- Home

- »

- Medical Devices

- »

-

France Condom Market Size & Share, Industry Report, 2030GVR Report cover

![France Condom Market Size, Share & Trends Report]()

France Condom Market Size, Share & Trends Analysis Report By Material Type (Latex, Non-latex), By Product (Male Condoms, Female Condoms), By Distribution Channel, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-282-4

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

France Condom Market Size & Trends

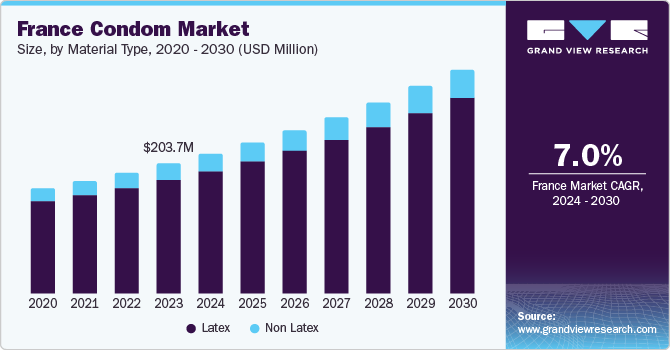

The France condom market size was estimated at USD 203.75 million in 2023 and is projected to grow at a CAGR of 7.0% from 2024 to 2030. The increasing health and safety concerns,innovation and product diversification, rising cultural acceptance and openness,and government initiatives and sexual education are expected to drive market growth. For instance, as per the report byDeutsche Welle (DW), in September 2022, President Emmanuel Macron announced free-of-cost condoms for adults aged 18 to 25 years- from 2023 to reduce unwanted pregnancies and sexually transmitted diseases.

The government of France has been undertaking initiatives to raise awareness and promote the use of contraceptives in the younger generation to control the epidemic of HIV and other STIs and avoid unintended pregnancies. For instance, according to the France 24 report in February 2024, the number of syphilis cases has increased to 110% in the period of year 2020 to 2022.

Male condoms are highly effective in preventing pregnancy and sexually transmitted infections, including HIV. According to Euronews, the French Minister of Health declared that the government is expected to fully reimburse condoms for individuals when prescribed by a healthcare professional. This initiative aims to curb the spread of HIV and AIDS in the country.

The prevalence of HIV in the male population was found to be double the population of females aged between 15 to 45 years. For instance, according to the World Bank, in 2021, approximately 34% of the female share of the population aged above 15 years were living with HIV. The prevention of HIV is the most concerning factor for the France government to inhibit the spread of the virus in the population. The use of condoms is the foremost initiative by the government of France to combat the spread of HIV virus in the inhabitants.

Market Concentration & Characteristics

The market growth stage is medium, and the pace is accelerating. Leading market players in France are actively participating in various strategies, such as regional expansion, new product launches, research and development, collaborations, partnerships, mergers, and acquisitions, to strengthen their market presence.

The market is characterized by a moderate degree of innovation owing to the research and development in materials driving the market. The availability of multiple types of condom materials in France is a contributing factor to the market.

The product substitute activity in the market is low, owing to the factor such as no alternate option available to prevent STDs. The low cost of condoms is one of the potential driving factors for the market. For instance, in January 2023, Philippe Besset, the president of the Federation of Pharmaceutical Associations of France (FSPF), notified Le Figaro newspaper that no lower age limit is set to get cost-free condoms in France. This is expected to boost the demand for condoms with time.

Material Type Insights

Latex condoms dominated the market and held the largest revenue share of 87.71% in 2023. Latex and non-latex material types are key type segments analyzed in this study. The launch of new products and reimbursement initiatives for condoms in France are expected to boost the market for latex and non-latex condoms over the forecast period. Latex condoms are about 98% effective if used correctly, and real-world use of condoms offers 87% effectiveness and safe sex. Condoms by most brands available in the market are made with latex, a form of natural rubber, due to its durability, flexibility, effective contraception, and protection against STDs.

The non-latex condoms segment is estimated to witness the fastest CAGR of 7.6% during the forecast period. This is attributed to the exceptional benefits of these condoms over latex condoms, such as their thin, odorless, and non-allergic properties. Non-latex condoms evolved from the need for latex alternatives due to the number of allergy cases reported for latex condoms. However, non-latex condoms are more expensive than latex condoms and are less effective in preventing viral infections, such as STDs and HIV, compared to latex condoms, which is expected to slow down the segment growth.

Product Insights

The male condom segment dominated the market with the highest revenue share in 2023 due to factors such as manufacturers' focus on the production of male condoms, open-mindedness regarding their use as compared to female condoms, and diverse portfolio. France has high unmet demand for male condoms due to the increasing prevalence of HIV/AIDS. According to Euronews, approximately 6,000 inhabitants in France are diagnosed HIV positive annually, and 800 to 1000 new cases of HIV are encountered among the inhabitants aged 25 years and below. Furthermore, male condoms are mostly the preferred option among couples, resulting in higher demand.

The female condom segment is estimated to witness the fastest CAGR during the forecast period. Female condoms are being increasingly accepted for reducing the risk of STIs and unplanned pregnancies. The World Health Organization (WHO) has set a stringent prequalification procedure for female condoms that has been cleared by a few organizations, leaving huge scope for companies in this market.

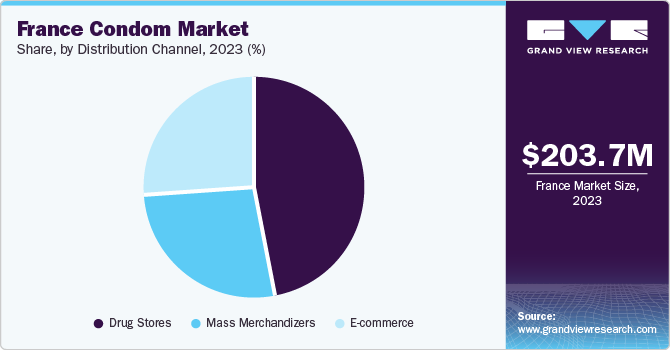

Distribution Channel Insights

The drug stores segment dominated the market with the largest revenue share in 2023. This growth is attributed to factors such as the easy availability and access to drug stores. However, the trend is moving towards e-commerce due to closed markets and restrictions that began during the pandemic. E-commerce is also expected to exhibit substantial growth during the forecast period. Discrete delivery services and freedom to choose on e-commerce platforms are anticipated to fuel the segment's growth.

The mass merchandizers segment is expected to exhibit the fastest CAGR during the forecast period. The mass merchandisers segment is expected to drive the growth within the market. The retailers, that include large supermarket chains, hypermarkets, and discount stores, offer a wide range of condom brands and varieties at competitive prices. This accessibility and affordability have contributed to increased consumer demand and market expansion in the condom industry.

Key France Condom Company Insights

Some of the key players operating in the market include Ansell Healthcare;Glyde; ONE Condom

-

Ansell Healthcare, a division of Ansell Limited, offers various condom brands, including Durex, Skyn, One, and Import, that cater to diverse consumer preferences and needs.

-

GLYDE is a well-known brand that offers a range of high-quality condoms, including GLYDE ultra-thin premium condoms, GLYDE ULTRA medium vegan condoms, and GLYDE SLIMFIT ultra-thin snug-fit condoms.

Key France Condom Companies:

- Ansell Healthcare

- LELO

- One Condoms

- Fair Squared

- Trojan (Church & Dwight Co., Inc.)

- REAL FIT (OKAMOTO)

- SOFT

- Protex (Sagami Rubber Industries Group)

- GLYDE Health Pty. Ltd.

- Lifestyles Healthcare

- Suisse Norma

Recent Developments

-

In October 2023, ONE Condoms launched the graphene condom named ONE Flex claiming world’s first graphene condom.

-

In August 2018, Trojan Condoms investigates contemporary sexuality through the New Trojan Man campaign.

France Condom Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 353.18 million

Growth rate

CAGR of 7.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material type, product, distribution channel

Country scope

France

Key companies profiled

Ansell Healthcare; LELO; One Condoms; Fair Squared; Trojan (Church & Dwight Co., Inc.); REAL FIT (OKAMOTO); SOFT; Protex (Sagami Rubber Industries Group); GLYDE Health Pty. Ltd.; Lifestyles Healthcare; Suisse Norma

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

France Condom Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest vertical trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the France condom market research report based on material type, product, and distribution channel:

-

Material Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Latex

-

Non Latex

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Male Condoms

-

Female Condoms

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Mass Merchandizers

-

Drug Stores

-

E-commerce

-

Frequently Asked Questions About This Report

b. The France condom market size was estimated at USD 203.7 million in 2023.

b. The France condom market is projected to grow at a compound annual growth rate (CAGR) of 7.0% from 2024 to 2030 to reach USD 353.18 million by 2030.

b. The latex condoms held the largest segment share with revenue accounting for over 80% in 2023. Latex condoms are about 98% effective if used correctly and real-world use of condoms offers 87% effectiveness and safe sex. Most of the brands available in the market are made with latex, a form of natural rubber due to its durability, flexibility, effective contraception, and protection against STDs.

b. Some of the key players operating in the market include Ansell Healthcare; Glyde; ONE Condom; Fair Squared; REAL FIT (OKAMOTO); SOFT; among others.

b. The increasing health and safety concerns, innovation and product diversification, rising cultural acceptance and openness, government initiatives, and sexual education are expected to drive the growth of the France condom market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."