- Home

- »

- Consumer F&B

- »

-

Freeze Dried Dog Food Market Size & Share Report, 2030GVR Report cover

![Freeze Dried Dog Food Market Size, Share & Trends Report]()

Freeze Dried Dog Food Market Size, Share & Trends Analysis Report By Life Stage (Senior, Adult, & Puppy), By Distribution Channel (Hypermarkets/Supermarkets, Specialty Stores, Convenience Stores, Online, Others), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-405-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Freeze Dried Dog Food Market Trends

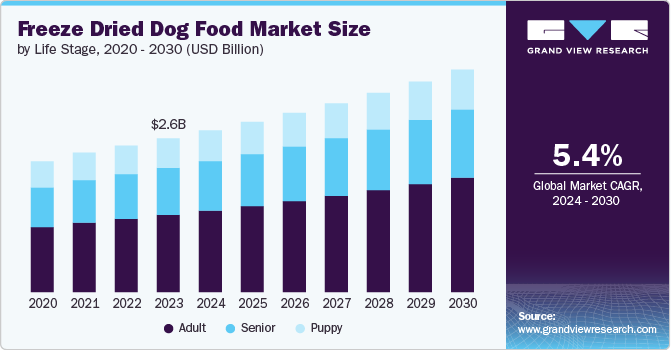

The global freeze dried dog food market size was estimated at USD 2.60 billion in 2023 and is expected to expand at a CAGR of 5.4% from 2024 to 2030. The growth in pet ownership globally is one of the foremost drivers of the market. In recent years, pets have increasingly been considered as family members rather than just animals, leading to a surge in spending on high-quality pet products. As per the 2024 American Pet Products Association (APPA) National Pet Owners Survey, approximately 82 million households in the U.S. own a pet and spend. According to the same report the U.S. pet industry was valued at USD 147.0 billion in 2023 and approximately USD 64.4 billion was spent on pet food & treats. This humanization of pets drives demand for premium and nutritious food options, including freeze-dried products, as owners seek to provide the best possible care for their furry companions.

There is an increasing awareness among pet owners regarding the importance of proper nutrition for their pets. This awareness is partly driven by educational campaigns from veterinarians, pet food manufacturers, and pet health organizations. Freeze-dried dog food is perceived as a healthier alternative to traditional kibble and canned foods due to its minimal processing and higher nutrient retention. Freeze drying preserves the integrity of nutrients, including proteins, vitamins, and minerals, which are essential for maintaining a pet's health. This shift towards nutritionally rich and minimally processed food is a significant factor driving the growth of the market.

Manufacturers are continuously innovating in product formulation to meet the evolving needs of pet owners. The market has seen the introduction of various formulations tailored to specific health needs, such as grain-free, high-protein, and hypoallergenic options. Innovations also include the addition of superfoods and supplements, such as probiotics and omega fatty acids, which enhance the overall nutritional profile of the food. For instance, companies like Stella & Chewy’s offer freeze-dried products with added functional ingredients to support joint health, digestive health, and skin and coat health. These innovations help to differentiate products in a competitive market and drive consumer interest.

The convenience of freeze dried dog food is another significant driver of market growth. Freeze-dried food is lightweight, easy to store, and has a long shelf life compared to wet or refrigerated pet foods. This makes it an attractive option for pet owners who are looking for easy-to-serve and long-lasting food solutions. The process of freeze-drying removes moisture from the food while preserving its nutritional value, allowing for quick rehydration. This convenience factor is particularly appealing to pet owners who travel frequently or prefer to buy in bulk.

Life Stage Insights

Freeze-dried dog food for adult dogs accounted for a revenue share of 50.2% in 2023. Adult dogs have unique nutritional requirements that differ from those of puppies and senior dogs. They need balanced nutrition that supports sustained energy, muscle maintenance, and overall health without the specialized needs of growth or age-related issues. Freeze-dried dog food is particularly popular among adult dog owners due to its high protein content, minimal processing, and convenience of storage and preparation. This food type helps maintain muscle mass, supports optimal energy levels, and offers a nutritional profile that aligns with the general health needs of adult dogs.

Freeze-dried dog food for senior dogs is expected to grow at a CAGR of 5.5% from 2024 to 2030. Senior dogs require specialized diets that cater to their age-related health issues such as joint problems, digestive sensitivities, and reduced metabolism. Moreover, senior dog owners are often more willing to invest in premium, health-focused products to enhance their pets' quality of life. The freeze-drying process preserves the nutritional integrity of ingredients, making it an attractive option for providing essential nutrients in a palatable form. This growing awareness and demand for age-appropriate nutrition drive the rapid growth of freeze dried dog food for senior dogs.

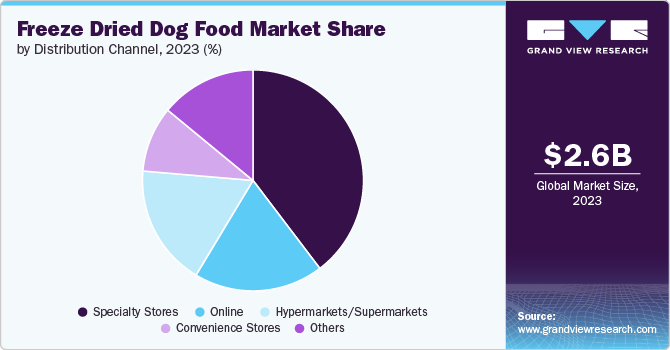

Distribution Channel Insights

Sales through specialty stores accounted for a revenue share of 39.66% in 2023. Specialty stores offer a curated selection of high-quality, premium products such as freeze-dried dog food. These stores cater to pet owners who are willing to spend more on premium and niche products, providing a more personalized shopping experience and expert advice on pet nutrition. Additionally, specialty stores tend to focus on educating pet owners about the benefits of freeze-dried food and other premium options. This educational approach, combined with a curated product selection, helps drive consumer preference and loyalty. The in-store experience, including knowledgeable staff and the opportunity to see and handle products, adds value for customers seeking premium pet food options.

Sales through online channels are expected to grow at a CAGR of 7.5% from 2024 to 2030. The convenience of online shopping allows pet owners to easily compare products, read reviews, and make purchases from the comfort of their homes. This convenience is especially appealing for those purchasing freeze-dried dog food, which is often priced at a premium and may require a more informed decision. Online platforms also offer a wide range of freeze-dried products that may not be available in local stores. This extensive selection helps cater to niche markets and specific dietary needs, attracting consumers looking for specialized options.

Regional Insights

North America freeze dried dog food market accounted for a revenue share of 42.87% in 2023 The region, particularly the U.S., has a well-established pet food industry with a strong emphasis on premium and health-oriented products. High disposable income, a large pet-owning population, and a strong focus on pet health contribute to the substantial market share held by North America. A high level of consumer awareness and demand for premium pet food options, including freeze-dried products. Additionally, the presence of major pet food manufacturers and a robust distribution network support the market's dominance in this region.

U.S. Freeze Dried Dog Food Market Trends

The U.S. freeze-dried dog food market is expected to grow at a CAGR of 4.8% from 2024 to 2030. The popularity of freeze-dried and air-dried (or dehydrated) dog food in the U.S. is a significant driver for the market. This food provides similar nutritional benefits to raw products but comes in a cleaner and more convenient format. They eliminate the need for refrigeration and minimize the mess typically associated with raw food, making them an attractive option for pet owners who seek high-quality, hassle-free nutrition for their dogs.

Asia Pacific Freeze Dried Dog Food Market Trends

The freeze dried dog food market in Asia Pacific is expected to grow at a CAGR of 6.7% from 2024 to 2030. The region is witnessing a rapid increase in pet ownership, driven by rising disposable incomes, urbanization, and changing lifestyles. As more consumers in the Asia Pacific adopt pets, the demand for high-quality pet food products, including freeze-dried options, is growing. The increasing awareness of pet nutrition and the humanization of pets are also contributing to the market's growth in this region. Pet owners in Asia Pacific are becoming more knowledgeable about the benefits of premium and specialized pet foods, leading to higher demand for freeze-dried products. Additionally, the expansion of retail and e-commerce channels in the region is making freeze dried dog food more accessible to a broader audience.

Europe Freeze Dried Dog Food Market Trends

Europe freeze-dried dog food market is expected to grow at a CAGR of 5.1% from 2024 to 2030. The European market is characterized by a growing trend towards premium and health-focused pet food products. Pet owners in Europe are increasingly seeking out high-quality and specialized foods for their pets, including freeze-dried options. Moreover, the presence of a diverse range of freeze dried dog food brands and products, along with an increasing focus on pet health and nutrition, contributes to the market's growth in Europe.

Key Freeze Dried Dog Food Company Insights

Manufacturers in the market are staying competitive by aligning their offerings with current food market trends. They are focusing on products with single and limited ingredients, catering to weight management needs, and emphasizing overall health and wellness. These initiatives help meet consumer demand for transparency and specialized nutrition, enhancing their market position.

Key Freeze Dried Dog Food Companies:

The following are the leading companies in the freeze dried dog food market. These companies collectively hold the largest market share and dictate industry trends.

- Mars

- Stella & Chewy's

- PRIMAL PET GROUP, INC.

- Merrick

- Northwest Naturals

- Instinct

- Dr. Harvey's

- Open Farm Inc.

- Nulo

- Dr. Marty Pets

Recent Developments

-

In November 2023, Shepherd Boy Farms announced the launch of freeze-dried diets for dogs. The product lineup includes new freeze-dried raw dog food including whole organic produce and protein and are available in flavors.

-

In June 2023, 360 Pet Nutrition launched a new Freeze Dried Raw Complete Meal for Adult Dogs in a Chicken Formula. This meal is manufactured with 16 ounces of high-quality chicken and vegetables, providing a nutrient-dense option to support the dog's overall health and well-being. The chicken protein in the formula is vital for promoting strong muscles and bones, helping dogs to stay healthy and active.

-

In April 2023, CULT Food Science Corp. announced the launch of its premium pet nutrition brand, Noochies. The brand introduced the world's first freeze-dried, high-protein cultured pet foods for cats and dogs. These vet-formulated foods feature unique, nutrient-dense ingredients aimed at enhancing immunity, digestion, and overall health for pets.

Freeze Dried Dog Food Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.74 billion

Revenue forecast in 2030

USD 3.77 billion

Growth rate

CAGR of 5.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Life Stage, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain;, China; Japan; India; South Korea; Australia; South Africa, Brazil

Key companies profiled

Mars; Stella & Chewy's; PRIMAL PET GROUP, INC.; Merrick; Northwest Naturals; Instinct; Dr. Harvey's; Open Farm Inc.; Nulo; and Dr. Marty Pets

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Freeze Dried Dog Food Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global freeze dried dog food market report based on life stage, distribution channel, and region:

-

Life Stage Market Outlook (Revenue, USD Million, 2018 - 2030)

-

Senior

-

Adult

-

Puppy

-

-

Distribution Channel Market Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets/Supermarkets

-

Specialty Stores

-

Convenience Stores

-

Online

-

Others

-

-

Regional Market Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global freeze dried dog food market was estimated at USD 2.60 billion in 2023 and is expected to reach USD 2.74 billion in 2024.

b. The global freeze dried dog food market is expected to grow at a compounded growth rate of 5.4% from 2024 to 2030 to reach USD 3.77 billion by 2030.

b. Freeze-dried dog food for adult dogs accounted for a revenue share of 50.2% in 2023. Adult dogs have unique nutritional requirements that differ from those of puppies and senior dogs.

b. Some key players operating in the freeze-dried dog food market include Mars; Stella & Chewy's; PRIMAL PET GROUP, INC.; Merrick; Northwest Naturals; Instinct; Dr. Harvey's; Open Farm Inc.; Nulo; Dr. Marty Pets

b. The growth in pet ownership globally is one of the foremost drivers of the freeze-dried dog food market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."