- Home

- »

- Display Technologies

- »

-

France Digital Signage Market Size & Share Report, 2030GVR Report cover

![France Digital Signage Market Size, Share & Trends Report]()

France Digital Signage Market Size, Share & Trends Analysis Report By Type, By Component, By Technology, By Screen Size, By Content Category, By Application, By Location, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-058-4

- Number of Report Pages: 107

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

Market Size & Trends

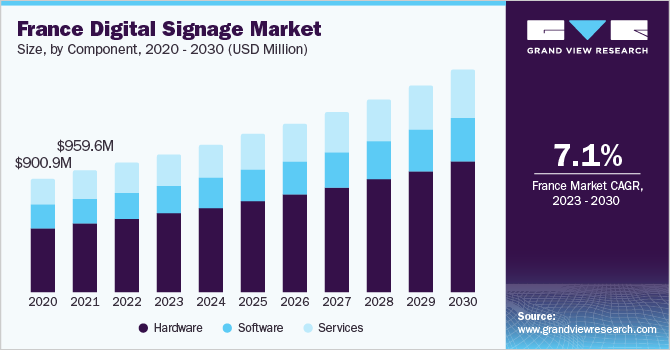

The France digital signage market size is expected to reach USD 1.02 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.1% from 2023 to 2030. Growing demand for interactive and personalized experiences and 4K embedded displays are factors boosting the market's growth. Digital signage refers to display technologies such as Liquid Crystal Display (LCD) monitors and Light Emitting Diode (LED) walls for displaying digital content, such as digital images and videos. It can be used at various locations, such as sporting arenas, retail stores, and sporting arenas. It is used for promotions, public information, and internal communication.

With the introduction of the latest technologies, digital signage displays are becoming more versatile, interactive, and engaging, leading to increased adoption by businesses in various industries. One of the most significant advancements in digital signage technology is Artificial Intelligence (AI). AI can be used to analyze data from digital signage displays, such as customer interactions and engagement rates, to provide valuable insights for businesses. This can help businesses optimize their displays and improve their effectiveness. The development of more immersive and interactive displays is expected to play a significant role in driving the adoption of digital signage across France.

The market players are adopting strategies such as partnerships & collaborations to improve their product offerings. For instance, in January 2023, Acrelec announced a partnership with XXII GROUP, an artificial intelligence company based in France, to help restaurant operators in boosting revenues by providing them with analytic solutions and drive-thru operational insights.

COVID-19 Impact

The COVID-19 pandemic had a positive impact on the market in France and accelerated the adoption of digital signage solutions in many industries. The pandemic increased demand for contactless solutions in public spaces such as airports, hospitals, and shopping malls. Digital signage has played a key role in this shift, providing touchless interactive experiences for customers. It can be used for virtual presentations and videoconferencing instead of physical displays and signs. Hence, digital signage solutions saw increased adoption due to the accelerated trend of virtual events and remote working.

With physical stores closed or operating at reduced capacity during lockdowns, many businesses shifted their focus toward e-commerce and online advertising. It has provided a key tool for businesses to promote their products and services online and drive website traffic. Moreover, it has been key in disseminating messages such as reminders to wear masks and social distancing promptly and effectively in public spaces. However, due to pandemic-induced supply chain disruptions, digital signage solution deployment was delayed due to longer lead times.

Type Insights

The kiosks segment dominated the overall market, gaining a market share of 23.7% in 2022. It is expected to expand at a CAGR of 8.4% throughout the forecast period. Kiosks are commonly used to provide information, such as wayfinding, maps, and schedules, and to sell products or services, such as tickets, food, and merchandise. Kiosks often feature touchscreens that allow users to interact with the content displayed on the screen, which makes them ideal for providing information or conducting transactions. They can also be equipped with cameras, scanners, and other sensors, which allow for even more advanced functionality, such as facial recognition and augmented reality.

The transparent LED screen segment is anticipated to grow at the fastest CAGR of 9.0% throughout the forecast period. Transparent LED screens are commonly used in various settings, such as retail stores, museums, and exhibitions, to showcase content such as advertisements, product information, and artistic displays. The key advantage of transparent LED screens is their ability to blend seamlessly into the surrounding environment. Moreover, they are energy-efficient, which is important for businesses that want to reduce energy costs.

Component Insights

In terms of component, the market is classified into software, hardware, and services. The hardware segment dominated the overall market, gaining a market share of 56.7% in 2022, and is expected to grow at the fastest CAGR of 7.6% throughout the forecast period. Several hardware components are necessary to set up a digital signage system, such as display panels, media players, front projection, mounts, and other accessories. The hardware components consist of displays, components required to manufacture digital panels and banners. The growth of the segment can be attributed to the increased hardware requirements in comparison to the software.

The software segment is anticipated to expand at a considerable CAGR of 6.5% throughout the forecast period. Software is a critical component of digital signage, providing the platform for content creation, management, and scheduling. The market presents significant opportunities for software providers. Several factors drive the market, including the increasing demand for dynamic and interactive content, the high requirement for real-time information display, and the growing adoption of cloud-based digital signage solutions.

Technology Insights

In terms of technology, the market is classified into LCD, LED, interactive screens/touch screens, and others. The LED segment dominated the overall market, gaining a market share of 35.6% in 2022 and witnessing a CAGR of 7.5% during the forecast period. Most modern electronic devices, such as laptop screens, computer monitors, tablets, and televisions, are equipped with LEDs. LED screens are suitable for outdoor use as they are weatherproof and offer a bright display. Moreover, they are quick and easy to set up and energy efficient. They can be customized to any size or shape, which makes them suitable for trade shows and huge arenas.

The interactive screens/touch screens segment is anticipated to witness the fastest growth, growing at a CAGR of 8.2% throughout the forecast period. Interactive screens add interactivity to digital signage, increasing customer involvement for mobile devices, kiosks, and touch screens, among others. They enhance the customer experience by keeping customers engaged and creating various opportunities for individuals and businesses. According to Touchify, a France-based Software-as-a-Service company, usual digital signage has average attention of 1.5 seconds, whereas interactive displays have average attention of 40 seconds.

Screen Size Insights

The below 32 inches segment is expected to dominate in 2022, gaining a market share of 41.2% and witnessing a CAGR of 6.7% during the forecast period. Screens less than 32 inches in size are used where the audience is in closed areas and have time & proximity to focus on the message. Small screens, such as 5-inch or 10-inch screen sizes, can be installed in small areas such as elevators, bathrooms, and dressing rooms. They help create a better one-on-one connection with the audience, easing marketing.

The 32 to 52 inches segment is anticipated to witness the fastest growth, growing at a CAGR of 7.6% throughout the forecast period. Screens, ranging from 32 to 52 inches, are used in places where there is ample space for installation. COTEP, a France-based digital signage solution provider, offers an indoor interactive terminal of 32-inch size. It has a full HD resolution and is equipped with infrared touch technology.

Content Category Insights

The non-broadcast segment is expected to dominate in 2022, gaining a market share of 58.7% and witnessing a CAGR of 6.3% during the forecast period. Non-broadcast content for digital signage refers to any type of content excluding traditional videos or TV broadcasts. The content includes static images, social media feeds, event schedules, digital menus, and interactive content, among others. The increasing adoption of non-broadcast content in France is attributed to the rising use of digital signage in retail environments. Retailers are using digital signage to display product information, promotions, and special offers in real-time.

The broadcast segment is anticipated to witness the fastest growth, expanding at a CAGR of 8.1% over the forecast period. Digital signage uses digital media to display advertising and broadcasting information at various places, such as airports, stations, lobbies, and along roadsides. The broadcast category includes news, weather, sports, and others. Digital signage solutions display contents of various categories to improve customer experience and enhance target audience engagement.

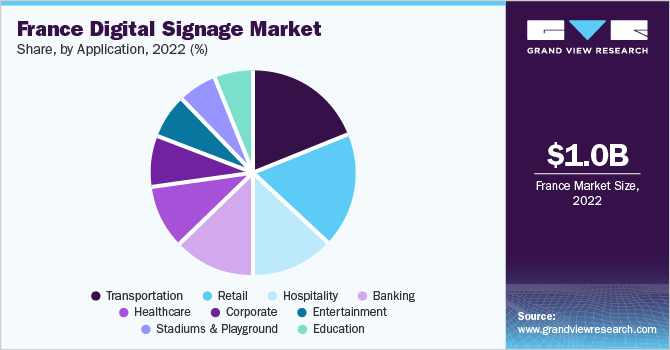

Application Insights

The transportation segment is expected to dominate in 2022, gaining a market share of 19.1% and witnessing a CAGR of 9.0% during the forecast period. Digital signage solutions can help commuters with valuable and real-time transport data at places such as bus stops, airports, and metros. COTEP, a France-based digital signage solution provider, offers solutions for the transportation sector. Dynamic signage is displayed through its portfolio of indoor and outdoor monitors. The company provided 115 indoor 32-inch SLIM monitors at the check-in counters of the Toulouse-Blagnac airport in France.

The healthcare segment is anticipated to witness the fastest growth, expanding at a CAGR of 9.2% throughout the forecast period. Digital signage screens in hospitals display healthcare information, including appointments, patient and doctor information, and advertisements. These screens can also help streamline visitor wayfinding by displaying directions to cafeterias, bathrooms, and clinics. Moreover, they can display health tips and awareness videos in common areas such as waiting rooms and elevators. Wait-time updates can be displayed to inform patients, enhancing patients’ satisfaction.

Location Insights

In terms of location, the market is classified into in-store and out-store. The in-store segment is expected to dominate in 2022, gaining a market share of 70.2% and witnessing a CAGR of 6.1% during the forecast period. Digital signage screens are used for advertising and marketing within stores, closed premises, or locations such as retail shops, malls, showrooms, corporate offices, inside hospitals & healthcare facilities, and hotels & restaurants. Interactive kiosks and digital screens in stores can provide essential product-related information such as comparisons with other products, physical parameters, and testimonials of clients.

The out-store segment is anticipated to witness the fastest growth, growing at a CAGR of 9.1% over the forecast period. Digital signage screens are also used in open premises such as outside malls and outside showrooms for advertising and marketing applications. Market players in France are offering out-store screen deployment solutions. The screens can also be deployed in shows or concerts, stadiums, and sports arenas. Moreover, they can be deployed at railway stations and airports.

Key Companies & Market Share Insights

The market is fragmented, with numerous regional and global companies. Major players are pursuing expansion, merger & acquisition strategies to gain market share. These players are launching new products to improve customer experience. For instance, in May 2022, Barco extended its ClickShare wireless conferencing and presentation solution with digital signage capabilities to enable organizations to use ClickShare to display digital signage messages for employees, visitors, and customers. Some prominent players in the France digital signage market include:

-

Intuiface

-

Acrelec

-

Barco

-

BenQ, Daktronics, Inc.

-

Delta Electronics, Inc.

-

Intel Corporation

-

LG Electronics

-

NEC Corporation

-

Panasonic Holdings Corporation

France Digital Signage Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.09 billion

Revenue forecast in 2030

USD 1.76 billion

Growth Rate

CAGR of 7.1% from 2023 to 2030

Base year for estimation

2022

Historic year

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, component, technology, screen size, content category, application, location

Country scope

France

Key companies profiled

Intuiface; Acrelec; Barco; BenQ; Daktronics, Inc.; Delta Electronics, Inc.; Intel Corporation; LG Electronics; NEC Corporation; Panasonic Holdings Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

France Digital Signage Market Report Segmentation

This report forecasts revenue growth at the country level and offers a qualitative and quantitative analysis of the market trends for each segment and sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the France digital signage market based on type, component, technology, screen size, content category, application, and location.

-

Type Outlook (Revenue, USD Million; 2017 - 2030)

-

Video Wall

-

Video Screens

-

Transparent LED Screens

-

Digital Posters

-

Kiosks

-

Others

-

-

Component Outlook (Revenue, USD Million; 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Technology Outlook (Revenue, USD Million; 2017 - 2030)

-

LCD

-

LED

-

Interactive screens/Touch screens

-

Others

-

-

Screen Size Outlook (Revenue, USD Million; 2017 - 2030)

-

Below 32 Inches

-

32 to 52 Inches

-

More than 52 Inches

-

-

Content Category Outlook (Revenue, USD Million; 2017 - 2030)

-

Broadcast

-

News

-

Weather

-

Sports

-

Others

-

-

Non-Broadcast

-

-

Application Outlook (Revenue, USD Million; 2017 - 2030)

-

Retail

-

Hospitality

-

Entertainment

-

Stadiums & Playground

-

Corporate

-

Banking

-

Healthcare

-

Education

-

Transportation

-

-

Location Outlook (Revenue, USD Million; 2017 - 2030)

-

In-store

-

Out-store

-

Frequently Asked Questions About This Report

b. The France digital signage market size was estimated at USD 1.02 billion in 2022 and is expected to reach USD 1.09 billion in 2023.

b. The France digital signage market is expected to grow at a compound annual growth rate of 7.1% from 2023 to 2030 to reach USD 1.76 billion by 2030.

b. The hardware segment dominated the France digital signage market with a share of 56.7% in 2022. This is attributable to advancements in digital signage display technologies.

b. Some key players operating in the France digital signage market include Intuiface, Acrelec, Barco, BenQ, Daktronics, Inc., Delta Electronics, Inc., Intel Corporation, LG Electronics, NEC Corporation, and Panasonic Holdings Corporation.

b. Key factors driving the market growth include the growing demand for interactive and personalized experiences and 4K embedded displays.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."