- Home

- »

- Consumer F&B

- »

-

Freeze Dried Candy Market Size And Share Report, 2030GVR Report cover

![Freeze Dried Candy Market Size, Share & Trends Report]()

Freeze Dried Candy Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Fruit-based, Dairy-based, Chocolate-based, Gummy Bears), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-375-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Freeze Dried Candy Market Summary

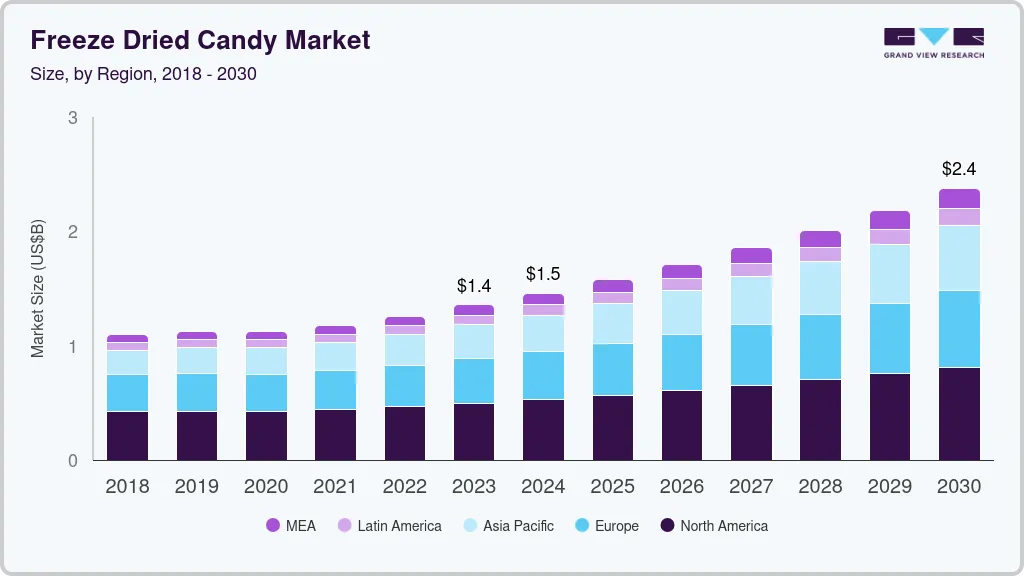

The global freeze dried candy market size was estimated at USD 1,358.8 million in 2023 and is projected to reach USD 2,376.1 million by 2030, growing at a CAGR of 8.3% from 2024 to 2030. The market has seen notable growth and innovation since 2022, driven by evolving consumer preferences, advancements in food technology, and strategic business initiatives.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- In terms of segment, fruit-based accounted for a revenue of USD 1,358.8 million in 2023.

- Fruit-based is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 1,358.8 Million

- 2030 Projected Market Size: USD 2,376.1 Million

- CAGR (2024-2030): 8.3%

- North America: Largest market in 2023

The increasing popularity of freeze-dried candy can be attributed to several key factors, including its unique texture, health benefits, and versatility. Unlike traditional candies, freeze-dried candies have a light, airy, and crispy texture that offers a novel sensory experience. This distinct texture is achieved through a freeze-drying process that enhances the flavors of the original ingredients, making these candies appealing to consumers seeking new and exciting confectionery options.

Additionally, many consumers perceive freeze-dried candy as a healthier alternative due to the minimal use of additives and preservatives, which aligns with the growing demand for clean-label and health-conscious snacks. The versatility of freeze-dried candy further contributes to its popularity. It is not only consumed as a standalone snack but also used as a topping for various desserts, including ice cream, yogurt, and baked goods. This adaptability makes freeze-dried candy an attractive option for both direct consumption and culinary applications.

One significant trend is the expansion of product varieties. Companies are experimenting with different flavors and ingredient combinations to cater to diverse consumer preferences. Fruit-based freeze-dried candies such as strawberries, apples, and bananas remain popular, but there is also growing interest in more exotic flavors and mixed fruit varieties. This diversification of products helps brands to attract a wider audience and stay competitive in the market.

As per SweetyTreatyCo, a key player based in the U.S., in 2023, Freeze-dried candy enthusiasts are increasingly drawn to exotic fruits in their sweet treats. Flavors like dragon fruit, lychee, and passion fruit are becoming popular due to their vibrant taste profiles and visual appeal. Manufacturers are leveraging the natural sweetness of these fruits, using the freeze-drying process to intensify their flavors, resulting in a delightful tropical taste experience.

Another trend is the premiumization of freeze-dried candy. Brands are focusing on high-quality ingredients, organic options, and gourmet flavors to appeal to consumers who are willing to pay a premium for superior products. This trend is evident in the launch of artisanal and small-batch freeze-dried candies that emphasize craftsmanship and quality.

Sustainability and ethical sourcing have also become important trends in the market. Consumers are increasingly concerned about the environmental impact of their food choices, prompting brands to adopt sustainable practices and ethical sourcing. This includes using sustainably sourced ingredients, minimizing waste in production, and utilizing eco-friendly packaging. These initiatives not only appeal to eco-conscious consumers but also contribute to the overall sustainability of the industry. For instance, WELLNESS CROFT's Freeze-Dried Candy Corn is packaged with Forest Stewardship Council (FSC) labels, demonstrating their commitment to environmentally responsible practices.

Technological advancements have played a crucial role in the growth of the freeze-dried candy market. Innovations in freeze-drying technology have improved the efficiency and quality of production processes, allowing manufacturers to produce freeze-dried candy more consistently and at a larger scale. These advancements ensure that the flavor, color, and nutritional value of the original ingredients are better retained in the final product.

The rise of e-commerce has significantly impacted the freeze-dried candy market, with brands leveraging online sales channels and direct-to-consumer models to reach a broader audience. The COVID-19 pandemic accelerated this shift towards online shopping as consumers increasingly turned to e-commerce for their purchases. Direct-to-consumer sales allow brands to build stronger relationships with their customers and offer personalized experiences.

Companies have undertaken various initiatives to capitalize on the growing demand for freeze-dried candy. Product launches and innovations are a primary focus, with companies continuously introducing new products and flavors to keep their offerings fresh and exciting. For example, Sow Good Inc. announced the launch of new freeze-dried candy products in 2023, along with plans to increase production capacity to meet rising demand. The decision to enter this market was influenced by the viral popularity of freeze-dried candy on social media platforms, especially TikTok, where the hashtag "freezedriedcandy" has garnered over 2 Million views. Sow Good anticipates that the sustained and growing interest in freeze-dried candy will solidify its position as a must-have retail category.

These initiatives highlight the company's commitment to innovation and market expansions. Marketing and branding efforts have also been instrumental in popularizing freeze-dried candy. Brands are utilizing social media, influencer partnerships, and engaging content to connect with consumers and build brand loyalty. These efforts aim to educate consumers about the unique qualities of freeze-dried candy and encourage them to try these products.

Product Insights

The fruit-based freeze dried candy accounted for a revenue share of 41.5% in 2023. This sub-segment is driven by the demand for healthier, natural snacks. Consumers appreciate the retention of nutritional value and the intensified natural flavors achieved through freeze-drying. Popular choices include strawberries, bananas, and exotic fruits like dragon fruit and lychee, which offer vibrant taste profiles and visual appeal.

The freeze dried gummy bears is projected to grow at a CAGR of 9.5% over the forecast period of 2024-2030. Freeze-dried gummy bears are the fastest-growing product segment. This growth is driven by the unique texture transformation that occurs during the freeze-drying process, which makes them crunchy and intensely flavorful. The novelty of freeze-dried gummy bears appeals to consumers looking for innovative and exciting snack options, particularly among younger demographics who enjoy the twist on classic candy.

Flavor Insights

The sweet freeze dried candy accounted for a revenue share of 41.3% in the year 2023. These flavors include classics like strawberry, apple, and banana, which cater to a broad audience seeking familiar and comforting tastes. The dominance of sweet flavors is supported by their versatility and the natural sweetness of the fruits used, making them a staple choice in the freeze-dried candy category.

The mixed flavors freeze dried candy is projected to grow at a CAGR of 9.3% over the forecast period of 2024-2030. The mixed flavor freeze-dried candy segment is experiencing notable growth, driven by consumer demand for variety and the excitement of trying multiple flavors in one package. These products cater to adventurous eaters who seek diverse taste experiences without committing to a single flavor.

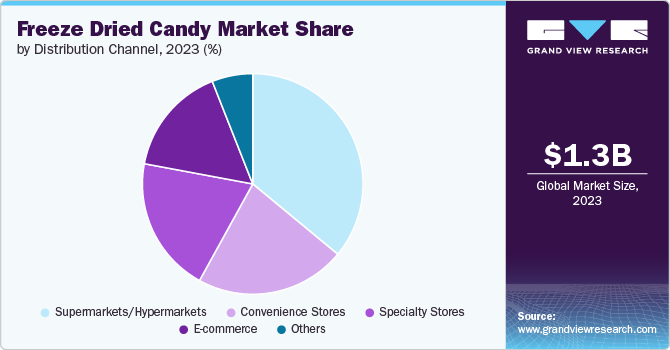

Distribution Channel Insights

Sales of freeze dried candy through supermarkets/hypermarkets accounted for a revenue share of 36.0% in 2023. These retail channels are bolstered by the wide distribution networks and extensive product variety available in these retail channels. Consumers benefit from the convenience and the ability to explore new flavors and brands. For instance, Sow Good Inc.'s presence in major stores like Cracker Barrel and Target enhances accessibility.

Sales of freeze dried candy through the e-commerce stores segment are estimated is projected to grow at a CAGR of 11.5% over the forecast period of 2024-2030. The e-commerce segment's growth in the freeze-dried candy market is fueled by the convenience of online shopping, extensive product availability, personalized consumer experiences, effective digital marketing, and the influence of customer reviews. These factors collectively contribute to the increasing sales and popularity of freeze-dried candies in the digital marketplace.

Regional Insights

The North America freeze dried candy market accounted for a share of 36.0% of the global revenue in 2023. North America is a leading market for freeze-dried candy, driven by high consumer awareness and demand for innovative and healthy snacks. The region's focus on clean-label products and the presence of key players contribute to market growth.

U.S. Freeze Dried Candy Market Trends

The freeze dried candy market in the U.S. is expected to grow at a CAGR of 7.4% from 2024 to 2030. The growth is due to a strong emphasis on health-conscious snacking and convenience. The U.S. market benefits from robust e-commerce channels and significant marketing efforts by brands. New product launches and partnerships with major retailers have been pivotal in increasing market penetration.

Asia Pacific Freeze Dried Candy Market Trends

Asia Pacific is expected to grow at a CAGR of 10.1% from 2024 to 2030. The Asia Pacific region is experiencing rapid growth in the freeze-dried candy market, driven by changing consumer preferences toward healthier snacks. The demand for exotic fruit flavors and the rising popularity of Western snack trends are notable in countries like China and Japan. The growth of modern retail channels supports market expansion.

Europe Freeze Dried Candy Market Trends

Europe is projected to grow at a CAGR of 8.0% from 2024 to 2030. Europe's freeze-dried candy market is characterized by a preference for premium and organic products. The region's stringent regulations on food quality and safety enhance consumer trust in freeze-dried candies. Growth is fueled by the rising popularity of sustainable and natural snacks, with countries like Germany and the U.K. leading the trend towards healthy confectionery options.

Key Freeze Dried Candy Company Insights

The market features both established global firms and emerging players. Key industry leaders prioritize product innovation, differentiation, and distinctive designs in line with evolving consumer preferences. These major players leverage extensive global distribution networks to reach diverse customer bases and tap into emerging markets.

Key Freeze Dried Candy Companies:

The following are the leading companies in the freeze dried candy market. These companies collectively hold the largest market share and dictate industry trends.

- Freeze Dried USA

- SOW Goods Inc.

- The Freeze Dried Candy Company

- SweetyTreatyCo

- The Candy Space

- Mythical Candy Factory

- Ice Age Candy Company LLC

- SpaceSweets

- Happy Candy UK

- Candy Copia

Recent Developments

-

In May 2023, Sow Good, Inc. announced its entry into the freeze-dried candy market and the addition of two new freeze dryers, which are expected to boost its annual production capacity to approximately USD 35 million. This increased capacity will enable the company to meet the anticipated retail demand following the launch of its freeze-dried candy line, which has generated significant excitement among retailers.

-

In February, 2023, Kanpai Foods innovatively entered the confectionery market by launching a line of freeze dried candy. It has applied the freeze-drying process to traditional candies, creating a crunchy product with an intense flavor profile that offers a surprising and delightful snacking experience.

Freeze Dried Candy Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,460.3 million

Revenue forecast in 2030

USD 2,376.1 million

Growth rate

CAGR of 8.5% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, flavors, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; South Africa

Key companies profiled

Freeze Dried USA; SOW Goods Inc.; The Freeze Dried Candy Company; SweetyTreatyCo; The Candy Space; Mythical Candy Factory; Ice Age Candy Company LLC; SpaceSweets; Happy Candy UK; Candy Copia

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Freeze Dried Candy Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the freeze dried candy market based on product, flavor, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fruit-based

-

Strawberries

-

Apples

-

Bananas

-

Blueberries

-

Mixed Fruits

-

-

Dairy-based

-

Chocolate-based

-

Gummy Bears

-

Others

-

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Sweet

-

Sour

-

Mixed Flavors

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Specialty Stores

-

E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global freeze dried candy market was estimated at USD 1,358.8 million in 2023 and is expected to reach USD 1,460.3 million in 2024.

b. The global freeze dried candy market is expected to grow at a compound annual growth rate of 5.0% from 2024 to 2030 to reach USD 2,376.1 million by 2030.

b. North America dominated the freeze dried candy market with a share of around 36% in 2023. The market is driven by high consumer awareness and demand for innovative and healthy snacks.

b. Some of the key players operating in the freeze dried candy market include Freeze Dried USA; SOW Goods Inc.; The Freeze Dried Candy Company; SweetyTreatyCo; The Candy Space; Mythical Candy Factory; Ice Age Candy Company LLC; SpaceSweets; Happy Candy UK; Candy Copia

b. Key factors that are driving the freeze dried candy market growth include the preference for premium and organic products has fueled growth, with a focus on sustainable and natural snacks, and the demand for exotic fruit flavors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.