Fraud Detection And Prevention Market Size, Share & Trends Analysis Report By Component (Solution, Service), By Application, By Organization, By Vertical, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-578-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

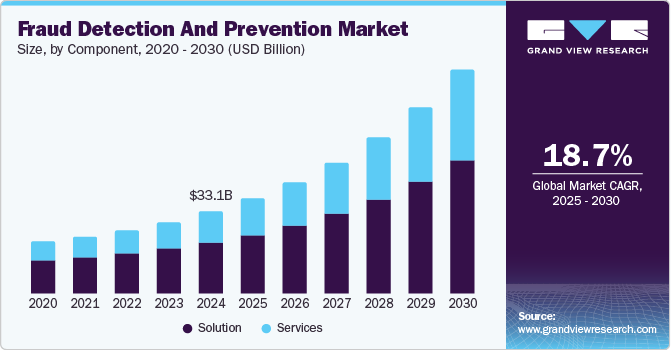

The global fraud detection and prevention market was valued at USD 33.13 billion in 2024 and is projected to grow at a CAGR of 18.7% from 2025 to 2030. One of the primary drivers is the increasing sophistication of cyberattacks, which has led businesses across various sectors, such as banking, e-commerce, and healthcare, to adopt advanced fraud detection solutions. The rise in online transactions has also significantly contributed to this growth, as more consumers engage in digital payments, creating opportunities for fraudsters to exploit vulnerabilities.

The digital transformation across industries is a significant catalyst, as organizations increasingly rely on online platforms for transactions. According to the Federal Trade Commission data, consumers reported losses exceeding USD 10 billion due to fraud in 2023, marking the first instance of such losses reaching this level. This figure represents a 14% increase compared to the losses reported in 2022. Moreover, this shift necessitates robust fraud detection systems to protect sensitive data and ensure compliance with regulatory standards. In addition, advancements in technologies such as Artificial Intelligence (AI) and Machine Learning (ML) enhances the capabilities of fraud detection solutions, enabling real-time monitoring and analysis of transactions.

Furthermore, as businesses prioritize security and risk management, the demand for sophisticated fraud prevention tools will likely surge. In addition, regulatory compliance is becoming increasingly stringent, pushing organizations to implement effective fraud detection systems to meet legal requirements. Regulations such as the General Data Protection Regulation (GDPR) and Payment Card Industry Data Security Standard (PCI DSS) are compelling companies to invest in comprehensive fraud prevention strategies. This trend is particularly evident in sectors such as finance and healthcare, where compliance with data protection laws is critical. As organizations seek to avoid hefty fines and reputational damage associated with data breaches, the adoption of fraud detection solutions will continue to rise.

Component Insights

The solution segment dominated the market with a revenue share of 62.4% in 2024, primarily due to the increasing demand for advanced authentication methods and fraud analytics. Organizations increasingly implement multi-factor authentication systems to enhance security and prevent unauthorized access. For instance, in 2024, Snowflake responded to a series of data breaches by introducing an option for administrators to enforce multi-factor authentication (MFA) to enhance data protection. This update allows admins to implement MFA enforcement tools, ensuring improved security measures for their data. Moreover, fraud analytics tools utilize machine learning algorithms to analyze vast amounts of transaction data, identifying unusual patterns that may indicate fraudulent activities. This approach assists in early fraud detection and supports compliance with regulatory standards, rendering these solutions essential for businesses across various sectors.

The service segment is projected to grow at the highest CAGR during the forecast period, driven by the rising need for professional and managed services. Professional services encompass consulting, integration, and training, which are essential for organizations looking to implement effective fraud detection frameworks. Managed services, on the other hand, provide continuous monitoring and real-time analysis of transactions, allowing businesses to respond swiftly to potential threats. As cyber threats evolve, organizations are increasingly seeking expert assistance to navigate complex security landscapes, further fueling the demand for these services.

Application Insights

The payment fraud segment dominated the market with the highest revenue share in 2024 due to the surge in online transactions and associated risks. With the rise of e-commerce and digital payments, businesses are facing unprecedented levels of payment fraud, including credit card fraud and account takeovers. According to the European Central Bank (ECB) and the European Banking Authority (EBA), the total value of fraudulent activities involving credit transfers, direct debits, card payments, cash withdrawals, and e-money transactions in the European Economic Area (EEA) reached USD 4.5 billion in 2022 and USD 2.1 billion in the first half of 2023. The majority of this fraud, measured by value, was associated with credit transfers and card payments, with card payments also representing the highest volume of fraudulent transactions. As a result, companies are investing heavily in specialized solutions designed to detect and effectively prevent payment-related fraud.

The identity theft segment is expected to grow at the fastest CAGR over the forecast period as awareness regarding personal data protection increases. With more individuals conducting transactions online, identity theft has become a prevalent issue that poses significant risks to consumers and businesses. Organizations are, therefore, prioritizing identity verification solutions that can authenticate users effectively while safeguarding sensitive information. This heightened focus on preventing identity theft reflects a broader trend toward enhanced overall security measures in response to evolving cyber threats.

Organization Insights

The large enterprises segment dominated the market with the highest revenue share in 2024 due to their extensive resources and greater exposure to complex fraud risks. Large organizations often manage vast networks of transactions and sensitive data across multiple channels, making them attractive targets for cybercriminals. Consequently, these enterprises are investing significantly in comprehensive fraud detection systems that incorporate advanced technologies such as AI-driven analytics and automated response mechanisms.

The SMEs segment is expected to grow at the fastest CAGR over the forecast period as smaller businesses increasingly acknowledge their vulnerability to fraud. Many Small and Medium Sized Enterprises (SMEs) have operated under the misconception that they are less likely targets for cybercriminals; however, recent statistics indicate otherwise. For instance, Accenture's Cybercrime study in 2023 indicated that approximately 43% of cyberattacks were aimed at small businesses, yet only 14% of these businesses were adequately prepared to confront such threats. As digital transformation accelerates within this sector, SMEs are seeking scalable and cost-effective fraud detection solutions that can be customized to fit their unique operational needs. The rise of cloud-based services has made it easier for SMEs to access advanced security technologies without substantial upfront investments.

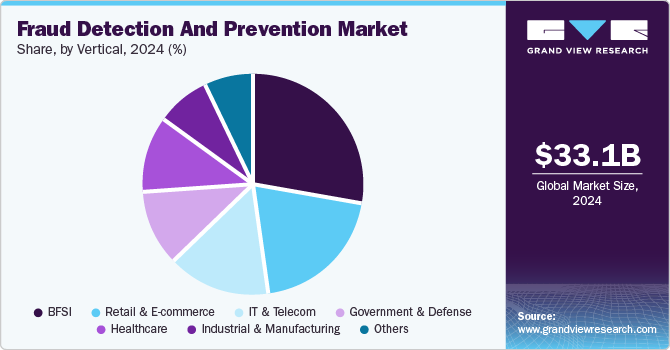

Vertical Insights

The BFSI segment dominated the market with the highest revenue share in 2024, owing to its constant exposure to various financial fraud risks. Institutions within this sector face continuous threats from activities such as money laundering, credit card fraud, and identity theft. In response, banks and financial institutions are adopting advanced fraud detection technologies that help mitigate financial losses and ensure compliance with stringent regulations related to data protection and anti-money laundering efforts. The integration of advanced analytics into transaction monitoring systems allows Banking, Financial Services, and Insurance (BFSI) organizations to identify suspicious activities swiftly while maintaining a seamless customer experience.

The retail and e-commerce segment is expected to grow at the fastest CAGR over the forecast period. Retailers face new opportunities and challenges as online shopping grows, particularly in combating online fraud, such as account takeovers and payment fraud. To address these threats, they invest heavily in robust fraud prevention measures, including enhanced transaction monitoring systems and customer identity verification processes. With consumer preferences increasingly favoring e-commerce for its convenience, ensuring secure transactions is vital for retailers aiming to build customer loyalty while navigating a competitive landscape filled with evolving threats.

Regional Insights

The North America fraud detection and prevention industry dominated the global market with a revenue share of 37.3% in 2024, primarily due to the region's advanced technological infrastructure and high adoption rates of digital payment methods. The presence of players such as IBM Corp., Microsoft, and Oracle has fostered innovation and competition, leading to the development of sophisticated fraud detection solutions tailored to combat the increasing sophistication of cyber threats.

U.S. Fraud Detection And Prevention Market Trends

The U.S. dominated the regional fraud detection and prevention market in 2024, driven by the increasing volume of digital transactions and the rising sophistication of cyber threats. The fraud detection and prevention industry is expected to benefit from advancements in artificial intelligence and machine learning technologies, which enhance the capabilities of fraud detection systems. In addition, stringent regulatory requirements compel organizations to adopt comprehensive fraud prevention measures to safeguard sensitive data and maintain compliance. As businesses across various sectors, including finance, e-commerce, and healthcare, prioritize security, the demand for innovative fraud detection solutions continues to rise.

Europe Fraud Detection And Prevention Market Trends

In Europe, the fraud detection and prevention industry is witnessing significant growth due to a significant rise in cybercrimes and sophisticated fraud schemes. The increasing preference for online shopping and digital payment methods complicates the landscape, necessitating effective solutions to mitigate risks associated with cross-border transactions. Regulatory frameworks regarding data privacy and identity protection are becoming stricter, compelling organizations to adopt advanced fraud prevention measures. For instance, the Payment Systems Regulator (PSR) has implemented new rules to address the increasing threat of Authorized Push Payment (APP) fraud. This regulatory change allows banks and financial institutions to comply and take the lead, innovate, and strengthen customer trust. As a result, businesses are investing in technologies that enhance their ability to detect and prevent fraudulent activities while ensuring compliance with evolving regulations.

Asia Pacific Fraud Detection And Prevention Market Trends

The Asia Pacific fraud detection and prevention industry is projected to grow at the highest CAGR during the forecast period, fueled by digitalization and increasing internet penetration. The expanding e-commerce sector has led to a surge in online transactions, creating opportunities for fraudulent activities such as payment fraud and identity theft. Countries such as China are at the forefront of this growth, with businesses investing heavily in advanced fraud detection technologies to protect consumer data and enhance transaction security. The widespread adoption of mobile payment systems further drives this trend as companies strive to implement robust measures against potential cyber threats.

In addition, India is emerging as a significant player within the Asia Pacific market due to its booming digital economy and increasing reliance on online transactions. The growing number of internet users and mobile banking adoption has heightened concerns over cybersecurity risks. As a result, Indian businesses are increasingly turning to comprehensive fraud detection solutions that incorporate AI-driven analytics for real-time monitoring and anomaly detection. For instance, the Reserve Bank of India (RBI) is developing an AI-enabled fraud information system aimed at detecting and preventing cyber fraud. An expert group established by the RBI to address cyber fraud has provided recommendations, including utilizing AI to learn from previous fraud incidents to identify high-risk transactions.

Key Fraud Detection And Prevention Company Insights

The fraud detection and prevention industry feature several key players that shape its landscape. ACI Worldwide is known for its comprehensive payment fraud detection solutions, while Experian Information Solutions, Inc. offers advanced identity verification services to mitigate fraud risks. IBM Corp. leverages AI-driven technologies to enable real-time anomaly detection, and SAS Institute Inc. specializes in analytics and machine learning to help businesses effectively identify fraudulent activities.

-

ACI Worldwide provides electronic payment solutions, focusing on fraud detection and prevention technologies for banks, financial institutions, and merchants. The company offers a range of products designed to enhance transaction security and reduce fraud risks. ACI's fraud management solutions utilize machine learning and behavioral analytics to identify and prevent various types of fraud, including payment fraud and account takeovers. By integrating into payment processes, ACI helps organizations secure customer transactions while ensuring compliance with regulatory standards.

-

AltexSoft is a technology consulting firm that develops software solutions, including fraud detection and prevention systems tailored to diverse business needs. The company employs advanced analytics, machine learning, and artificial intelligence to create customized solutions that effectively identify and address fraudulent activities. AltexSoft's expertise in data science and software development enables it to build robust fraud detection frameworks that improve security measures, minimize false positives, and enhance overall risk management for its clients.

Key Fraud Detection And Prevention Companies:

The following are the leading companies in the fraud detection and prevention market. These companies collectively hold the largest market share and dictate industry trends.

- ACI Worldwide

- AltexSoft

- BAE Systems

- Dell Inc.

- Equifax, Inc.

- Experian Information Solutions, Inc.

- Fiserv, Inc

- IBM Corp.

- NICE

- Oracle

- SAP SE

- SAS Institute Inc.

- SEON Technologies Ltd.

- Signifyd

- Software GmbH

Recent Development

-

In August 2024, CPI Card Group partnered with Rippleshot, a platform specializing in fraud prevention, to incorporate Rippleshot’s advanced services into its offerings. This alliance is intended to strengthen the fraud management capabilities available to CPI’s customers, helping them to proactively combat fraudulent activities, reduce related expenses, and enhance customer retention and satisfaction.

-

In March 2024, Visa announced the addition of three new AI-powered solutions to its Visa Protect suite, aimed at enhancing fraud prevention efforts. Among these innovations is a state-of-the-art solution specifically designed for immediate payment fraud and expanded capabilities that address fraud across various payment networks.

Fraud Detection And Prevention Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 38.30 billion |

|

Revenue forecast in 2030 |

USD 90.07 billion |

|

Growth rate |

CAGR of 18.7% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

November 2024 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

component, application, organization, vertical, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, UAE, Saudi Arabia, South Africa |

|

Key companies profiled |

ACI Worldwide; AltexSoft; BAE Systems; Dell Inc.; Equifax, Inc.; Experian Information Solutions, Inc.; Fiserv, Inc; IBM Corp.; NICE; Oracle; SAP SE; SAS Institute Inc.; SEON Technologies Ltd.; Signifyd; Software GmbH |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Fraud Detection And Prevention Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fraud detection and prevention market report based on component, application, organization, vertical, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Fraud Analytics

-

Authentication

-

Governance, Risk, and Compliance

-

-

Services

-

Professional Services

-

Managed Services

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Identity Theft

-

Money Laundering

-

Payment Fraud

-

Others

-

-

Organization Outlook (Revenue, USD Million, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Government and Defense

-

Healthcare

-

IT and Telecom

-

Industrial and Manufacturing

-

Retail and E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."