France Nicotine Pouches Market Size, Share & Trends Analysis Report By Product (Tobacco-derived, Synthetic), By Flavor (Original/Unflavored, Flavored), By Strength (Light, Normal, Strong, Extra Strong), By Distribution Channel, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-535-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

France Nicotine Pouches Market Trends

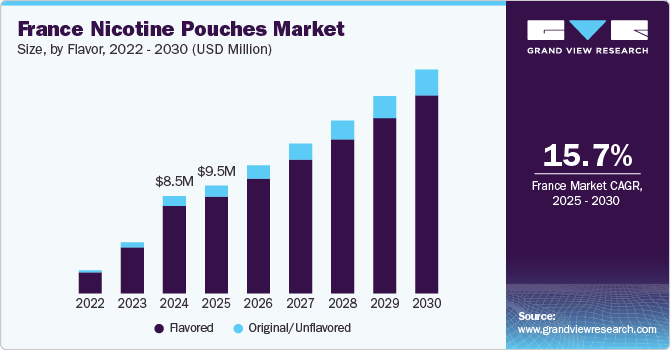

The France nicotine pouches market size was estimated at USD 8.52 million in 2024 and is projected to grow at a CAGR of 15.7% from 2025 to 2030. The growth can be attributed to the increasing awareness of the health risks associated with smoking, leading consumers to seek healthier alternatives. Nicotine pouches offer a discreet, smokeless option for nicotine consumption, fueling their rising popularity in France. In addition, the growing trend toward smokeless products, evolving regulations, and higher consumer demand for innovative nicotine delivery methods are all contributing to the market's rapid expansion.

The growth of the nicotine pouches market in France can be primarily attributed to increasing awareness about the health risks associated with smoking. As more people become conscious of the harmful effects of tobacco use, many are turning to less harmful alternatives like nicotine pouches. These products offer a convenient and discreet way to consume nicotine without the health risks linked to traditional smoking, which has driven their popularity among consumers looking for healthier choices.

Furthermore, the market is benefiting from the broader trend toward smokeless products and shifting regulations. With increasing consumer interest in innovative nicotine delivery options, such as nicotine pouches, coupled with evolving regulations that encourage less harmful alternatives to smoking, the market is experiencing rapid expansion. As a result, France is witnessing a significant rise in demand for these products, reflecting a broader global shift toward safer nicotine consumption methods.

Regulatory Insights

|

Guide to Nicotine Pouch Regulations in France: Key Compliance Requirements |

|

|

Regulation Aspect |

Requirements |

|

Regulatory Body |

|

|

Product Classification |

|

|

Taxation & Pricing |

|

|

Age Restrictions & Sales |

|

|

Marketing & Advertising |

|

|

Packaging & Labelling |

|

|

Potential Future Regulations |

|

|

Health Minister's Plan to Ban |

|

Consumer Insights

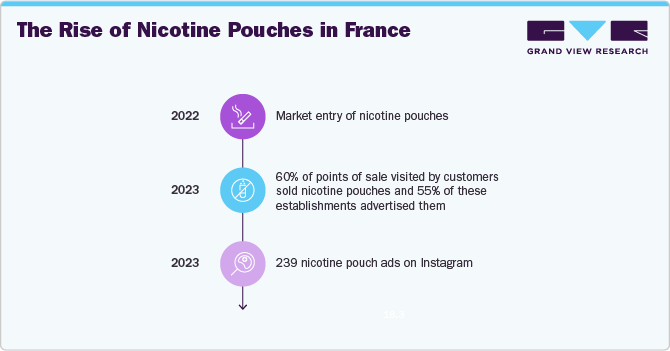

The consumption of nicotine pouches in France has been steadily growing in recent years. These tobacco-free products offer a discreet and clean way to consume nicotine, leading to a rise in adoption among consumers.

The National Committee against Smoking (CNCT) observed massive advertising for nicotine pouches since their market entry in 2022.

In 2023, nicotine pouches were available in 60% of the 185 points of sale visited, with 55% of these locations actively promoting the product, reflecting strong consumer interest and visibility in physical retail spaces. The 239 nicotine pouch advertisements on Instagram further emphasize the significant role digital platforms play in engaging a younger, more tech-savvy audience. This online presence aligns with the increasing consumer demand for discreet, portable alternatives to traditional smoking and vaping products.

Consumer preferences in France are clearly shaped by the convenience and flexibility that nicotine pouches offer. Key factors such as the ability to use them in places where smoking and vaping are prohibited resonate with those seeking a more discreet nicotine experience. In addition, the wide range of available flavors appeals to a diverse audience, including those who may not typically use nicotine products but are attracted by the variety and customization options. This shift in consumer behavior suggests a growing preference for products that offer convenience, choice, and a seamless fit into modern lifestyles.

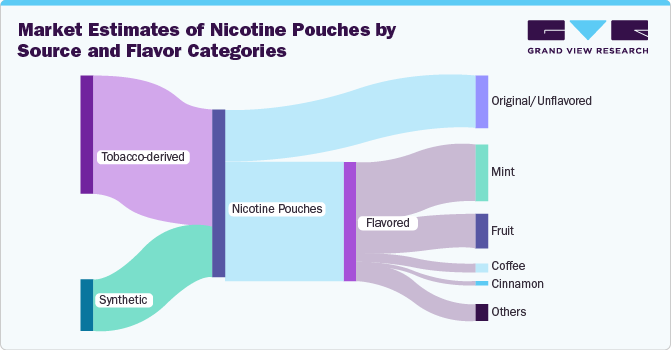

Product Insights

Tobacco-derived nicotine pouches held a revenue share of 98.87% in 2024, primarily as they align with existing consumer habits and the regulatory environment. In France, where tobacco use remains prevalent, consumers are more likely to trust and prefer tobacco-derived products, given their familiarity with traditional tobacco-based nicotine consumption. In addition, the regulatory framework governing tobacco products in France is well-established, making it easier for tobacco-derived nicotine pouches to gain market acceptance and legal approval. The widespread availability of these products in both retail stores and online, coupled with targeted marketing efforts, further reinforces their dominant position in the market.

The synthetic nicotine pouches segment is expected to grow at a CAGR of 19.9% from 2025 to 2030 due to increasing consumer demand for alternatives to tobacco-derived products. As France adopts stricter regulations on tobacco and nicotine consumption, synthetic nicotine pouches offer a non-tobacco option that appeals to health-conscious consumers seeking discreet and flexible nicotine use.

Flavor Insights

Flavored nicotine pouches held a revenue share of 90.19% in 2024, owing to strong consumer preference for variety and customization in their nicotine products. Flavors make nicotine pouches more appealing to a broader audience, including those who might be new to nicotine or are looking for a more enjoyable experience compared to traditional tobacco products. The appeal of flavors, along with the discreet and convenient nature of nicotine pouches, particularly in places where smoking is restricted, has contributed to their widespread popularity.

The original/Unflavored nicotine pouches segment is expected to grow at a CAGR of 18.8% from 2025 to 2030, owing to the increasing awareness of nicotine products with fewer additives and a more natural profile aligns with the shift toward healthier alternatives, further driving demand for unflavored pouches.

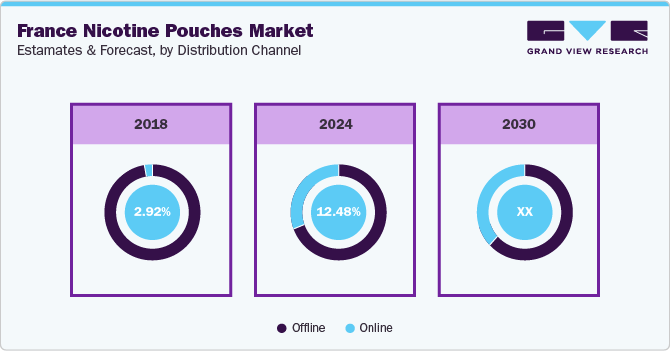

Distribution Channel Insights

Sales of nicotine pouches through offline channels held a revenue share of 69.5% in 2024. Offline channels offer the opportunity for consumers to make informed choices through direct interaction with sales staff and to comply with regulatory restrictions on online nicotine product sales, further driving the dominance of offline purchases.

Sales of nicotine pouches through online channels are expected to grow at a CAGR of 20.0% from 2025 to 2030. French consumers are becoming more comfortable with purchasing nicotine products online, driven by the convenience, privacy, and discreet nature of home delivery. With the growing demand for a wider variety of flavors, strengths, and brands that may not always be available in local stores, online platforms offer a broader selection.

Strength Insights

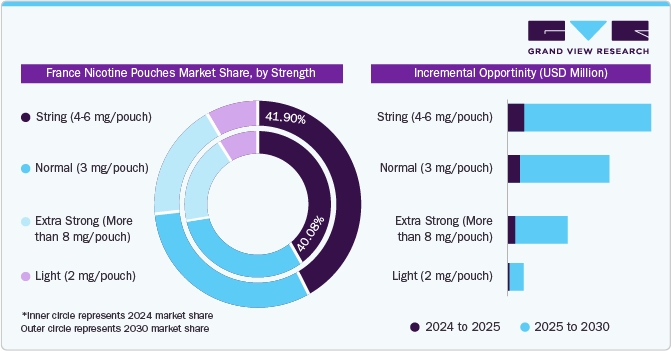

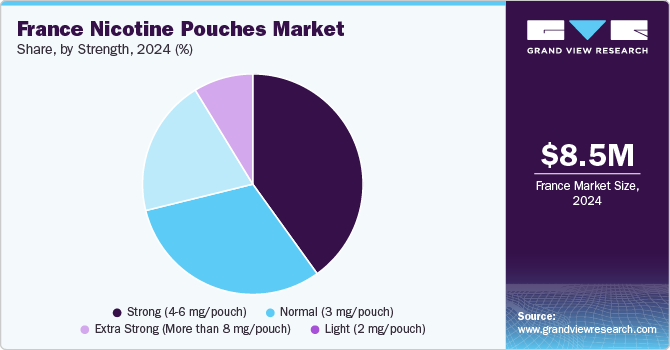

Strong (4-6 mg/pouch) strength nicotine pouches accounted for a revenue share of 40.08% in 2024. This can be attributed to the growing popularity of nicotine pouches as a smoking alternative that has led to increased demand for stronger options that provide a more immediate and lasting effect, contributing to their dominant market share.

The Normal (3 mg/pouch) strength nicotine pouches segment is anticipated to grow at a CAGR of 16.0% from 2025 to 2030 due to a shift in consumer preferences towards moderate nicotine doses. As more French consumers seek a balance between satisfying their nicotine cravings and avoiding the harshness of higher-strength products, 3 mg pouches offer a more accessible and controlled alternative. This strength appeals to both new users looking for a milder experience and existing users aiming to reduce their nicotine intake gradually.

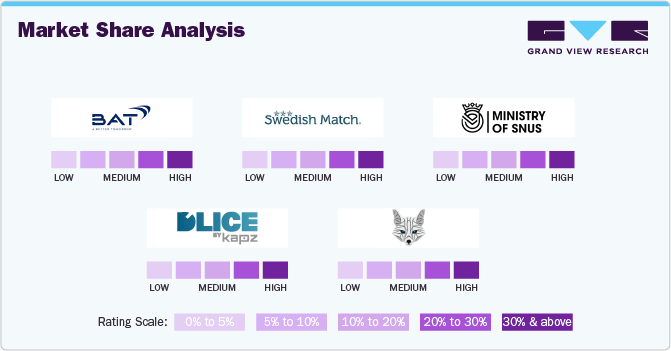

Key France Nicotine Pouches Company Insights

The nicotine pouch market in France is driven by a mix of established tobacco giants and specialized brands focused on smokeless nicotine alternatives. These companies lead the market by utilizing strong brand recognition, innovative product offerings, and extensive distribution networks.

As consumer demand for discreet, tobacco-free nicotine products grows, the market has become increasingly competitive, with major players continually enhancing product strength, flavor variety, and overall user experience.

With continued market growth, both global and emerging local brands are expected to compete for market share, targeting health-conscious individuals and those looking to reduce or quit traditional smoking.

Key France Nicotine Pouches Companies:

- British American Tobacco PLCO

- Swedish Match AB

- D'LICE

- White Fox Me

- Ministry of Snus

View a comprehensive list of companies in the France Nicotine Pouches Market

Recent Developments

-

In January 2025, British American Tobacco PLCO (BAT) France launched an appeal for collaborative dialogue among the government, public health organizations, and industry stakeholders to achieve the objectives outlined in the National Program for Tobacco Control (PNLT) 2023 - 2027. With France's smoking rate stagnating at 31%, BAT France advocates for the inclusion of innovative solutions, such as nicotine pouches, into public health policies to provide adult smokers with viable alternatives to traditional tobacco products.

France Nicotine Pouches Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 9.46 million |

|

Revenue forecast in 2030 |

USD 19.64 million |

|

Growth rate (Revenue) |

CAGR of 15.7% from 2025 to 2030 |

|

Actuals |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, flavor, strength, distribution channel |

|

Key companies profiled |

British American Tobacco PLCO; Swedish Match AB; D'LICE; White Fox Me; Ministry of Snus |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

France Nicotine Pouches Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the France nicotine pouches market report based on product, flavor, strength, and distribution channel.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Tobacco-derived

-

Synthetic

-

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Original/Unflavored

-

Flavored

-

Mint

-

Fruit

-

Coffee

-

Cinnamon

-

Other Flavors

-

-

-

Strength Outlook (Revenue, USD Million, 2018 - 2030)

-

Light (2 mg/pouch)

-

Normal (3 mg/pouch)

-

Strong (4-6 mg/pouch)

-

Extra Strong (More than 8 mg/pouch)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Frequently Asked Questions About This Report

b. The France nicotine pouches market size was estimated at USD 8.52 million in 2024 and is expected to reach USD 9.46 million in 2025.

b. The France nicotine pouches market is expected to grow at a compounded growth rate of 15.7% from 2025 to 2030 to reach USD 19.64 billion by 2030.

b. Tobacco-derived nicotine pouches accounted for a revenue share of 98.87% in 2024, primarily due they align with existing consumer habits and the regulatory environment.

b. Some key players operating in the market include British American Tobacco PLCO; Swedish Match AB; D'LICE; White Fox Me; and Ministry of Snus.

b. The growth can be attributed to the increasing awareness of the health risks associated with smoking, leading consumers to seek healthier alternatives. Nicotine pouches offer a discreet, smokeless option for nicotine consumption, fueling their rising popularity in France.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."