- Home

- »

- Next Generation Technologies

- »

-

Freelance Platforms Market Size, Industry Report, 2033GVR Report cover

![Freelance Platforms Market Size, Share & Trends Report]()

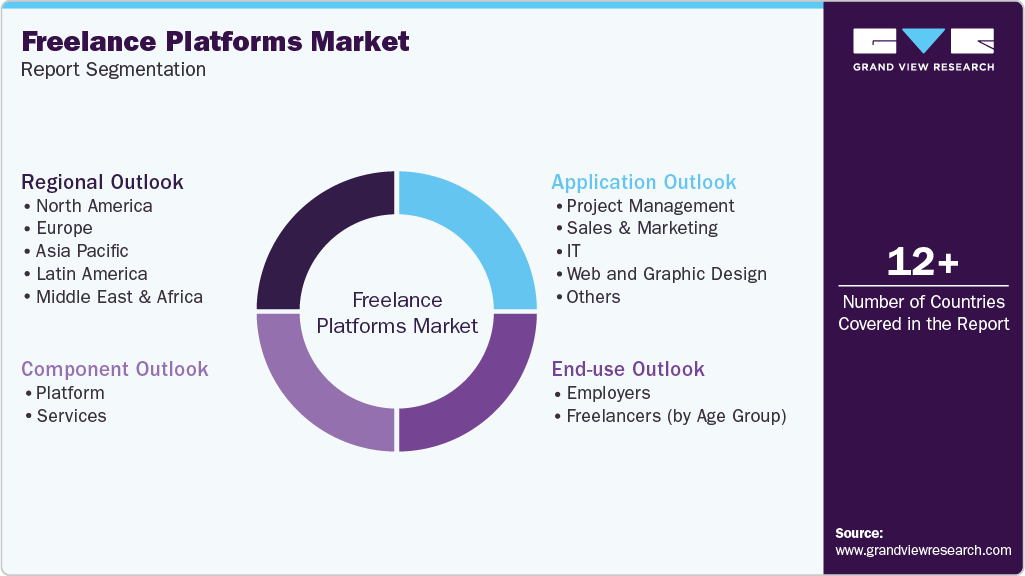

Freelance Platforms Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Platform, Services), By End Use (Employers, Freelancers (by Age Group)), By Application (Project Management, Sales & Marketing, IT, Web & Graphic Design, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-089-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Freelance Platforms Market Summary

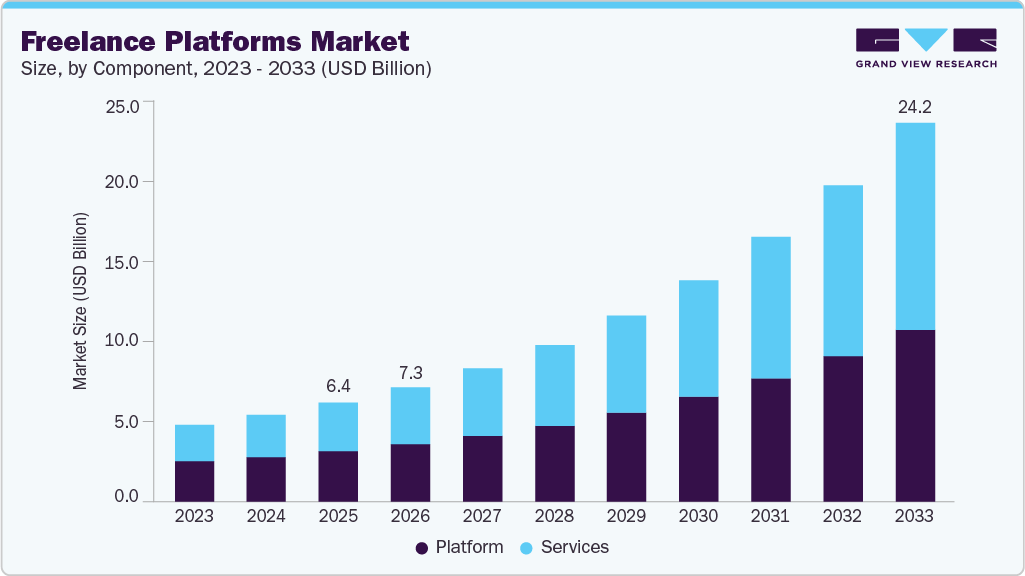

The global freelance platforms market size was valued at USD 6.37 billion in 2025 and is projected to reach USD 24.16 billion by 2033, growing at a CAGR of 18.6% from 2026 to 2033. This growth is highlighted by the ongoing increase of the gig economy, broader acceptance of remote and flexible work arrangements, and advances in technologies such as AI-driven job matching, secure digital payments, and cloud infrastructure that improve platform effectiveness and scalability.

Key Market Trends & Insights

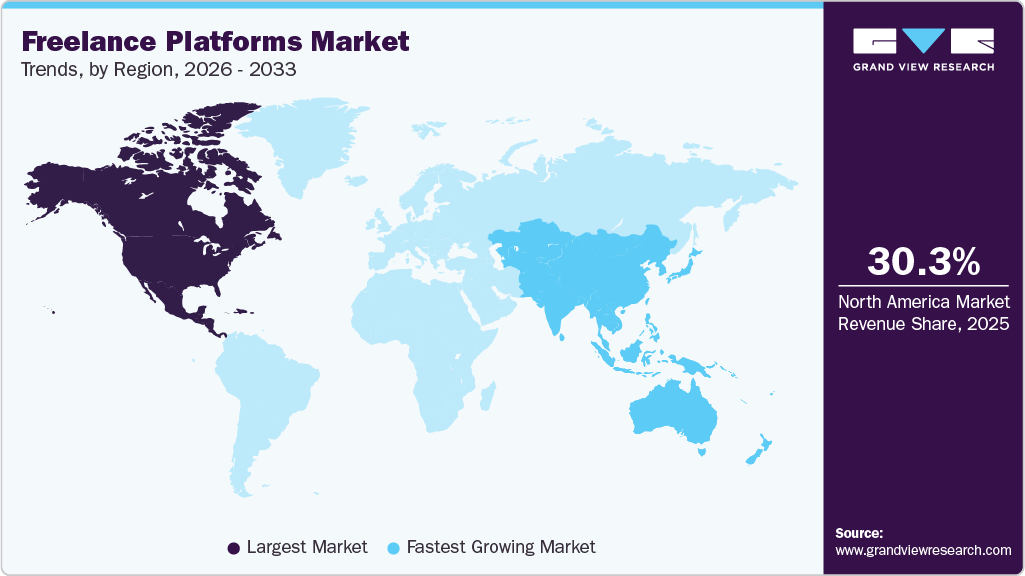

- North America held 30.3% revenue share of the freelance platforms industry.

- The U.S. dominated the freelance platforms industry in 2025.

- By component, the platform segment held the largest revenue share of 50.6% in 2025.

- By end use, the freelancers segment held the largest revenue share in 2025.

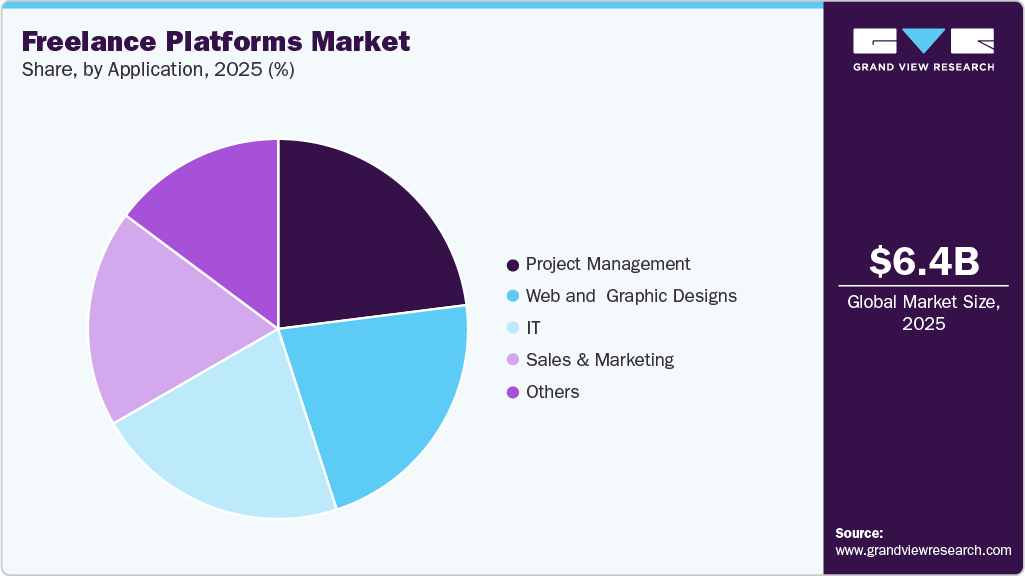

- By application, the project management segment held the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 6.37 Billion

- 2033 Projected Market Size: USD 24.16 Billion

- CAGR (2026 - 2033): 18.6%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Enterprises are turning to freelance platforms to tap global skill pools, reduce hiring costs, and react swiftly to evolving project demands. At the same time, freelancers benefit from broader access to opportunities and autonomy over work schedules, all of which together drive market momentum through the forecast period.The rise of the gig economy drives the growth of the freelance platform industry. The gig economy, characterized by short-term, flexible jobs, has grown rapidly as more people seek alternatives to traditional, full-time employment. Freelance platforms facilitate this by offering a marketplace for individuals to find short-term, on-demand work that suits their skills and interests. Freelance platforms allow individuals to select the projects they want to work on, set their hours, and enjoy greater control over their career paths. This shift toward gig-based employment has made freelance platforms an increasingly popular option for workers and employers.

Freelance platforms offer significant advantages to both businesses seeking talent and individuals pursuing freelancing opportunities. These platforms provide companies with access to a global pool of professionals, allowing them to find freelancers suited to their specific project needs. In addition, businesses can reduce costs by opting for freelance talent instead of hiring full-time employees, thereby avoiding expenses related to fixed salaries, employee benefits, and office space. For freelancers, this model offers flexibility to work remotely, enhancing work-life balance by allowing them to choose projects that align with their preferences. It also eliminates the need for daily commutes to an office. As more professionals explore alternatives to traditional nine-to-five jobs, freelancing continues to gain popularity.

The expansion of the freelance platform industry is driven by the rising demand for freelancers to fulfill project-based requirements and the growing reliance on freelancing platforms. Remote freelancing offers numerous benefits, including the flexibility to work from any location, lower operational costs for businesses, and access to a diverse global talent pool. These advantages have significantly contributed to the increasing popularity and growth of freelance platforms. Furthermore, the COVID-19 pandemic prompted businesses to reconsider their work models, highlighting the value of remote work and freelance arrangements. Organizations have increasingly recognized the efficiency and effectiveness of employing temporary talent for specific projects, leading to a shift in their strategies for talent acquisition and workforce management.

Component Insights

The platform segment held the largest revenue share in 2025. The platform segment is further categorized as project-based, solution-based, talent-based, and hybrid. Freelance platforms act as virtual marketplaces, linking skilled freelancers with employers to facilitate work opportunities and payments. These platforms allow direct collaboration between freelancers and clients, bypassing intermediaries such as recruitment or talent search agencies. They streamline the entire process, encompassing job postings, proposal submissions, communication, project management, and secure payment transactions. The platforms typically operate on a revenue model that includes service or commission fees and subscription charges, often supported by offering escrow services to ensure secure financial dealings.

The services segment is expected to grow at the fastest CAGR during the forecast period. The freelance platform industry provides a wide range of services that support both freelancers and businesses. These services are mainly grouped into managed services and technology services. Managed services cover areas such as finding and managing talent, consulting, engineering support, and freelance hiring, helping companies handle their freelance workforce more efficiently. On the technology side, platforms offer tools such as cloud-based systems, application development, quality testing, and data security. Together, these services make it easier for freelancers to find work and for businesses to collaborate smoothly, manage projects efficiently, and complete tasks without operational complexity.

End Use Insights

The freelancers segment dominated the market in 2025. The freelancer segment is further categorized into age groups: 18 - 34, 35 - 54, and above 55. The 18-34 age group demonstrates a strong preference for remote work as a full-time employment option. This trend is driven by several factors, including flexible working hours, the ability to work from anywhere, access to a global talent marketplace, and the convenience of selecting preferred work opportunities. This age group’s willingness to upskill and adapt despite challenges such as delayed payments, inconsistent client retention, and employment uncertainties further fuels the growth of the freelance platform market during the forecast period. Moreover, their entrepreneurial mindset and desire to create their own career opportunities align well with freelancing. Freelance platforms serve as a springboard for this demographic, providing a marketplace to build their businesses, establish a client base, showcase their skills, and undertake projects independently, fostering their entrepreneurial goals.

The employers segment is expected to grow at the fastest CAGR over the forecast period. The employers’ segment is further bifurcated into SMEs and large enterprises. The rise of entrepreneurship and start-ups contributes to the growth of the segment. Start-ups and small businesses often have limited budgets and resources to hire full-time employees for every role. Freelance platforms provide these businesses with an affordable solution to access high-quality talent on a short-term or project basis. The scalability of freelance hiring models makes it easier for entrepreneurs to manage fluctuating workloads while maintaining high-quality standards without compromising resources. The ability to hire specialized freelancers also enables these businesses to remain nimble and efficient, essential for their growth and survival in highly competitive markets.

Application Insights

The project management segment dominated the market in 2025. The rising demand for specialized project management skills is a critical driver in the freelance platforms industry. Many industries require specific project management expertise to navigate the complexities of their sectors. Freelance platforms have made it easier for businesses to find project managers with the niche skills needed for these industries. Rather than hiring full-time employees with general project management skills, companies increasingly turn to freelancers with specialized expertise who can provide targeted solutions and contribute immediately to project success. This trend reflects the growing recognition that specialized knowledge significantly enhances project outcomes for businesses that hire freelancers with the right experience.

The web and graphic designs segment is expected to grow at a significant CAGR over the forecast period. The shift towards digital marketing and branding drives the growing demand for web and graphic designers. As businesses increasingly adopt digital marketing strategies, the need for visually compelling and engaging content has surged. Graphic designers are hired to create branding elements such as logos, brochures, infographics, and promotional materials that help businesses stand out in a crowded marketplace.

Regional Insights

North America freelance platforms industry dominated with a revenue share of over 30.3% in 2025. The rise of the gig economy is a major factor contributing to the growth of the freelance platforms industry in North America. The gig economy, characterized by short-term contracts and freelance work rather than permanent full-time employment, has gained significant traction in recent years. Many workers seek opportunities to participate in this flexible and diverse work environment. Freelance platforms are essential to the gig economy, connecting independent workers with employers needing temporary or project-based work.

U.S. Freelance Platforms Market Trends

The U.S. dominated the freelance platforms industry in 2025, and it is expected to grow significantly from 2026 to 2033. The rise of online education and digital skills development is fueling the growth of the U.S. market. With the increasing availability of online courses, certifications, and training programs, more individuals are acquiring skills that make them competitive candidates on freelance platforms. Many people are upskilling or reskilling themselves in web development, graphic design, digital marketing, and other in-demand fields.

Asia Pacific Freelance Platforms Market Trends

The freelance platforms industry in the Asia Pacific is growing at the fastest CAGR from 2026 to 2033. The increasing adoption of remote and flexible work arrangements across countries in APAC drives market growth. As economies in the region continue to digitalize, businesses are increasingly open to remote collaboration, allowing freelancers to work with clients globally. The demand for freelance talent is particularly high in countries like India, China, and the Philippines, where large pools of skilled professionals in areas such as IT, graphic design, digital marketing, and customer service are available.

The freelance platforms industry in China held a significant market share in 2025. The rapid expansion of China's gig economy is another important factor driving the freelance platforms industry. Gig work, or short-term contract-based labor, is becoming increasingly common across various sectors, particularly transportation, food delivery, and creative services. Platforms like Didi for ride-hailing and Meituan for food delivery are examples of how gig work has penetrated China's mainstream economy.

The Japan freelance platforms industry is expected to grow rapidly in the coming years. The expansion of remote work policies across Japan is another key factor driving the adoption of freelance platforms. Over the past few years, especially during the COVID-19 pandemic, many companies in Japan have realized the benefits of remote work, including cost savings on office space, increased employee productivity, and access to a broader talent pool.

Europe Freelance Platforms Market Trends

The Europe freelance platforms industry is growing at a significant CAGR from 2026 to 2033. This growth is mainly driven by the increasing acceptance of freelancing as a valid and long-term career option. As freelancing becomes more widely accepted across Europe, a growing number of professionals are moving away from traditional full-time jobs. Many workers now prefer the flexibility, independence, and work-life balance that freelancing provides, which is encouraging higher usage of freelance platforms across the region.

The UK freelance platforms industry is expected to grow rapidly over the coming years. The traditional 9-to-5 employment model is gradually being replaced by freelance and project-based work, allowing individuals to work independently and choose their assignments. The UK’s strong digital infrastructure and well-developed economy support this shift, making it one of the leading markets for freelance platforms. These platforms help connect skilled freelancers with businesses looking for specialized expertise on a short-term basis, creating benefits for both freelancers and employers.

The freelance platforms industry in Germany held a notable market share in 2025. Growth in the country is strongly supported by its large industrial and manufacturing sectors, which increasingly rely on freelance professionals for specialized skills. As Industry 4.0 initiatives continue to expand, German companies are adopting advanced technologies such as automation, the Internet of Things (IoT), and robotics. This technological shift is increasing the need for flexible, on-demand talent, further driving the adoption of freelance platforms in Germany.

Key Freelance Platforms Company Insights

Some of the key companies operating in the freelance platform industry include 99designs, Braintrust, Contently, Crowdspring, DesignCrowd, Fiverr International Ltd., among others.

-

Braintrust is a decentralized global freelance talent network that connects highly skilled technical and design professionals with reputable companies, allowing freelancers to keep 100% of their earnings by eliminating middleman fees. Built on blockchain technology and governed by its community, the platform focuses on large projects in software, machine learning, and analytics. It serves organizations seeking flexible, on-demand talent without traditional staffing costs.

-

Contently is a content marketing and creative freelance platform that connects enterprise brands with a global network of vetted content creators, including writers, editors, designers, and multimedia professionals, to produce engaging content at scale. Headquartered in New York, it offers an end‑to‑end platform combining strategy, workflow tools, and talent matching to help businesses plan, create, and deliver high‑quality content while supporting freelancers with project opportunities.

Key Freelance Platforms Companies:

The following key companies have been profiled for this study on the freelance platforms market.

- 99designs

- Braintrust

- Contently

- Crowdspring

- DesignCrowd

- Fiverr International Ltd.

- FlexJobs

- Freelancer Technology Pty Limited

- Gigster LLC

- Guru.com

- Paro, Inc.

- People Per Hour Ltd

- Toptal, LLC

- Upwork Global Inc.

- WorkGenius

Recent Developments

-

In August 2025, Upwork took a major step beyond its traditional freelance marketplace by acquiring Bubty, which is a workforce management platform, and entering into a final agreement to acquire Ascen, which is a global compliance and employer-of-record provider. With these acquisitions, Upwork plans to create a new enterprise-focused business unit designed to handle a wide range of corporate staffing needs, including agent-of-record, employer-of-record, and staff augmentation models. This move allows Upwork to compete more directly in the broader corporate staffing space and support large enterprises looking for end-to-end workforce management solutions in addition to freelance talent.

-

In Feb 2025, Fiverr International Ltd. launched a Freelancer Equity Program to give top-performing, eligible U.S. freelance sellers a financial stake in the company by awarding them up to USD 10,000 worth of Fiverr shares over four years based on meeting annual eligibility criteria. This initiative is designed to reward high achievers on the platform, encourage long-term engagement, and reinforce Fiverr’s commitment to investing in its talent community by making freelancers not just service providers but part-owners in the company’s growth.

Freelance Platforms Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 7.33 billion

Revenue forecast in 2033

USD 24.16 billion

Growth rate

CAGR of 18.6% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, end use, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

99designs; Braintrust; Contently; Crowdspring; DesignCrowd; Fiverr International Ltd.; FlexJobs; Freelancer Technology Pty Limited; Gigster LLC; Guru.com; Paro, Inc.; People Per Hour Ltd; Toptal, LLC; Upwork Global Inc.; WorkGenius

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Freelance Platforms Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the freelance platforms market report based on component, end use, application, and region.

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Platform

-

Project-based

-

Solution-based

-

Talent-based

-

Hybrid

-

-

Services

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Employers

-

SMEs

-

Large Enterprises

-

-

Freelancers (by Age Group)

-

18 - 34

-

35 - 54

-

Above 55

-

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Project Management

-

Sales & Marketing

-

IT

-

Web and Graphic Design

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global freelance platforms market size was estimated at USD 6.37 billion in 2025 and is expected to reach USD 7.33 billion in 2026.

b. Key factors driving the freelance platforms market growth include the rise of the gig economy, the increasing need for change in employee hiring processes, and the emergence of a remote work culture drive market growth.

b. The global freelance platforms market is expected to grow at a compound annual growth rate of 18.6% from 2026 to 2033 to reach USD 24.16 billion by 2033.

b. The freelance platforms market in North America held a share of nearly 30.0% in 2025. North America has witnessed a significant rise in the gig economy, with more individuals opting for flexible work arrangements. Moreover, the region has a thriving start-up culture and a robust entrepreneurial spirit

b. Some prominent players in the market include 99designs; Braintrust; Contently; Crowdspring; DesignCrowd; Fiverr International Ltd.; FlexJobs; Freelancer Technology Pty Limited; Gigster LLC; Guru.com; Paro, Inc.; People Per Hour Ltd; Toptal, LLC; Upwork Global Inc.; WorkGenius

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.