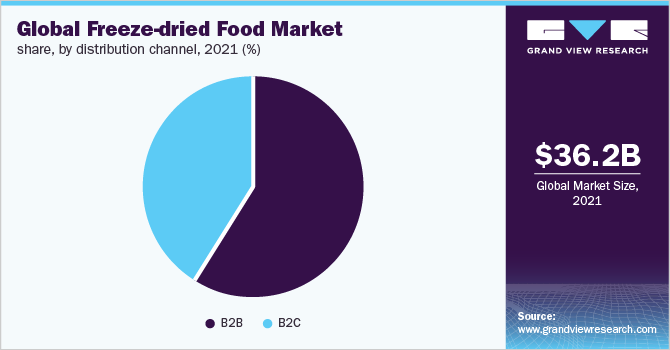

The global freeze-dried food market size was valued at USD 36.23 billion in 2021 and is projected to reach USD 69.83 billion by 2030, growing at a CAGR of 7.6% from 2022 to 2030. The rising demand for food products with a long shelf-life is a major growth driving factor. According to an article published by Power Reviews, a technology company, in April 2022, nearly 49% of consumers picked non-perishable foods from grocery stores

Key Market Trends & Insights

- Asia Pacific accounted for the largest share of the global freeze-dried food market in 2021.

- By product, The vegetables segment held the largest revenue share of 34.3% in 2021 and is expected to maintain dominance over the forecast period.

- By distribution channel, In 2021, B2B led the freeze-dried food market, boosted by VC and PE funding in B2B payments that enhanced growth and efficiency.

Market Size & Forecast

- 2021 Market Size: USD 36.23 Billion

- 2030 Projected Market Size: USD 69.83 Billion

- CAGR (2022-2030): 8.93%

- Asia Pacific: Largest market in 2021

There has been a substantial rise in customer demand for non-perishable food items, notably freeze-dried foods like meat products or their counterparts, vegetables, fruits, and ready-to-eat meals. The outbreak of COVID-19 has also spurred the demand for food items that can be stored for a longer period to avoid frequent visits to stores and catching infections, which drives the intake of freeze-dried food.

According to an article published by Frontiers Media S.A., in March 2021, approximately 20% of consumers opted for freeze-dried food after the COVID-19 pandemic due to increased consumption of processed (comfort) food. Furthermore, the trend of consumers seeking healthy products that can be easily incorporated into their everyday routines and lifestyles has opened new avenues for freeze-dried food.

The increasing demand for ready-to-cook and ready-to-consume food packages is predicted to positively impact the market over the forecast period. Key market players are launching products in the vegetables category to increase their market shares. For instance, in December 2020, Brothers All Natural announced the launch of freeze-dried sweet corn with salt and pepper under its savory Brothers line, Harvester Farms. The product is said to be peanut-free, tree-nut-free, soy-free, and gluten-free, and contains four grams of plant protein, zero added sugar, and 160 calories. Such launches are further expected to increase product visibility.

In addition, the growing demand for healthy snacks among consumers, combined with product innovation, would integrate well with the growth of the market. According to an article published by Scotland Publishing, a network, trade, and development body for the book publishing sector in Scotland, in January 2022, nearly 80% of consumers across the world are seeking snacks to improve their physical and mental well-being. Furthermore, these food products are also a great addition to emergency food storage, providing fresh flavor and nutrients, which is expected to help increase the sales of these products in the timeframe considered.

The rising adoption of freeze-dried fruits in the daily diet of consumers to maintain a healthy weight and minimize the risk of cardiovascular disorders is projected to augment the market in future years. Freeze-dried ingredient suppliers across regions are launching various campaigns to inform manufacturers of the benefits of alternatives to fresh fruits. In June 2020, Lio Licious, a U.K.-based company, released a line of freeze-dried fruits including strawberries, raspberries, and apples with longer shelf life and easy-to-use products. The product range is available as whole fruit pieces or powders that can be mixed into bakes or used as decoration toppers.

Furthermore, the increasing number of product launches in the freeze-dried fruit segment is expected to boost the growth of the market in the next seven years. For instance, in October 2021, Brothers All Natural, an American brand of freeze-dried fruit crisps launched all-natural freeze-dried Fuji apple and mango fruit crisps in a large, sharable pouch. Similarly, in October 2021, Kooky, a premium exotic dried fruit brand in the U.K. launched a range of super fruits, including freeze-dried, light, and crispy jackfruit, mango, and mangosteen. The products are available in varied textures and offer immune, digestive, and cardiovascular health benefits.

Product Insights

The vegetables segment held the largest revenue share of 34.3% in 2021 and is expected to maintain dominance over the forecast period. The growing adoption of freeze-dried vegetables as a result of their longer shelf life and the shortage of fresh vegetables all year round will drive the segment’s growth. Despite the expensive process and long drying time, manufacturers are using the freeze-drying process to produce high-value food products because of maximum food quality retention when compared to other drying techniques.

For instance, in March 2019, Concord Foods launched a new freeze-dried vegetable snack line which includes corn and roasted red pepper with sea salt, sliced beets with balsamic vinegar, and sugar snap peas with sea salt and pepper. The products are said to be made with 100% vegetables, containing no artificial ingredients, added sugar, or preservatives.

The fruit segment is projected to register the fastest growth during the forecast period with a CAGR of 9.7% from 2022 to 2030. The growing incorporation of freeze-dried fruits in bakery products such as biscuits and buns, as well as beverages such as smoothies will bode well for the growth of the segment over the forecast period.

For instance, in May 2021, Sow Good Inc. announced the launch of its direct-to-consumer (DTC) freeze-dried consumer packaged goods (CPG) food brand, Sow Good. The product line includes six non-GMO ready-to-make smoothies such as Açaí of Relief (açaí, blueberry), Mint to Be (banana, coconut, mint), and Berry Apeeling (banana, strawberry), along with nine snacks.

Distribution Channel Insights

The B2Bsegment accounted for a larger market share in 2021. Aggressive investments by private equity and venture capital firms in B2B payments are creating new growth opportunities for key players in the freeze-dried food market. For instance, in January 2022, Rupifi, a B2B payment application provider, raised USD 25 million in a series-A round of funding led by Tiger Global Management, LLC and Bessemer Venture Partners.

Rupifi plans to use this funding to build complete B2B checkout products and omnichannel mobile-first B2B payment solutions for distributors, merchants, and sellers in India. Moreover, the increasing adoption of B2B mobile payments by banks to enhance the experience for business customers is likely to boost the growth of the segment.

The B2C segment is projected to register faster growth during the forecast period with a CAGR of 8.4% from 2022 to 2030. The increasing share of mobile payments in the e-commerce industry vertical is driving the growth of the abovementioned segment. According to a study by SalesForce, a company that makes cloud-based software designs, in June 2022, mobile consumers account for 60% of the world’s total e-commerce traffic. Furthermore, the increasing adoption of digital wallets across the globe is expected to drive the B2C segment growth over the forecast period.

Regional Insights

Asia Pacific accounted for the largest share of the global freeze-dried food market in 2021. The growing interest of Asian consumers in healthy products formulated with innovative ingredients is supporting the growth. Hence, domestic retail manufacturers are expanding their presence in the region, which is expected to drive market growth in the years to come.

For instance, in November 2020, Luckin, a famous Chinese coffee chain, launched two freeze-dried coffees; one of them uses coffee beans from Yirgacheffe, and the other uses a mixture of coffee beans from Ethiopia and the Yunnan River Valley. The initiative was taken to expand the sales of the brand.

Central & South America is expected to witness a CAGR of 9.8% in the forecast period. Increasing consumer awareness about the ill effects of artificial food additives used for food preservation is fueling the demand for natural and healthy food products including freeze-dried food.

According to an article published by Hiperbaric, a manufacturer of high-pressure processing (HPP) equipment for the food industry, in May 2021, nearly 90% of the Latin American population was interested in eating healthy and nutritious food. Such trends suggest a positive outlook for the market in the region.

Key Companies & Market Share Insights

The freeze-dried food market is consolidated with the presence of many developed global players and many developing key market entrants. These players are engaging in the major acquisition and promotional activities to increase their customer base and brand loyalty. Some of the initiatives by the key players in the market are:

-

In May 2021, a Richmond-based entrepreneur Larkin, a 34-year-old person released freeze-dried citrus strips

-

In December 2020, Carnivore Meat Company, a premium freeze-dried and frozen raw pet food manufacturer in the U.S., launched its newest freeze-dried pet food and treat line under the brand Nature’s Advantage

-

In August 2019, Chaucer Foods launched freeze-dried fruit for the food service sector. The product range includes strawberry, orange, raspberry, lime, pineapple, and banana

Some prominent players in the global freeze-dried food market include:

-

European Freeze Dry

-

ASAHI GROUP HOLDINGS, LTD.

-

Ajinomoto Co., Inc.

-

Harmony House Foods, Inc.

-

Nestlé

-

Freeze-Dry Foods, Ltd.

-

SouthAM

-

The Hain Celestial Group, Inc.

-

Kerry Group plc.

-

Nuts.com

Freeze-dried Food Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 38.68 billion

Revenue forecast in 2030

USD 69.83 billion

Growth rate

CAGR of 7.6% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

European Freeze Dry; ASAHI GROUP HOLDINGS, LTD.; Ajinomoto Co., Inc.; Harmony House Foods, Inc.; Nestlé; Freeze-Dry Foods, Ltd.; SouthAM; The Hain Celestial Group, Inc.; Kerry Group plc.; Nuts.com

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Freeze-dried Food Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the global freeze-dried food market report based on product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Fruit

-

Strawberry

-

Raspberry

-

Pineapple

-

Apple

-

Mango

-

Others

-

-

Vegetables

-

Pea

-

Corn

-

Carrot

-

Potato

-

Mushroom

-

Others

-

-

Meat, Poultry & Seafood

-

Pet Food

-

Others

-

- Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

B2B

-

B2C

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online

-

Others

-

-

- Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global freeze-dried food market size was estimated at USD 36.23 billion in 2021 and is expected to reach USD 38.68 billion in 2022.

b. The freeze-dried food market is expected to grow at a compound annual growth rate of 7.6% from 2022 to 2030 to reach USD 69.83 billion by 2030

b. North America dominated the freeze-dried food market with a revenue share of 25.3% in 2021, on account of several factors including increased consumption of processed food, rising demand for convenience on-the-go food, and growing demand for pet foods.

b. Some of the key players operating in the freeze-dried food market include European Freeze Dry, ASAHI GROUP HOLDINGS, LTD., Ajinomoto Co., Inc., Harmony House Foods, Inc., Freeze-Dry Foods, Ltd., SouthAM, The Hain Celestial Group Inc., Nuts.com, Kerry Group plc, and Nestlé.

b. The key factors that are driving the freeze-dried food market include rising demand for food products with long shelf-life, growing demand for ready-to-eat products among consumers globally, and increasing demand for pet food.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.